Get the free ADDITIONS TO TRUST PROPERTY:

Get, Create, Make and Sign additions to trust property

Editing additions to trust property online

Uncompromising security for your PDF editing and eSignature needs

How to fill out additions to trust property

How to fill out additions to trust property

Who needs additions to trust property?

Additions to Trust Property Form: A Comprehensive Guide

Understanding trust property and its importance

Trust property refers to assets that are held within a trust, often for the benefit of designated beneficiaries. This can include real estate, investments, cash, and personal property. Understanding trust property is essential as it plays a critical role in effective estate planning. Properly managing trust property ensures that the grantor's wishes are honored and that beneficiaries receive their intended inheritances.

The benefits of adding property to a trust are numerous. When assets are placed in a trust, they can bypass the lengthy and sometimes costly probate process, making it easier and quicker for beneficiaries to access their inheritance. Additionally, trust property can be managed in a way that provides financial support and security for family members or other beneficiaries, particularly in instances of special needs or minor children.

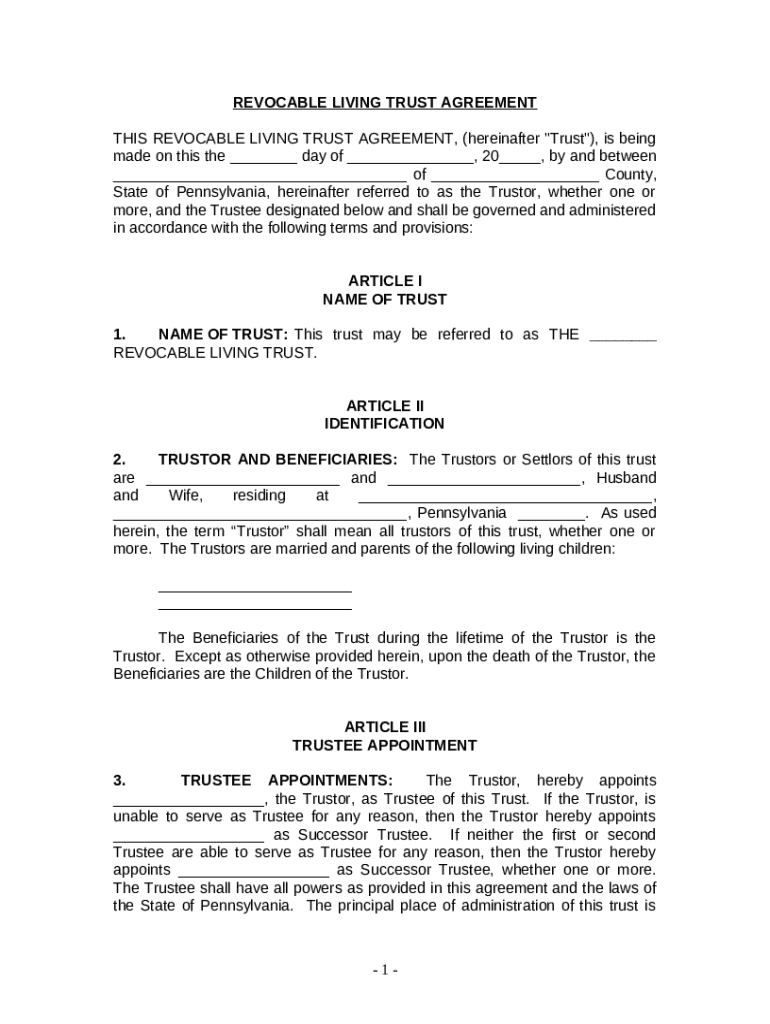

What is an additions to trust property form?

The Additions to Trust Property Form is a legal document specifically designed to facilitate the inclusion of new assets into an existing trust. This form is crucial when a grantor wishes to amend the terms of a trust to reflect changes in asset ownership or additions resulting from various life events. By using this form, grantors ensure that the newly acquired property is legally recognized as part of the trust's asset pool.

This form can be used in various contexts, such as when inheriting property, purchasing real estate, or receiving valuable gifts. The legal implications of amending a trust through this form include ensuring that the trust document remains valid and up-to-date, which minimizes potential disputes among beneficiaries and provides clarity regarding asset distribution.

When to use the additions to trust property form

Circumstances prompting the addition of property to a trust can vary widely. Common events that necessitate the use of the Additions to Trust Property Form include inheriting assets from relatives, making significant purchases, or receiving any financial gifts that the grantor intends to pass on to their beneficiaries. Real estate transactions, especially investment properties or vacation homes, frequently trigger the need to add property to a trust.

Other scenarios may involve changes in family dynamics, such as marriage or divorce, which could influence what assets should be included in the trust. Each of these situations reinforces the importance of reviewing and updating the trust regularly, especially when significant life events occur.

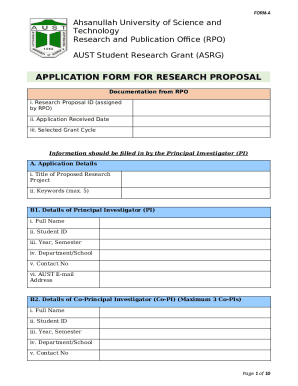

Key elements of the additions to trust property form

When filling out the Additions to Trust Property Form, several essential details must be included to ensure its validity. Key elements of the form include the name of the trust and the date it was established. Clear identification of the property being added is also crucial; this typically requires a thorough description that includes the property's address, legal description, or any identifying features.

Moreover, the form must bear the signatures of all trustees involved, affirming their agreement to the additions. This attestation is vital and not only formalizes the amendment but also reduces the potential for disputes regarding ownership or asset distribution in the future.

Step-by-step guide to filling out the additions to trust property form

1. Review the existing trust document: Before making any additions, fully understand the current terms and arrangements of the trust. This ensures that all changes align with the grantor's wishes.

2. Gather necessary documentation: Collect proof of ownership for the new property you are adding, such as deeds, titles, or valuation documents. Relevant legal documents should also be acquired to support the trust amendment.

3. Complete the form: Follow specific instructions on filling out each section accurately. Note any required fields to avoid future validation issues. Each piece of information should be complete and correct.

4. Execute the form legally: Once the form is completed, ensure all relevant parties sign it. Depending on jurisdiction, you may also need to have the document notarized. This legal process solidifies the additions and helps safeguard against any potential challenges.

Tips for managing property within a trust

Managing trust property requires regular attention to detail. Regularly review and update the trust to reflect any significant changes in ownership or family circumstances. This ensures that the trust accurately represents the grantor's current wishes and plans.

Another essential practice is maintaining accurate property records. Keeping thorough documentation of all trust assets, including purchase dates and values, provides clarity in managing and distributing these assets. This documentation can also help in tax preparation and in ensuring compliance with state regulations.

Common mistakes to avoid when using the form

Some common pitfalls arise during the use of the Additions to Trust Property Form. For example, overlooking state-specific requirements can lead to improper filings and disputes. Always ensure that you’re adhering to local regulations concerning trusts.

Failing to include all necessary properties is another frequent mistake; ensure that any and all assets being added are listed clearly. Additionally, misunderstandings regarding the implications of irrevocable trusts can create problems for grantors. It’s crucial to comprehend the rules surrounding irrevocable trusts before making any amendments.

Frequently asked questions (FAQs)

Can I add property to an irrevocable trust? Yes, property can be added to an irrevocable trust under certain circumstances, but it's important to understand the limitations and legal implications. Consult a legal professional for specific advice.

What if the property has outstanding liens or mortgages? It’s advisable to disclose any such obligations when submitting the form as they can affect how the asset is treated within the trust.

How does adding property affect trust taxation? Adding property to a trust can influence how the property is taxed. Consulting a tax professional can help clarify any tax implications arising from these additions.

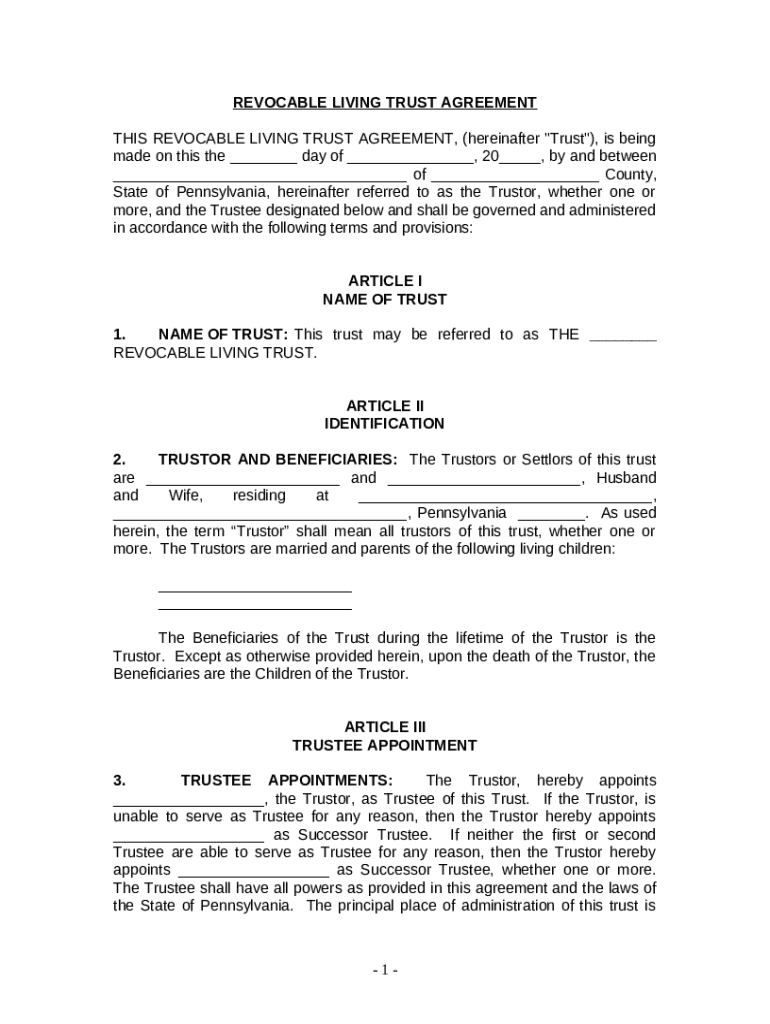

Sample additions to trust property form

To provide clarity on the Additions to Trust Property Form, a visual representation alongside annotations of each section can be extremely beneficial. By examining a completed form, users can better understand how to properly fill out their forms, ensuring all necessary information is included.

Sample annotations may include notes on where to write the trust name, how to adequately describe the property being added, and reminders for signatures. This visual aid can demystify the process of updating the trust and stands as a useful reference.

Ensuring compliance with state laws

Laws governing trusts can vary significantly from one state to another. Understanding these differences is essential for ensuring compliance when using the Additions to Trust Property Form. Certain states have unique requirements regarding spouses’ rights to assets or specific rules about amendments.

Consulting with a legal professional knowledgeable in estate planning can provide vital assistance. They can help navigate the complexities involved with trust changes and ensure that all amendments are made within the legal framework.

Utilizing pdfFiller for your additions to trust property needs

pdfFiller simplifies the process of filling out and managing trust forms, including the Additions to Trust Property Form. With its cloud-based platform, users can easily access templates and complete forms from anywhere. This feature is particularly beneficial for individuals who require ready access to their documents for timely updates.

Collaboration is made easy with pdfFiller, as users can share documents with family members or legal advisors for input and eSignature. The platform’s unique features enhance document management, leading to a more efficient and organized approach to trust administration.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my additions to trust property in Gmail?

Can I edit additions to trust property on an iOS device?

Can I edit additions to trust property on an Android device?

What is additions to trust property?

Who is required to file additions to trust property?

How to fill out additions to trust property?

What is the purpose of additions to trust property?

What information must be reported on additions to trust property?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.