Get the free Schedule K-1 (Form 1065) Partner's Share of Current Year ...

Get, Create, Make and Sign schedule k-1 form 1065

How to edit schedule k-1 form 1065 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule k-1 form 1065

How to fill out schedule k-1 form 1065

Who needs schedule k-1 form 1065?

Schedule K-1 Form 1065: A Comprehensive How-To Guide

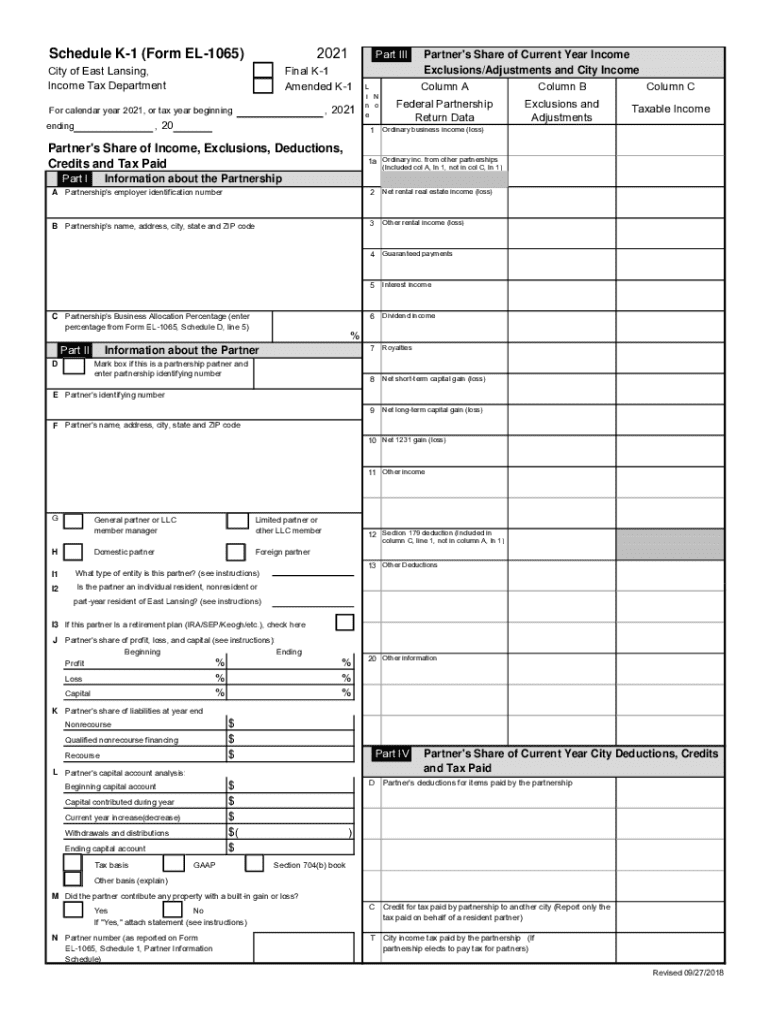

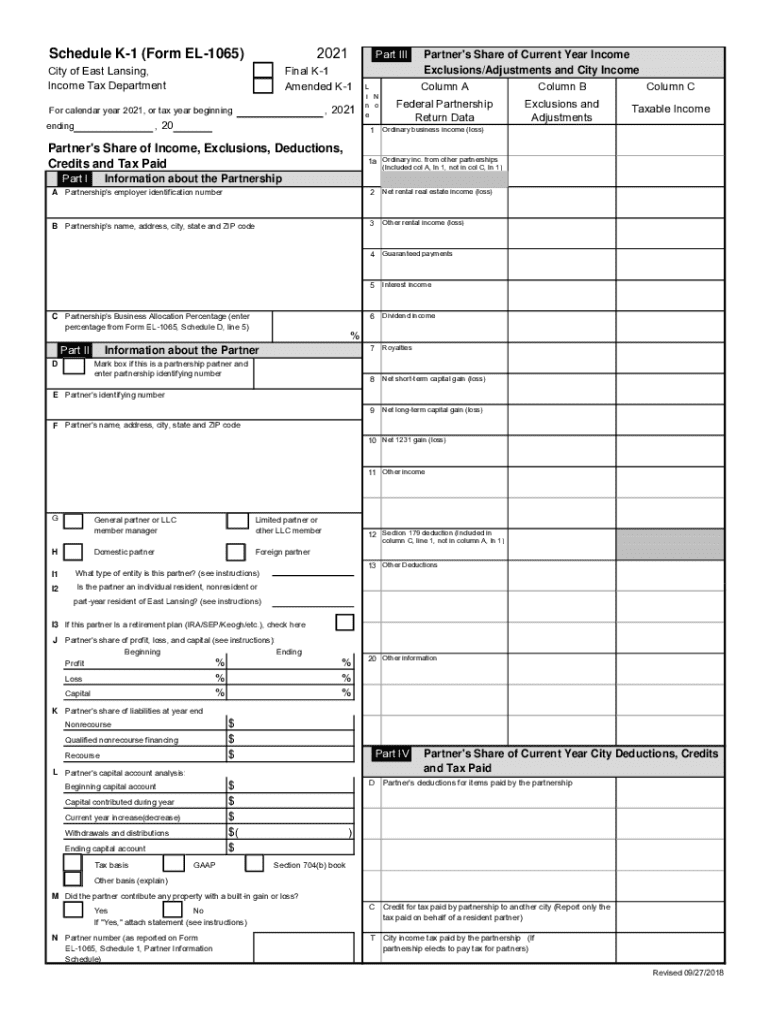

Understanding the Schedule K-1 Form 1065

The Schedule K-1 is a vital tax form for partners in a business partnership, as it details each partner's earnings from the partnership. It is generated as part of the IRS Form 1065, which serves to report the income, deductions, gains, losses, and other relevant financial information of a partnership. This form helps ensure that partners accurately report their share of the business income on their individual tax returns, thus facilitating compliance with tax obligations.

Understanding the different structures of partnerships is key. Partnerships are categorized into three main types: general partnerships, limited partnerships, and limited liability companies (LLCs). General partnerships involve partners participating fully in managing the business, while limited partnerships consist of both general and limited partners, where limited partners have restricted roles in business management. LLCs offer liability protection similar to corporations, making them a popular choice for many business owners.

Key components of Schedule K-1

Schedule K-1 contains essential information critical for proper tax reporting. It features multiple fields, with key components including the partner's identifying information, the partnership’s tax year, and detailed sections on income, deductions, and credits. Each of these components plays a crucial role in ensuring accurate tax documentation.

Notably, the section detailing ordinary business income indicates the share of profits attributable to each partner. It's crucial to pay attention to capital gains and losses as well, since these impacts directly affect personal income tax liabilities. The reporting of deductions and credits on Schedule K-1 also enhances tax planning opportunities for partners, letting them understand their total tax obligations.

How to read your Schedule K-1

To effectively leverage the Schedule K-1 data, one must be able to read and interpret the information correctly. The form is typically structured with numbered boxes, each representing a unique type of income, deduction, or credit. Understanding these box numbers and their contents, along with the codes utilized, is key to ensuring one accurately reports their income.

Correctly mapping this information to your individual tax return is imperative. For instance, the ordinary business income derived from the K-1 must be entered on the appropriate lines of Form 1040. Misinterpretations can lead to discrepancies with the IRS, making accuracy essential for good standing in tax compliance.

Filling out Schedule K-1: Step-by-step instructions

To complete Schedule K-1, begin by preparing the necessary documentation such as the partnership agreement and previous years' tax returns. This foundational information ensures that all partner details are accurate and up to date.

However, common pitfalls exist that you should be aware of. For example, misreporting income or deductions can lead to significant errors on individual tax returns. Additionally, overlooking partner basis limitations, which affect the amount of loss a partner can claim, can also negatively impact tax filings.

Using Schedule K-1 in tax planning

Effectively incorporating Schedule K-1 data requires a strong understanding of its integration with other tax documents like W-2s and 1099s. It is essential to ensure that all forms align correctly to avoid mismatches that could trigger audits or penalties from the IRS. Planning your taxes accordingly also means consulting with a tax professional to navigate complexities and maximize potential credits.

Furthermore, understanding the implications of K-1 data on estimated tax payments is key to effective tax planning. Partners may need to adjust their own estimated tax payments based on their earnings as reported on the K-1, optimizing their tax strategies to minimize liabilities and avoid surprises come tax season.

Common questions about Schedule K-1

Many individuals encounter common queries regarding Schedule K-1. A frequent issue arises when partners do not receive a K-1. In such cases, partners should follow up with the partnership to ensure the information was prepared. If discrepancies in reported numbers occur, diligently document communications and maintain clear records to assist in resolving any issues.

Leveraging pdfFiller for managing your Schedule K-1

pdfFiller offers a cloud-based solution for managing the complexities of tax documentation. Users can effortlessly edit, e-sign, and collaborate on Schedule K-1 forms in real time. This feature significantly streamlines the process, ensuring accurate and timely submission of essential documents.

The ability to upload and store documents securely provides peace of mind, knowing that sensitive information is protected. Features like tracking changes and managing versions further enhance the user’s ability to maintain order amidst the complexities of tax compliance, thus making tax season more manageable.

Conclusion: Navigating your tax responsibilities with confidence

Navigating the intricacies of Schedule K-1 Form 1065 is crucial for partnership tax compliance. Armed with a comprehensive understanding of how to read, fill out, and leverage this document, partners can feel more confident in their tax responsibilities. Always prioritize accuracy and diligence in dealing with tax forms to ensure seamless filing and compliance.

By utilizing pdfFiller’s platform for managing tax documents, users are empowered to take control of their tax processes efficiently. From editing and signing to secure storage and real-time collaboration, pdfFiller enhances the overall tax management experience, making it easier to tackle any tax obligations with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find schedule k-1 form 1065?

How do I edit schedule k-1 form 1065 in Chrome?

How do I complete schedule k-1 form 1065 on an Android device?

What is schedule k-1 form 1065?

Who is required to file schedule k-1 form 1065?

How to fill out schedule k-1 form 1065?

What is the purpose of schedule k-1 form 1065?

What information must be reported on schedule k-1 form 1065?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.