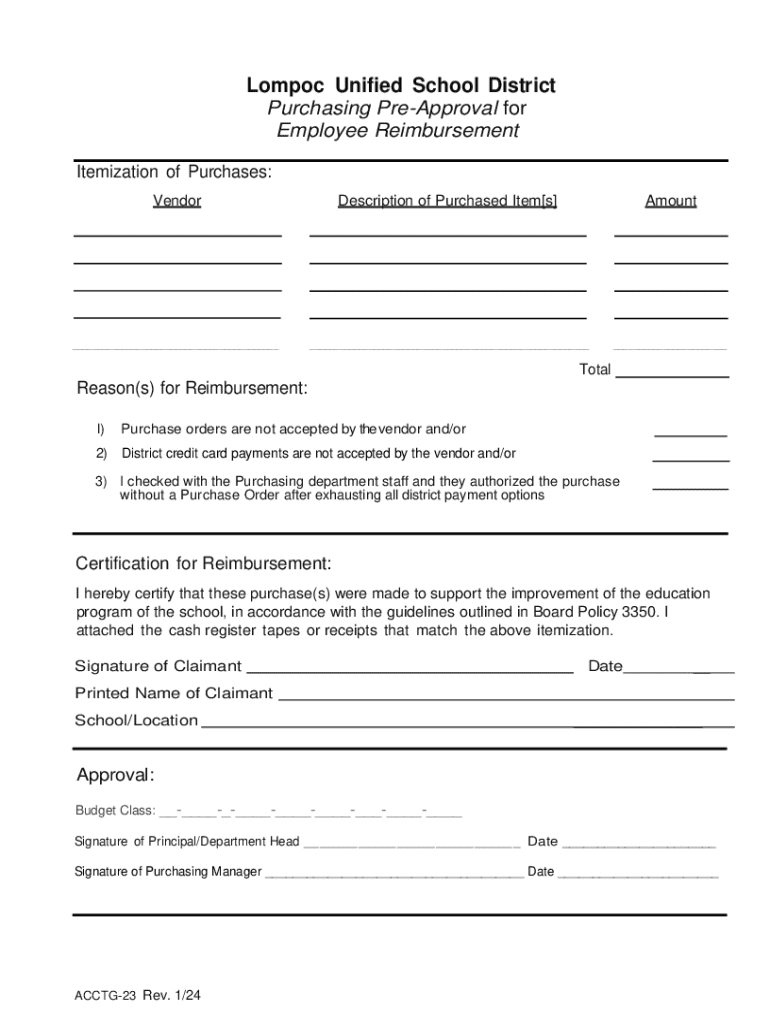

Get the free Accounting Certification for Employee Reimbursement

Get, Create, Make and Sign accounting certification for employee

How to edit accounting certification for employee online

Uncompromising security for your PDF editing and eSignature needs

How to fill out accounting certification for employee

How to fill out accounting certification for employee

Who needs accounting certification for employee?

Accounting Certification for Employee Form

Understanding accounting certifications

Accounting certifications are formal recognitions awarded to professionals in the accounting field, demonstrating their expertise, skills, and adherence to industry standards. These credentials are significant as they signal a commitment to the profession and an understanding of the latest practices, regulations, and technologies. They vary in specialization and focus, making them suitable for a wide range of roles within the finance and accounting sectors.

From enhancing personal knowledge to meeting complex compliance requirements, accounting certifications offer numerous advantages to employees. Several types, including the Certified Public Accountant (CPA) and Certified Management Accountant (CMA), cater to different career paths and interests, each providing essential qualifications to meet job demands.

Why are accounting certifications important for employees?

Accounting certifications are vital for various reasons. They allow employees to enhance their skills, grasp essential accounting principles, and remain updated with ever-changing regulatory requirements. By obtaining these certifications, professionals signal to employers a commitment to excellence and ongoing professional development, which can significantly impact their marketability.

Furthermore, certifications often lead to increased career advancement opportunities and higher earning potential. Many organizations now prioritize hiring certified individuals, so obtaining these credentials not only demonstrates quality but also aligns with industry standards, making them essential for employees looking to advance their careers.

Types of accounting certifications

There are several popular accounting certifications that professionals should consider, each serving unique career paths:

Choosing the right certification involves assessing individual career goals and areas of interest or specialization. It’s essential to consider the certification requirements, such as education levels, work experience, and examination details, to select the most appropriate path.

Preparing for accounting certifications

The first step towards obtaining an accounting certification is identifying the right one for your career aspirations. This involves assessing your current qualifications, including educational background and professional experience, to determine suitability for various certifications. Research different certification options extensively, focusing on how each aligns with your professional objectives.

Preparation resources are crucial for success. Consider a combination of textbooks, online courses, and practice exams to thoroughly understand the material. Engaging with professional organizations or networks can also provide valuable insights, mentorship opportunities, and collaborative study groups that enhance learning.

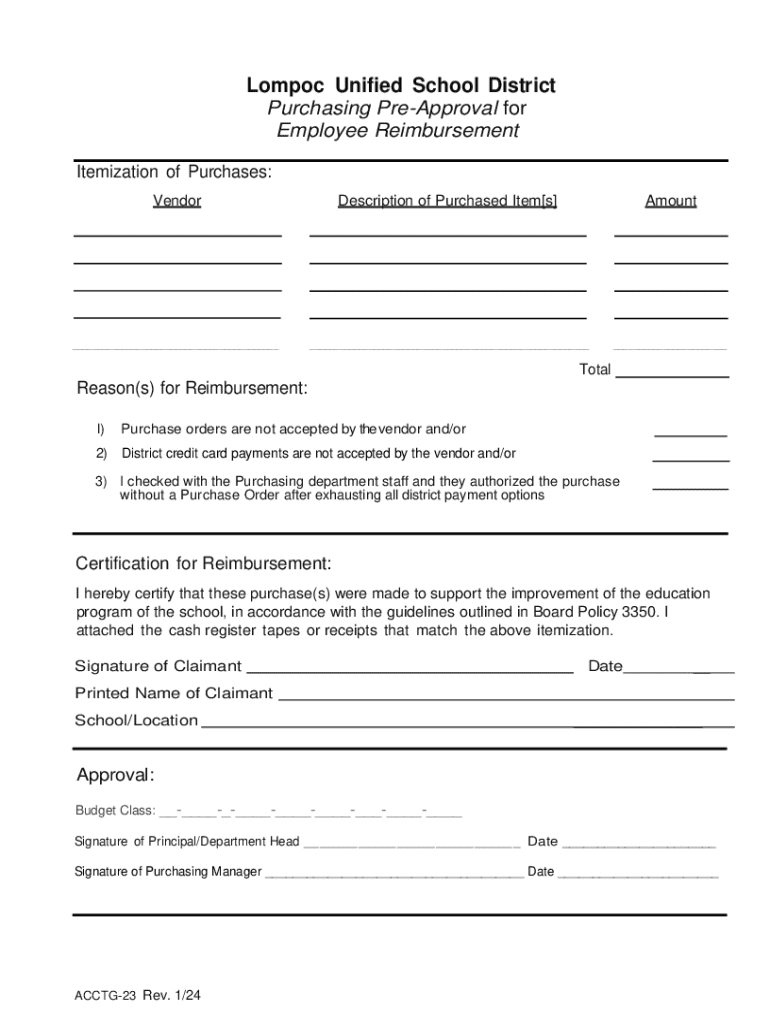

Completing the accounting certification employee form

When applying for an accounting certification, completing the employee form accurately is crucial. Necessary information typically includes personal details such as your name and contact information, alongside comprehensive information about your professional background, including educational history and relevant work experience.

Follow detailed instructions for each section of the form, ensuring that all required elements are addressed. Take time to review each entry for accuracy and completeness, as errors can delay processing.

Submitting the certification employee form

Before submitting the certification employee form, it’s essential to review and edit the document thoroughly. Proofreading helps eliminate typographical errors and ensures that all required information is present. Utilizing tools available on pdfFiller, such as editing functions and error-checking features, can streamline this process.

Understanding the submission process is equally important. Common methods include online submission through a secure portal or mailing the completed form. After submission, anticipate receiving a confirmation, which signifies that your application has been received and is under review.

Tracking progress after submission

After submitting your application, it’s important to stay informed about its progress. Different organizations will have varying processing times, and it’s wise to familiarize yourself with these timelines. Most institutions offer online services to allow applicants to check the status of their application.

Follow up at regular intervals to ensure your application is being processed correctly. Polite inquiries can help clarify any uncertainties and demonstrate your proactive approach to achieving certification.

Additional resources for employers and teams

For employers, encouraging employees to pursue accounting certifications can significantly enhance the overall competence of the team. Certified professionals bring credibility and expertise, which can elevate the organization's standing in the competitive marketplace.

Employers can incorporate certifications into employee development plans by providing resources, mentorship opportunities, and possibly financial assistance for certification courses. Supporting your team in their pursuit of further education can lead to long-term benefits for both the individual and the company.

Success stories

Real-world success stories highlight the positive impact of certifications on individual careers and organizational effectiveness. Interviews and testimonials from certified professionals often demonstrate how their certifications have led to significant career growth, increased job satisfaction, and enhanced workplace confidence.

For instance, a certified public accountant may recount how obtaining their CPA not only refined their technical skills but also opened doors for leadership roles, contributing to their team’s success in navigating challenging audits and regulatory frameworks.

Frequently asked questions

Many potential candidates have common inquiries regarding accounting certifications. Questions often arise concerning eligibility requirements, with some certifications demanding specific educational backgrounds or experience levels. The associated costs of obtaining certifications are also a frequent concern, along with available financial assistance options.

It’s beneficial for individuals to research these aspects thoroughly, leveraging forums and resources from professional associations that can provide up-to-date information and guidance on certifications, enhancing understanding and preparedness for the application process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my accounting certification for employee directly from Gmail?

How can I edit accounting certification for employee from Google Drive?

Can I sign the accounting certification for employee electronically in Chrome?

What is accounting certification for employee?

Who is required to file accounting certification for employee?

How to fill out accounting certification for employee?

What is the purpose of accounting certification for employee?

What information must be reported on accounting certification for employee?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.