Comprehensive Guide to Business Purchase Agreement Template Form

Overview of business purchase agreements

A business purchase agreement is a critical document used in the transfer of ownership of a business entity. It outlines the terms and conditions agreed upon by the buyer and seller. This legal agreement not only serves as a binding contract but also plays an essential role in protecting the interests of both parties involved in the transaction.

Unlike other legal agreements such as employment contracts or lease agreements, a business purchase agreement is specifically tailored to transactions involving the sale of business assets or equity. This distinction is crucial, as it dictates the rights and responsibilities of each party before, during, and after the sale.

Essential components of a business purchase agreement

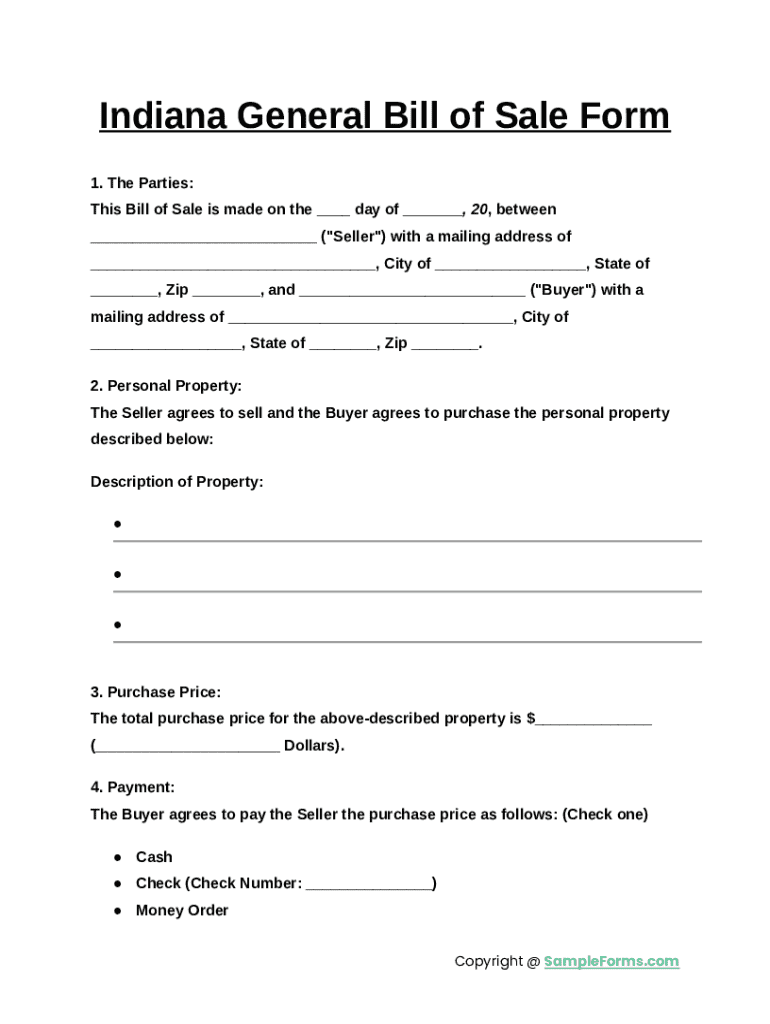

Understanding the essential components of a business purchase agreement is vital for anyone involved in a sale transaction. The purchase agreement should encompass several key elements to ensure legal protection and clarity between parties.

Purchase Price: Clearly outline the total amount being paid for the business.

Payment Terms: Specify how this price will be paid (e.g., upfront, installments, etc.).

Assets Included: Detail the assets being sold, such as inventory, equipment, or intellectual property.

Liabilities Assumed: Define any debts or financial obligations the buyer will take on.

Closing Date: Establish when the transaction will officially be completed.

Optional clauses can also be included to further customize the agreement based on specific needs. For instance, a non-compete agreement can prevent the seller from starting a competing business, while an indemnification clause provides protection against future claims.

The purpose and benefits of a business purchase agreement

The primary purpose of a business purchase agreement is to provide legal protection for both the buyer and the seller. By clearly defining the terms of the sale, such agreements help eliminate ambiguity, ensuring that all parties understand their rights and obligations.

Moreover, a well-drafted purchase agreement serves to avoid future disputes that could arise from misunderstandings. By having all terms down on paper, both parties can refer back to the agreement in case of disagreements, thus minimizing potential legal battles and emotional stress.

Types of business purchase agreements

In the realm of business transactions, two primary types of purchase agreements exist: the asset purchase agreement and the stock purchase agreement. Each type has its own structural differences and implications, which can significantly affect the sale process.

In this agreement, the buyer purchases the assets of the business. This includes equipment, inventory, and other tangible assets, but typically excludes liabilities. Buyers can choose specific assets they wish to acquire, providing a tailored approach.

Here, the buyer purchases shares of the company directly, thus acquiring ownership of the entire business, including its liabilities. This type is often simpler as it involves fewer asset transfers but requires careful due diligence to assess potential risks.

Understanding these key differences is crucial for both buyers and sellers to ensure the transaction aligns with their broader business goals and legal requirements.

Step-by-step guide to completing the business purchase agreement template

Completing a business purchase agreement template requires careful attention to detail and an understanding of the specific needs of the transaction. Following a structured process can help streamline this task.

Preparing the Document: Begin by gathering all necessary information, including financial data, asset evaluations, and any previous agreements that may impact the current sale.

Using pdfFiller's Template: Access the business purchase agreement template on pdfFiller. This user-friendly platform allows for easy navigation and document management.

Filling in Details: Carefully adjust each section of the template to reflect the specific terms and conditions of your agreement. Ensure all details are complete and accurate to avoid confusion.

eSigning the Agreement: Utilize pdfFiller's eSignature features to securely sign the agreement. This method is legally binding and facilitates quick transaction closures.

Collaborating with Stakeholders: Share the drafted document with all relevant parties, utilizing pdfFiller's collaboration tools to ensure that everyone is aligned with the terms.

Each of these steps is designed to make the process efficient, ensuring no detail is overlooked, thereby safeguarding the interests of both buyers and sellers.

Legal considerations in business purchase agreements

When drafting a business purchase agreement, understanding the legal framework surrounding it is paramount. Local and state regulations can affect various aspects of the agreement, highlighting the importance of consulting with legal professionals experienced in business transactions.

Compliance with the Uniform Commercial Code (UCC) is essential in jurisdictions like California, as it governs the sale of goods and helps clarify the rights of buyers and sellers in voluntary transfers. A legal expert can provide valuable insights and ensure that all aspects of the pact conform to applicable laws.

Financial implications of business purchases

From a financial standpoint, both buyers and sellers must consider the implications of the transaction. Tax considerations can significantly affect the actual value derived from the sale. For instance, buyers should explore potential use tax liabilities tied to the acquisition, while sellers must understand the tax consequences of capital gains from the sale.

Employing accurate asset valuation methods is essential in determining a fair purchase price. Buyers should engage financial analysts to conduct thorough valuation assessments, ensuring the price reflects true market value, which minimizes risks and ensures a profitable transition.

Maintaining a seamless transition post-purchase

Completing a business purchase is only the first step; ensuring a smooth transition is paramount for long-term success. Developing a thorough transition plan is essential, detailing how the integration of the new business operations will occur.

Effective communication is also vital. Informing employees and customers about the changes in ownership can help manage expectations and maintain trust. Being transparent in communications will facilitate a smoother transition and help stabilize operations during the change.

Common mistakes to avoid when drafting a business purchase agreement

Drafting an effective business purchase agreement can be challenging, and several common pitfalls should be avoided. One of the riskiest mistakes is an incomplete disclosure of information, which can raise legal issues later on.

Failing to specify payment terms clearly can lead to misunderstandings about how and when payments are made.

Overlooking contingencies in the agreement can result in complications if certain conditions aren't met post-sale.

Neglecting to consult with legal professionals can lead to non-compliance with existing laws, risking the validity of the agreement.

Being aware of these potential mistakes allows both buyers and sellers to craft a more resilient agreement, ultimately reducing the likelihood of disputes or legal ramifications.

Interactive tools and resources on pdfFiller

pdfFiller is more than just a platform for accessing a business purchase agreement template. It comprises a robust suite of tools designed to enhance the document management process. Users can capitalize on features such as document storage, easy access to additional templates, and collaboration tools to streamline the purchasing process.

For users seeking enhanced document management, pdfFiller offers tutorial guides and resources that make navigating the platform intuitive and efficient. This empowers individuals and teams to effectively create, manage, and sign critical documents from anywhere, furthering productivity in business transactions.

Case studies and real-world examples

Exploring real-world examples provides valuable insights into successful business transactions. Companies that used clear, well-structured business purchase agreements often report smoother transitions and fewer disputes. This can be exemplified by a few successful sales where detailed clauses specifying asset valuations led to favorable outcomes.

Conversely, cases where agreements lacked clear terms often resulted in misunderstandings and legal challenges, emphasizing the necessity for thoroughness. Learning from these successful examples and common errors can guide future transactions and foster stronger relationships between buyers and sellers.