Get the free Tax Forms for Businesses - Louisiana Department of Revenue

Get, Create, Make and Sign tax forms for businesses

How to edit tax forms for businesses online

Uncompromising security for your PDF editing and eSignature needs

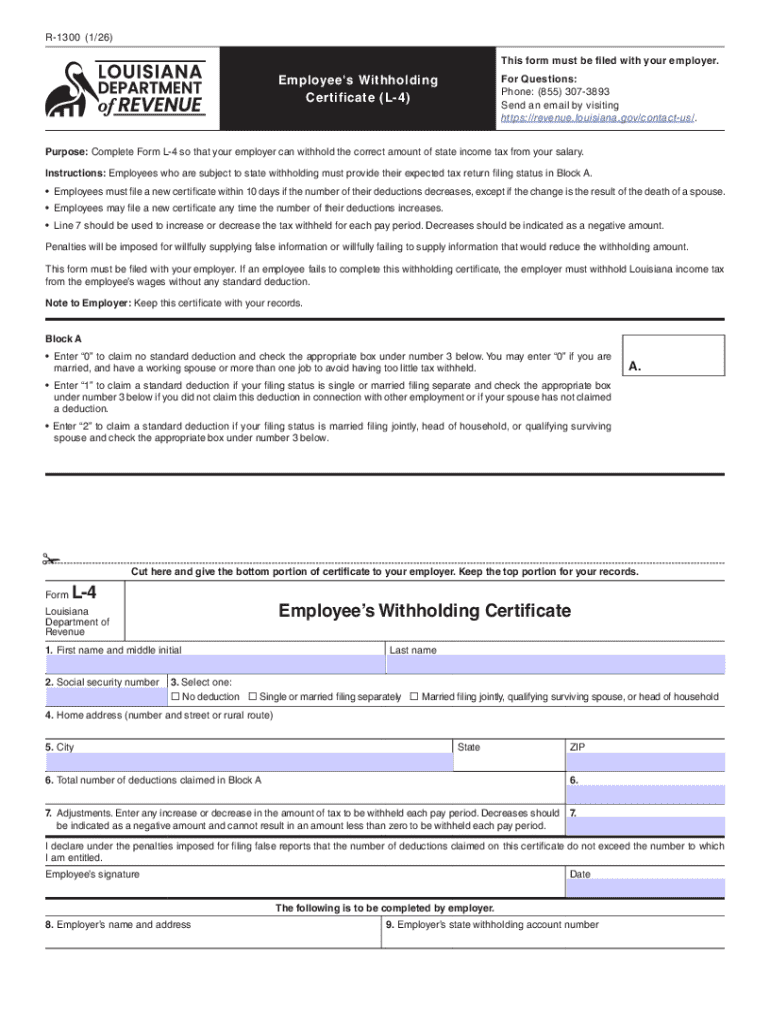

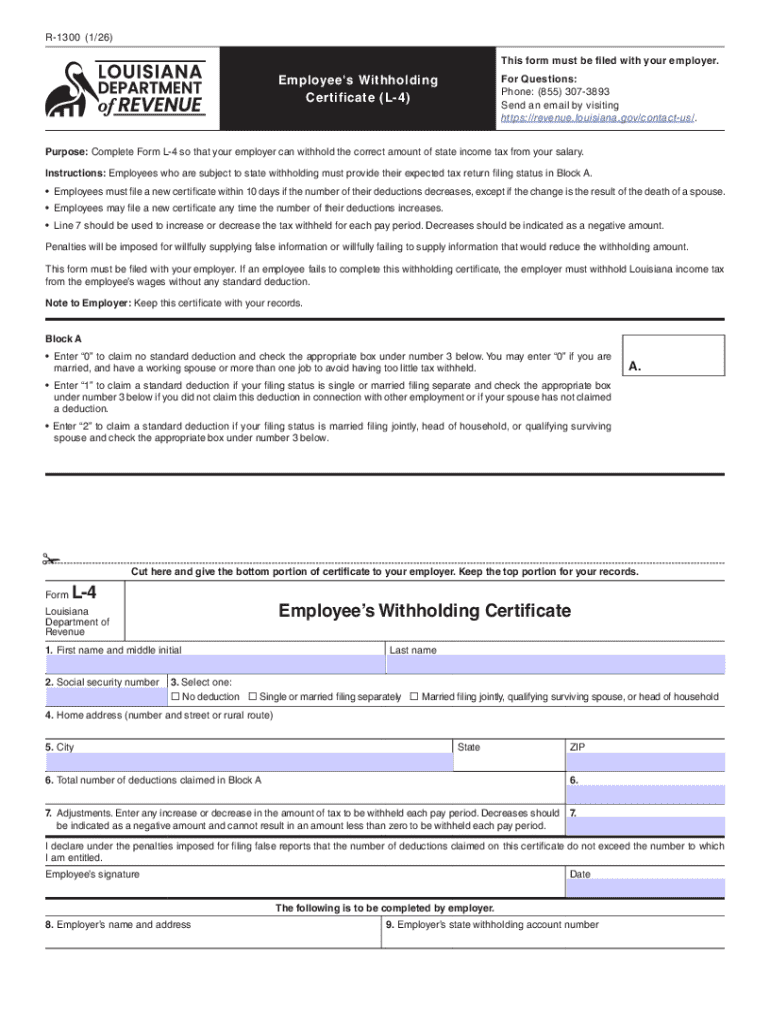

How to fill out tax forms for businesses

How to fill out tax forms for businesses

Who needs tax forms for businesses?

Tax Forms for Businesses: A Comprehensive Guide

Understanding the importance of tax forms for businesses

Businesses must navigate a complex landscape of tax obligations that vary depending on their legal structure and operations. Properly completing tax forms is essential for compliance with government regulations. Failure to do so can lead to penalties and additional scrutiny from tax authorities. Moreover, tax forms serve a critical role in maintaining accurate records, which are imperative for both internal management and external auditing.

A variety of tax forms are required based on an entity's classification, such as a sole proprietorship, partnership, or corporation. Each structure has its specific forms that need to be filled out correctly to fulfill tax obligations and benefit from potential deductions. Understanding these distinctions is vital for anyone immersed in business management.

Exploring essential tax forms for businesses

There are essential federal tax forms that every business owner should be familiar with. For example, the IRS Form 1040 combined with Schedule C is necessary for sole proprietors, as it reports income, expenses, and profit or loss. Meanwhile, partnerships utilize Form 1065, which serves as the partnership tax return, while corporations must file Form 1120 to report their income tax.

Employers need to complete Form 941 quarterly to report payroll taxes withheld from employees, ensuring compliance with federal tax obligations. However, it's important to note that each state may have its specific tax forms and requirements, which can vary significantly from federal regulations. Understanding these differences can save businesses from costly mistakes.

How to fill out business tax forms accurately

Filling out tax forms requires meticulous attention to detail. Begin by collecting all necessary financial information, including income, expenses, and any qualifying deductions. The next step involves carefully completing the sections of the appropriate forms, ensuring accuracy throughout. Double-checking figures is crucial to avoid common errors that may lead to audits or penalties.

A simple checklist can be instrumental in ensuring compliance. Things to include on your checklist could be financial statements, vendor expenses, and prior year tax returns. It's also wise to consider consulting with a tax professional who can provide tailored guidance based on your business needs.

Editing and managing tax forms effortlessly

When it comes to managing and editing tax forms, pdfFiller offers robust document creation capabilities that make the process seamless. Users can easily upload existing documents, convert them, and utilize a suite of editing tools to customize forms according to their business needs. This flexibility is particularly valuable when trying to comply with varying tax regulations and forms.

Furthermore, organizing forms in the cloud using clear file naming conventions and designated folders enables instant access whenever needed. Streamlined document management can contribute to a more efficient accounting process, particularly during tax season.

eSigning and collaborating on tax forms

The significance of electronic signatures in today's business environment cannot be overstated. Electronic signatures provide a convenient way to authorize tax forms quickly, contributing to smoother operations and reduced paperwork. Utilizing tools like pdfFiller for eSigning can enhance security and ensure your signatures are compliant with regulations.

With features that allow team members to collaborate on form preparation, pdfFiller empowers businesses to work together efficiently. Shared access features ensure that everyone involved in the tax filing process can provide feedback and make edits in real time, which facilitates quicker completion of forms.

Submitting tax forms: what you need to know

Once tax forms are completed, the next critical step is submission. Business owners can choose between electronic filing and paper submissions. Electronic filing through the IRS E-File system simplifies the reporting process and typically results in faster processing times. Conversely, paper filing may still be necessary for specific forms that do not allow e-filing.

It's also crucial to track the status of your submissions. Business owners should confirm the receipt of their forms and be prepared to respond if the IRS requires amendments or further information. Knowing how to handle any issues that arise will help ensure compliance and peace of mind.

Keeping records of tax forms

Proper record-keeping is one of the cornerstones of effective tax management. Maintaining a record of tax forms and supporting documents can provide essential insights for future tax returns and financial planning. In addition, organized records are invaluable in the event of an audit.

Businesses should adopt digital archiving solutions that enable quick access to past tax forms. Following the IRS retention guidelines ensures that records are kept for appropriate lengths of time, typically three to seven years depending on the context. Staying organized now reduces stress down the line during tax season.

Frequently asked questions about business tax forms

Many business owners have questions regarding tax forms. For instance, the type of forms required can vary significantly based on the chosen business structure. Additionally, changes in tax law can impact which forms need to be filed or how they are completed. If deadlines are missed, it’s crucial to understand the implications and steps to rectify the situation promptly.

Having a grasp of these factors not only lessens anxiety during tax season but also empowers businesses to take proactive measures in their fiscal responsibilities. Equip yourself with the knowledge to navigate the intricate requirements of tax forms for businesses successfully.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tax forms for businesses without leaving Google Drive?

Can I create an electronic signature for signing my tax forms for businesses in Gmail?

How do I edit tax forms for businesses on an Android device?

What is tax forms for businesses?

Who is required to file tax forms for businesses?

How to fill out tax forms for businesses?

What is the purpose of tax forms for businesses?

What information must be reported on tax forms for businesses?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.