Get the free 2022-Form-990-public-disclosure.pdf

Get, Create, Make and Sign 2022-form-990-public-disclosurepdf

Editing 2022-form-990-public-disclosurepdf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2022-form-990-public-disclosurepdf

How to fill out 2022-form-990-public-disclosurepdf

Who needs 2022-form-990-public-disclosurepdf?

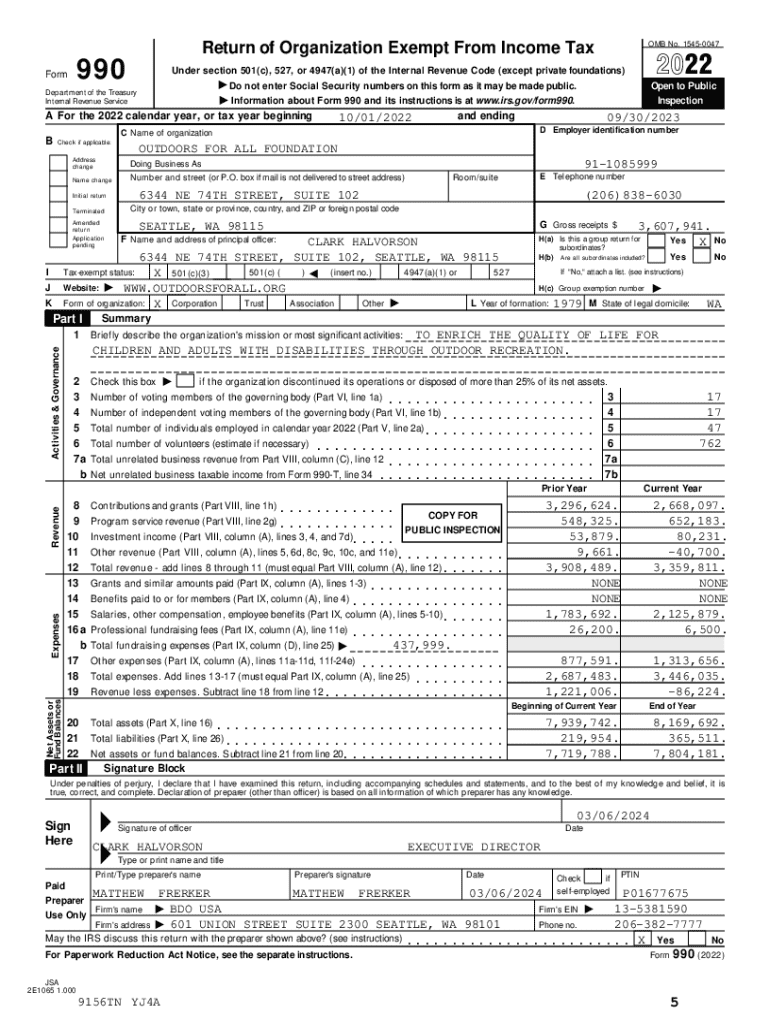

2022 Form 990 Public Disclosure PDF Form: A Comprehensive Guide

Understanding Form 990: A Comprehensive Overview

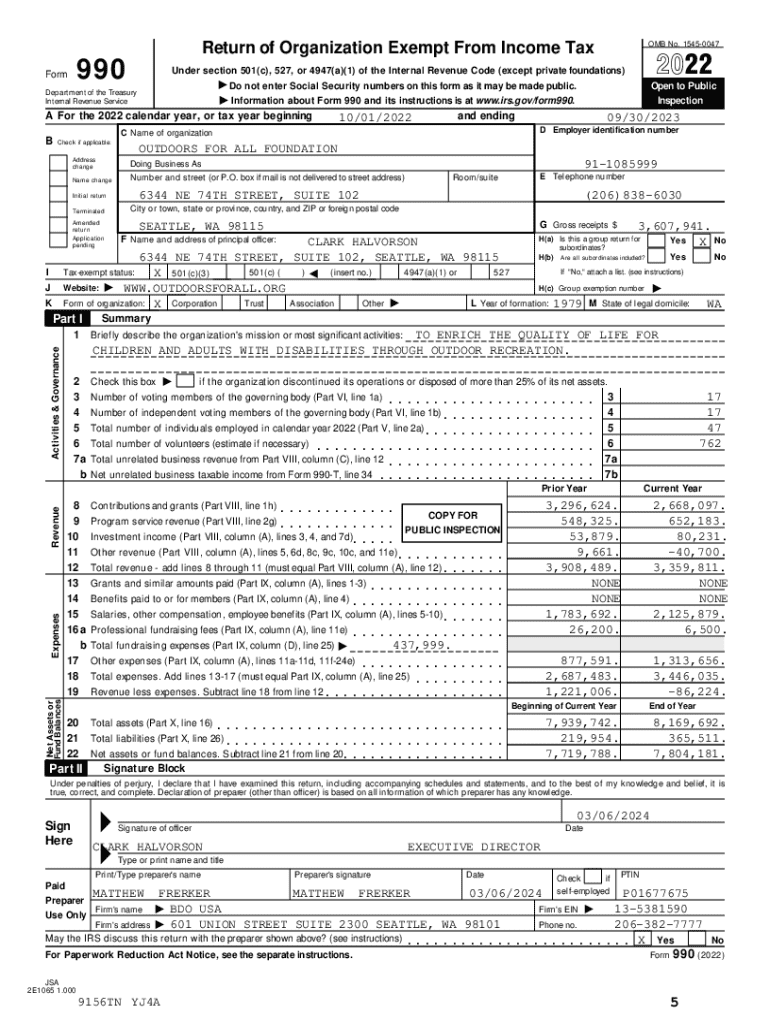

Form 990 is a pivotal document utilized by tax-exempt organizations, nonprofits, and public charities to report their financial status to the Internal Revenue Service (IRS). It captures information regarding the organization's mission, program activities, and financials. The Form 990 is not merely a tax form; it serves as a window into the organization’s financial health and operational transparency, making it essential for stakeholders.

The purpose of public disclosure through Form 990 is to provide transparency and accountability, which helps in building trust with the public, potential donors, and other stakeholders. By having access to this information, individuals can make informed decisions about their financial support and engagement with nonprofits.

Navigating the 2022 Form 990

The 2022 Form 990 comes with certain updates and changes that filers should be aware of. Notably, the IRS has adjusted various parts to enhance clarity and to modernize reporting requirements in line with enhanced technology use and compliance norms. Recognizing these changes is crucial for accurate completion.

Key sections to focus on include the summary of the organization’s mission, the statement of program service accomplishments, and compensation information. Each section includes specific questions that require detailed and, often, numerical responses, demanding careful attention to ensure accuracy.

Common mistakes include underreporting specific items, misunderstanding which activities qualify as program services, and missing documentation. Filers can avoid pitfalls by being thorough, double-checking entries, and utilizing available resources.

Step-by-step guide to filling out the 2022 Form 990

Filling out the 2022 Form 990 requires careful preparation and organization of documentation. Start by gathering the necessary documentation, including financial statements, operational records, and previous forms to ensure consistency and reference.

Utilizing interactive tools can streamline the document preparation process. For instance, pdfFiller’s Document Creator features templates specifically designed for Form 990 that help organize information efficiently. These templates offer guidance for each section, simplifying reporting.

After completing the form, review it carefully for any discrepancies, and prepare to eSign using Document Management tools available in pdfFiller, finalizing the document efficiently.

Managing and storing your Form 990

Managing your Form 990 doesn’t end once it’s completed. Adopting best practices for document management ensures easy retrieval and compliance in the future. Utilize cloud-based solutions that secure data while allowing access from various locations.

pdfFiller offers enhanced document management capabilities with features like secure storage and easy sharing options. This ensures all your important files, including your Form 990, are organized and readily available for stakeholders or auditors.

Understanding the implications of public disclosure

Public disclosure is not just a legal requirement; it’s a significant aspect of transparency in the nonprofit sector. Organizations are legally bound to provide their Form 990 to the public, which reinforces accountability and fosters trust with donors and the community.

Transparency plays a vital role in building trust and engaging the community effectively. When organizations transparently share their successes and challenges, it enhances credibility, which can directly affect fundraising capabilities and support from the community.

Leveraging Form 990 for strategic insight

Form 990 is not only a compliance tool but also a strategic asset for nonprofits. By analyzing their own Form 990 alongside those of peer organizations, nonprofits can identify trends, strengths, and opportunities for improvement.

Utilizing this analysis can help attract donors by showcasing program success stories, financial health, and operational practices that align with donor interests. Additionally, employing benchmarking tools can facilitate performance assessments, leading to informed strategic decisions.

FAQs about the 2022 Form 990

Individuals and teams often have questions when it comes to navigating the 2022 Form 990, from its requirements to submission processes. Engaging with these frequently asked questions can demystify various aspects of the form and highlight essentials to ensure compliance.

From inquiries about deadlines, the consequences of late submissions, to the impact of errors, having clear answers can provide solace and guidance to those responsible for completing this form.

Engaging with the community

Engagement with the nonprofit community can enhance your understanding and application of the Form 990. This can happen through forums where individuals share their experiences completing the form. Sharing your insights can greatly assist others navigating similar challenges.

Moreover, contribute to resource-sharing initiatives that promote transparency across the nonprofit sector. Signing up for updates on nonprofit compliance practices keeps you informed about best practices in document management and regulatory requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2022-form-990-public-disclosurepdf in Chrome?

How can I edit 2022-form-990-public-disclosurepdf on a smartphone?

How do I edit 2022-form-990-public-disclosurepdf on an iOS device?

What is 2022-form-990-public-disclosurepdf?

Who is required to file 2022-form-990-public-disclosurepdf?

How to fill out 2022-form-990-public-disclosurepdf?

What is the purpose of 2022-form-990-public-disclosurepdf?

What information must be reported on 2022-form-990-public-disclosurepdf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.