Get the free 15-1022: T.S. and U.S. POSTAL SERVICE, POST OFFIC...

Get, Create, Make and Sign 15-1022 ts and us

How to edit 15-1022 ts and us online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 15-1022 ts and us

How to fill out 15-1022 ts and us

Who needs 15-1022 ts and us?

15-1022 TS and US Form: A Comprehensive How-to Guide

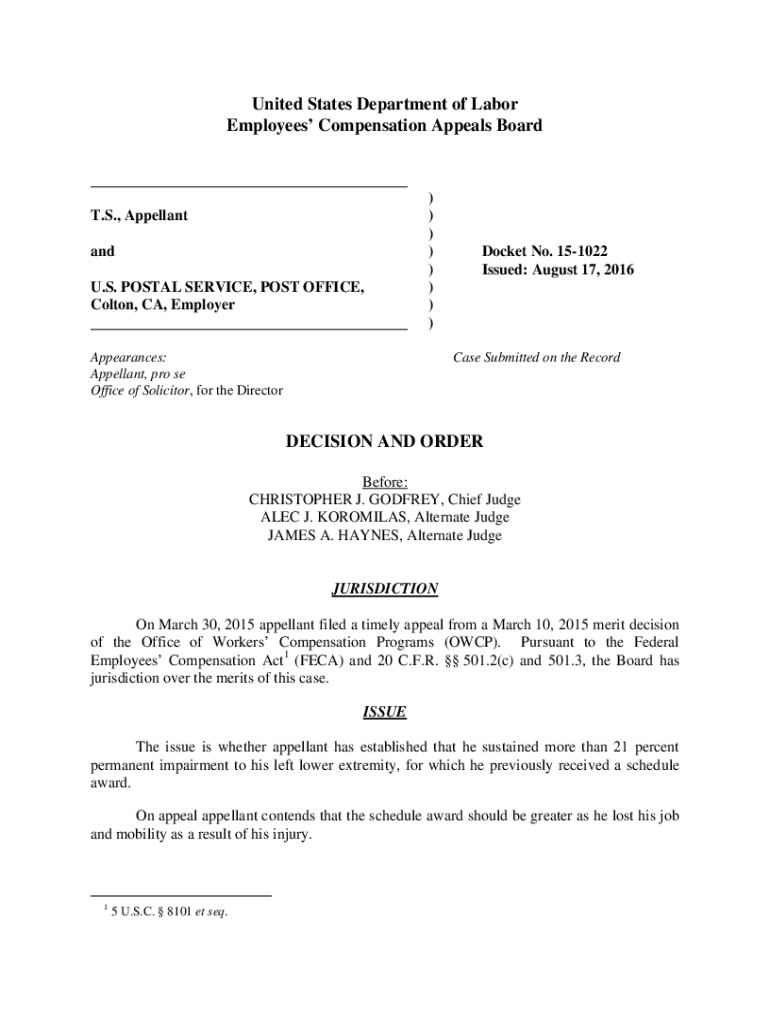

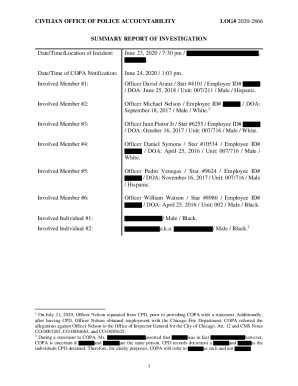

Understanding the 15-1022 TS and US Form

The 15-1022 TS and US Form is a critical document used for various tax-related purposes in the United States. Designed to cater to both individual taxpayers and teams, this form is pivotal for accurate reporting of income and deductions. It not only ensures compliance with the Internal Revenue Service (IRS) but also aids in the efficient management of financial obligations. Understanding the specifics of this form is essential for effective tax planning.

The importance of the 15-1022 TS and US Form cannot be overstated. Each year, millions of individuals and businesses submit this form to verify their income and claim deductions. The accuracy of this document can affect potential tax refunds and overall financial health. Hence, both new and seasoned taxpayers must familiarize themselves with the requirements and processes associated with this form.

Who Needs to Use the 15-1022 Form?

The target audience for the 15-1022 Form encompasses a wide range of taxpayers. Individuals who have become self-employed, teams managing collective income, or those who seek to report multiple income streams must utilize this form. Common scenarios include freelancers filing taxes for the first time, teams in partnership arrangements, and small businesses claiming expenses.

Additionally, any taxpayer who has undergone significant life changes—such as a marriage, divorce, or change in dependents—may find the 15-1022 Form particularly relevant. It's crucial to recognize not only who needs the form but also why it holds such significance. By staying informed about tax obligations, individuals and teams can ensure they fulfill their responsibilities accurately and timely.

Preparing to fill out the 15-1022 Form

Before you dive into filling out the 15-1022 TS and US Form, preparation is key. Start by gathering all necessary information and documents. Essential paperwork includes income statements, identification documents, previous tax returns, and any other relevant financial information. These documents will serve as the foundation for accurately completing the form.

Effective data organization helps streamline the process. Utilizing tools such as pdfFiller can simplify this task significantly. By compiling your data into an easily accessible format, you can focus more on accuracy instead of scrambling for documents at the last minute. Having your information organized will contribute to a smoother completion of the 15-1022 Form.

Step-by-Step Instructions for Completing the 15-1022 Form

To access the 15-1022 Form, pdfFiller provides a straightforward approach. Navigate to the site and search for the 15-1022 template. The platform offers plenty of editing and signing options which simplify the process of completing the form. You can fill it out, sign it, and manage all your documents in one place, thus enhancing productivity.

When filling out the form, start with your personal information. Ensure that your name, address, and identification details are filled accurately. Next, report your financial information diligently. Provide correct income figures and ensure you are aware of any deductions you may be eligible for. Finally, signing and certifying the document electronically is crucial. An eSignature via pdfFiller is legally binding, providing a seamless way to finalize your submission.

Common mistakes can include misreporting income, leaving sections blank, or failing to recognize applicable deductions. Always double-check entries to ensure your form is filled out correctly.

Tips for editing and revising the form

Once you've filled out your 15-1022 Form, take advantage of pdfFiller's editing tools for any necessary revisions. The platform offers comprehensive annotation features that allow you to make corrections with ease. In addition, if you’re teaming up with others, the collaboration functionalities enable multiple users to work on the document simultaneously, ensuring everyone's input is considered.

To ensure compliance and accuracy, establish best practices for double-checking your entries. This includes reviewing all income figures, verifying your personal information, and confirming that all necessary signatures are present. Utilizing pdfFiller's tracking features can be invaluable for keeping an eye on who has reviewed and modified the document.

Signing and submitting the 15-1022 Form

Understanding the submission process for the 15-1022 TS and US Form is essential. You can choose to submit the form online through the IRS portal or send it via traditional mail. Each option has its benefits; submitting online typically offers quicker processing times. Make sure to adhere to deadlines to avoid penalties or delays in processing.

To eSign the form through pdfFiller, follow these straightforward steps. After filling the document, click on the ‘Sign’ feature on the platform, select your preferred eSignature, and apply it to the designated section of the form. Once signed, pdfFiller allows you to download or share your completed form as required. Tracking your submission status afterward is just as important; regularly check for updates and ensure all documents have been processed.

Managing your 15-1022 Form and related documents

Once your 15-1022 Form is submitted, consider how you will manage this document and any related files. Utilizing a cloud-based solution like pdfFiller offers substantial benefits for securely storing documents. You'll ensure that your data is accessible from anywhere and safe from unauthorized access or loss.

When it comes to retrieving past submissions, pdfFiller provides easy access to your historical data. This feature is particularly useful for future reference. Additionally, if you need to collaborate with tax professionals or other stakeholders, pdfFiller simplifies the sharing process, allowing you to share documents and receive feedback seamlessly.

FAQs about the 15-1022 Form

Common queries regarding the 15-1022 TS and US Form often revolve around eligibility, submission deadlines, and potential penalties for inaccuracies. For individuals unsure if they need to submit this form, consulting a tax professional can provide clarity tailored to their specific situations. Lastly, crucial resources such as the IRS website and community forums can offer additional assistance.

If you have further questions beyond common queries, consider reaching out to a tax advisor or relevant government agency. They can provide detailed insights into your specific requirements and help navigate complexities associated with tax compliance.

Conclusion on utilizing pdfFiller for document management

In summary, using pdfFiller for managing the 15-1022 TS and US Form presents numerous benefits. The platform empowers users to efficiently create, edit, and sign documents from a single, easy-to-use interface. By leveraging pdfFiller's tools, individuals and teams can focus more on their financial strategies rather than on the intricacies of paperwork.

Embracing this seamless document creation experience not only increases productivity but also fosters a sense of confidence in handling financial responsibilities. With the right tools at your disposal, navigating your tax obligations becomes a manageable task.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 15-1022 ts and us to be eSigned by others?

How can I get 15-1022 ts and us?

Can I edit 15-1022 ts and us on an iOS device?

What is 15-1022 ts and us?

Who is required to file 15-1022 ts and us?

How to fill out 15-1022 ts and us?

What is the purpose of 15-1022 ts and us?

What information must be reported on 15-1022 ts and us?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.