Get the free Tata - Transaction Slip-NO CODEPDFFinancial Services

Get, Create, Make and Sign tata - transaction slip-no

How to edit tata - transaction slip-no online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tata - transaction slip-no

How to fill out tata - transaction slip-no

Who needs tata - transaction slip-no?

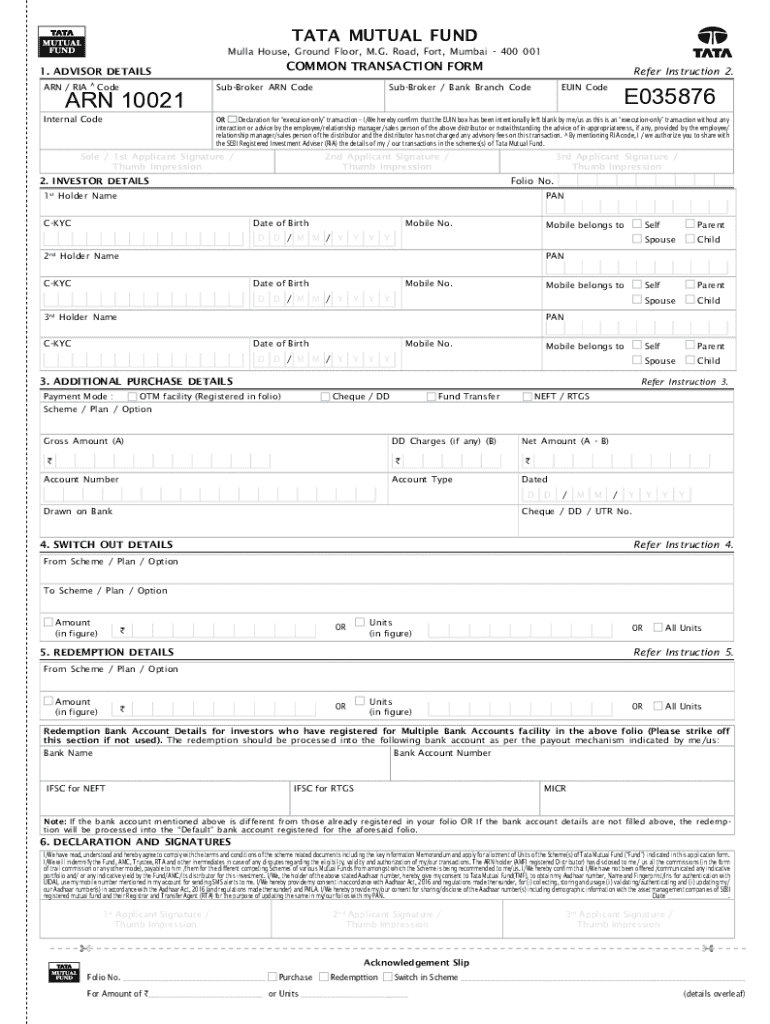

Understanding the Tata Transaction Slip No Form: A Comprehensive Guide

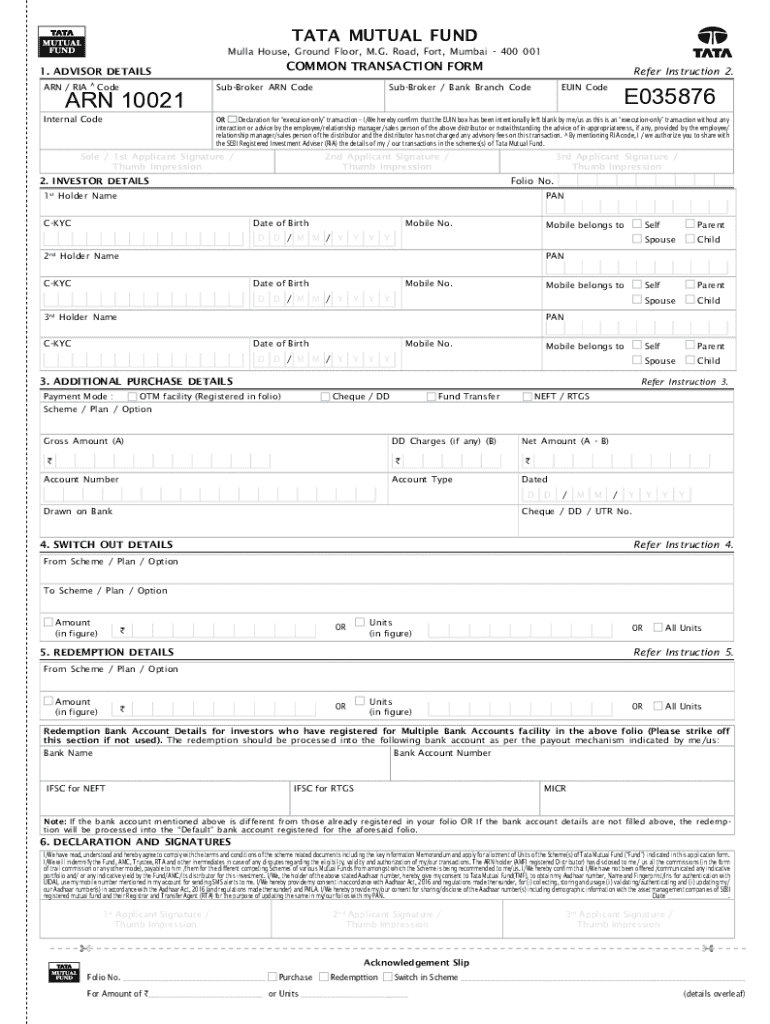

Understanding the Tata transaction slip no form

The Tata Transaction Slip No Form is a document critical for ensuring transparent, efficient, and verifiable financial transactions. It acts as a concrete record of an agreement or transaction between two parties, detailing specific transaction information without requiring a formal printed form. This sharpens the transaction process, making it quicker and more reliable.

The importance of the Tata Transaction Slip No Form extends beyond merely recording transactions; it serves as a vital reference point for audits, compliance inspections, and financial reconciliations. When utilized correctly, it safeguards against inaccuracies and disputes related to financial dealings.

Key features of the Tata transaction slip no form

A key feature of the Tata Transaction Slip No Form is its structured layout, which includes essential elements that encapsulate all relevant information concerning a transaction. Critical sections on the form include the transaction date, amount, payer and payee details, and the transactional purpose, all of which help streamline the overall transaction process.

This form is flexible enough to accommodate various types of transactions ranging from financial investments, inter-account transfers, and service payments to payroll processing. It facilitates smooth transactions by giving transparent visibility into the details, reducing the risk of conflicts and misinterpretations.

Step-by-step guide to filling out the Tata transaction slip no form

Before filling out the Tata Transaction Slip No Form, consider the necessary documentation. Ensure that you have all relevant invoices, identification, and any previous correspondence reliable to the transaction. This preparation helps you avoid errors and streamline the process, increasing compliance with your corporate or legal standards.

Here's a comprehensive guide on how to fill out the Tata Transaction Slip No Form effectively.

Common pitfalls include incorrect data entry in any of the fields mentioned above. Such misentries can lead to rejections or, in worse scenarios, audits and penalties. To counteract potential issues, double-check all provided information before submission.

Interactive filling experiences are available via pdfFiller, allowing users to navigate the process easily while ensuring compliance.

Editing and customizing your Tata transaction slip no form

Using pdfFiller’s editing tools, users can customize the Tata Transaction Slip No Form to meet specific transactional needs. The platform provides options to modify fields, add or remove sections, and adjust the layout, giving you full control over how the document appears and functions.

Moreover, users can add signatures and approvals electronically, making it a convenient solution for teams that require collaborative oversight. When working in a team, collaboration tools help in gathering feedback and ensuring that all necessary personnel are on board with the transaction.

In case of uncertainties or inquiries, users can refer to the frequently asked questions section on pdfFiller, which provides valuable insights into editing and customization.

eSigning your Tata transaction slip no form

One of the significant advantages of using the Tata Transaction Slip No Form on pdfFiller is the capacity to eSign the document securely. eSigning greatly enhances the speed of transactions by enabling the instant signing of documents from any location. This feature removes geographical constraints and allows for real-time collaboration.

To sign your document securely, follow these steps: access the form via pdfFiller, select the eSignature option, draw or upload your signature, and finalize the signing process. The platform ensures that all signatures are encrypted and legally binding.

Managing your Tata transaction slip no form

Once you’ve completed the Tata Transaction Slip No Form, proper management is key. Storing and organizing your forms in the cloud allows for easy access anytime and anywhere. pdfFiller offers cloud storage solutions that enable you to retrieve your documents quickly, ensuring that you maintain records of all transactions.

Moreover, tracking changes and having version control features mean that you can monitor any modifications made to the documents over time. This functionality is particularly crucial when collaborative teams are involved as it eliminates confusion about the most current version of the document.

Troubleshooting common issues with the Tata transaction slip no form

Submitting the Tata Transaction Slip No Form can sometimes lead to issues if not done correctly. Common mistakes include missing information, incorrect format in entered data, or failure to validate the document. Recognizing these mistakes early can save significant time and resources.

In cases where your form is rejected or questions arise, it’s essential to consult pdfFiller’s support resources. They can provide you with detailed guidance and troubleshooting steps to resolve any issues swiftly.

Advanced features and best practices

Leveraging advanced analytics can provide insightful data regarding your transactions when using the Tata Transaction Slip No Form. pdfFiller offers functionalities that generate analytics on transaction patterns, giving teams and individuals the ability to make data-driven decisions.

Additionally, automating transaction processes through pdfFiller can significantly enhance workflow efficiency. By utilizing system prompts and reminders, you can ensure that each step in the process is completed timely and accurately. Practicing legal compliance in all your transactions also remains crucial, especially when dealing with sensitive information.

User testimonials and case studies

Real-life examples illustrate how individuals and teams have effectively utilized the Tata Transaction Slip No Form. Many businesses report enhancements in operational efficiency and accuracy by switching to a digital format for transactions and approvals. By integrating with pdfFiller, users gain access to interactive tools that ensure accuracy and expedience.

One case study noted a small business reducing its transaction processing time by over 50% after adopting pdfFiller tools. This switch not only enhanced productivity but also improved client satisfaction due to faster turnaround times.

Future of document management with the Tata transaction slip no form

The landscape of financial documentation continues to evolve. With increasing calls for efficiency and transparency, the usage of solutions like the Tata Transaction Slip No Form is expected to become more prevalent. Trends point toward enhanced digitization, with tools that further simplify creation, editing, and management of documents.

pdfFiller stands at the forefront of these innovations, continuously enhancing the user experience for document management. In the coming years, features like AI integration and seamless collaboration are anticipated to make transactions even smoother, reinforcing the importance and utility of the Tata Transaction Slip No Form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tata - transaction slip-no without leaving Google Drive?

How can I send tata - transaction slip-no for eSignature?

Can I sign the tata - transaction slip-no electronically in Chrome?

What is tata - transaction slip-no?

Who is required to file tata - transaction slip-no?

How to fill out tata - transaction slip-no?

What is the purpose of tata - transaction slip-no?

What information must be reported on tata - transaction slip-no?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.