Get the free Non-Stock Corporations Only

Get, Create, Make and Sign non-stock corporations only

How to edit non-stock corporations only online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-stock corporations only

How to fill out non-stock corporations only

Who needs non-stock corporations only?

Navigating Non-Stock Corporations Only Form: A Comprehensive Guide

Understanding non-stock corporations

Non-stock corporations, primarily established for purposes that do not focus on profit generation, are essential entities within sectors like non-profits, cooperatives, and community organizations. Unlike traditional stock corporations, these entities do not issue shares or dividends to shareholders, which significantly alters their operational and financial frameworks.

The most crucial characteristic of non-stock corporations is their purpose. They are often aimed at fulfilling a charitable, educational, or social mission, which makes them integral to community development. This structure fosters collaboration and a pursuit of collective welfare instead of profit maximization.

Importance of non-stock corporations forms

Understanding the legal landscape governing non-stock corporations is essential for anyone looking to launch one. Filing the appropriate forms is not just a formality; it’s a legal requirement that verifies your organization’s legitimacy. This verification is critical for obtaining grants, tax exemptions, and maintaining good standing with the authorities.

Improper filing can lead to several consequences, such as fines, a loss of non-profit status, and even legal repercussions. Moreover, a business that neglects to maintain its document filing history might face challenges in securing funding or achieving operational goals.

Types of non-stock corporation forms

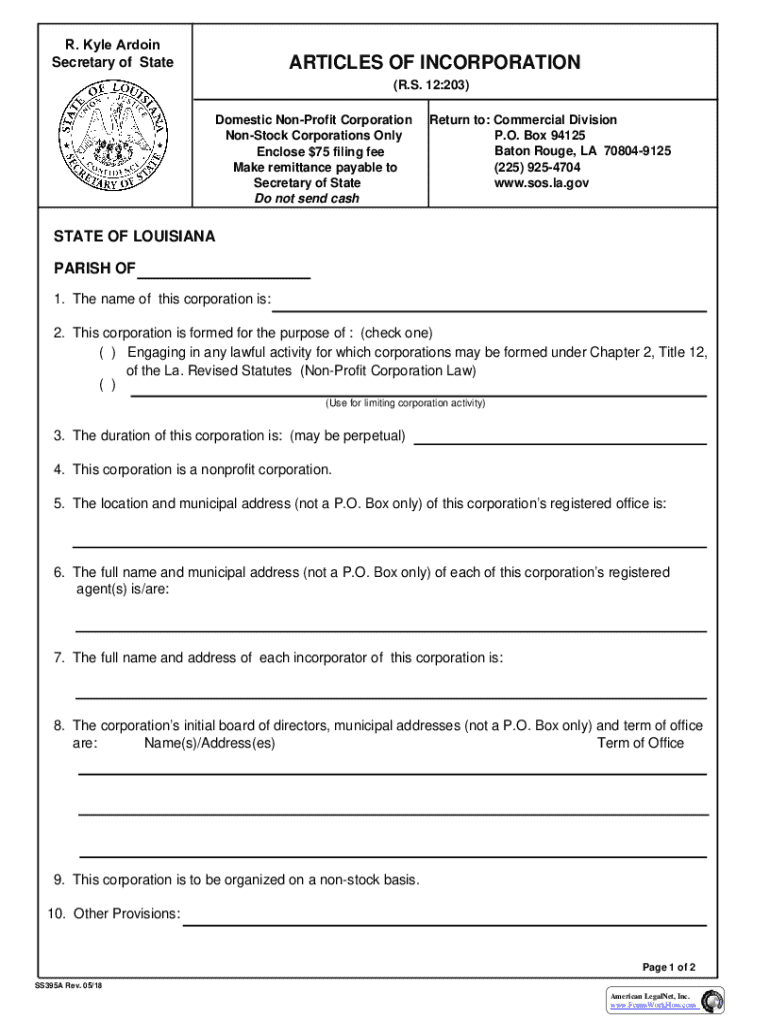

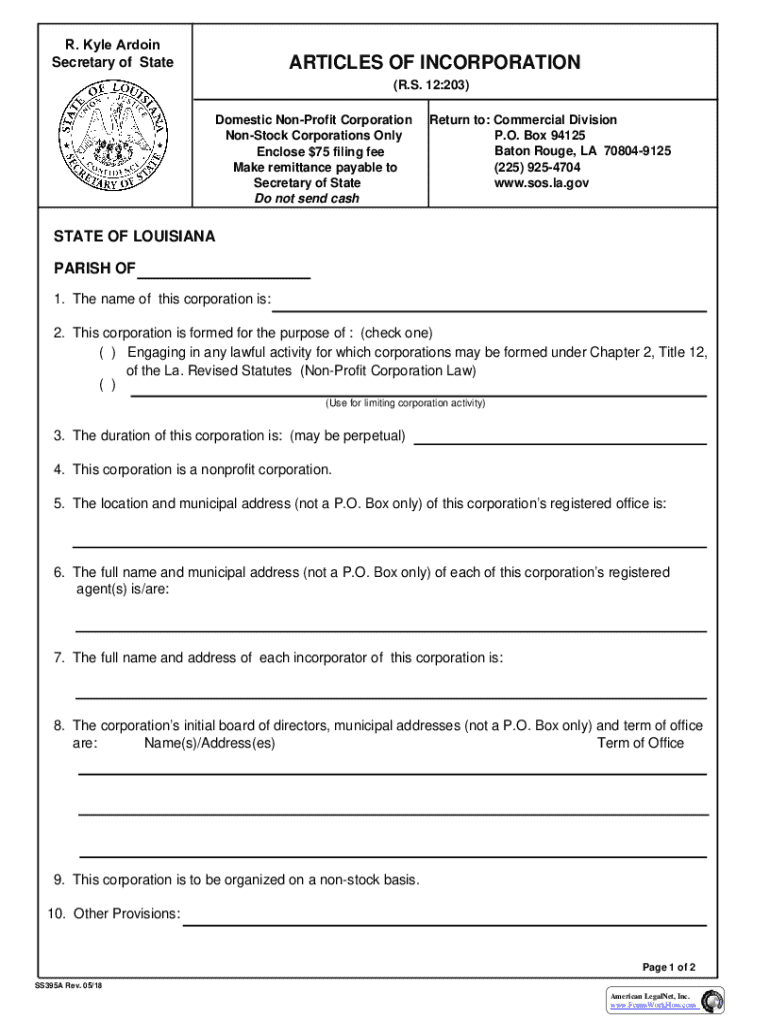

When setting up a non-stock corporation, several essential documents must be prepared. The Articles of Incorporation outline your organization’s name, purpose, and structure. Following this, corporate bylaws govern the internal operations of the corporation, such as membership criteria, and procedural rules.

Additionally, applying for non-profit status with the IRS often requires submitting specific forms that establish eligibility for tax exemptions. Furthermore, any certificates related to dissolution or revocation might be necessary if the organization’s trajectory changes.

How to file non-stock corporation forms

Filing for a non-stock corporation involves a systematic and multi-step approach. First, prepare the necessary documents, ensuring all information is accurate and complete. The next step is to fill out the non-stock corporation form, which provides critical data about your entity.

Once the documentation is prepared, submission procedures vary by state, but generally involve mailing or filing directly with the secretary of state’s office. After submission, one must wait for confirmation of incorporation, which can take a few weeks. Here are the steps broken down:

To ensure successful filing, double-check all provided information for accuracy. Additionally, signatures must be gathered correctly as incomplete or unsigned documents may delay processing.

Interactive tools for filing non-stock corporation forms

Tools like pdfFiller provide a seamless and efficient way to manage non-stock corporation documentation. Utilizing pdfFiller, users can edit templates online, ensuring all forms are tailored to organizational needs. The platform also supports eSigning, allowing multiple stakeholders to sign necessary documents securely.

Collaboration becomes streamlined when using pdfFiller. Teams can engage in real-time editing and feedback, allowing for dynamic adjustments as forms are completed. Sharing capabilities let users disseminate documents easily, helping track changes and maintain organized filing workflows.

Understanding fees and costs associated with non-stock corporations

When budgeting for the incorporation of a non-stock corporation, it’s essential to consider various potential fees. States can charge filing fees for articles of incorporation, and other necessary legal documents can incur costs. In addition to these upfront fees, periodic compliance costs and potential legal consultation fees should be factored into your budget.

To save on filing costs, understanding your state’s fee structure will help minimize expenses. Some states offer reduced rates for non-profit entities, and applying for financial assistance through grants can often cover some expenses. Keeping a detailed list of all business filings can aid in organizational efficiency and transparent budgeting.

Managing and maintaining your non-stock corporation

Ongoing management and maintenance are crucial for your non-stock corporation’s sustainability. Comprehensive record-keeping practices ensure critical documents remain organized, accessible, and compliant with state laws. This includes maintaining updated records of meetings, financials, and operational activities.

Conducting regular compliance checks reinforces a corporation's standing and helps identify required updates. As regulations and internal structures evolve, updating corporate records is essential to reflect current practices, ensuring that your organization operates within legal parameters.

Common challenges in forming non-stock corporations

Forming a non-stock corporation comes with its challenges, particularly in navigating state-specific regulations and legal complexities. Business owners must be well-informed about the required documentation and processes needed to avoid unnecessary hurdles. This knowledge gap can lead to significant delays in establishing the organization.

Avoiding common pitfalls, such as overlooking critical forms or failing to meet filing deadlines, is essential. Relying on resources like legal advice or templates specifically tailored for non-stock corporations can provide clarity and help circumvent most issues associated with the formation process.

Related articles for further reading

For those interested in extending their knowledge on related topics, several articles delve deeper into specifics—key considerations when forming non-stock corporations, a comparison between non-profit and for-profit statuses, and resources available for entrepreneurs navigating this space. These readings can provide insights and practical advice critical for anyone in the process.

FAQs about non-stock corporation forms

As you navigate the non-stock corporation landscape, understanding frequently asked questions can help clarify common uncertainties. For instance, one may wonder how a non-stock corporation differs from a regular corporation. It primarily lies in the absence of stock issuance and profit motives, focusing instead on mission-driven activities.

Another common inquiry concerns the duration of the filing process. While it varies by state, users can typically expect to wait a few weeks for processing. Lastly, amending corporate documents post-submission is possible—business owners should follow specific state guidelines to ensure modifications are officially recognized.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my non-stock corporations only in Gmail?

How can I send non-stock corporations only for eSignature?

How can I edit non-stock corporations only on a smartphone?

What is non-stock corporations only?

Who is required to file non-stock corporations only?

How to fill out non-stock corporations only?

What is the purpose of non-stock corporations only?

What information must be reported on non-stock corporations only?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.