Get the free Registered Investment Advisor (RIA) registration form

Get, Create, Make and Sign registered investment advisor ria

How to edit registered investment advisor ria online

Uncompromising security for your PDF editing and eSignature needs

How to fill out registered investment advisor ria

How to fill out registered investment advisor ria

Who needs registered investment advisor ria?

Understanding the Registered Investment Advisor RIA Form: A Comprehensive Guide

Overview of registered investment advisors (RIAs)

Registered Investment Advisors (RIAs) play a crucial role in the financial advisory landscape by providing personalized investment advice to clients. They are fiduciaries, which means they are legally obligated to act in the best interest of their clients. This level of trust and responsibility sets them apart from other financial professionals. RIAs must register with either the Securities and Exchange Commission (SEC) or state regulatory authorities, depending on the amount of assets they manage.

Compliance is more than just a regulatory requirement; it's the cornerstone of a trustworthy advisory relationship. Ensuring that RIAs adhere to strict compliance guidelines helps protect investor interests and upholds the integrity of the financial markets. Therefore, understanding the nuances of the RIA registration process is essential for both investment professionals and their clients.

Understanding the RIA form

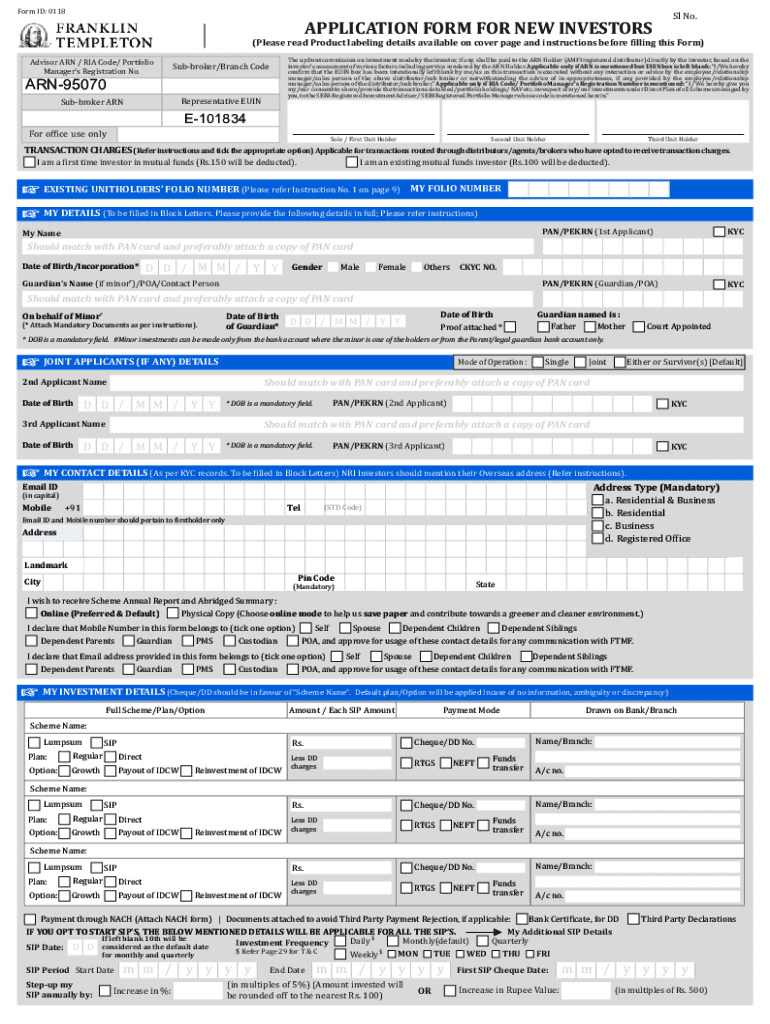

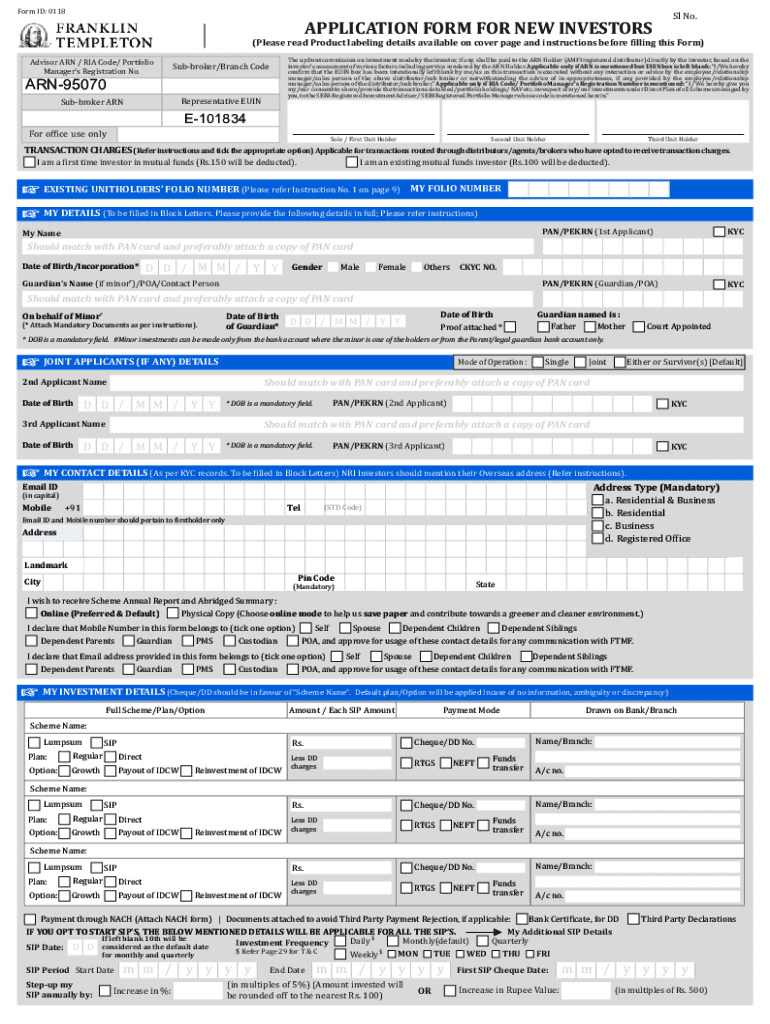

To establish themselves legally, RIAs must complete specific forms outlined by regulatory bodies. The most prominent among these is Form ADV, which is divided into several parts to capture detailed information about the advisory firm and its practices. Understanding this form is crucial for compliance and successful registration.

For new applicants, two primary parts of Form ADV are significant: Part 1 and Part 2. Form ADV Part 1 collects essential information about the advisor's business structure, services offered, and any disciplinary actions. In contrast, Part 2 offers clients a comprehensive overview of the advisor’s fees, services, and investment strategies, which must be provided in a clear and easily understood format.

Step-by-step guide to completing the RIA form

Completing the RIA form, specifically Form ADV, requires meticulous attention to detail. The following steps break down the process, ensuring each aspect is covered without error, enabling a smoother registration journey.

Step 1 involves gathering necessary personal and firm information, such as names, addresses, business structure, and key personnel details. This information lays the foundation for completing the form accurately.

Next, Step 2 focuses on filling out Form ADV Part 1. Each section must be completed with precision, typically covering the advisor’s background, the advisory firm’s structure, and any disciplinary history related to the firm or its management.

In Step 3, advisors complete Form ADV Part 2, which outlines the services provided, the fee structure, and any potential conflicts of interest. This part must be clear and concise, fostering transparency for clients.

Step 4 involves reviewing and revising your form. Common mistakes include inaccurate information and missing signatures. A thorough review process can prevent lengthy delays and potential issues.

Finally, Step 5 covers the submission process. RIAs have the option to submit their forms electronically through the Investment Adviser Registration Depository (IARD) or via paper submission, which involves additional fees and time.

Editing and managing your RIA form with pdfFiller

Navigating the RIA form doesn’t stop at submission; ongoing management is essential for compliance and updates. pdfFiller offers superior document management features that allow for easy editing, signing, and collaboration on the Form ADV and other related documents.

With pdfFiller, users benefit from seamless editing features that let you make quick corrections or updates, ensuring your RIA form is always current. The eSigning capability streamlines the process of obtaining necessary signatures, making it easier for all parties involved.

Frequently asked questions about RIA registration

As potential RIAs embark on the registration journey, questions often arise during the process. Addressing common queries can reduce anxiety and help streamline completion.

One pivotal question is: what to do if you make an error on your RIA form? Most errors can be rectified through amendments filed after submission. However, it's vital to handle these corrections promptly to avoid compliance issues.

Updating registration information is another point of confusion for many. RIAs must file amendments in a timely manner to reflect any changes in their business structure, services, or personnel. This ensures that regulators have accurate and up-to-date information at all times.

Compliance considerations for registered investment advisors

Compliance does not stop after submitting the RIA form. Registered Investment Advisors must engage in ongoing compliance efforts to maintain their regulatory standing and provide superior service to clients.

Post-submission, RIAs are required to conduct an annual review of their Form ADV. This ensures that the information remains current and accurate, preventing possible compliance violations. Additionally, any amendments must be filed promptly whenever there are changes in the firm, such as changes to business address or key management.

It's also vital to navigate the landscape of state-specific regulations. Different states may impose additional requirements that must be adhered to, making it essential for RIAs to understand their jurisdiction.

State-specific guidelines for RIA registration

Each state has its own unique requirements for RIAs, influencing the registration process. Understanding these state-specific guidelines will prevent unnecessary delays and complications.

Key state agencies oversee the registration of investment advisors, with many requiring additional documentation or proof of compliance with local laws. Common requirements can include background checks, financial disclosures, and continuing education mandates.

Additional tools and resources available on pdfFiller

pdfFiller boasts an array of resources aimed at simplifying document management for RIAs. Its cloud-based services enable easy access to templates for various financial documents, enhancing workflow efficiency for investment professionals.

Users can benefit from customizable workflows tailored to the specific needs of their investment advisory firm. This adaptability allows RIAs to streamline their processes, maintain compliance, and manage their documents effectively.

Related information and next steps

As RIAs prepare for registration, understanding the timelines involved is critical. Various state investment adviser association websites can provide updated information on deadlines, forms, and regulatory changes.

Building a network with other registered investment advisors will help in sharing knowledge and experiences that can simplify the registration process. This network can also provide insights into best practices for managing ongoing compliance.

Conclusion

Successfully completing the registered investment advisor RIA form is a critical step in establishing a compliant and reputable advisory practice. From understanding the intricacies of Form ADV to utilizing pdfFiller for efficient document management, each phase of this process is pivotal to an RIA’s success.

Embracing tools like pdfFiller not only simplifies form completion but enhances ongoing document management, making regulatory compliance a seamless part of your advisory business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my registered investment advisor ria in Gmail?

How do I complete registered investment advisor ria online?

How do I make changes in registered investment advisor ria?

What is registered investment advisor ria?

Who is required to file registered investment advisor ria?

How to fill out registered investment advisor ria?

What is the purpose of registered investment advisor ria?

What information must be reported on registered investment advisor ria?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.