Get the free MGTS Aequitas Defensive Fund R Inc - Markets data

Get, Create, Make and Sign mgts aequitas defensive fund

Editing mgts aequitas defensive fund online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mgts aequitas defensive fund

How to fill out mgts aequitas defensive fund

Who needs mgts aequitas defensive fund?

Navigating the MGTS Aequitas Defensive Fund Form: A Comprehensive Guide

Understanding the MGTS Aequitas Defensive Fund

The MGTS Aequitas Defensive Fund is an investment vehicle designed to prioritize capital preservation while offering a potential for moderate growth. Its primary strategy focuses on minimizing risks associated with market volatility, making it an attractive option for conservative investors. By emphasizing stability and low correlation to broader market swings, this fund aims to safeguard clients’ investments while still achieving reasonable returns.

Defensive funds are characterized by their positioning in stable asset classes, such as bonds and high-quality equities. This approach allows investors to navigate tumultuous market conditions with improved peace of mind. The key objectives of the MGTS Aequitas Defensive Fund include maintaining low volatility, enhancing portfolio diversification, and providing steady income through regular distributions.

Key features of the MGTS Aequitas Defensive Fund

The investment philosophy behind the MGTS Aequitas Defensive Fund is centered on stability rather than aggressive growth. During times of economic uncertainty, this fund favors assets that exhibit lower volatility. This might include government treasuries, blue-chip stocks, or higher-rated corporate bonds. The asset allocation strategies often employ a balanced mix to ensure safety while still capturing some growth.

Historical performance analysis reveals that the MGTS Aequitas Defensive Fund has successfully outperformed several peer funds in down markets, showcasing its effectiveness in risk management. Comparing it to similar funds confirms that its unique strategy aligns well with risk-averse investors who seek reliable income streams without compromising safety.

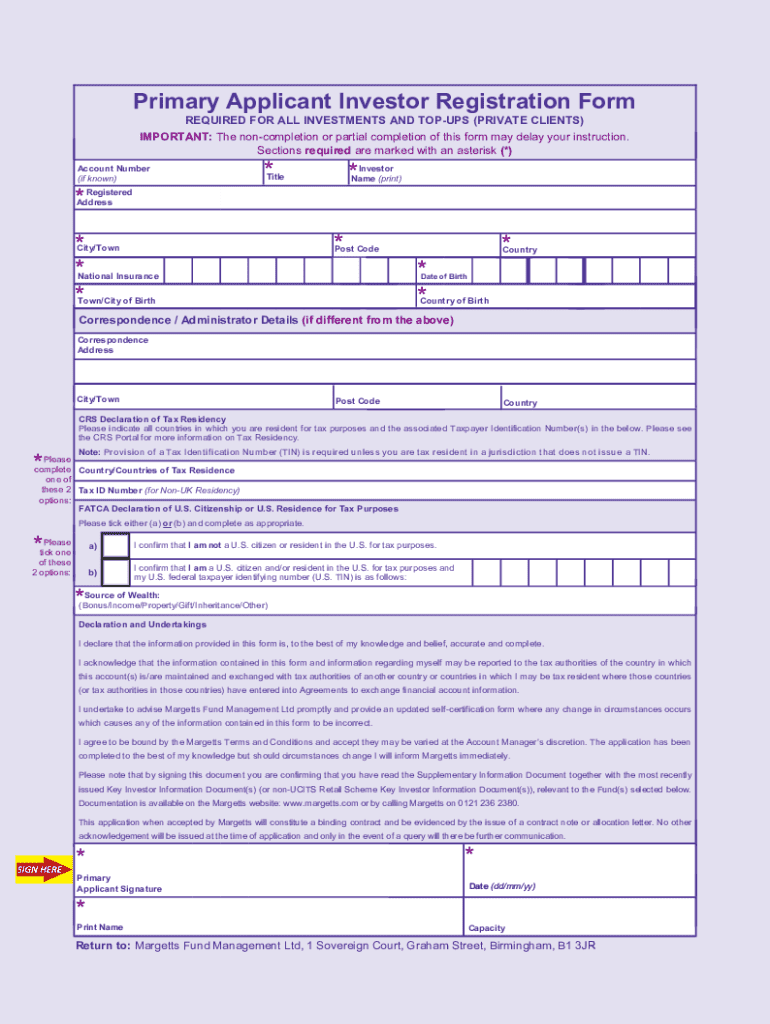

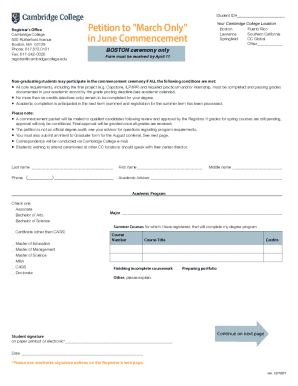

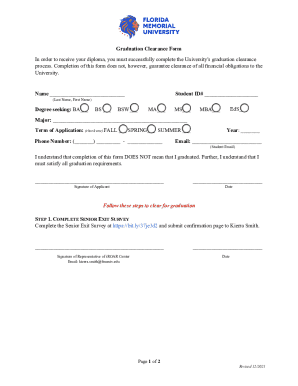

Filling out the MGTS Aequitas Defensive Fund Form

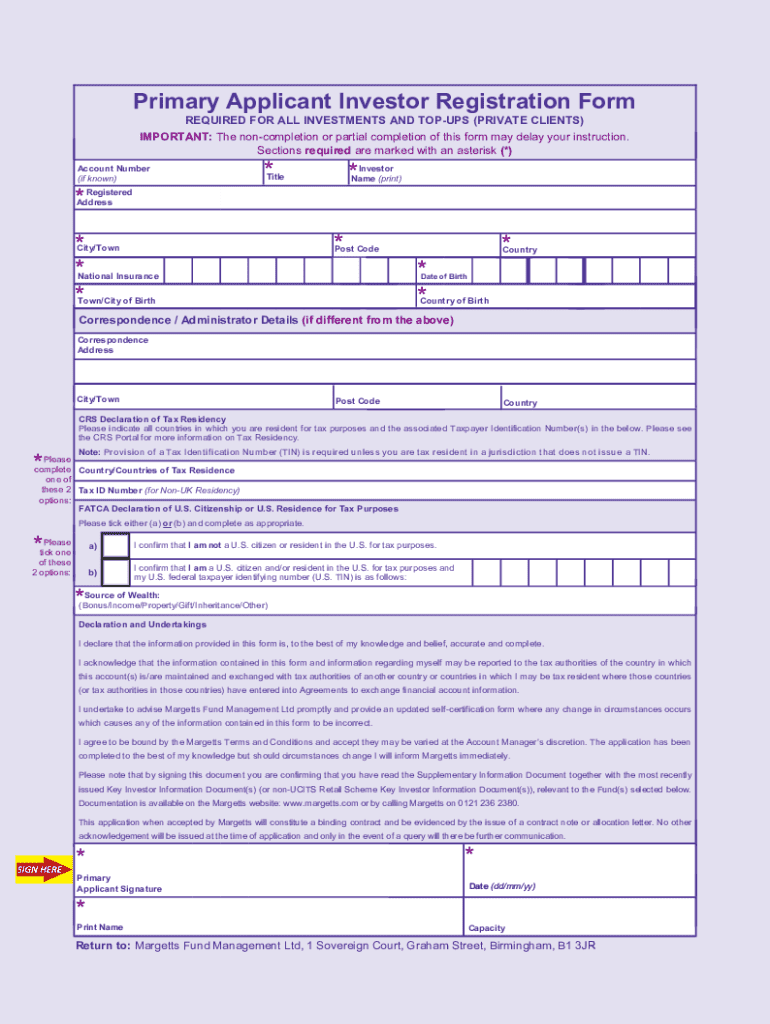

Completing the MGTS Aequitas Defensive Fund Form is crucial for investors. To ensure a smooth application process, start by gathering the necessary personal and financial details such as your identification information, address, and financial background relevant to your investment objectives.

Next, you can access the MGTS Aequitas Defensive Fund Form conveniently through pdfFiller. This platform provides an efficient environment for downloading and editing forms. Simple navigation tools allow you to locate the form quickly — just search 'MGTS Aequitas Defensive Fund' on the homepage.

As you fill out the form, follow a structured approach to ensure accuracy. Pay close attention to each section, particularly financial information and investment preferences. Additionally, avoid common pitfalls such as incorrect personal details or overlooking the signature fields.

Utilize pdfFiller's editing tools to double-check your entries, ensuring the document is both accurate and neatly presented. This includes formatting options that enhance clarity, such as bullet points and bolded headers.

Electronic signatures and document management

The importance of electronic signatures in funding applications cannot be overstated. eSigning offers legal validity and streamlines the application process, significantly reducing the time it takes for approval. Utilizing pdfFiller for electronic signatures ensures your document meets compliance standards while simplifying the signing process.

Once your application is submitted, managing it is pivotal. With pdfFiller, you have the ability to save and retrieve your form conveniently. You will be able to track different versions and maintain a document history, which is crucial if any updates or changes need to be made.

Understanding the investment strategy of the fund

The investment strategy of the MGTS Aequitas Defensive Fund is fundamentally about risk management and stability. The fund’s target sectors include defensive industries such as utilities, healthcare, and consumer staples, which tend to remain steady even during economic upheavals. Additionally, the fund diversifies across various asset types like fixed income and equities to minimize risks.

Risk management techniques employed by the MGTS Aequitas Defensive Fund include rigorous asset selection criteria, strict portfolio monitoring, and implementing stop-loss measures. These strategies are put in place to safeguard investments against market volatility and protect the capital from significant downturns.

Checking the status of your application

After submitting your MGTS Aequitas Defensive Fund Form, tracking its status is essential for ensuring timely updates. pdfFiller provides intuitive tracking tools that allow you to check the progress of your application with ease. By accessing your account, you can see real-time status updates and any actions required.

Generally, after submission, you can expect communication from the fund administrators, detailing the next steps and any additional requirements. This clear line of communication helps manage expectations and offers reassurance throughout the evaluation process.

Frequently asked questions (FAQs)

Many potential investors have queries when it comes to filling out the MGTS Aequitas Defensive Fund Form. One common question is: What happens if I make an error on the form? Generally, errors can often be corrected by contacting the support team or using pdfFiller’s editing tools.

Another frequent question is about the timeline for the application process. Typically, applicants can expect the evaluation and processing of their forms to occur within a few business days. However, this timeline may vary based on submission volume and specific requirements.

Interactive tools for a seamless experience

pdfFiller offers a variety of interactive tools that enhance the experience of managing the MGTS Aequitas Defensive Fund Form. From online editing features to document collaboration capabilities, these tools empower users to personalize their documentation process effectively. The integration of smart templates and real-time updates ensures a streamlined approach to form management.

Additionally, users can customize their document experience based on specific needs. This could involve selecting different formatting styles, working with annotations, or integrating workflows that align with individual preferences. By maximizing the available features in pdfFiller, users can elevate their form management endeavors to a new level.

Next steps after submitting your form

After submitting the MGTS Aequitas Defensive Fund Form, it’s important to have realistic expectations regarding the next steps. Investors should be prepared for a processing timeline that may vary but is typically efficient. You might receive updates regarding your application status and any necessary follow-up documentation or information.

Furthermore, staying prepared for future investments is essential. The MGTS Aequitas Defensive Fund often provides various resources and insights that can help investors make informed decisions post-application. This could include market analyses, updates on fund performance, and strategic recommendations for maximizing investment returns, ensuring that you feel equipped to engage with the fund moving forward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my mgts aequitas defensive fund in Gmail?

How can I send mgts aequitas defensive fund to be eSigned by others?

Where do I find mgts aequitas defensive fund?

What is mgts aequitas defensive fund?

Who is required to file mgts aequitas defensive fund?

How to fill out mgts aequitas defensive fund?

What is the purpose of mgts aequitas defensive fund?

What information must be reported on mgts aequitas defensive fund?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.