Get the free Name of Fund: Life

Get, Create, Make and Sign name of fund life

Editing name of fund life online

Uncompromising security for your PDF editing and eSignature needs

How to fill out name of fund life

How to fill out name of fund life

Who needs name of fund life?

Understanding the Fund Life Form: A Comprehensive Guide

Overview of fund life forms

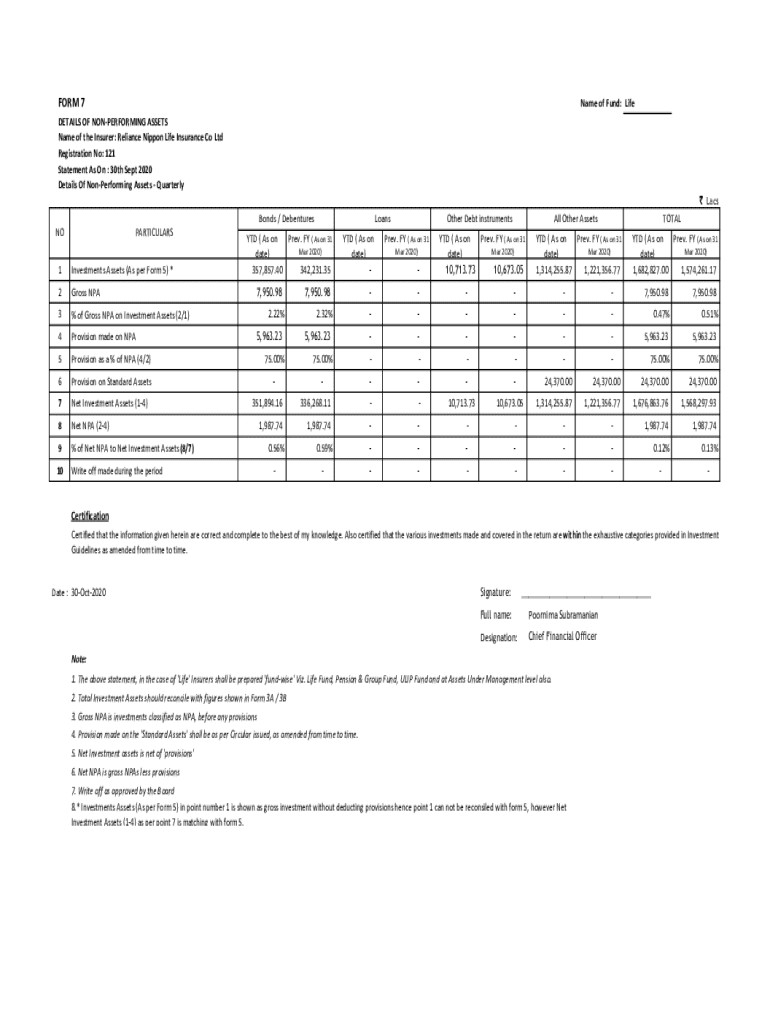

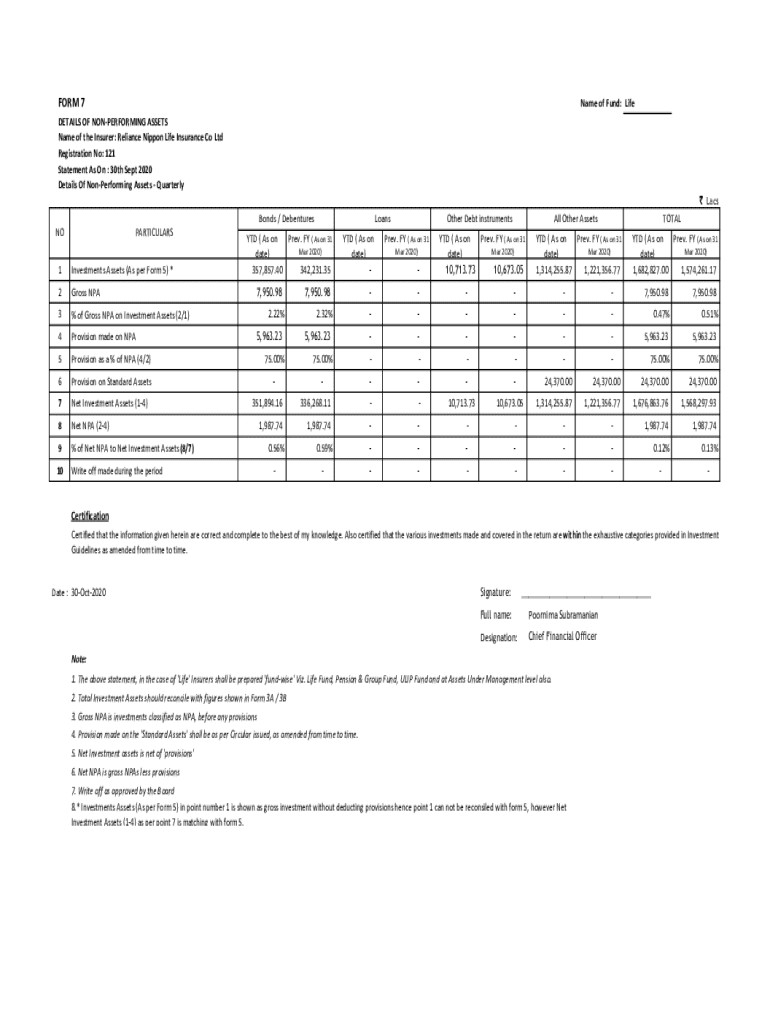

A fund life form is an essential document used in the financial landscape, primarily designed to outline the various components of an investment fund. These forms help in managing investment strategies, risk assessment, and ensuring compliance with regulatory standards. Understanding fund life forms is crucial for both individual investors and financial professionals, as they facilitate clear communication about investment strategies and performance metrics.

The importance of fund life forms lies in their ability to provide structured information that can guide investment decisions. Investors often rely on these documents to evaluate mutual funds, retirement plans, and other financial products tailored to meet their distinct financial situations. By capturing key details regarding fund composition, risk profile, and potential returns, fund life forms allow investment specialists to identify suitable account options for their clients.

Key features of fund life forms

Fund life forms typically comprise several essential components that clarify their purpose and function for investors. For instance, they include personal information sections, financial overviews, and specific investment goals. Each component plays a vital role in ensuring that investment specialists have all the necessary material to create tailored investment strategies.

When compared to other financial documents, fund life forms hold unique advantages. They are often more detail-oriented than standard information forms, providing a comprehensive snapshot of an investor's situation. This detailed nature allows for precise recommendations from financial advisors. Moreover, fund life forms enable funds and investors to maintain transparency throughout their financial planning and management processes.

Preparing your fund life form

Preparation is key when it comes to creating an effective fund life form. The first step is to collect all necessary information. This includes your personal details such as name, address, and social security number. Additionally, you’ll need to gather financial information like income, existing investments, and any liabilities you may have. Accurate and complete data is vital for constructing a reliable foundation for your fund life form.

Next, it’s important to understand the different types of fund life forms available. By familiarizing yourself with options such as equity funds or bond funds, you can determine which type aligns best with your investment goals. This understanding will facilitate a more informed decision-making process when filling out your form.

Filling out your fund life form

Completing a fund life form involves several structured sections, making it easier for users to provide necessary details. First, the personal information section typically requires the basic data previously collected. Following this, the financial overview should detail your current investments, assets, and debts. This offers a holistic view of your financial situation.

In the investment goals section, clearly outline your financial objectives and desired returns. Be realistic; this helps your financial advisor curate a tailored investment strategy that fits your circumstances. Accuracy in each of these sections is paramount to avoid common mistakes, such as incorrectly entering figures or misunderstanding terms and conditions associated with each fund.

Editing and modifying your fund life form

Editing tools, like those offered by pdfFiller, simplify the process of modifying a fund life form. With the platform's user-friendly interface, you can easily add, delete, or modify text within your document. This flexibility is crucial as financial situations can change and adjustments to your fund life form may be necessary.

Moreover, it includes options to insert signatures and stamps, ensuring that your fund life form maintains legal validity. Best practices for maintaining document clarity include using concise language and avoiding clutter. Additionally, if collaborating with other members, leveraging collaboration features is essential to streamline the review process.

Signing your fund life form

Once your fund life form is completed, signing it is the final step before submission. Various methods for signing are available, such as e-signatures or scanned signatures. The legality of e-signatures has been validated in many jurisdictions, making it a suitable option for modern electronic submissions. However, it's important to ensure that you have used proper security measures to protect your document's integrity during the signing process.

By implementing various security measures—such as encrypting your document and using trusted platforms for e-signatures—you further safeguard your financial information. This layer of protection not only legitimizes your legal agreement but also ensures confidentiality during the exchange of sensitive data.

Managing your fund life form

After preparing and signing your fund life form, effective management is crucial. Primarily, ensure that your document is saved and stored securely within a cloud-based platform like pdfFiller. This ensures accessibility from anywhere and helps in avoiding potential data loss. Regular backups can also help retain important information against unforeseen incidents.

Options for sharing your fund life form with financial advisors and stakeholders should also be considered. Utilizing controlled sharing features allows you to maintain oversight while providing necessary access to pertinent parties. Additionally, it's vital to track changes and versions of your fund life form, ensuring that all adjustments are documented for future reference.

Frequently asked questions (FAQs)

When dealing with fund life forms, several questions frequently arise. One common inquiry is, 'What should I do if I lose my fund life form?' In such cases, you may be able to request a new form from your financial provider. Being proactive about documentation can help prevent these circumstances.

Another query is whether a fund life form can be used for different types of investments. The answer is a yes, as these forms can be tailored to accommodate various financial products depending on your needs. Lastly, consider updating your fund life form regularly, especially after significant life changes or shifts in financial goals, to ensure its relevance.

Related financial tools and resources

In addition to the fund life form, several related financial planning forms can enhance your investment experience. Tools that assist in budgeting, track expenses, or organize financial goals can complement your fund management efforts. Utilizing interactive tools available on pdfFiller allows users to explore additional document options seamlessly.

Furthermore, accessing links to additional templates for financial planning provides resources for consistent financial oversight. These documents, when used together with your fund life form, create a comprehensive financial strategy that aligns with your investment objectives.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send name of fund life to be eSigned by others?

How can I edit name of fund life on a smartphone?

How do I fill out name of fund life on an Android device?

What is name of fund life?

Who is required to file name of fund life?

How to fill out name of fund life?

What is the purpose of name of fund life?

What information must be reported on name of fund life?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.