Get the free S-1: Surety Company Annual Report

Get, Create, Make and Sign s-1 surety company annual

Editing s-1 surety company annual online

Uncompromising security for your PDF editing and eSignature needs

How to fill out s-1 surety company annual

How to fill out s-1 surety company annual

Who needs s-1 surety company annual?

Comprehensive Guide to the S-1 Surety Company Annual Form

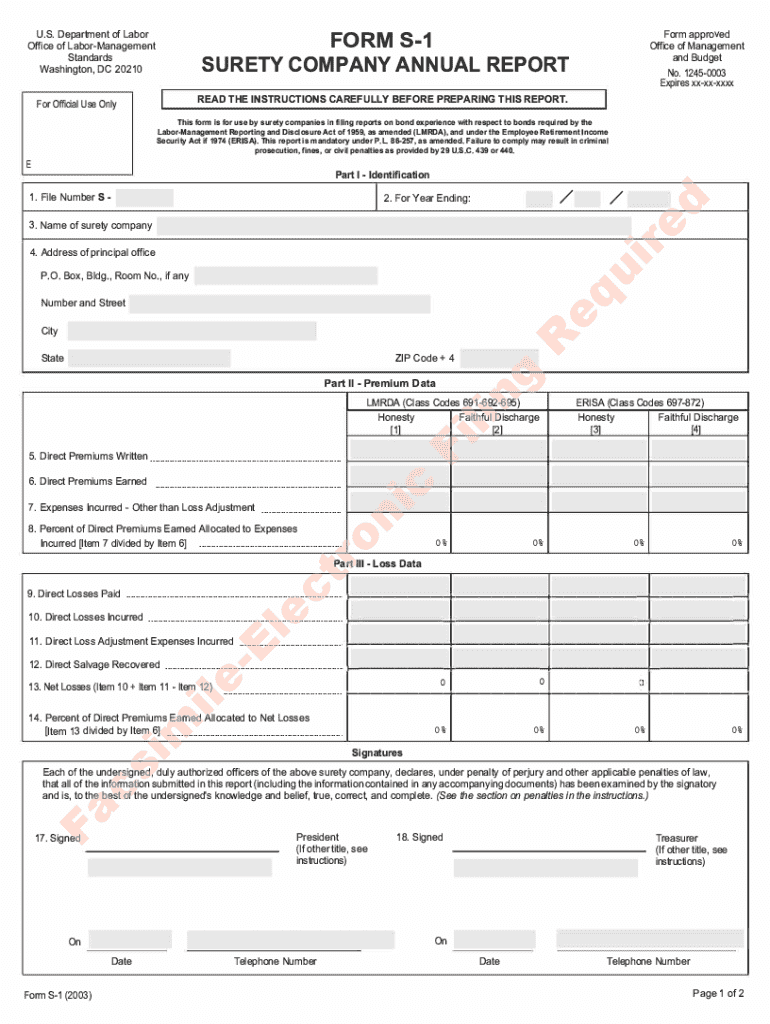

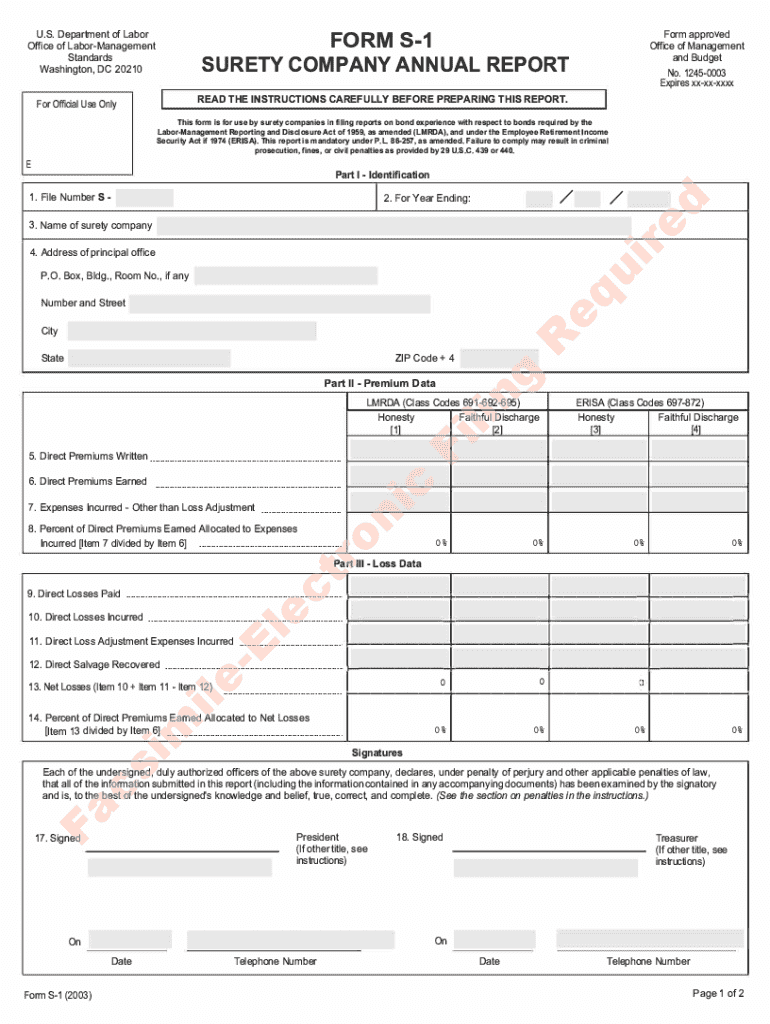

Overview of the S-1 Surety Company Annual Form

The S-1 surety company annual form is a crucial document for companies operating in the surety industry, serving as a comprehensive representation of their financial health and compliance with regulatory requirements. Understanding its significance is essential for any stakeholder involved, including investors, regulators, and business owners. Each surety company is mandated to file this form annually, which not only outlines the financial status but also showcases the company's operational integrity and reliability.

Key requirements for filing the S-1 form include submitting accurate financial statements, compliance documentation, and validating the company’s ability to underwrite surety bonds. The implications of these requirements extend to both individuals and businesses alike as they influence credit ratings, licensing status, and market reputation.

Filing the S-1 annually is paramount for maintaining compliance and transparency in the surety sector. It ensures that companies remain accountable to their stakeholders and uphold the necessary standards mandated by fiscal services. A complete and accurate filing provides assurance to investors about the firm's stability, ultimately contributing to a more trustworthy business environment.

Understanding the purpose of the S-1 form

The S-1 form collects vital information about a surety company's financial performance, operational focus, and compliance with relevant regulatory frameworks. Data collected includes annual revenue, outstanding surety obligations, and details surrounding the company’s liquidity and solvency. This data serves as a foundation for various stakeholders to assess the company's overall financial health.

Moreover, the S-1 plays a significant role in financial disclosures for surety companies. It provides transparency about the company’s operations, ensuring stakeholders are informed about its standings and any potential risks involved. This not only fosters trust but also helps external parties make informed decisions based on the financial insight provided in the filing.

By centralizing relevant financial information, the S-1 form enhances the ability of investment analysts, regulatory bodies, and risk assessors to gauge a surety company’s market position and stability, which is crucial for maintaining industry standards and safeguarding stakeholder interests.

Step-by-step guide to completing the S-1 surety company annual form

Completing the S-1 surety company annual form requires meticulous attention to detail and adherence to several steps. To facilitate the process, it’s imperative to gather all necessary documentation ahead of time.

Step 1: Gathering required documentation

Key documents you’ll need include:

Step 2: Filling out the form

Begin filling out the S-1 form by addressing these core areas:

Step 3: Common pitfalls and how to avoid them

While filling out the S-1 form, be aware of these frequently encountered errors:

Step 4: Reviewing and finalizing the form

Before submitting the S-1 form, adhere to this checklist for a final review:

Submission process for the S-1 form

Once your S-1 Surety Company Annual Form is complete, it's time to submit it. You can choose from among the following submission methods, ensuring compliance with regulatory requirements.

Keep key deadlines in mind to avoid penalties. Generally, the due date for filing the S-1 falls at the end of each fiscal year. After submission, expect to receive acknowledgment receipts confirming the acceptance of your filing, along with potential follow-ups for additional documentation or clarification.

Tracking and managing your S-1 filing

To stay organized, utilize tools such as pdfFiller to monitor the status of your submitted S-1 forms. These capabilities allow you to track submission confirmations, outstanding requirements, and any necessary amendments promptly.

Making amendments after submission is also crucial. Should any discrepancies arise, pdfFiller’s simple editing features enable you to update the forms as required. Maintaining accurate records ensures compliance during potential future reviews.

Interactive tools and features available via pdfFiller

pdfFiller offers a robust suite of features for comprehensive document management, tailored specifically for creating, editing, and submitting forms like the S-1 Surety Company Annual Form. You can seamlessly eSign documents, collaborate with team members, and manage document versions all from a single, user-friendly platform.

The cloud-based advantage means you can access your documents from anywhere, guaranteeing security and flexibility. Whether you need to revise data or ensure compliance with the latest regulations, pdfFiller simplifies each step of the process.

Frequently asked questions (FAQs) about the S-1 surety company annual form

Navigate common queries regarding the S-1 form effectively. Here are some important points to consider:

Clarity in these areas helps alleviate anxiety regarding regulatory obligations and improves confidence in managing the annual filing process. Ensure that you stay updated with any changes in requirements to navigate the filing process with ease.

Case studies: Successful S-1 filings

Examining real-world examples of successful S-1 filings provides useful insights into best practices that ensure accuracy and compliance. For instance, consider a mid-sized surety company that implemented a robust internal review process to guarantee precision in their annual filings. This proactive approach not only enhanced their credibility but also facilitated smoother interactions with regulators.

The outcome was a stronger reputation within the industry and increased competitiveness in securing contracts. Such case studies reinforce the relevance of an effective filing strategy, demonstrating the significance of commitment to transparency and regulatory adherence.

Future trends in surety company reporting

As the surety industry continues evolving, staying informed about upcoming regulatory changes is imperative. Innovations in technology are also impacting S-1 form filings, with many surety companies beginning to adopt automated systems for data entry and verification, thereby reducing human errors.

The reliance on digital tools may streamline reporting processes and enhance compliance. Firms that embrace these changes early stand to differentiate themselves in the competitive marketplace, ensuring that they remain compliant and capable of quick adaptations in the swiftly changing regulatory landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete s-1 surety company annual online?

How do I make edits in s-1 surety company annual without leaving Chrome?

Can I create an eSignature for the s-1 surety company annual in Gmail?

What is s-1 surety company annual?

Who is required to file s-1 surety company annual?

How to fill out s-1 surety company annual?

What is the purpose of s-1 surety company annual?

What information must be reported on s-1 surety company annual?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.