Get the free Independent Auditors' Reports as Required by Title 2 U.S. ...

Get, Create, Make and Sign independent auditors039 reports as

How to edit independent auditors039 reports as online

Uncompromising security for your PDF editing and eSignature needs

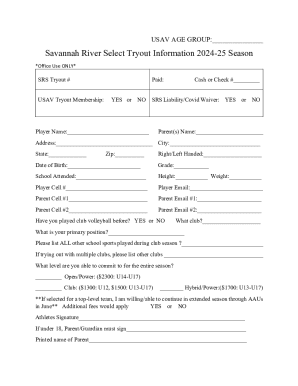

How to fill out independent auditors039 reports as

How to fill out independent auditors039 reports as

Who needs independent auditors039 reports as?

Independent Auditors' Reports as Form

Understanding independent auditors' reports

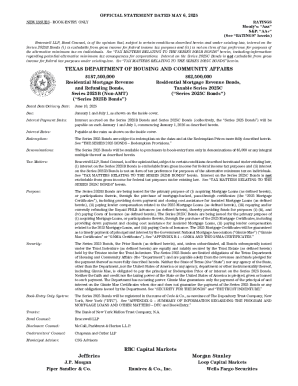

Independent auditors' reports serve as formal documentation summarizing the findings of an auditor's examination of an organization's financial statements. Their primary purpose is to provide an objective evaluation that enhances the credibility of financial reporting and ensures compliance with applicable accounting principles. These reports play a crucial role in the broader context of corporate governance, offering stakeholders essential insights into the accuracy and reliability of a company's financial status.

Types of independent auditors' reports

The type of opinion expressed in the auditors’ report reflects the auditor's assessment of the financial statements. An unqualified opinion indicates that the financial statements present a true and fair view in accordance with accounting principles. Conversely, a qualified opinion suggests some reservations about specific issues in the financial statements. An adverse opinion indicates significant deviations from accepted standards, and a disclaimer of opinion arises when the auditor cannot form an opinion due to various circumstances.

Key components of auditors' reports

An independent auditor's report is composed of various critical components that provide stakeholders with a comprehensive overview of the audit. The executive summary provides quick insights, while the scope of the audit details what was examined. The report clearly delineates the auditor's responsibility, the management's responsibility, detailed findings, and recommendations for improvement, ensuring all parties understand critical issues and actionable steps.

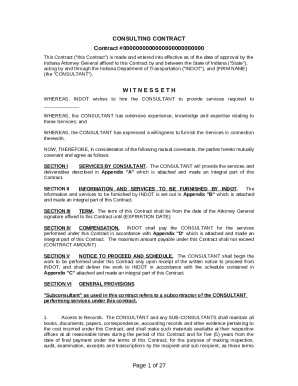

The audit process and form utilization

Conducting an audit entails a structured process that incorporates various stages, ensuring comprehensive evaluation. The process begins with pre-audit preparation, which includes understanding the client's operations and gathering preliminary information. Fieldwork procedures involve in-depth examinations of financial records while finalization focuses on drafting the report based on the findings and conclusions drawn throughout the audit.

Using proper form templates and documentation is essential for maintaining consistency and accuracy throughout the audit process. Common audit forms include risk assessment worksheets, internal control evaluations, and compliance checklists, which help auditors systematically document findings and enhance the overall effectiveness of the audit.

Utilizing pdfFiller for independent auditors' reports

pdfFiller offers a powerful platform for editing and customizing independent auditors' reports, allowing for easy creation and modification of PDF documents. Editing reports using pdfFiller is straightforward; users can upload existing documents, navigate to specific fields, and make necessary amendments. This streamlines the report generation process and ensures timely delivery of findings to stakeholders.

Best practices for independent auditors' reports

Effective communication is vital in auditors' reports. Therefore, the language used must be clear and straightforward, avoiding jargon that could confuse stakeholders. Objectivity and bias-free reporting are equally crucial, as they build trust and credibility in the findings presented. Training auditors regularly on new standards and utilizing software solutions like pdfFiller can enhance compliance and accuracy, ensuring that reports meet needed professional criteria.

Common challenges and solutions in preparing independent auditors' reports

Navigating complex regulations can be a significant challenge for auditors. It is crucial for firms to stay updated on new rules and guidelines from authoritative bodies. Strategies such as leveraging professional networks or attending seminars can equip auditors with the tools needed to handle evolving regulatory environments. Additionally, discrepancies and issues identified during the audit process must be approached methodically; establishing open communication channels with management can facilitate resolution and foster collaboration.

Case studies on effective use of auditors' reports

Various sectors can benefit significantly from effective independent auditors' reports. For example, non-profit organizations rely heavily on transparent financial reporting to uphold their donor confidence. In public sectors, compliance with formal regulations requires detailed audit findings to maintain accountability. Insights from notable audit findings can guide best practices across industries. These cases illustrate how diligent audits can lead to improvements in financial practices and organizational strategies.

Future trends in independent auditing

Emerging technologies such as AI and machine learning significantly impact the auditing landscape. These tools can automate data analysis, enhance risk assessment, and streamline audit processes, ultimately leading to more efficient and accurate reports. Additionally, auditors need to adapt to evolving standards and stakeholder expectations, which require continuous education and adaptability in practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit independent auditors039 reports as from Google Drive?

How do I execute independent auditors039 reports as online?

How do I edit independent auditors039 reports as in Chrome?

What is independent auditors039 reports as?

Who is required to file independent auditors039 reports as?

How to fill out independent auditors039 reports as?

What is the purpose of independent auditors039 reports as?

What information must be reported on independent auditors039 reports as?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.