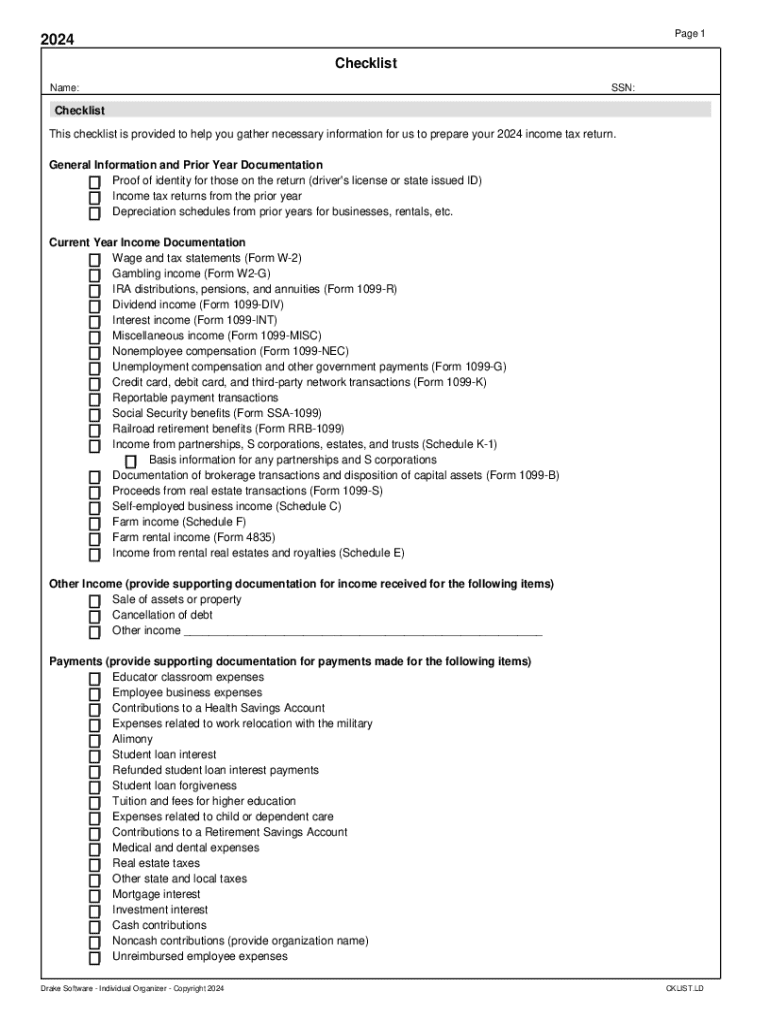

Get the free Tax Time Checklist: Prepare for Tax SeasonHeadStart.gov

Get, Create, Make and Sign tax time checklist prepare

Editing tax time checklist prepare online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax time checklist prepare

How to fill out tax time checklist prepare

Who needs tax time checklist prepare?

Tax Time Checklist: Prepare Form

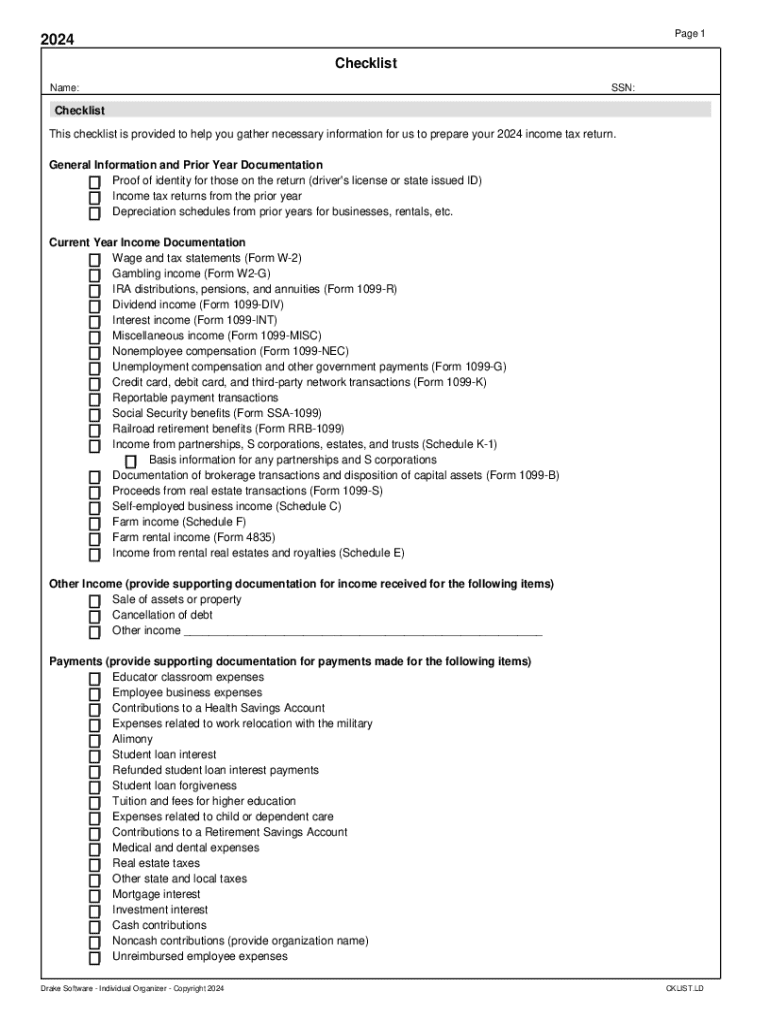

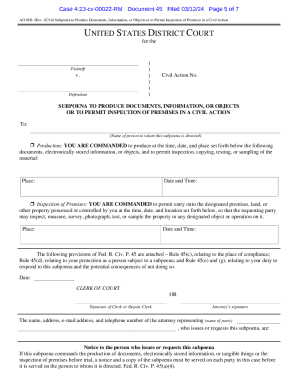

Essential tax forms overview

During tax season, understanding the essential forms required for individual tax filing is crucial. The most important form is the IRS Form 1040, which is the standard form used for filing personal income tax returns. This form enables individuals to report their income, calculate their tax liability, and indicate any tax refunds due. Additionally, W-2 forms from employers and 1099 forms for freelancers or contractors are necessary to report various sources of income. Each of these forms plays an integral role in fulfilling tax obligations, ensuring that all taxable income is accounted for.

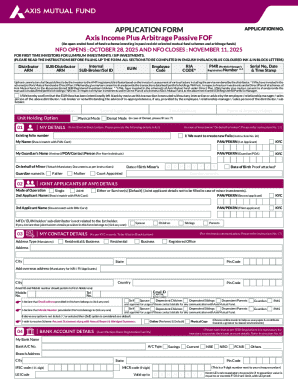

Document preparation before filing

Proper document preparation is essential for an organized tax filing process. Begin by gathering necessary documentation, such as personal identification details, including your Social Security Number (SSN) and a driver’s license. Income-related documents, like W-2s and 1099s, should be collected to ensure accurate reporting. Additionally, gather receipts for potential deductions, such as medical expenses and charitable donations, which can greatly impact your tax liability.

Organizing your financial year involves categorizing expenses and income by month, making it easier to assess your overall financial picture. Utilizing financial software or spreadsheets is recommended for effective tracking, allowing you to see both income streams and expenditures throughout the year. This organization not only simplifies tax preparation but can also help identify additional deductions or credits you may qualify for, enhancing your potential refund or reducing tax obligations.

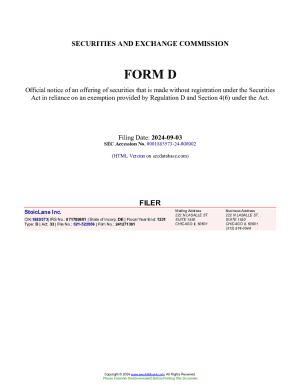

Understanding tax brackets and rates for 2024

For the 2024 tax year, understanding federal tax brackets and rates will be essential for accurate tax calculation. Federal tax rates vary based on income levels, with rates categorized into brackets. Higher earners may be subject to higher tax rates, impacting how much they owe each year. Additionally, state-specific tax rates should be taken into account, as these can further influence total tax liability. Knowing your tax bracket is crucial as it affects deductions and credits, allowing you to maximize potential savings.

Setting up your tax filing system

Establishing a systematic approach to tax filing can streamline the process and enhance compliance. Begin by choosing the right filing method; while paper filing is traditional, e-filing offers convenience and faster processing. Utilizing platforms like pdfFiller can aid in document editing and management, making it a valuable asset for your tax preparation. Each method has benefits and drawbacks, but e-filing often results in quicker refunds and fewer errors.

Creating a filing timeline is essential to ensure you meet all deadlines. Familiarize yourself with important submission dates for both state and federal filings to avoid penalties. Set reminders for when you need to gather documentation, complete forms, and submit your returns. This proactive approach will alleviate last-minute stress, allowing you to focus on accuracy and compliance.

Step-by-step: filling out your Form 1040

Filling out your Form 1040 involves several straightforward steps, starting with the personal information section. Here, accuracy is key; entering your name, address, and SSN precisely will help avoid processing delays. Next, the income section requires that you report all sources of income accurately, including wages and freelance earnings. Make sure to double-check the amounts reported on your W-2s and 1099s against your entries for consistency.

Understanding deductions and credits is vital in reducing your taxable income. Choose between the standard deduction or itemized deductions using Schedule A, ensuring you have documentation proof for any claimed expenses. Credits can also significantly lower your tax liability; researching eligibility requirements will help you identify and claim all credits for which you qualify. Finally, perform a thorough review of your Form 1040 to check for common mistakes such as miscalculated totals or incorrect Social Security numbers—double-checking can save you from future headaches.

Using interactive tools for tax preparation

Utilizing interactive tools can enhance your tax preparation experience, making it more efficient and less stressful. pdfFiller offers an array of interactive tools for document creation, allowing you to create a tailored tax compliance kit zip file that meets your specific needs. These tools simplify the creation of tax documents, ensuring all required information is included and accurately reported. Additionally, collaborating with others online while preparing taxes can streamline the process and improve accuracy.

Engaging with collaborative features allows individuals and teams to share documents easily and receive feedback in real-time. This accessibility means you and your financial advisors, family members, or colleagues can work together to ensure compliance and accuracy, enhancing your overall tax filing experience.

Frequently asked questions

Many individuals have common concerns about the tax filing process. For instance, what should you do if you cannot pay your taxes? The first step is to file your return on time, as failing to do so can incur penalties. After filing, you can explore options for a payment plan with the IRS, which allows you to settle your tax debt over time without immediate full payment.

Another frequent concern involves misconceptions about filing taxes. Many believe that only high-income earners are subject to tax, but even those with modest incomes may have tax obligations depending on their sources of income. Being informed and understanding the intricacies of tax filing can help dispel these myths, allowing individuals to approach tax time with clarity and confidence.

Tax filing mistakes to avoid

Avoiding common errors during tax filing is crucial to ensure compliance and avoid penalties. Among the most prevalent mistakes are incorrect Social Security numbers, which can lead to processing delays or incorrect taxation. Additionally, misreported income can result in audits or back taxes owed. Keeping organized records and double-checking all entries will help mitigate these errors.

The consequences of mistakes can be severe, ranging from penalties to interest on unpaid taxes. In instances where errors have occurred, amending a tax return can be easily managed using tools like pdfFiller. This platform enables you to quickly correct previously submitted forms, ensuring compliance while maintaining accurate records.

After filing: what to expect

After submitting your tax return, it’s important to know what to expect in terms of processing timelines. Generally, the IRS processes returns within 21 days for e-filed submissions and can take longer for paper returns. Tracking your refund status is easily managed through the IRS website, which provides updates on the processing stage. Understanding this timeline can help alleviate anxiety regarding your tax return status.

If you anticipate a refund, being aware of possible underpayment notices is equally important. You may receive notifications regarding discrepancies, which should be addressed promptly to avoid future complications. Keeping a record of all submitted forms and communications with the IRS will help in such situations.

Stay updated: future tax changes to watch

Tax legislation is frequently changing, so staying informed about expected updates is crucial for comprehensive tax planning. Coming tax years may introduce modifications to rates, brackets, or deductions that could significantly impact your financial landscape. Preparing now by reviewing potential changes can prevent surprises during subsequent tax seasons.

By being proactive and remaining educated about anticipated changes, you can better navigate future tax filings. Resources such as tax compliance kits provided by platforms like pdfFiller can also assist you in preparing for these changes efficiently.

Key takeaways

Utilizing resources like pdfFiller is invaluable in managing the complexities of tax preparation seamlessly. The platform empowers users to edit, eSign, collaborate, and manage documents efficiently, enabling you to transform the daunting task of filing taxes into a manageable process. Keeping organized and informed with this tax time checklist—focused on preparing forms—ensures you're well-equipped to meet your obligations while maximizing potential benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax time checklist prepare for eSignature?

How do I make changes in tax time checklist prepare?

Can I create an electronic signature for signing my tax time checklist prepare in Gmail?

What is tax time checklist prepare?

Who is required to file tax time checklist prepare?

How to fill out tax time checklist prepare?

What is the purpose of tax time checklist prepare?

What information must be reported on tax time checklist prepare?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.