Get the free Tax Forms for Individuals - Louisiana Department of Revenue

Get, Create, Make and Sign tax forms for individuals

Editing tax forms for individuals online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax forms for individuals

How to fill out tax forms for individuals

Who needs tax forms for individuals?

Tax forms for individuals: A comprehensive guide

Understanding tax forms: An overview

Tax forms serve as official documents for individuals to report their income, claim deductions, and outline tax/withholding information to the IRS and state tax authorities. They are fundamental in the tax filing process, ensuring compliance with legal requirements and helping taxpayers accurately calculate their obligations.

Various types of tax forms exist for individuals, each serving a specific purpose. The most common forms include income tax returns, employment tax forms, and miscellaneous tax forms, which may pertain to specific circumstances such as estates or gifts.

Current year individual tax forms

Every tax year introduces updates to individual tax forms. It's crucial to stay informed about the latest forms applicable for the year you're filing. Taxpayers can access the current forms through the IRS website or tax preparation software.

Key changes often include updates on deductions and credits available, as well as new reporting requirements that may impact individual taxpayers significantly. Sections of the forms may be adapted to reflect recent legislation, making it essential for individuals to utilize the current year’s forms.

Filling out your individual tax forms

Completing tax forms correctly is crucial to avoiding penalties and ensuring timely processing of your return. Start by gathering all necessary documentation, including W-2s, 1099s, and records of other income. Having these documents on hand will facilitate a smoother filing experience.

As you navigate different sections of your tax form, be mindful of the details required in each area. Here are a few common challenges and tips for overcoming them:

Consider utilizing interactive tools available on platforms like pdfFiller to simplify this process. Form previews, templates, and deduction calculators can provide added guidance in navigating your unique tax situation.

Editing and managing your tax forms

Editing tax forms can be daunting, but employing best practices helps ensure accuracy. When working with PDF tax forms, consider using specialized tools designed for modification. pdfFiller allows individuals to easily upload their tax forms and make necessary changes.

For effortless editing, utilize features that allow you to modify content directly. Upload your tax forms, adjust entries as needed, and save or share your finalized documents with ease. This is particularly valuable for managing multiple forms stemming from different income sources or for adjusting information for various tax years.

Signing and submitting your tax forms

Properly signing your tax forms is a critical step you cannot overlook. Most forms require a signature to validate the return, ensuring that all information is accurate and complete. eSigning offers a convenient method for submitting forms online, reducing the need for physical mailing.

pdfFiller provides a straightforward eSigning process. Users can create digital signatures and easily add them to their forms. When it's time to submit your taxes, you'll face choices between e-filing and mailing paper forms, with specific deadlines attached to each option—all influenced by your state’s regulations.

Side navigation: Additional tax form types

In addition to standard income tax forms, there are specialized tax forms required for individuals in unique situations. Self-employment tax forms and health care forms, for example, cater to specific income types or health coverage situations. Understanding these forms is equally important for comprehensive tax reporting.

Moreover, taxpayers may need to complete various schedules, which assist in detailing specific types of income or deductions. For example, Schedule A outlines standard itemized deductions, while Schedule C focuses on income derived from self-employment.

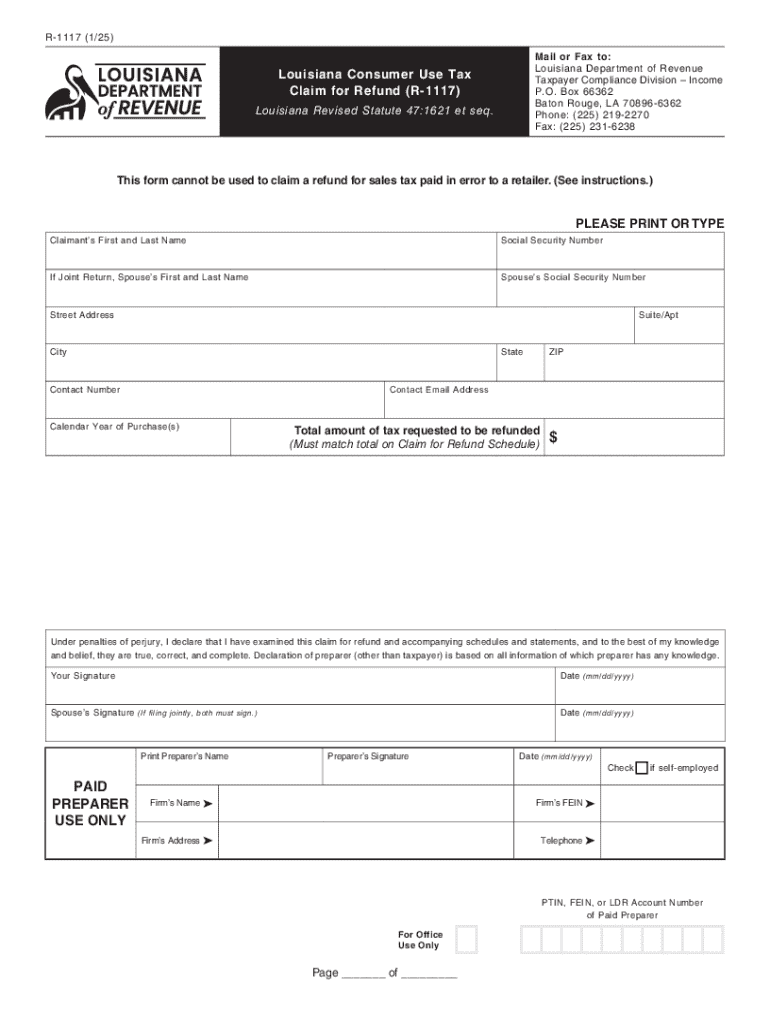

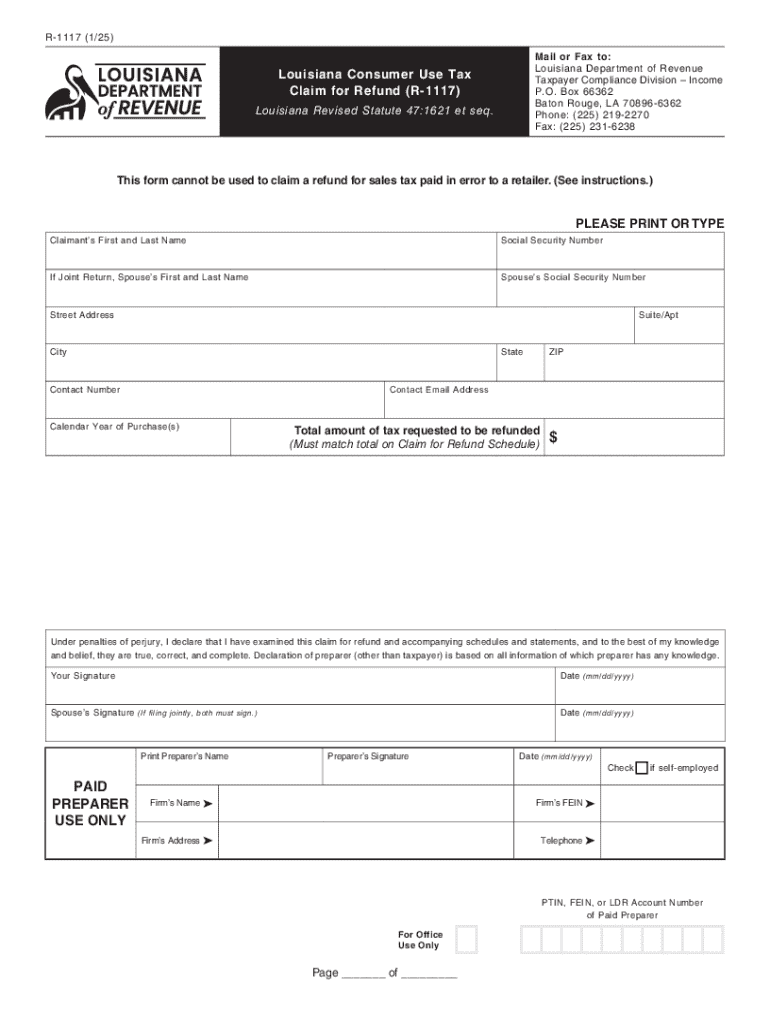

State-specific individual tax forms

Understanding that state taxation may differ significantly from federal regulations is essential for filing accurately. Each state has unique tax forms as well as specific guidelines on how to fill them out. Therefore, taxpayers should familiarize themselves with the forms required by their respective state tax authorities.

To access state-specific forms easily, individuals can use state tax agency websites. It’s also essential to note any unique credits or deductions that states might offer, impacting your overall tax liabilities. Resources such as local tax clinics can provide valuable assistance in understanding these nuances.

FAQs on individual tax forms

Navigating tax forms can often lead to questions about specific processes. Common questions revolve around understanding which forms are necessary for various situations and how to troubleshoot issues that may arise during the filing process.

Taxpayers may wonder about clarifications on specific form usage, such as whether they can e-file certain forms or if they need to include additional documentation. It’s advisable to consult the IRS website or tax professionals for authoritative answers tailored to individual circumstances.

want to...

In tackling taxes, many individuals will seek further information on deductions or inquire about filing extensions. Each option allows for unique opportunities to ensure compliance and optimize tax savings. pdfFiller serves as a comprehensive resource, enabling users to access archived forms for previous years, alongside modern tools to enhance the current filing experience.

pdfFiller: Your ultimate document creation solution for tax forms

pdfFiller enhances your tax filing experience by offering an all-in-one document management solution. Users can effortlessly create, edit, and submit tax forms from a single, cloud-based platform accessible from anywhere with an internet connection. This flexibility increases efficiency, especially for individuals managing multiple forms or income types.

Utilizing pdfFiller guarantees collaboration features that enable teams to work seamlessly on shared documents, ensuring accuracy and timeliness. Increased security and compliance measures protect sensitive information, providing peace of mind while managing necessary filings. With pdfFiller as your trusted partner, navigating the complexities of tax forms for individuals becomes significantly more manageable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax forms for individuals from Google Drive?

How do I fill out the tax forms for individuals form on my smartphone?

How do I complete tax forms for individuals on an Android device?

What is tax forms for individuals?

Who is required to file tax forms for individuals?

How to fill out tax forms for individuals?

What is the purpose of tax forms for individuals?

What information must be reported on tax forms for individuals?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.