Get the free NONFILER FORM

Get, Create, Make and Sign nonfiler form

Editing nonfiler form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nonfiler form

How to fill out nonfiler form

Who needs nonfiler form?

A Comprehensive Guide to the Nonfiler Form

Understanding the nonfiler form

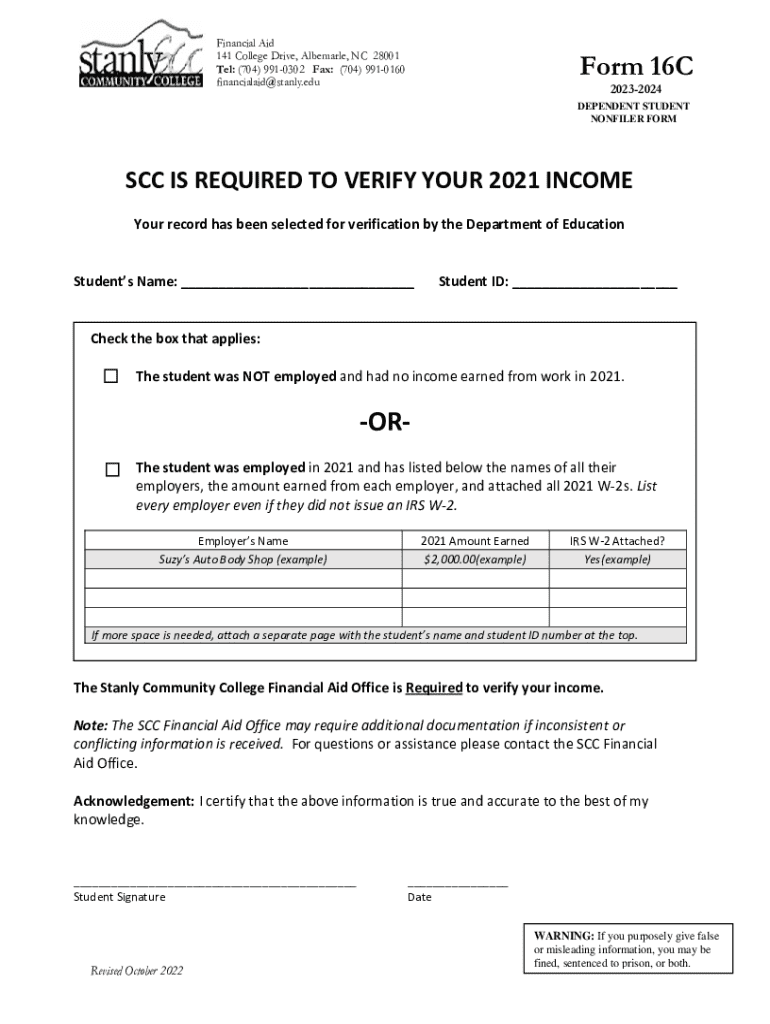

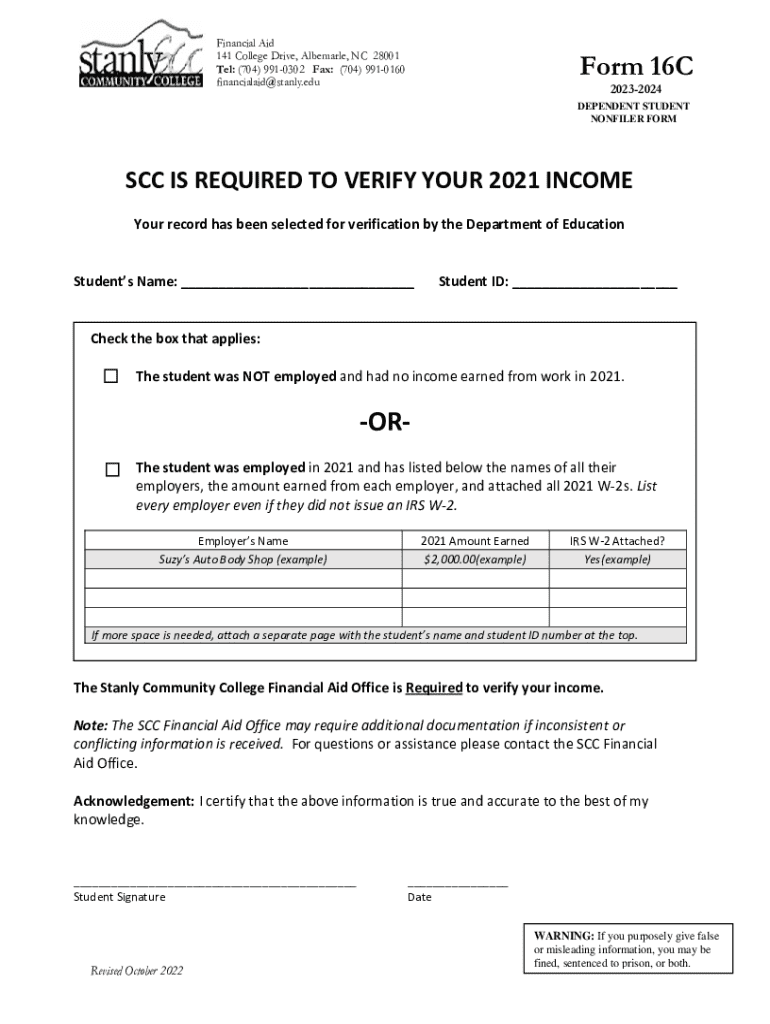

The nonfiler form is a crucial document designed for individuals who are not required to file a federal tax return but still need to report certain information to the IRS. Its primary purpose is to address specific operational needs for non-tax filers, such as students, veterans, or low-income individuals. Filing this form is essential for maintaining compliance and verifying eligibility for various federal programs, including financial aid and other services.

For individuals and teams, understanding the implications of the nonfiler form can save time and ensure adherence to IRS requirements. This document clarifies one's filing obligations, helping avoid unnecessary penalties for not reporting income. In essence, it serves as a formal announcement of one's non-filing status while confirming any income that must be disclosed.

Who needs the nonfiler form?

Several categories of individuals require the nonfiler form to navigate their tax obligations effectively. One prominent group includes students who may not earn enough to necessitate a standard tax return but still need to fill out the nonfiler to qualify for FAFSA (Free Application for Federal Student Aid) or other financial aid programs.

Parents and guardians may also need to consider the nonfiler form for their children, especially when financial verification is part of the aid application process. Veterans often find themselves in similar situations, particularly when applying for benefits or educational programs that require proof of income. Understanding whether you need this form hinges on your income level, filing status, and eligibility for various financial aid opportunities.

Preparing to complete the nonfiler form

Correctly completing the nonfiler form begins with gathering all necessary information. Essential documents include any income verification letters or 1099 forms reflecting earnings from freelance work, odd jobs, or other income sources. Students, for instance, should compile their work-study documentation, while parents may need tax returns or income statements from their employer.

It's advisable to organize this information in a systematic way, using folders or digital tools to segregate different documents. This meticulous preparation leads to a more efficient filling-out process. Additionally, familiarizing yourself with IRS guidelines relevant to the nonfiler form can mitigate confusion. Many misconceptions about filing can lead to errors, so understanding what is required upfront is crucial.

Understanding IRS guidelines

The IRS has specific requirements related to non-filing that every potential nonfiler must know. For instance, individuals below a certain income threshold are not obligated to file an income tax return but still may choose to submit a nonfiler form to serve as documentation of their financial status. This form can be vital for verification processes, especially for students applying for federal financial aid.

One common misconception is that people believe they need to submit a tax return regardless of their income level. This isn't true; the nonfiler form exists to address those situations transparently and efficiently. Being aware of these guidelines can help nonfilers avoid unnecessary complications with the IRS, especially when applying for services that require proof of income.

Step-by-step guide to filling out the nonfiler form

The process of completing the nonfiler form can be straightforward when broken down into manageable steps. First, it's necessary to access the official form, which can be found on the IRS website. Ensure you are using the most current version of the form. Alternative resources, including tax preparation sites and platforms like pdfFiller, can also provide templates.

After obtaining the form, you will start with your personal information, such as name, address, and Social Security number. It is imperative to double-check these details as inaccuracies can delay processing. Subsequently, you'll need to report your income sources accurately. It's essential to list all incomes, including wages or freelance earnings, which may seem negligible but still need to be disclosed.

Submitting your nonfiler form

Once you’ve completed the nonfiler form, the next step is submission. You have two primary options: electronic submission or mailing the form. Electronic filing is often more efficient, allowing you to submit documents directly to the IRS through their online platform, which may result in quicker processing. Ensure that you follow all specific instructions for electronic submission as outlined by the IRS.

For those opting to send the form by mail, be sure to check the correct mailing address specified by the IRS, as sending it to the wrong location can cause significant delays. After filing, you can check the status of your submission through the IRS website, providing peace of mind as you await confirmation.

After submission: what to expect

After submitting your nonfiler form, it’s essential to know the timeline for processing. Typically, the IRS will take about six to eight weeks to process the form, though factors such as the time of year or the clarity of the information provided can affect this duration. Should there be any discrepancies or issues, the IRS may send a follow-up query requiring additional documentation or clarification.

During this waiting period, ensure that you have organized your documents well enough to respond to any queries quickly. If you receive a follow-up request, addressing it promptly will expedite any resolution. Always keep track of correspondence with the IRS to maintain accurate records.

Interactive tools for nonfilers

Utilizing interactive tools can significantly enhance the process of completing and managing your nonfiler form. With pdfFiller, users can fill out and edit the nonfiler form effortlessly. This platform not only allows for easy editing of PDF forms but also enables electronic signatures, which streamline submission while ensuring that documents are legally binding.

Furthermore, collaboration features on pdfFiller allow teams to share and edit documents in real time. This capability is particularly useful for families or groups of students where multiple parties are involved in filling out financial verification requirements. Using pdfFiller's tracking and version control features can also help to prevent errors or omissions.

Common questions surrounding the nonfiler form

Many individuals may wonder what happens if they don't file the nonfiler form. Not submitting the form can lead to complications, especially in circumstances where income verification for federal programs is needed. The IRS may treat individuals as full tax filers, resulting in potential penalties or issues with financial aid eligibility.

Another common query revolves around handling disputes or issues that may arise after filing; various steps, such as contacting IRS customer service or seeking the aid of a tax professional, may be necessary to resolve conflicts. Clarity in responding to FAQs ensures that individuals are better equipped to deal with situations surrounding their nonfiler submission.

Contact and support information

For those seeking assistance or additional information about the nonfiler form, pdfFiller offers robust customer support. Users can reach out via live chat, phone, or email for quick resolutions to their questions. The support team is well-versed in IRS requirements and can guide you through any challenges you may face while completing your form.

Customer service operates within standard hours and is available to help clarify any doubts regarding the form itself or its implications. Having direct lines of communication to support can significantly enhance the user experience when dealing with such critical tax documents.

Final tips for nonfilers

As deadlines loom for submitting the nonfiler form, keeping track of key tax dates is essential. These deadlines can vary based on individual circumstances, including whether you fall into categories pertaining to financial aid applications or veteran services. It's vital to stay ahead of these timelines to avoid missing submission dates.

Furthermore, maintaining organized records should be an ongoing practice for all nonfilers. This organization is particularly useful for future filings or any potential inquiries from the IRS. Implementing best practices in record keeping, such as digital storage options and consistent updating of documents, prepares you for future tax seasons and ensures compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send nonfiler form for eSignature?

How do I make edits in nonfiler form without leaving Chrome?

How do I fill out nonfiler form on an Android device?

What is nonfiler form?

Who is required to file nonfiler form?

How to fill out nonfiler form?

What is the purpose of nonfiler form?

What information must be reported on nonfiler form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.