Get the free Understanding Schedule 13D: Filing Process & Key ...

Get, Create, Make and Sign understanding schedule 13d filing

How to edit understanding schedule 13d filing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out understanding schedule 13d filing

How to fill out understanding schedule 13d filing

Who needs understanding schedule 13d filing?

Understanding Schedule 13D Filing Form

Overview of Schedule 13D Filing

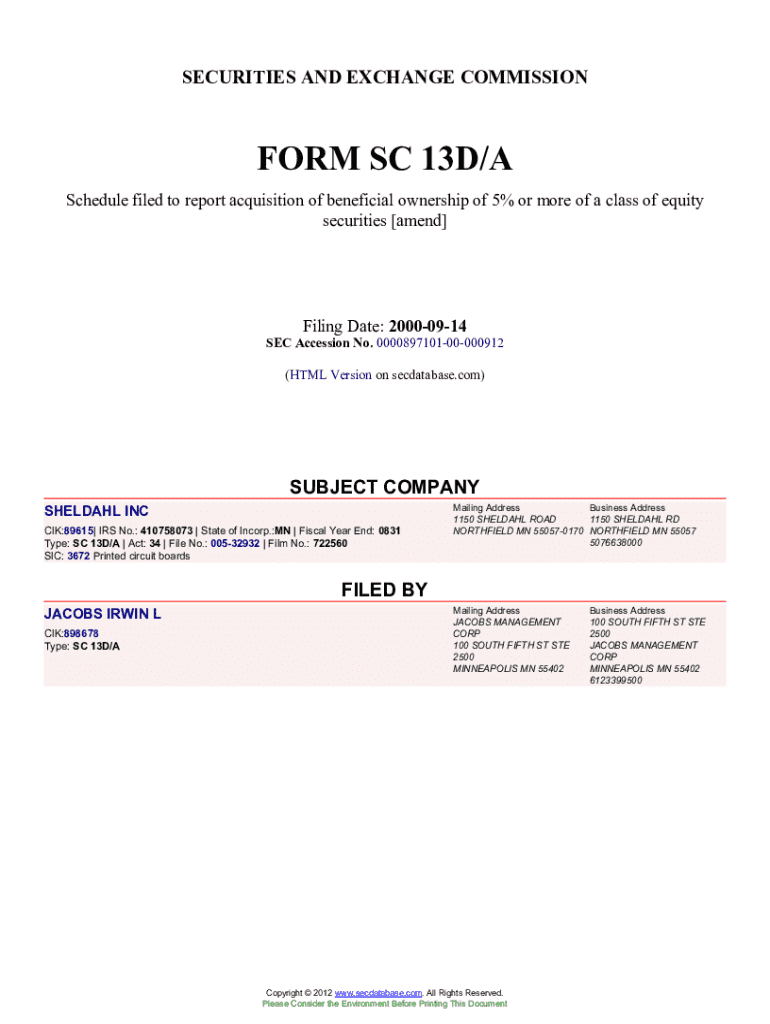

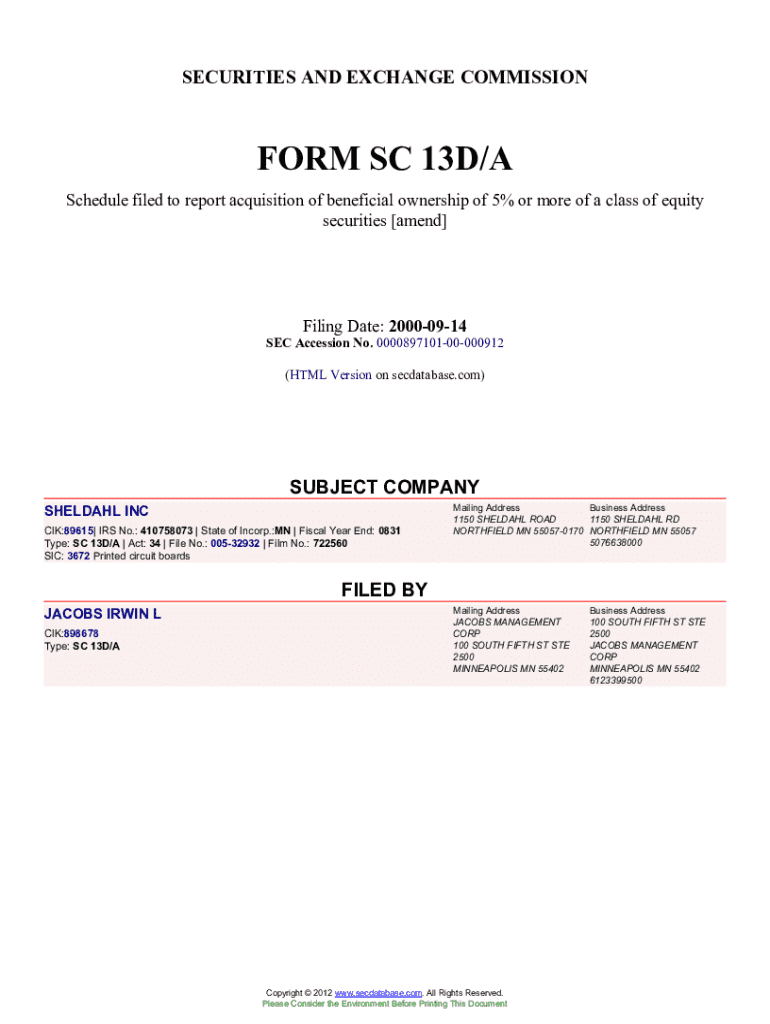

Schedule 13D is a crucial regulatory document required by the Securities and Exchange Commission (SEC) in the United States. It serves the purpose of disclosing information about the acquisition of beneficial ownership of more than 5% of a registered class of a company's securities. This filing aims to ensure greater transparency regarding shareholder intentions and ownership stakes in public companies.

The primary importance of Schedule 13D lies in its ability to inform other shareholders and the market about significant stake acquisitions, which could influence corporate governance and decision-making. Unlike Schedule 13G, which is a more simplified form used by certain passive investors, Schedule 13D requires detailed disclosures that can influence strategic investor relations and regulatory compliance.

Who must file a Schedule 13D?

Individuals or entities must file a Schedule 13D when they acquire beneficial ownership of 5% or more of a class of equity securities registered under the Exchange Act. Beneficial ownership refers to the rights and benefits derived from ownership, regardless of whether the individual or entity is the actual shareholder.

Certain exemptions exist in filing Schedule 13D. For instance, foreign entities may be subject to different regulatory scrutiny, and institutional investors can often file Schedule 13G instead provided their intentions remain passive. However, they must remain vigilant regarding the reporting thresholds and obligations to ensure compliance.

Key components of Schedule 13D

A Schedule 13D filing comprises several essential components that collectively provide a comprehensive overview of the reporting person's stake and motivations. Among the required information are the identity of the reporting person, the purpose of the transaction, and the source and amount of funds involved in the investment.

Filing timeline and requirements

The Schedule 13D must be filed with the SEC within ten days of the acquisition of beneficial ownership of more than 5% of a company’s stock. This timing is crucial, as it ensures that market participants are aware of significant ownership stakes promptly, facilitating informed trading.

Furthermore, filers are obligated to update their Schedule 13D filing in response to any material changes. Triggering events for amendments include acquiring additional shares, selling shares, or any substantive changes in intentions regarding their ownership stake. Keeping this document current is vital to maintaining transparency and compliance.

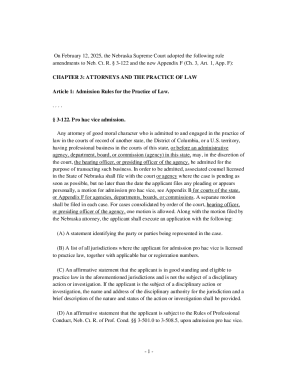

Detailed instructions for filling out Schedule 13D

Completing Schedule 13D requires meticulous attention to detail. First, begin by gathering all necessary information about the issuer, the security, and your ownership. Ensure that you understand the various items that need to be filled out, as accuracy is crucial in this document.

The next step involves filling out each section carefully. It’s essential to review and verify the information to avoid inaccuracies or omissions that could lead to compliance issues. Common mistakes to avoid include inaccurate reporting of security ownership and missing filing deadlines, which can result in penalties or negative implications for investor relations.

Implications of Schedule 13D filings

Schedule 13D filings have significant implications for public companies, especially regarding shareholder relations. When a 13D is filed, it can alert other shareholders to the presence of a significant investor, potentially leading to increased scrutiny and discussion regarding corporate direction and governance.

Moreover, these filings can trigger market reactions and volatility. Investors often react to new information about stakeholders, possibly influencing stock prices as they speculate on the strategic implications of the new ownership. Additionally, Schedule 13D filings can provide insights into potential corporate changes or shareholder activism, allowing existing investors to position themselves accordingly.

Enhancing your document management with pdfFiller

Using pdfFiller simplifies the Schedule 13D filing process significantly. With its seamless PDF editing and eSigning capabilities, users can effortlessly complete their documents without the hassle of printing and scanning. This platform is especially valuable for team collaboration, allowing different stakeholders to communicate efficiently and share insights during the filing process.

Additionally, pdfFiller offers step-saving features tailored for document management, including interactive forms and templates specifically designed for filing forms like Schedule 13D. Cloud-based access allows users to manage their documents from anywhere, ensuring compliance and ease of use at every stage of the filing process.

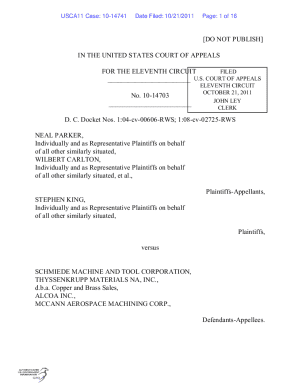

Case studies and examples of effective Schedule 13D filings

Numerous notable Schedule 13D filings have demonstrated their impact on corporate strategy and investor relations. For example, major institutional investors often file 13Ds to unveil strategic intentions, prompting existing shareholders to reassess their positions. An analysis of these filings often uncovers lessons about successful engagement with corporate boards and shareholder activism.

From successful filings, it becomes clear that an effective Schedule 13D can act as a catalyst for change. Tools like pdfFiller facilitate this process through efficient document management, preparing users to present their intentions more clearly and transparently, which can lead to favorable outcomes.

Frequently asked questions about Schedule 13D

Potential filers often have common questions concerning the Schedule 13D process. Clarifying these areas can help demystify the filing requirements. One common concern is about the intricacies of determining beneficial ownership and how it affects the filing threshold of 5% ownership.

Addressing concerns upfront ensures that new filers can navigate the regulatory landscape with confidence. Insights from experienced financial professionals emphasize the importance of adhering to the filing timelines and maintaining accurate disclosures to mitigate risk and enhance credibility among shareholders.

Tools and resources to simplify your filing process

When it comes to simplifying the Schedule 13D filing process, pdfFiller stands out as a unique tool with features specifically designed to meet the challenges of document management. Users can leverage its unique functionalities to enhance their filing experience, ensuring that all necessary information is captured accurately and timely.

Moreover, additional support services and interactive tools provide users with real-time tracking and management capabilities. These resources help streamline the complexities of filing, reducing the stress often associated with compliance and allowing users to focus more on their investment strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send understanding schedule 13d filing for eSignature?

How do I fill out the understanding schedule 13d filing form on my smartphone?

How do I edit understanding schedule 13d filing on an iOS device?

What is understanding schedule 13d filing?

Who is required to file understanding schedule 13d filing?

How to fill out understanding schedule 13d filing?

What is the purpose of understanding schedule 13d filing?

What information must be reported on understanding schedule 13d filing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.