Get the free Form 5500 Information Guide & FAQs

Get, Create, Make and Sign form 5500 information guide

How to edit form 5500 information guide online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 5500 information guide

How to fill out form 5500 information guide

Who needs form 5500 information guide?

Form 5500 Information Guide Form

Understanding Form 5500

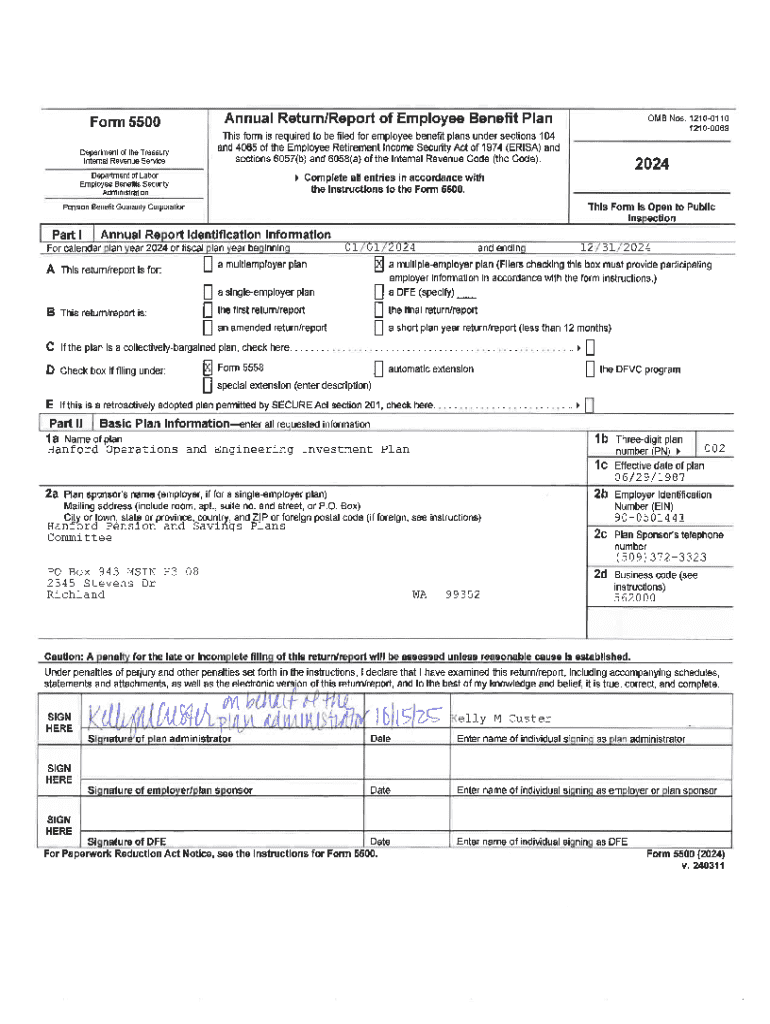

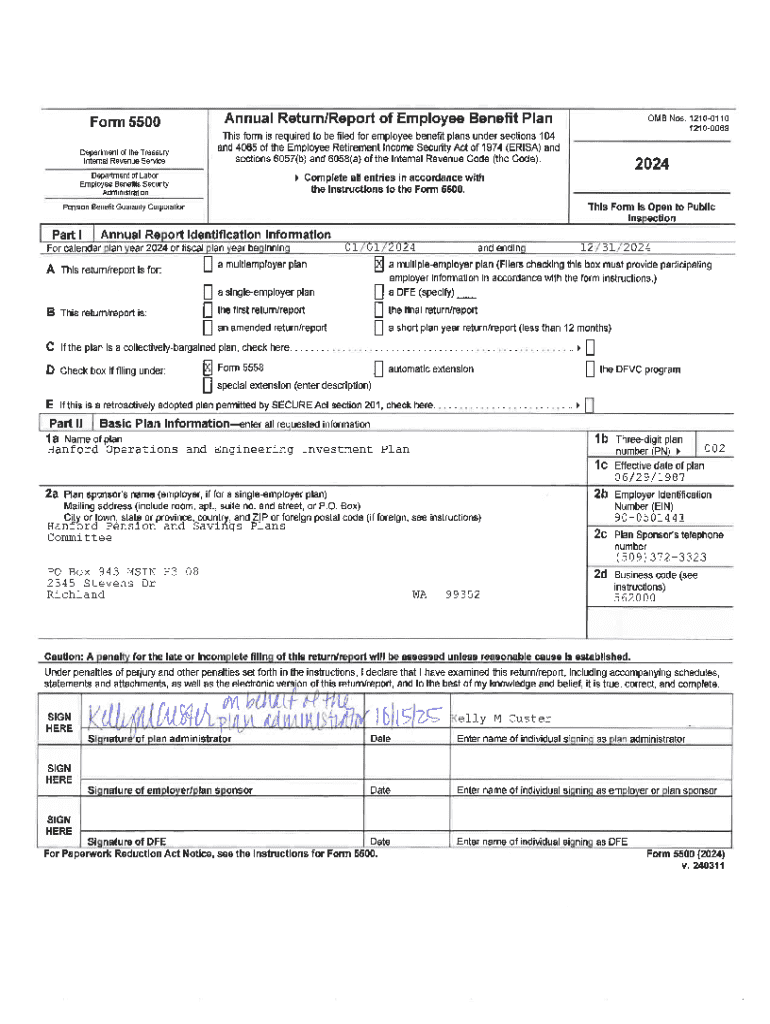

Form 5500 is a critical document used for annual reporting by employee benefit plans. It is mandated by the Employee Retirement Income Security Act (ERISA) and serves as a comprehensive disclosure tool that provides vital information about the plan’s financial status and operations.

The primary purpose of Form 5500 is to enhance transparency surrounding employee benefit programs, with an emphasis on safeguarding participants’ interests. This form plays an essential role in ensuring compliance with federal regulations and makes information accessible for government oversight, thus protecting plan participants from potential mismanagement or fraud.

The Form 5500 series encompasses several versions tailored to different types of plans and filers, including Form 5500 itself, Form 5500-SF for simplified reporting, and Form 5500-EZ for one-participant plans. Each version facilitates appropriate reporting requirements and compliance.

Who needs to file Form 5500?

Generally, large employers and those with certain employee benefit plans must file Form 5500. Specifically, any employer with more than 100 plan participants is required to submit this form annually. The need to file also extends to various employee benefit programs, including pension plans and welfare benefit plans.

However, certain small employers are exempt from filing Form 5500. For instance, small businesses maintaining plans with fewer than 100 participants qualify for simplified filing options, including the Form 5500-SF. Additionally, specific types of plans, such as unfunded welfare benefit plans, may also be exempt from reporting obligations.

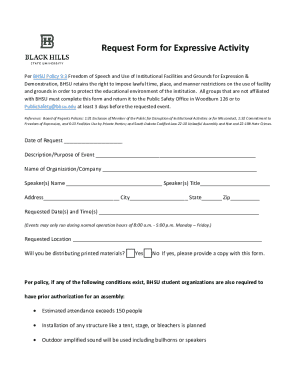

Filing requirements for Form 5500

Form 5500 comes in three primary variants: the standard Form 5500, Form 5500-SF, and Form 5500-EZ, each designed to address specific needs of different filers. The standard Form is typically utilized by large employers and plans with over 100 participants, providing extensive details required by the Department of Labor.

Form 5500-SF is a streamlined version for plans with fewer than 100 participants who meet specific criteria, allowing simpler reporting. Meanwhile, Form 5500-EZ is reserved for one-participant plans and is especially beneficial for solo business owners. Understanding which form to file is essential based on the plan size and type.

Filing deadlines for Form 5500 typically fall on the last day of the seventh month after the end of the plan year. Filers who require additional time can apply for an extension of up to 2.5 months by filing Form 5558, yet it's crucial to ensure adherence to deadlines to avoid penalties.

How to prepare Form 5500

To prepare Form 5500 correctly, it is necessary to gather all required information and documentation meticulously. This includes the comprehensive details of the plan, the Employer Identification Number (EIN), and specific financial disclosures about the plan’s assets and liabilities. Having accurate and current data is critical for compliant reporting.

The filing process involves several steps: First, collect the necessary data regarding participants, beneficiaries, and plan features. Next, you may utilize pdfFiller for data entry, which provides a user-friendly interface that simplifies the input process. Ensure to edit and review the information carefully to avoid errors, then sign the form electronically for a quick and efficient completion.

Interactive tools for form completion

pdfFiller offers a range of digital tools designed to facilitate the completion of Form 5500 seamlessly. Their user-friendly editing features allow individuals and teams to fill out the form accurately while collaborating in real-time, ensuring that all necessary details are captured efficiently.

The platform also includes eSignature capabilities, enabling stakeholders to quickly approve and sign documents electronically. Additionally, pdfFiller provides cloud storage options that simplify document management, allowing users to access and store their files securely from any location.

Common mistakes to avoid when filing Form 5500

Filing Form 5500 comes with its challenges, and recognizing common pitfalls is essential for ensuring compliance and avoiding penalties. Many filers mistakenly leave sections incomplete or submit incorrect information, which can lead to complications and the risk of government audits.

In addition, failing to meet the filing deadline is another frequent error, often resulting in substantial penalties. It's crucial to thoroughly understand the requirements to prevent misinterpretations that could lead to mistakes. Attention to detail and proper time management can significantly enhance the accuracy of submissions.

FAQs about Form 5500

A common question among filers is what to do if they miss the filing deadline. It's crucial to file as soon as possible to mitigate the penalties. Another frequently asked question is how to amend a submitted Form 5500; this can typically be done by filing a corrected version along with an explanation of the changes.

Additionally, understanding the implications of submitting incorrect information is vital. The government may impose penalties for incorrect filings. Lastly, many filers seek assistance due to the complexity of the form, and there are resources available, including consultation with tax professionals and accessing information on website resources.

Best practices for record keeping after filing

Once Form 5500 has been filed, maintaining comprehensive records is essential. Keeping all supporting documentation organized and accessible ensures that you have everything needed for any future references or audits. ERISA regulations suggest retaining records for at least six years after the filing date.

Incorporating efficient document management practices, such as utilizing pdfFiller, can streamline this process. The platform allows for secure storage and easy accessibility, ensuring that all documents related to the plan are retained properly while offering tools for easy retrieval during audits or when updates are necessary.

Conclusion on managing Form 5500 responsibly

Proper management of Form 5500 is essential for compliance and fostering trust among plan participants. Staying informed about changes in regulations and deadlines is crucial to ensure ongoing compliance in future filings. Establishing a regular review process helps to anticipate updates that affect reporting duties and participants.

Through leveraging pdfFiller's capabilities, employers can simplify not just the filing process, but also ensure year-round compliance with ease. By integrating robust document management tools, employers can focus on what truly matters—the welfare of their participants and the effectiveness of their plans.

Additional insights

Amid changing regulatory landscapes, the impact on Form 5500 filings remains significant. Recent legislation may adjust reporting requirements, particularly in response to the evolving structure of employee benefit plans. Keeping abreast of these changes is imperative for compliance and for effectively managing the information shared with participants.

Moreover, trends such as the increasing adoption of technology within human resources are transforming how benefits are reported. Employers are utilizing digital tools that offer real-time insights, enhancing their capabilities to maintain compliance and improve reporting quality, making solutions like pdfFiller invaluable in navigating this complex terrain.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 5500 information guide?

How do I edit form 5500 information guide online?

Can I edit form 5500 information guide on an Android device?

What is form 5500 information guide?

Who is required to file form 5500 information guide?

How to fill out form 5500 information guide?

What is the purpose of form 5500 information guide?

What information must be reported on form 5500 information guide?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.