Get the free State of Iowa Low-Income Home Energy Assistance Program ...

Get, Create, Make and Sign state of iowa low-income

How to edit state of iowa low-income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state of iowa low-income

How to fill out state of iowa low-income

Who needs state of iowa low-income?

State of Iowa Low-Income Form How-to Guide

Overview of Iowa low-income assistance programs

Low-income assistance programs in Iowa are designed to provide financial support to households facing economic challenges. These programs aim to alleviate the financial burden on families by offering resources for necessities such as food, energy, and housing. The importance of financial support for low-income households cannot be overstated; it provides a safety net that can significantly affect individuals' and families' overall well-being and stability.

In Iowa, various assistance programs are available, ensuring that residents can access critical lifelines when faced with economic difficulties. These programs not only help to meet immediate needs but also promote resilience and self-sufficiency for families striving for a better future.

Understanding the types of low-income forms

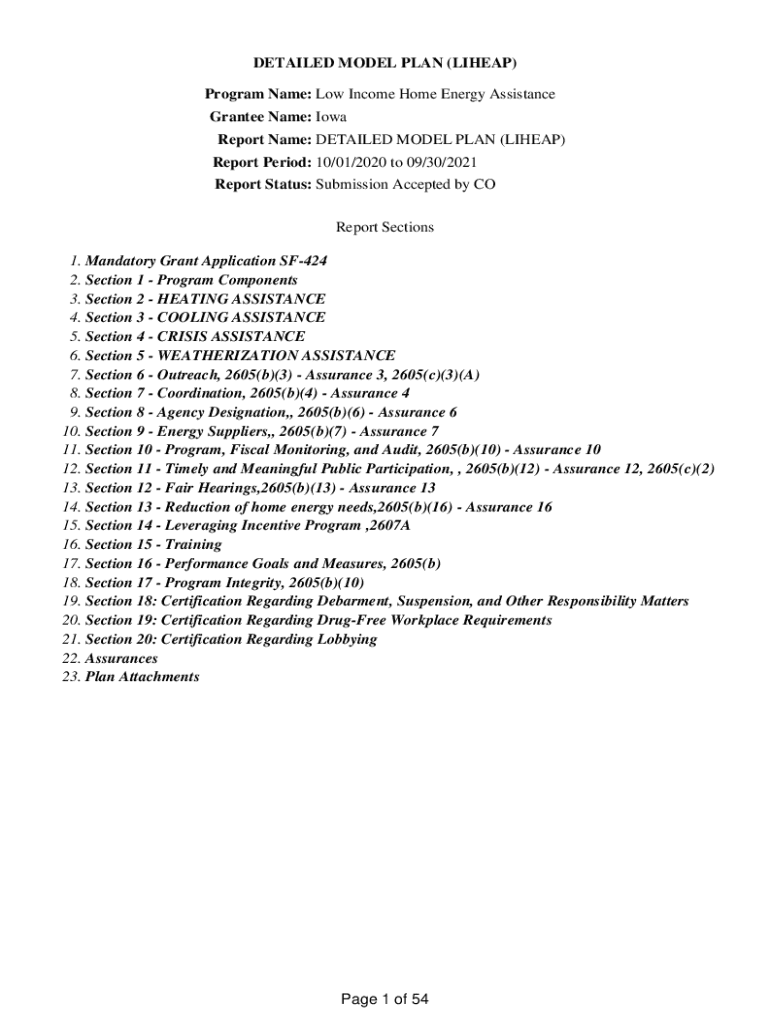

Iowa offers multiple forms for low-income assistance, targeting different areas of need. One of the most significant programs is the Low-Income Home Energy Assistance Program (LIHEAP), which helps households manage their heating costs, particularly during the winter months. This program is crucial for families struggling to pay their heating bills, especially in a state where winter temperatures often plummet.

Another vital program is the Supplemental Nutrition Assistance Program (SNAP), which provides nutritional assistance to eligible low-income families. Through SNAP, individuals can access healthy food options, combating food insecurity and promoting better health outcomes. Additionally, the Temporary Assistance for Needy Families (TANF) program offers financial support and job opportunities for families, allowing them to transition towards self-sufficiency.

Eligibility criteria for Iowa's low-income programs

To qualify for low-income programs in Iowa, applicants must meet specific eligibility criteria that vary by program. Generally, these criteria include income limits, household size, and residency requirements. Traditionally, to determine eligibility, state and federal poverty guidelines are utilized, ensuring those who need help the most receive it.

For each program, income limits will differ. For instance, LIHEAP requires applicants to have a household income at or below 175% of the federal poverty level. Meanwhile, SNAP differs slightly, applying different income criteria dependent on household size. In most cases, households must also be residents of Iowa and provide proof of their living situation.

Detailed income guidelines

Understanding the income guidelines is crucial for applicants seeking help through Iowa's low-income assistance programs. The income calculation methods typically depend on gross income, which includes wages, benefits, and other sources of income before any deductions. The state calculates eligibility using both state and federal poverty guidelines, with specific figures that can help families realize if they qualify.

For example, for a 1-person household in Iowa, the income limit is approximately $22,000 annually, while a 2-person household can earn up to about $30,000. Larger households have adjusted limits, for instance, a 4-person household is limited to around $44,000. These figures exemplify how household size impacts available assistance, guiding potential applicants in evaluating their eligibility.

Step-by-step instructions for completing the low-income form

Before filling out the state of Iowa low-income form, it is essential to prepare adequately. Start by collecting necessary documentation, which primarily includes proof of income, identity verification, and residence documentation. These documents will reinforce your application, ensuring it is complete and increases the likelihood of acceptance.

When filling out the form, you'll encounter several sections that require attention. Ensure the following: provide accurate personal information like your name, address, and Social Security number. Clearly specify your income details, including all job wages, benefits, and any other monetary sources. Additionally, list all members of your household while providing their income contributions as well. This detailed walkthrough will facilitate your application process, ensuring you meet the necessary criteria for low-income assistance.

Tips for effective form submission

Accuracy and completeness in your application form can significantly influence the outcome of your submission. Double-check every detail filled into the form, as common mistakes can lead to unnecessary delays or outright denials. Pay particular attention to income figures; discrepancies can prompt questions about eligibility.

Before submission, take the time to review each section to ensure all information aligns correctly and is fully filled out. Keep a copied copy of your application for reference during follow-up discussions. Lastly, be mindful of the submission deadlines; ensuring your form is filed on time is crucial for accessing necessary funds.

What happens after submission?

After submitting the state of Iowa low-income form, applicants can expect a processing timeline, typically ranging from a few weeks to a month, depending on the program and the volume of applications. To check the status of your application, you can contact the assistance office using the details provided in your submission confirmation.

In some instances, applicants may need to provide additional documentation or clarify certain details, so staying responsive to requests from the assistance office is crucial. Understanding the process after submission, including potential follow-up steps, helps applicants stay informed and prepared.

Resources for assistance

There are numerous resources available for individuals seeking help with the Iowa low-income form. State assistance offices can provide guidance through the application process and answer any questions. It's beneficial to reach out directly or visit their websites for up-to-date information on available programs and application procedures.

Additionally, various local community organizations offer support services aimed at low-income families. Many of these organizations have dedicated staff and volunteers who can assist with form completion, provide documentation assistance, and offer additional resources tailored to individual circumstances.

Utilizing pdfFiller for efficient form management

pdfFiller offers a robust platform for managing your state of Iowa low-income form, making the process easier and more efficient. Users can upload, edit, and sign their forms directly on the platform, eliminating the hassle of dealing with printed documents. With pdfFiller, individuals can ensure their submissions are both accurate and professional.

The platform also facilitates collaboration, allowing teams to work together on applications, ensuring all necessary information is included. Additionally, the cloud-based storage feature provides an advantage in managing various documents, making it easy to track applications and updates efficiently, reducing stress during the process.

Interactive tools for personalized assistance

pdfFiller offers interactive tools that enhance the user experience when managing the state of Iowa low-income form. These tools include interactive templates that guide users step-by-step through the form completion process, which is particularly beneficial for individuals unfamiliar with the forms.

By utilizing these tools, users can not only fill out forms accurately but also benefit from features that allow for easy access to frequently needed explanations or instructions. Most importantly, the emphasis on user-friendly design ensures that technology enhances the application process, making financial assistance more accessible.

Frequently asked questions (FAQs)

Individuals often have several inquiries regarding low-income forms in Iowa. Common questions include the eligibility requirements, documentation necessary for submission, and the typical processing times for applications. It’s important to clarify that many applicants often wonder about the specifics of their eligibility based on household income or size.

Additionally, users may have questions regarding the functionality of pdfFiller in relation to these forms, including how to easily edit documents or what collaborative features are available. Addressing these common FAQs can build confidence in applicants as they navigate the application process.

Success stories and testimonials

Many individuals and families in Iowa have successfully accessed low-income assistance, enabling them to overcome financial hurdles. Success stories often showcase how programs like LIHEAP and SNAP have provided essential resources, allowing families to focus on stability and growth.

Moreover, testimonials from users who have utilized pdfFiller for form submission underscore the platform's impact; individuals appreciate the ease of use and efficiency in managing their applications. These narratives highlight the transformative effects that effective financial assistance, paired with a powerful document management tool, can have on families striving for a better quality of life.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my state of iowa low-income directly from Gmail?

How can I modify state of iowa low-income without leaving Google Drive?

How do I edit state of iowa low-income on an iOS device?

What is state of Iowa low-income?

Who is required to file state of Iowa low-income?

How to fill out state of Iowa low-income?

What is the purpose of state of Iowa low-income?

What information must be reported on state of Iowa low-income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.