Get the free be denied coverage because you dont fill

Get, Create, Make and Sign be denied coverage because

How to edit be denied coverage because online

Uncompromising security for your PDF editing and eSignature needs

How to fill out be denied coverage because

How to fill out be denied coverage because

Who needs be denied coverage because?

Be Denied Coverage Because Form: Navigating Insurance Denials Effectively

Understanding coverage denials

Being denied coverage can be a frustrating experience, especially when the denial is rooted in issues related to forms. Insurance coverage denial means that a claim or request for benefits has been rejected by the insurer, often due to specific criteria not being met during the application process. Common reasons for denial include pre-existing conditions, providing insufficient information, and failing to adhere to policy stipulations.

The emotional impact of being denied coverage can be significant. Many individuals experience feelings of confusion and helplessness, especially when they are unaware of the precise reasons leading to the denial. Financially, this can lead to mounting medical bills or loss of coverage altogether, adding stress to an already challenging situation. Statistics reveal that health insurers in the United States deny a considerable percentage of claims each year, underlining the importance of understanding the reasons behind these denials.

Common reasons for coverage denials

One prevalent reason individuals face the issue of being denied coverage is related to pre-existing conditions. Health insurers can disallow claims if a condition was present before the start of the policy, leaving many patients in vulnerable financial states. Common examples include chronic illnesses or prior surgeries which can inadvertently lead to denials.

Another frequent cause for denial are insufficient information and documentation errors. If an application is filled out incorrectly or lacks essential details, insurers have grounds to deny the coverage. This can be particularly tricky in situations where complex medical histories need to be presented. Additionally, provider networks play a significant role; claims may be denied if a healthcare provider is out-of-network, ultimately resulting in unexpected out-of-pocket expenses.

The role of forms in coverage denial

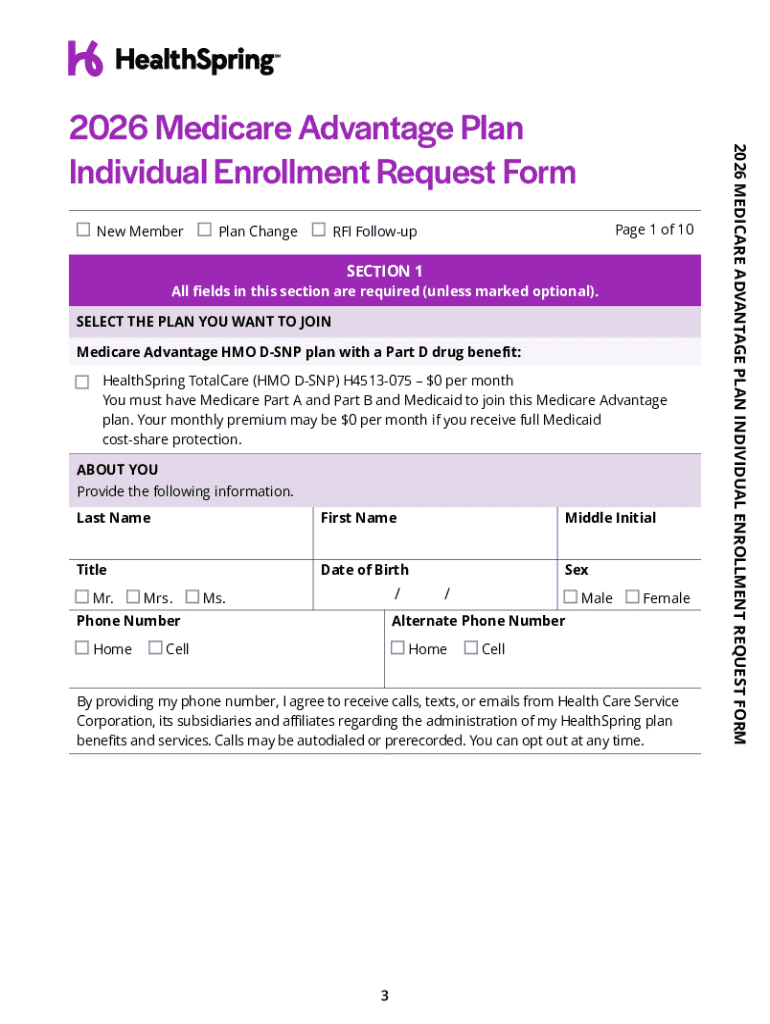

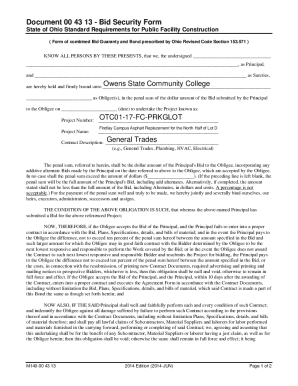

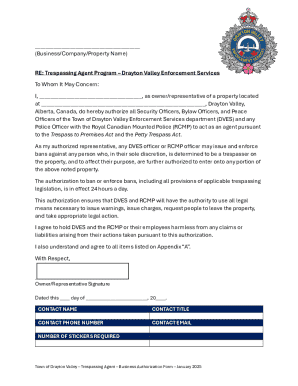

Forms play a critical role in the insurance application process. Key forms related to coverage denials include application forms, appeal letters, and other relevant documentation. To mitigate the risk of denial, it's essential to ensure that all forms are filled out correctly and completely. This includes double-checking personal information, providing comprehensive medical histories, and submitting all requested documentation.

To avoid being denied coverage because of forms, follow this step-by-step guide: Begin by reviewing all application materials thoroughly. Fill in each section with precise information. Keep copies of any previous medical records submitted and ensure all details are accurate. This attention to detail significantly lowers the risk of encountering common pitfalls that lead to denials.

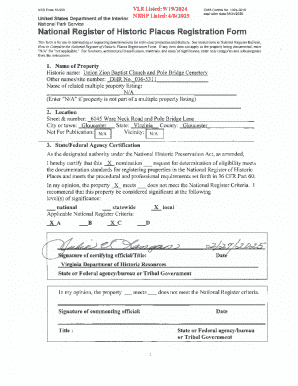

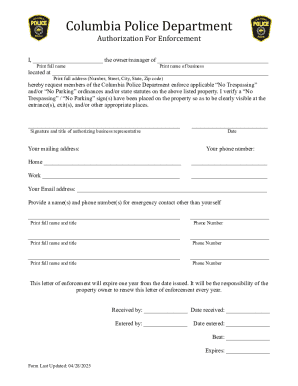

The appeal process for coverage denials

If your coverage has been denied, understanding the appeal process is vital. Start with reviewing your denial letter to comprehend the reason for denial. Insurers are required to provide specific details, which can be pivotal in crafting your response. Pay attention to terminologies used in the letter which might help you understand their underlying reason.

Gather all necessary documentation for your appeal, such as previous claim forms, correspondence with your insurer, and any supporting medical records. When submitting your appeal form, ensure that it's comprehensive and addresses each point made in the denial letter. Timing is critical; many insurers have strict deadlines. Missing these can lead to the inability to contest the decision.

Utilizing pdfFiller for your forms

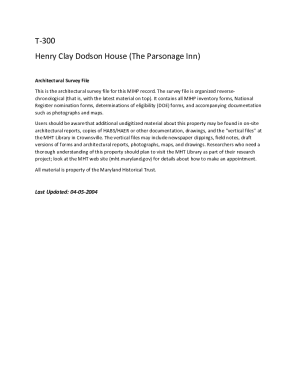

pdfFiller is an invaluable tool that assists you in managing your insurance forms effectively. Its features allow for document editing, eSigning, and enhanced collaboration, streamlining the process of completing insurance forms. With this platform, users can access templates for various forms, making it easier to avoid common mistakes that lead to coverage denials.

The interactive tools provided by pdfFiller simplify form management significantly. Users can edit documents, save information, and track changes swiftly, which is especially useful during time-sensitive appeal processes. Additionally, everything is stored in one secure, cloud-based location, ensuring that all your documentation is easily accessible and organized.

Real-life case studies: success stories in appealing denials

Case studies can offer hope and practical outlines of the appeal process. For instance, in one notable situation, a woman was denied coverage due to a pre-existing condition. By gathering comprehensive medical documentation and appealing with detailed evidence, she successfully overturned the denial. This process involved persistent communication with her insurer and demonstrating her condition had been managed effectively.

Another case involved an individual receiving a denial due to perceived insufficient information. They meticulously reviewed the denial letter, collected all relevant documents, and used pdfFiller to craft a precise appeal. The insurer accepted their appeal, which emphasized the clarifications needed, showcasing the importance of thorough preparation and understanding.

Expert insights and tips

Consulting with insurance experts can significantly improve your chances of a successful appeal. During interviews with various professionals in the insurance field, common strategies emerged. Experts recommend clearly articulating your situation, providing thorough documentation, and maintaining a positive yet determined demeanor when communicating with insurers.

Avoiding common mistakes is crucial. Many individuals fail to address all points raised in a denial letter, which can weaken their appeal. Additionally, submitting late or incomplete forms can derail the appeal process. Always ensure your submissions are timely, complete, and thoroughly vetted before sending.

Connect with professional help

Recognizing when to seek professional assistance is vital. Situations may arise where the complexity of your denial necessitates engaging with an advocate or legal expert who specializes in insurance claims. Indicators that you may need additional support include multiple denials, complex medical histories, or if you are unclear on the appeal process.

Choosing the right advocate involves asking pertinent questions. Inquire about their experience with similar cases and their success rate. A knowledgeable advocate can provide tailored guidance, enhancing your chances of overturning a denial effectively.

Additional considerations

Understanding your rights as a policyholder is crucial. As an insured individual, you have legal protections, including the right to appeal denials and receive clear communication regarding policy terms. Familiarizing yourself with these rights can empower you when facing a denial.

Additionally, staying informed about changes in insurance laws is essential. Legislative actions may affect coverage standards and rights available to you as a policyholder. Regularly consult resources provided by government organizations or state-level regulators to remain updated on any impactful changes in the insurance landscape.

Related topics for further exploration

For those looking to expand their knowledge about insurance, understanding health insurance basics is a solid starting point. Familiarizing yourself with essential concepts will help you navigate claims and potential denials more effectively. Moreover, exploring how to find affordable coverage after a denial can provide new avenues for securing necessary health services.

Lastly, recognizing the role of state insurance departments is crucial. These organizations exist to assist policyholders, provide resources on complaint processes, and offer guidance for those facing coverage denials. Utilizing these resources can prove advantageous in navigating complex insurance situations more efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send be denied coverage because to be eSigned by others?

How can I edit be denied coverage because on a smartphone?

Can I edit be denied coverage because on an iOS device?

What is be denied coverage because?

Who is required to file be denied coverage because?

How to fill out be denied coverage because?

What is the purpose of be denied coverage because?

What information must be reported on be denied coverage because?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.