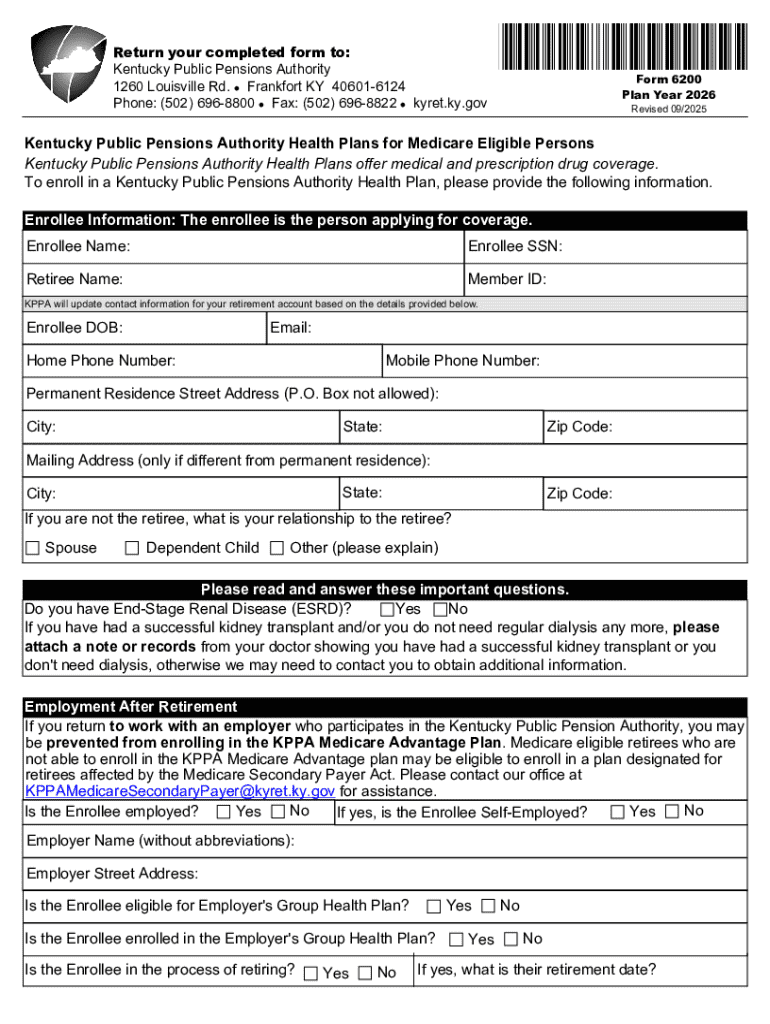

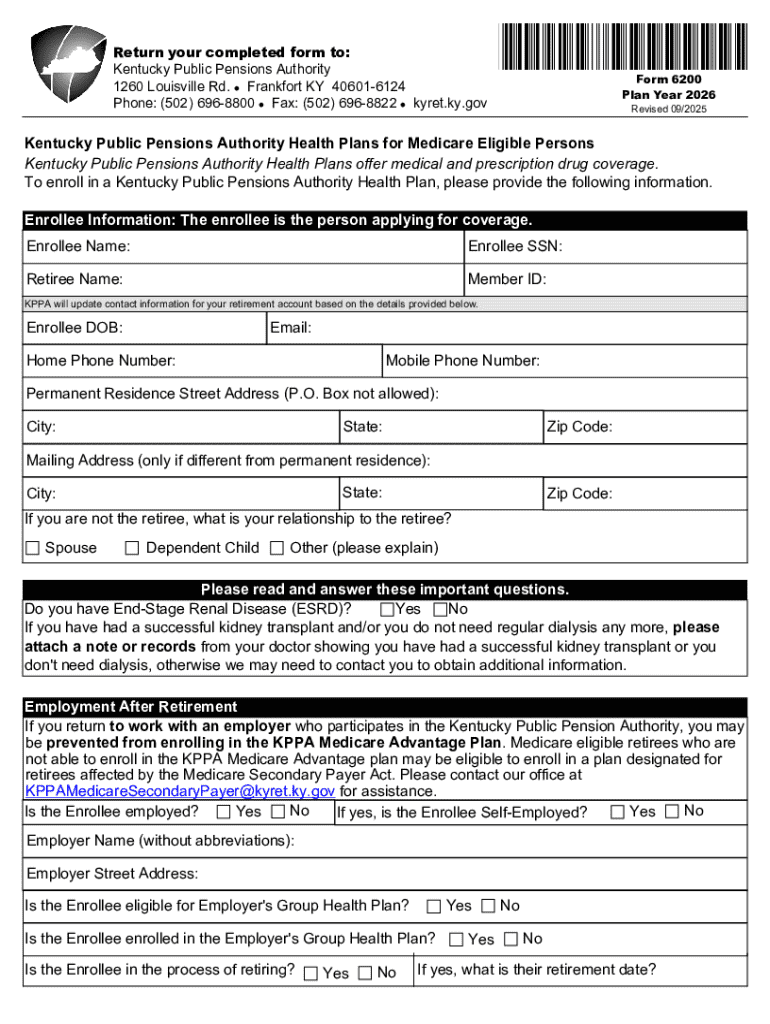

Get the free Form 6200 - PY 2026 Medicare-Eligible Enrollment Form

Get, Create, Make and Sign form 6200 - py

How to edit form 6200 - py online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 6200 - py

How to fill out form 6200 - py

Who needs form 6200 - py?

Form 6200 - PY Form: A Comprehensive Guide

Understanding Form 6200 - PY

Form 6200 - PY is a crucial document used for tax reporting purposes. Specifically designed for certain individuals and businesses, this form is essential for accurately disclosing income information to the Internal Revenue Service (IRS). The importance of Form 6200 - PY cannot be overstated, as it facilitates compliance with tax regulations and helps in avoiding penalties associated with incorrect filings.

Filing this form enables taxpayers to report their earnings and deductions in a structured manner, resulting in a hassle-free tax filing experience. Moreover, proper completion of Form 6200 - PY plays a significant role in financial transparency and accountability.

Who needs to file Form 6200 - PY?

Understanding who needs to file Form 6200 - PY is essential. This form targets specific individuals and businesses, primarily those who receive income that needs to be reported to the IRS. Generally, self-employed individuals, small business owners, freelancers, and contractors fall into this category.

The criteria for filing include factors such as income levels, business structures, and tax obligations. Those who earn above a certain threshold or operate a specific type of business entity are required to use this form to ensure compliance with federal tax laws.

Key features of Form 6200 - PY

Form 6200 - PY is structured to make the reporting process as straightforward as possible. The form includes several sections designed to capture essential financial information required for tax purposes. Each section is labeled for easy navigation, including fields for personal identification, income sources, deductions, and credits.

Common requirements for filling out the form generally involve having relevant financial documents at hand, such as pay stubs, expense records, and previous tax returns. Potential filers should ensure they meet the eligibility criteria outlined by the IRS, which might include limits on gross income or specific business classifications.

Steps to complete Form 6200 - PY

Completing Form 6200 - PY involves several crucial steps. Firstly, it’s essential to gather all required information ahead of time. This includes collecting any relevant documents like 1099s, W-2s, receipts, and previous tax filings. Being well-prepared streamlines the process and minimizes the risk of errors during completion.

Once the necessary documents are assembled, follow these step-by-step instructions: Start by filling out your personal information, including name, address, and taxpayer identification number. Next, proceed to report your income accurately and document all deductions applicable to your situation. Be diligent to cross-check the numbers to ensure they match your financial records.

Verifying your information is crucial. Make sure every entry is double-checked against your documentation. Creating a checklist can help facilitate this review process, confirming that no details are overlooked.

Editing and eSigning Form 6200 - PY on pdfFiller

One of the most efficient ways to edit Form 6200 - PY is through pdfFiller. This powerful platform offers users a range of editing tools that simplify navigating the complexities of the form. Start by uploading or importing the form into pdfFiller, then utilize the editing features to fill in the necessary fields. You can easily adjust formatting and layout, making the document look professional.

eSigning your form is particularly important as it certifies the authenticity of your filing and verifies that you consent to the information provided. Within pdfFiller, adding a digital signature is straightforward: navigate to the signing tool, place your signature where required, and save the document. Collaborating with others is also simplified; you can share the form in real time with teammates or financial advisors to ensure all necessary inputs are included.

Managing Form 6200 - PY after completion

After completing Form 6200 - PY, the next steps involve saving and submitting your form correctly. pdfFiller offers various options for saving your documents, including PDF, Word, or cloud storage formats. Establish a consistent storage practice for important tax documents; consider organizing files into designated folders by year or category to streamline future access.

When it comes to submitting Form 6200 - PY, familiarize yourself with submission methods, which may include electronic filing or mailing a physical copy to the IRS. Be mindful of deadlines specific to tax filings, ensuring that all forms are submitted on time to avoid penalties. It’s beneficial to track the status of your submission by retaining confirmation receipts or tracking numbers provided during submission.

Frequently asked questions (FAQs)

Common issues encountered with Form 6200 - PY can often stem from incomplete information or inaccuracies in entries. To mitigate these issues, review past submissions or consult with a tax professional for specific guidance related to your situation.

For further assistance, many resources are available online, including IRS guidelines and pdfFiller support options. If questions persist, reaching out to a professional tax advisor or accessing pdfFiller's support channels can provide the necessary clarifications and support required to navigate the filing process effectively.

Additional tools and resources on pdfFiller

pdfFiller provides access to several interactive resources that can aid in filling out Form 6200 - PY. These may include templates tailored specifically for different tax scenarios, offering a customizable starting point for users. Furthermore, the platform features details on other related tax forms you may need to complete.

For users seeking personalized assistance, pdfFiller’s customer support and help center deliver responsive support options. Whether you need help navigating the platform or specific guidance on utilizing Form 6200 - PY, don't hesitate to reach out. This customer-centric approach fosters a seamless experience as you manage your documents.

Accessing Form 6200 - PY on pdfFiller

To find Form 6200 - PY on pdfFiller, navigate to the website's content library. Utilize the search function to locate the form quickly. Once found, you can either fill it out directly online or download it for offline completion, depending on your preferences and requirements.

The benefits of using pdfFiller extend beyond simple access; the cloud-based platform enhances productivity significantly. Users can edit, sign, and collaborate on documents from virtually anywhere, allowing for a flexible and efficient document management experience.

Contact us

For any questions or support regarding Form 6200 - PY or the pdfFiller platform, users can contact customer support directly through the website. The support team is well-equipped to handle inquiries and provide information needed for efficient document management.

Additionally, pdfFiller maintains a clear privacy policy and terms of use available on their site to ensure user data remains protected while using their services.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 6200 - py?

How do I edit form 6200 - py online?

Can I sign the form 6200 - py electronically in Chrome?

What is form 6200 - py?

Who is required to file form 6200 - py?

How to fill out form 6200 - py?

What is the purpose of form 6200 - py?

What information must be reported on form 6200 - py?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.