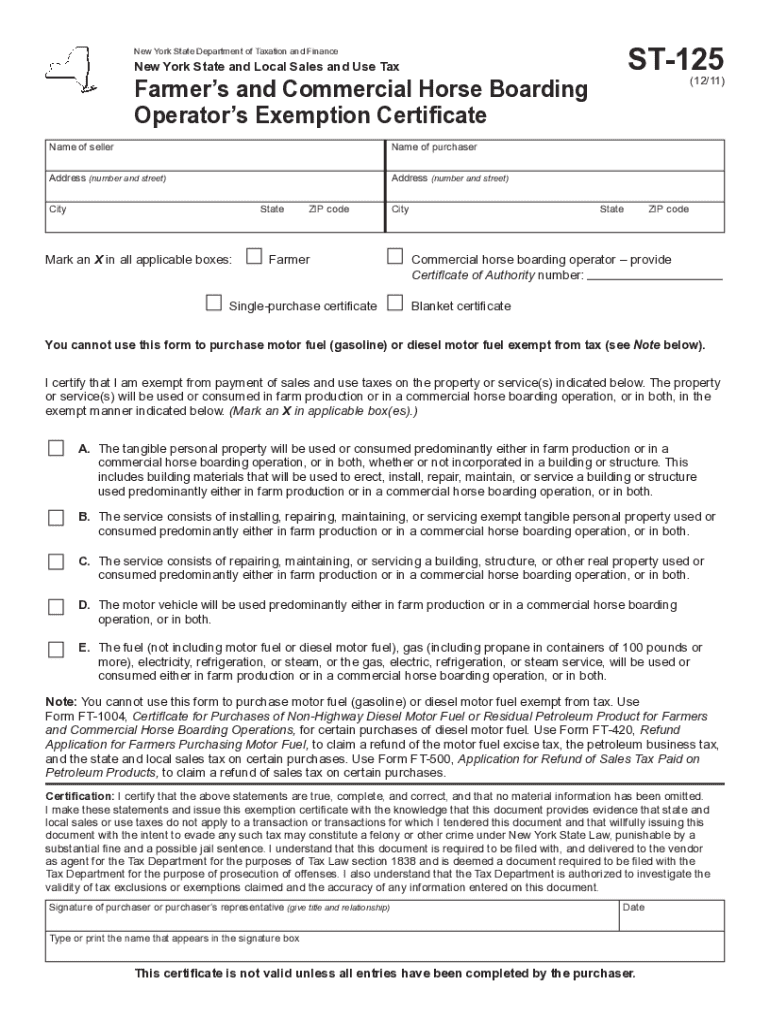

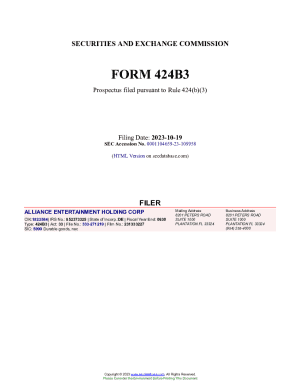

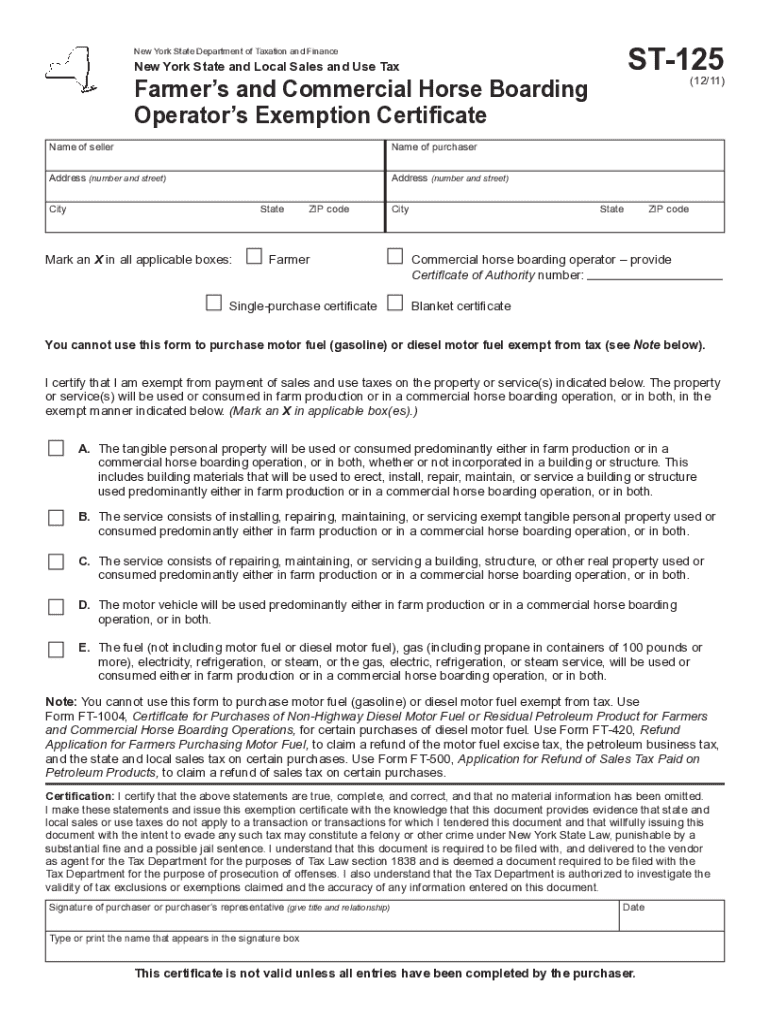

Get the free New York State Tax Exemption Certificate ST-125

Get, Create, Make and Sign new york state tax

How to edit new york state tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new york state tax

How to fill out new york state tax

Who needs new york state tax?

A Comprehensive Guide to New York State Tax Forms

Understanding New York State tax forms

New York State tax forms are essential documentation for individuals and businesses to report their taxable income and determine their tax liability. These forms serve as a means for the New York State Department of Taxation and Finance to assess and collect taxes due from its residents and operating businesses. The primary aim of tax forms is to ensure compliance with state tax laws, thereby enabling proper allocation of public resources.

There are various types of tax forms tailored to meet the diverse needs of taxpayers. Individuals primarily file personal income tax forms, such as the IT-201 for residents, while corporations must utilize forms like the CT-3 for franchise tax. Understanding which form to utilize is critical to fulfilling one's tax obligations efficiently.

Importance of filing accurately

Filing your New York State tax forms accurately is crucial. Errors in your filings can lead to fines, penalties, and additional tax liabilities. Moreover, filing late or incorrectly can trigger an audit by the tax department, which may require extensive communications and responses on your part. Conversely, accurate and timely submissions support a smoother tax experience, helping you receive any eligible refunds more quickly.

Common New York State tax forms and their uses

Several key forms are commonly used by taxpayers in New York State. Each form serves a specific function and is designed to accommodate different situations. Knowing which form to file can streamline the tax process significantly.

Selecting the appropriate form is paramount. Consider your residency status, type of income, and whether your situation involves deductions or credits. Each form may have different requirements and implications, so careful consideration at the outset can reduce potential headaches later.

Step-by-step guide to filling out New York State tax forms

Preparing to fill out your New York State tax form begins with gathering the necessary documents, such as W-2s or 1099s. Understanding your income, deductions, and any potential credits is fundamental before starting the process. These components make up the framework of your return.

When filling out your form, ensure that you follow each section accurately. Whether using IT-201 or IT-203, enter your information carefully. Double-check math calculations and the accuracy of all reported income. To avoid common pitfalls, familiarize yourself with the line items that might typically be misreported.

Utilizing pdfFiller's tools can simplify the process of editing your form online. Its interactive features allow you to input data directly into the form, reducing the chance of error and simplifying the process of organizing your tax return.

Managing your New York State tax forms with pdfFiller

Once you've completed your forms, managing them effectively is key to staying organized. pdfFiller provides a secure platform for uploading and storing your tax forms, safeguarding sensitive information. You can organize your forms by year, type, or any custom classification that suits your needs.

The electronic signature (eSigning) feature is another significant benefit, as signed forms can be easily authenticated and submitted electronically. This increases efficiency and ensures compliance with submission requirements set forth by the New York State Department of Taxation and Finance.

Submitting your New York State tax forms

When it comes time to submit your New York State tax forms, you have a few options. E-filing is increasingly popular due to its convenience and speed; it typically gets processed faster than paper submissions. However, some individuals and businesses still prefer the traditional paper filing method. Regardless, deadlines are critical, so make sure you mark your calendar for when forms are due.

To confirm the receipt of your submission, follow up with the New York State Department of Taxation and Finance. Keeping track of your online services account summary can ensure you stay informed about the status of your submission and any notices or notifications from the state.

Handling New York State tax issues

Mistakes can happen, and understanding how to amend your submitted tax form is critical. If you realize an error in your reported income or a missed deduction, you may need to file Form IT-201-X for corrections. Engaging the New York State Department of Taxation and Finance for communication about your issue will be necessary.

Common tax issues include audits, where the tax department may request additional documentation or clarification about your return. Being prepared for these situations can alleviate stress. Should you owe taxes, ensure your payments are promptly handled to avoid further complications.

Seeking assistance with New York State tax forms

When dealing with New York State tax forms, you don’t have to navigate it alone. Official government resources provide a wealth of information ranging from how-to guides to FAQs regarding tax forms. Tax professionals can also assist in ensuring that your forms are filled out correctly and that you're taking advantage of all available deductions and credits.

For additional support, pdfFiller offers tutorials and a user support center to help guide you through specific forms and tax requirements. Community forums can also be beneficial for connecting with others facing similar tax challenges.

Staying informed about changes in tax laws

Changes in tax laws can impact how you file your New York State tax forms. It's essential to stay informed about any legislative shifts that could affect your tax obligations or the forms you need to file. For instance, new credits may become available or certain deductions could be altered.

Regularly checking updates from official government channels, subscribing to email alerts, or even using resources provided by pdfFiller can help you remain informed about any relevant changes to tax laws. This proactivity will save you time and stress when tax season rolls around.

Best practices for document security and management

Safeguarding your personal information during tax season is paramount. Digital security practices, such as using secure passwords and enabling two-factor authentication, can help protect sensitive data stored in your online services account. Be cautious about sharing information and ensure your network is secure when accessing tax-related websites.

In addition, managing your tax documents effectively can bolster your security efforts. Store physical copies in a secure location and organize your digital files carefully. pdfFiller adds an extra layer of protection through encryption and document tracking, providing peace of mind when filing your forms.

Utilizing resources in pdfFiller for your tax needs

pdfFiller offers an array of features tailored to simplify the tax filing process. Collaboration tools allow teams to work together on tax documents seamlessly, enhancing productivity. Creating custom tax templates for future use can save additional time, ensuring that you’re always organized and prepared.

Many users have reported success using pdfFiller for their tax management needs. Features such as easy editing, eSigning, and efficient storage make filing taxes less stressful and more manageable.

Accessing language assistance

For individuals and business owners who may not be fluent in English, accessing language assistance is vital when preparing to file New York State tax forms. pdfFiller offers language support resources that cater to non-English speakers, ensuring that they can understand tax instructions and requirements.

Proper language accessibility aids in the completeness of tax filings. For those requiring additional help, utilizing translated guides or language services can bridge potential gaps in understanding tax law.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete new york state tax online?

How can I edit new york state tax on a smartphone?

How do I fill out new york state tax using my mobile device?

What is new york state tax?

Who is required to file new york state tax?

How to fill out new york state tax?

What is the purpose of new york state tax?

What information must be reported on new york state tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.