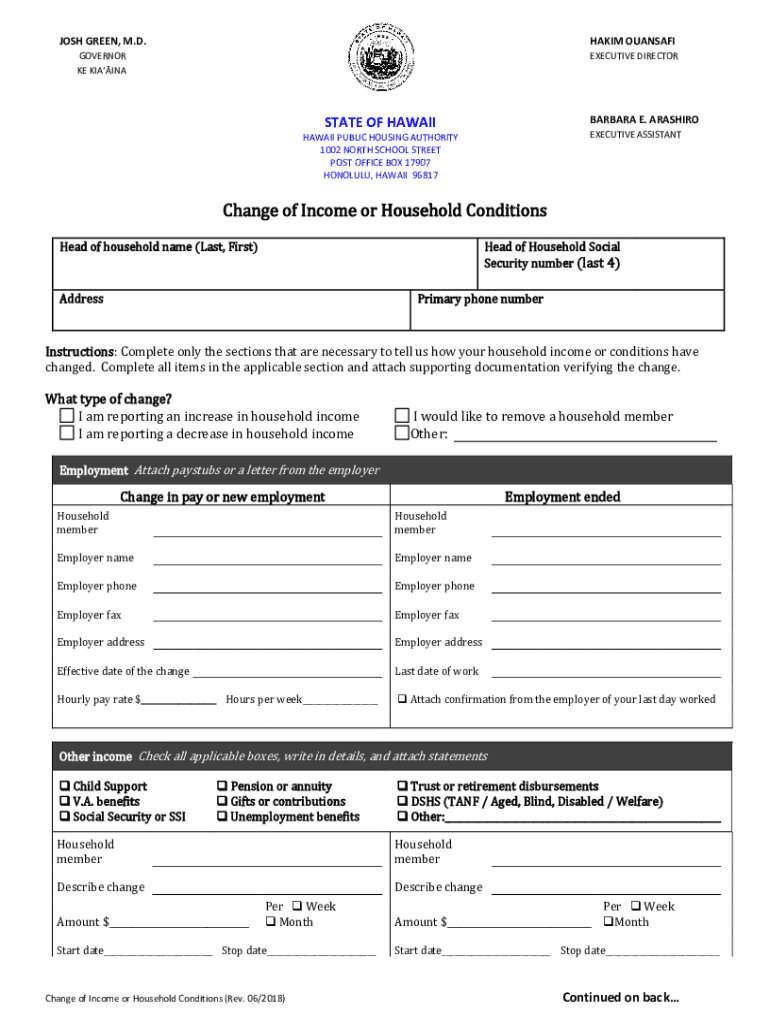

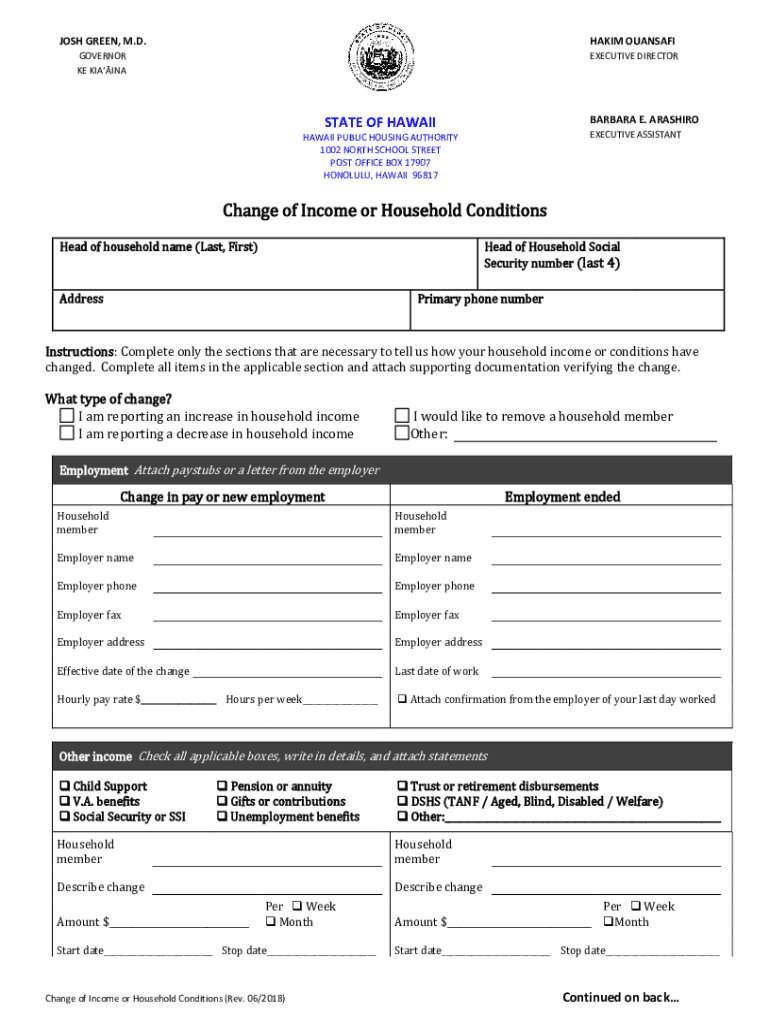

Get the free Head of household name (Last, First)

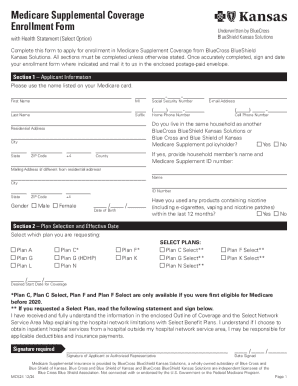

Get, Create, Make and Sign head of household name

Editing head of household name online

Uncompromising security for your PDF editing and eSignature needs

How to fill out head of household name

How to fill out head of household name

Who needs head of household name?

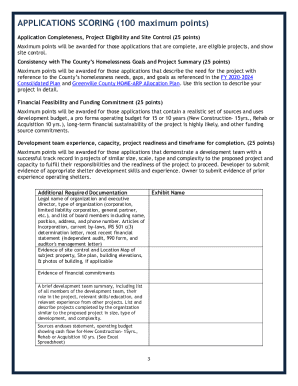

A Comprehensive Guide to the Head of Household Name Form

Understanding the Head of Household Name Form

The Head of Household Name Form is crucial for taxpayers who qualify for this filing status, which offers significant benefits during the tax season. This form is primarily designated for those who provide a home for a qualifying dependent and therefore have the opportunity to lower their overall tax liability. By filing as Head of Household, taxpayers can enjoy a higher standard deduction compared to Single or Married Filing Separately statuses, making it a favorable option for many.

So, when should you consider using this form? Individuals often qualify when they are single or considered unmarried for tax purposes but have dependents living with them. Common situations include single parents or those whose spouse hasn’t lived in the home for the last six months of the tax year. Understanding the nuances of this form can help lead to better financial outcomes come tax time.

Key qualifications for Head of Household status

To qualify as Head of Household, you need to meet certain eligibility criteria set by the IRS. The requirements include being unmarried or considered unmarried on the last day of the tax year, paying more than half the cost of keeping up a home for the year, and having a qualifying dependent, which could be a child or other relative. This status not only reflects your financial responsibilities but also your commitment to supporting your dependent.

However, many misconceptions exist surrounding this status. One common belief is that you must be divorced to file as Head of Household, which is not true. You may qualify if you have a child living with you after a separation, regardless of your marital status. It’s important to clarify these details to ensure compliance with IRS regulations and to maximize your tax benefits.

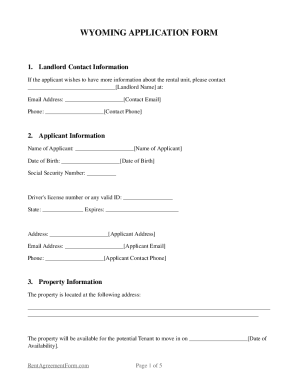

Detailed instructions for completing the Head of Household Name Form

Completing the Head of Household Name Form can seem daunting, but breaking it down into manageable steps makes it clearer. Start by gathering essential documents such as Social Security numbers for you and your dependents, W-2 or 1099 income forms, and records of expenses related to your home. These documents will provide the foundational information you need to complete your form accurately.

Next, carefully follow our step-by-step guidance. First, fill out the Personal Information Section with your details including your name, address, and filing status. Then, accurately enter the details of your dependents in the Dependent Information Section. Make sure to report your income in the Income Reporting section by including all sources of earnings. Lastly, understand any eligible deductions or credits that can benefit you as Head of Household, such as child tax credits or other dependent credits.

Common mistakes to avoid

Errors on the Head of Household Name Form can lead to delays in processing and potential issues with the IRS. One of the most common mistakes includes providing inaccurate information about income or dependents. To mitigate this risk, double-check each entry against your documentation before submission. Ensure that Social Security numbers, names, and financial figures are all accurate.

Another critical area to address is filing deadlines. Failing to submit your form on time can result in penalties or missed opportunities for tax refunds. Familiarize yourself with the annual tax filing dates to avoid any unnecessary stress. Additionally, make sure you account for all eligible dependents; omitting a qualifying child could significantly impact your tax outcome and benefits.

Interactive tools for efficient completion

Utilizing interactive tools can greatly streamline the process of completing the Head of Household Name Form. pdfFiller provides features that allow easy editing of PDF forms directly from your browser. Users can quickly fill out their forms, making corrections as necessary, which is particularly helpful for those who may find themselves needing to make last-minute adjustments.

Additionally, incorporating eSignatures into your documents has never been easier. pdfFiller’s platform supports quick and secure electronic signing, ensuring that your forms are not only completed accurately but also signed promptly. The collaboration tools available allow teams to work together on document creation and management, enhancing the experience for individuals filing their forms.

Managing your form after submission

Once you have submitted your Head of Household Name Form, it’s essential to keep track of its status. You can easily track your submission through the IRS’s online portal, which provides updates on processing and potential refunds. If you find that your circumstances change after submission—like your income or your dependency status—you can amend your form with the necessary adjustments to ensure compliance.

Storing your completed forms securely is just as important. pdfFiller’s cloud-based platform allows for easy storage and access to documents at any time. This is of value not just during tax season but for any future references or potential audits, making it easy to retrieve your Head of Household Name Form whenever needed.

Related forms and additional support

While the Head of Household Name Form is a critical aspect of the tax filing process, there are other forms that may also be pertinent to your situation. For instance, Form 1040 is commonly used to report your total annual income, while Form 8862 is used to claim the Earned Income Tax Credit after a disallowance. Familiarizing yourself with these forms can help you maximize your tax situation based on personal qualifications.

If you find yourself needing more tailored assistance, reaching out to tax professionals can be beneficial. Additionally, pdfFiller offers a wealth of customer support resources designed to assist users with any document-related questions. Whether through tutorials or one-on-one assistance, ensure you take advantage of available support for optimal filing experience.

Frequently asked questions (FAQs)

If you’re denied Head of Household status after filing, don’t panic. You have the option to contest the rejection by providing additional documentation or evidence for your claim. Additionally, if you find that your circumstances have changed and you wish to switch to a different filing status, you may do so by filing an amended return within the IRS guidelines. Keep in mind that maintaining records is important; it's generally recommended to keep forms on file for at least three years following your tax submission date.

Make sure to understand how the filing status affects your overall tax picture as returning to a previous status may have implications on your benefits. Always track your documents and forms securely—and ensuring compliance with the IRS will greatly smooth out your tax filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my head of household name directly from Gmail?

How can I send head of household name for eSignature?

How can I fill out head of household name on an iOS device?

What is head of household name?

Who is required to file head of household name?

How to fill out head of household name?

What is the purpose of head of household name?

What information must be reported on head of household name?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.