Get the free Budget Information and Sample Budget Narrative

Get, Create, Make and Sign budget information and sample

How to edit budget information and sample online

Uncompromising security for your PDF editing and eSignature needs

How to fill out budget information and sample

How to fill out budget information and sample

Who needs budget information and sample?

Budget information and sample form: A comprehensive guide to effective budgeting

Understanding budgeting basics

A budget is a financial plan that outlines expected income and expenses over a specific period. It serves as a roadmap for managing finances, allowing individuals and organizations to allocate resources effectively. By understanding what a budget is, you can recognize its importance in both personal and professional contexts.

Budgeting comes in several forms, including personal budgets for household expenses, business budgets for operational costs, and project budgets for specific initiatives. Each type of budget serves a distinct purpose but shares common goals such as ensuring financial stability and promoting informed decision-making.

However, budgeting isn't without its pitfalls. Common mistakes include underestimating expenses, overreliance on income projections, and ignoring irregular costs that can lead to budget overruns. Recognizing these mistakes is the first step to effective budgeting.

Key components of a budget

To create an effective budget, it's essential to understand its key components: income sources and expense categories. These elements form the foundation of your financial plan, allowing you to make informed decisions about spending and saving.

Income can be categorized into two main types: fixed income, which includes salaries and regular payments, and variable income, which encompasses bonuses and freelance work. Understanding these distinctions enables you to project your cash flow accurately.

Additionally, saving is a crucial component of a solid budget. Establishing an emergency fund helps cushion against unexpected expenses, reinforcing the importance of monthly savings. Consider setting aside at least 20% of your income for savings, with a goal of having three to six months' worth of living expenses saved.

How to create a budget

Creating a budget may seem daunting, but a step-by-step approach can simplify the process. Following a structured plan helps establish clarity and purpose in your financial endeavors.

Start by gathering financial information from income statements and expense receipts to ensure a comprehensive view of your financial situation. Next, list all income and expenses, either on paper, in spreadsheets, or through budgeting apps like those available on pdfFiller.

Utilizing budget templates can enhance your budgeting experience. They save time and help you stay organized. pdfFiller offers various customizable templates that allow for easy input and updates.

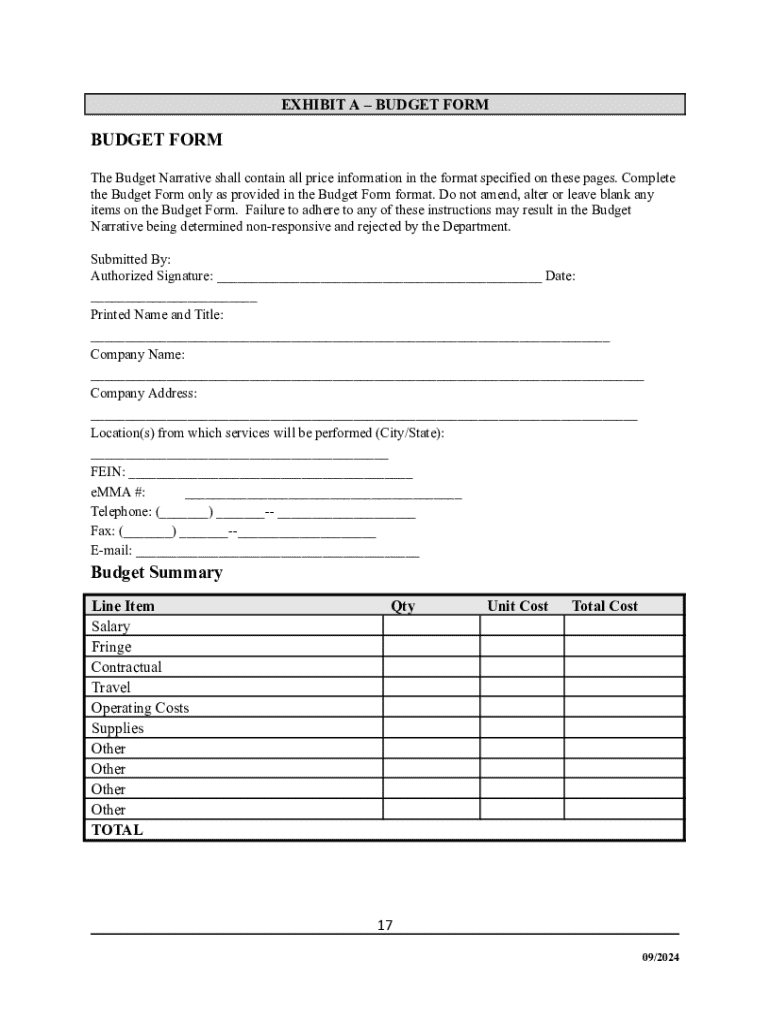

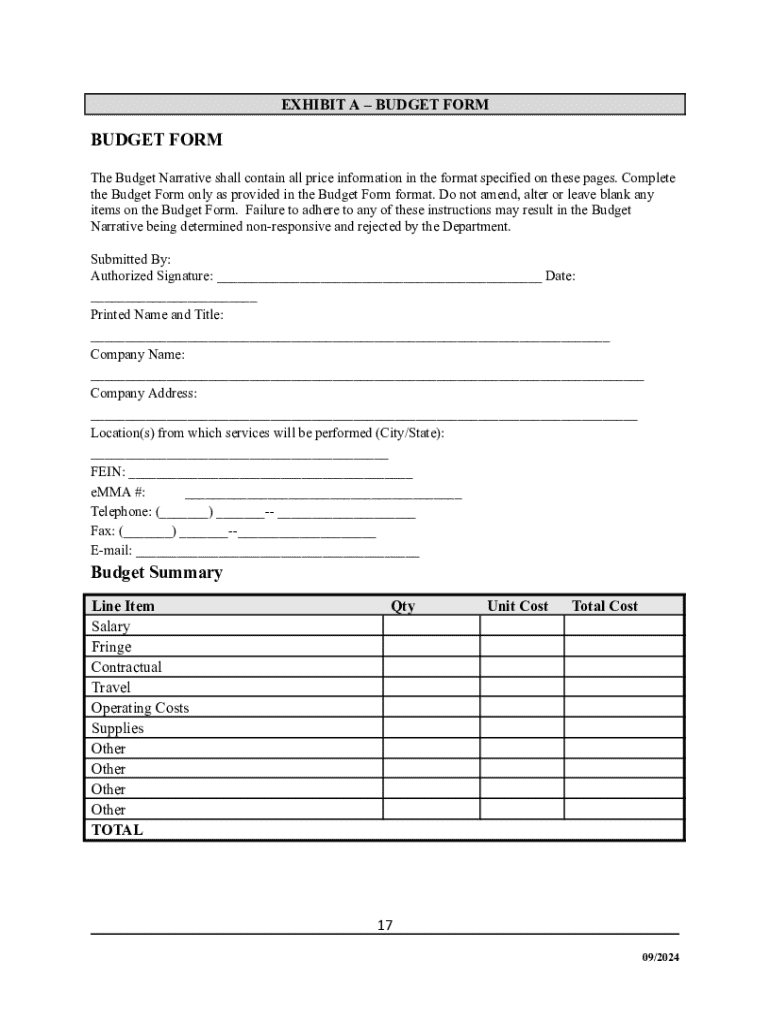

Budget sample form

A budget sample form is a useful tool for users wanting to implement effective budgeting strategies. It simplifies tracking all income and expenses, ensuring nothing is overlooked.

The structure of a sample budget form typically includes sections for income, fixed expenses, variable expenses, savings, and discretionary spending. It can also incorporate space for financial goals and notes, making it an excellent resource for individuals or teams.

Interactive features offered by pdfFiller, such as fillable fields and cloud storage access, make completing and managing your budget form effortless. Moreover, the eSigning capability allows for smooth business transactions.

Advanced budgeting techniques

For those seeking to elevate their budgeting strategies, exploring advanced techniques can provide additional control and savings opportunities. These methods are particularly beneficial for individuals facing complex financial situations.

One effective technique is zero-based budgeting, which requires each dollar of income to be assigned to specific expenses, savings, or debt repayment, ensuring no money is left unallocated. This method encourages conscious spending habits.

Common challenges in budget management

Budget management can be fraught with challenges. From seasonal expenses to unexpected costs, managing a budget requires proactive planning and adaptability.

Seasonal expenses, such as holiday shopping, can strain a budget. It's essential to plan for these occurrences in advance by allocating funds specifically for them. Moreover, unexpected costs can arise at any time, reinforcing the need for an emergency fund to buffer your finances.

Need help with budgeting?

If you find budgeting overwhelming, there are numerous resources at your disposal. Online courses and webinars offer valuable insights and strategies to improve your skills.

Additionally, community programs and local workshops can provide hands-on experiences in budgeting. For personalized support, pdfFiller's customer service is ready to assist with any inquiries related to their budget templates and features.

Quick access to budget templates

Finding the right budget template can streamline your budgeting process significantly. pdfFiller offers an array of templates suited for diverse budgeting needs, each customizable to fit your specific financial situation.

Accessing these templates is straightforward with pdfFiller's user-friendly interface. You'll be able to search for, download, and fill templates that meet your requirements in just a few simple steps.

Additional insights

Budgeting is not just about numbers; it’s a reflection of your financial lifestyle and priorities. Real-life case studies reveal how effective budgeting can radically alter one’s financial landscape, often leading to increased savings and reduced stress.

Recent trends indicate that inflation has reshaped many budgeting strategies. As the cost of living rises, individuals are adjusting their budget categories and reallocating funds to adapt to new economic realities. With predictions suggesting further shifts in financial climates, staying updated on these trends is crucial for effective budgeting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my budget information and sample in Gmail?

How do I make edits in budget information and sample without leaving Chrome?

How do I complete budget information and sample on an Android device?

What is budget information and sample?

Who is required to file budget information and sample?

How to fill out budget information and sample?

What is the purpose of budget information and sample?

What information must be reported on budget information and sample?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.