Get the free ENHANCED CUSTOMER DUE DILIGENCE FORM (ECDD)

Get, Create, Make and Sign enhanced customer due diligence

How to edit enhanced customer due diligence online

Uncompromising security for your PDF editing and eSignature needs

How to fill out enhanced customer due diligence

How to fill out enhanced customer due diligence

Who needs enhanced customer due diligence?

Enhanced customer due diligence form: A comprehensive guide

Understanding enhanced customer due diligence (ECDD)

Enhanced Customer Due Diligence (ECDD) is a rigorous process that businesses undertake to identify and assess the risks associated with their customers, particularly those considered high-risk. ECDD builds upon the standard due diligence practices to provide a more comprehensive understanding of the customer’s background, financial activities, and potential risks associated with their transactions. The importance of ECDD in risk management cannot be overstated; it acts as a safeguard against money laundering, fraud, and other illicit activities that can severely impact a business's reputation and finances.

Unlike standard due diligence, which may involve basic identification and screening, ECDD requires more in-depth scrutiny. This may include collecting additional documents, making further inquiries about the customer’s source of funds, and continuously monitoring transactions for red flags. As regulatory bodies impose stricter measures on businesses, understanding the nuances of ECDD becomes paramount for compliance and risk mitigation.

Why enhanced customer due diligence matters

The importance of ECDD in today's business environment extends beyond mere compliance; it protects against fraud and money laundering, enhancing overall corporate integrity. By conducting thorough due diligence, companies not only safeguard their operations but also build trust with stakeholders, including customers, regulators, and investors. Enhanced due diligence is particularly crucial in industries such as finance, real estate, and gaming, where the stakes are high and risks are exacerbated by complex regulatory environments.

Regulatory frameworks such as the Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations mandate businesses to adhere to stringent ECDD processes. Non-compliance can result in hefty penalties, legal repercussions, and severe reputational damage. Furthermore, the success of businesses is contingent on their ability to manage risks effectively, and ECDD plays a pivotal role in this risk assessment process.

Identifying high-risk customers

Identifying high-risk customers is a critical step in the ECDD process, as it allows businesses to focus their resources on monitoring customers who present the greatest risk. High-risk customers may include those located in politically exposed countries (PEP), individuals engaged in high-value transactions without clear financial justification, or those who frequently change their accounts and banking activities. Recognizing the characteristics of high-risk customers can help prevent exposure to fraudulent activity.

Geographic risk factors also play a significant role in identifying high-risk customers. Countries with a high prevalence of corruption or insufficient anti-money laundering controls should trigger enhanced scrutiny. Additionally, certain industry sectors, such as online gambling or cryptocurrencies, may be more susceptible to illicit activities, prompting businesses to examine customer behaviors more closely. Utilizing risk assessment tools like matrices and examination software can streamline this assessment.

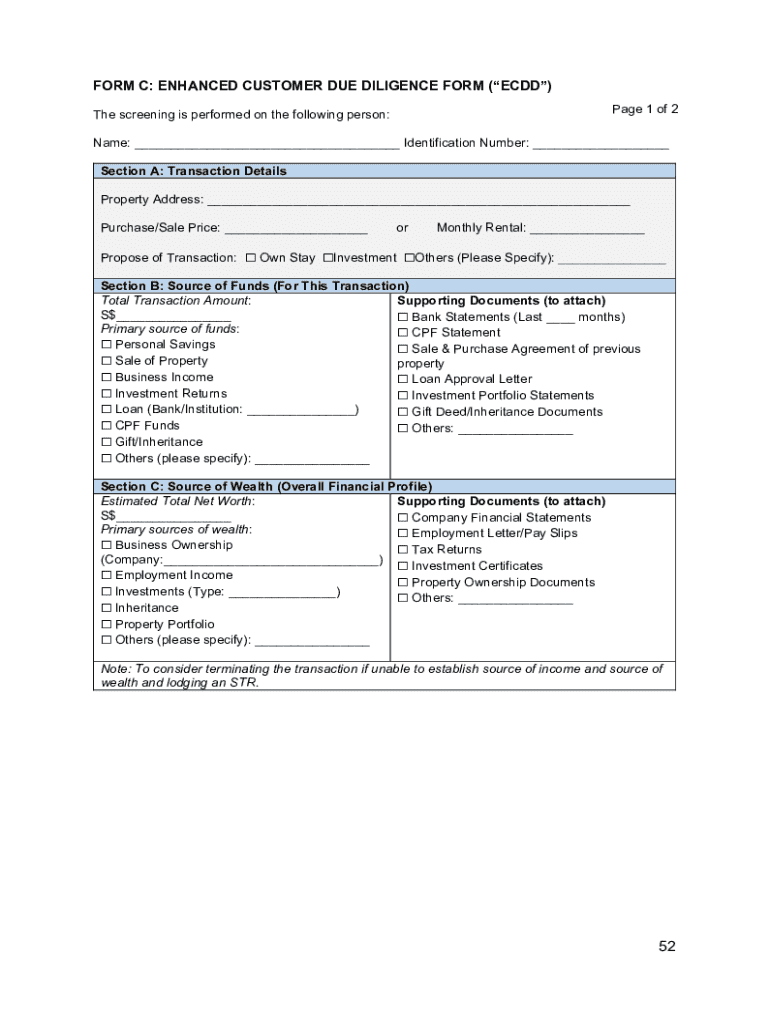

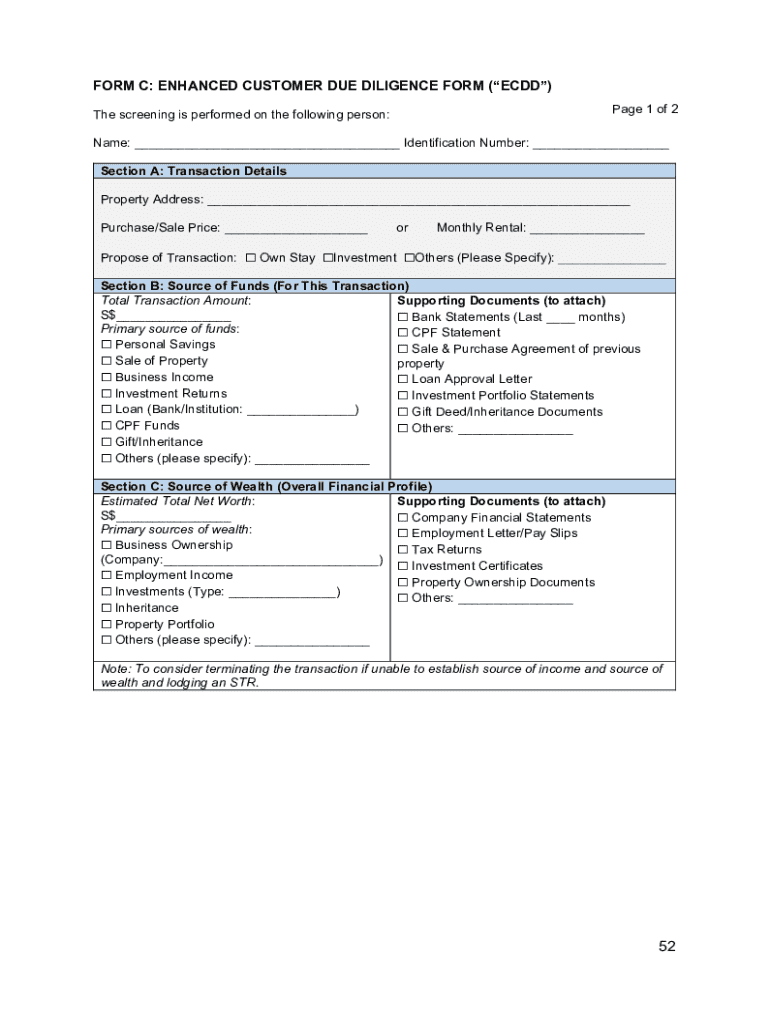

Steps to complete an enhanced customer due diligence form

Completing an enhanced customer due diligence form can be a meticulous task, but it is crucial for effective risk management. The process begins with the preparation phase, where businesses gather necessary documentation from the customer. This may include identification documents, financial statements, business records, and any additional information that could illuminate their financial behavior. Understanding industry-specific requirements that apply to your sector ensures that no essential detail is overlooked.

When filling out the enhanced customer due diligence form, take a systematic approach. Start with the customer's basic information and move on to specific sections like source of funds, transaction history, and key signatories for businesses. A well-structured approach can minimize errors and ensure a smooth review process. After completing the form, verification follows. This step requires corroborating the information provided with independent sources, such as government databases and financial histories.

Best practices for enhanced customer due diligence

Implementing best practices for ECDD is vital for maintaining an effective compliance framework. According to the Financial Action Task Force (FATF), organizations should ensure they have robust risk assessment processes in place, which include understanding customer behaviors and transaction patterns. Regularly revisiting the initial risk assessment during the customer lifecycle is also critical to address changing circumstances which could elevate risk. Businesses should adopt a proactive monitoring technique to consistently assess high-risk customers.

Furthermore, investing in staff training is essential. Training programs should educate employees about ECDD protocols, regulatory requirements, and tools to manage documentation and risks efficiently. Platforms like pdfFiller not only simplify the ECDD process but also provide seamless editing, signing, and collaboration features that can help staff manage documentation from anywhere.

Common scenarios requiring enhanced customer due diligence

Certain transaction types typically require enhanced customer due diligence due to their inherent risks. For instance, large cash transactions, international wire transfers, and dealings with customers from high-risk jurisdictions should all trigger ECDD processes. Customers engaged in industries with high levels of fraud, such as real estate or cryptocurrency trading, often warrant additional scrutiny, and these high-risk profiles necessitate a thorough understanding of both their business activities and financial flows.

Industry-specific cases can illustrate the necessity for ECDD. For example, financial institutions must closely monitor customer transactions to prevent money laundering, while real estate companies must vet buyers to avoid issues with financing and asset laundering. In international transactions, a deeper look into customer relationships and transaction origins is essential, as the risk landscape can dramatically shift depending on the country involved.

Global considerations in enhanced customer due diligence

Global considerations are paramount when establishing ECDD practices. Regions known for heightened ECDD requirements, such as the European Union and the United States, impose rigorous regulations on businesses operating within their jurisdictions. Companies must remain vigilant about the shifting landscape of international law regarding customer due diligence, adapting their processes to comply with local and international regulations.

Industries that operate internationally, particularly in banking and finance, face unique compliance challenges due to varying laws and practices across countries. As companies expand their global footprint, the ability to understand and navigate these differences becomes essential in implementing an effective ECDD strategy.

Tools and resources for effective ECDD management

Utilizing modern tools for enhanced customer due diligence management can greatly elevate the efficiency of compliance processes. Platforms like pdfFiller facilitate the creation, editing, and management of ECDD forms, allowing businesses to collaborate seamlessly on documents. The cloud-based nature of these tools ensures that stakeholders can access necessary information from anywhere, which is particularly beneficial in a remote working environment.

Integrating technology into ECDD practices can streamline document management, facilitate compliance checks, and enhance overall workflow. Automation tools can help reduce human error and improve the accuracy of customer information collected. Additionally, employing comprehensive software specifically designed for risk assessments can provide actionable insights and assist organizations in remaining compliant while efficiently managing high-risk customers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute enhanced customer due diligence online?

Can I create an electronic signature for the enhanced customer due diligence in Chrome?

How can I fill out enhanced customer due diligence on an iOS device?

What is enhanced customer due diligence?

Who is required to file enhanced customer due diligence?

How to fill out enhanced customer due diligence?

What is the purpose of enhanced customer due diligence?

What information must be reported on enhanced customer due diligence?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.