Get the free CO-OPERATIVE BANK LIMITED

Get, Create, Make and Sign co-operative bank limited

Editing co-operative bank limited online

Uncompromising security for your PDF editing and eSignature needs

How to fill out co-operative bank limited

How to fill out co-operative bank limited

Who needs co-operative bank limited?

Co-operative Bank Limited form: Your comprehensive guide to banking documents

Understanding co-operative bank limited forms

Co-operative banks serve unique functions within the financial system, blending community service with banking efficiency. They are owned and managed by their members, emphasizing mutual benefits. This distinct approach allows co-operative banks to cater to local interests, providing essential services tailored to their members' needs. As part of their operations, various forms are crucial in managing accounts, loans, and customer relations.

The importance of these forms cannot be overstated; they ensure proper documentation, streamline transactions, and enhance communication between the bank and its customers. Co-operative banks utilize a wide array of forms, each designed for specific functions within their banking operations, from account openings and loan applications to transactions and feedback submission.

Key co-operative bank limited forms

Navigating through different forms is essential for efficient interaction with your co-operative bank. Let's explore key forms, beginning with account opening forms.

Account opening forms

Opening a personal or joint account typically requires filling out an account opening form. For business accounts, specific documentation is essential to ensure compliance with banking regulations.

Loan application forms

Loans remain a staple service in co-operative banks, catering to personal and commercial financial needs. The loan application form is crucial for customers seeking funds for various purposes, from purchasing a vehicle to expanding a business.

When filling out the loan application form, providing thorough and clear information about your financial situation and any collateral is vital.

Transaction forms

Daily transactions also require various forms to ensure accuracy and security. Such forms include funds transfer forms, deposit and withdrawal forms, and requests for bank statements.

Feedback and complaint forms

Effective communication with your co-operative bank is essential to maintaining a healthy banking relationship. Feedback and complaint forms allow customers to express their opinions or concerns.

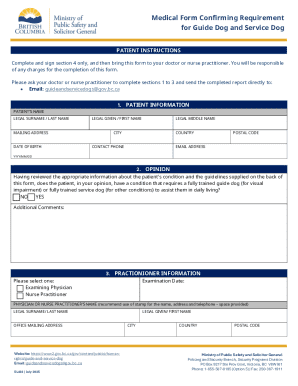

Step-by-step guide to filling out co-operative bank forms

Filling out co-operative bank limited forms can seem daunting, but preparation and understanding the requirements can make the process smoother.

Preparation stage

Start by gathering all necessary documents, which may include identification, proof of address, and any relevant financial documentation. Familiarize yourself with the form's requirements before you begin filling it out.

Filling the forms

As you complete each section of the form, ensure you provide complete and accurate information. Pay attention to detail, as incomplete forms can lead to delays. Common mistakes include incorrect account numbers or misspellings of names. Thus, review the information carefully.

Editing and revoking submission

After submission, it might be necessary to edit your form. You can use tools like pdfFiller, which allow you to edit PDF documents easily. If you need to revoke a submission, contacting customer service promptly ensures swift handling of your requests.

Electronic signature and submission process

In the digital age, eSigning forms is essential for efficiency and legality. As such, integrating eSigning with your co-operative bank limited forms can simplify transactions significantly.

Step-by-step guide to eSigning co-operative bank limited forms

To eSign your forms effectively:

This straightforward method not only saves time but also enhances security, ensuring your forms are processed quickly and efficiently.

Collaborating on forms with teams

When working on forms as a team, collaboration becomes key. pdfFiller allows for easy sharing and editing, ensuring that everyone involved can contribute effectively.

Best practices for effective collaboration

To promote efficiency in team settings, establish clear roles and responsibilities. Invite team members to review and provide feedback on forms, ensuring that all perspectives are considered.

Managing your forms effectively

A comprehensive approach to managing your co-operative bank limited forms encompasses accessibility and security.

Accessing and storing forms securely in PDF format

Using PDF format not only ensures compatibility across devices but also allows for secure storage. By utilizing cloud-based features, users have the freedom to access their forms anywhere, ensuring flexibility in managing banking transactions.

Version control: Keeping track of form updates

With regular updates to forms, maintaining version control becomes vital. By using platforms like pdfFiller, users can easily track changes, ensuring that they always refer to the latest document version.

Troubleshooting common issues with co-operative bank limited forms

Potential issues in filling out co-operative bank forms can occur, making it essential to be prepared.

In cases where quick resolutions are necessary, contacting customer service provides an opportunity for assistance specific to your banking needs.

Frequently asked questions (FAQs)

Understanding co-operative bank limited forms can often raise questions. Below are some common queries addressed.

These FAQs aim to alleviate some concerns and enhance your understanding of navigating through co-operative bank limited forms.

Related resources

To complement your understanding and management of co-operative bank limited forms, various resources are available online.

Overall, understanding the intricacies of co-operative bank limited forms positions you to approach banking interactions with confidence and clarity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my co-operative bank limited directly from Gmail?

Can I edit co-operative bank limited on an iOS device?

Can I edit co-operative bank limited on an Android device?

What is co-operative bank limited?

Who is required to file co-operative bank limited?

How to fill out co-operative bank limited?

What is the purpose of co-operative bank limited?

What information must be reported on co-operative bank limited?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.