Get the free M&S Everyday Savings Account Terms and Conditions

Get, Create, Make and Sign mamps everyday savings account

Editing mamps everyday savings account online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mamps everyday savings account

How to fill out mamps everyday savings account

Who needs mamps everyday savings account?

Navigating MAMP's Everyday Savings Account Form: A Comprehensive Guide

Understanding MAMP's Everyday Savings Account

An Everyday Savings Account from MAMP offers individuals an accessible way to save while benefiting from competitive interest rates. This account is specifically designed for everyday saving needs, allowing members to easily manage their finances without excessive fees that traditional savings accounts might impose.

One of the primary benefits of opening an Everyday Savings Account is the ability to earn interest on your deposits while maintaining liquidity. Unlike more specialized accounts, such as certificates of deposit (CDs), users can access their funds without penalty, providing peace of mind.

In comparison to other savings accounts, the Everyday Savings Account balances convenience and savings potential. High-yield savings accounts typically offer better rates, but may come with more restrictions, while regular savings accounts tend to have lower interest rates, thus offering less benefit for the saver.

Pre-requisites for filling out the Everyday Savings Account form

Before diving into the MAMP's Everyday Savings Account form, it's crucial to gather all required documents. To ensure a smooth process, you'll need certain personal and financial information at hand. First, personal details such as your name and contact information are essential.

You'll also need to provide identification documents, usually in the form of a driver's license or passport. Financial details like your Social Security Number (SSN) or tax identification number (TIN) are mandatory, along with relevant information regarding any current banking relationships.

Ensure you meet the eligibility criteria as well; typically, you need to be at least 18 years old and a resident of the location where MAMP operates. Some requirements may vary according to state regulations, so check accordingly.

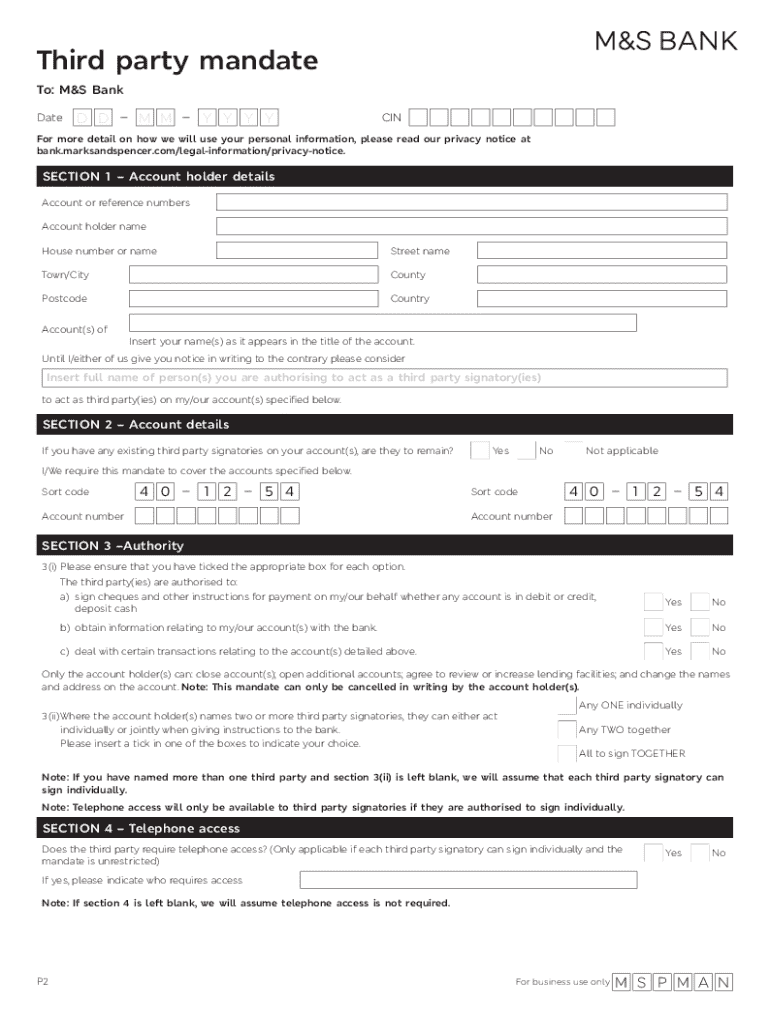

Step-by-step guide to filling out the MAMP's Everyday Savings Account form

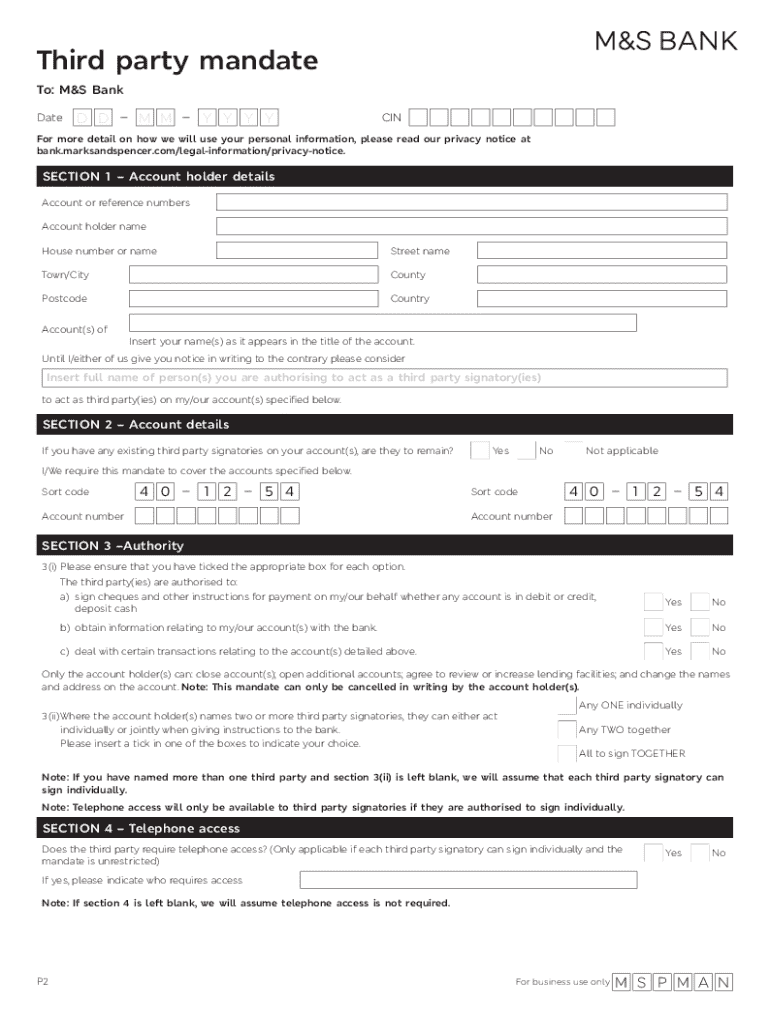

Filling out the MAMP's Everyday Savings Account form consists of several key steps. Start by accessing the form through MAMP's website or using platforms like pdfFiller, which allows for easy editing and signing of the document.

Begin with the personal information section, where you’ll enter your name, address, phone number, and email. Accuracy is crucial here to prevent any delays in your application. Use the auto-fill feature if available, but double-check the entries.

Next, complete the financial details section. This includes providing your SSN or TIN, as well as any information required about your existing bank accounts. Be cautious with this section to avoid common pitfalls like providing incorrect account numbers.

Editing and customizing your Everyday Savings Account form

Using pdfFiller not only allows you to fill out the MAMP's Everyday Savings Account form, but also lets you edit and customize it to suit your needs. The platform is user-friendly and provides a variety of tools for document management.

Once you have uploaded the form, you can easily edit text fields, add electronic signatures, or even annotate the document. This flexibility ensures that all necessary information is accurately reflected before submission.

Real-time collaboration is a beneficial feature of pdfFiller, especially for teams needing to fill out documents together. You can share your form with team members to review or assist in filling out specific sections.

Submission process for the MAMP Everyday Savings Account

After completing the form, you'll need to follow the correct submission process. MAMP provides multiple methods for you to submit your Everyday Savings Account application, which include both online and offline options.

Following your submission, you can expect a processing time that typically ranges from a few days to a week, depending on MAMP's workload. Check for a confirmation email detailing the status of your application.

If you need to check the status post-submission, MAMP generally provides a customer support line or an online tracking option to help you quickly ascertain the progress of your application.

Frequently asked questions (FAQs)

As you navigate through the MAMP's Everyday Savings Account form, it's common to have questions. One frequently asked question is what happens if you make a mistake on the form. Typically, you can correct it before submission, but once submitted, you may need to contact customer service for assistance.

Another common concern is the length of time it takes to open the account. Generally, the process is efficient, but it can vary based on workload and submission method. Lastly, it's essential to understand that editing the form after submission is often not permitted, unless specified by MAMP's policies.

Troubleshooting common issues

Some users might experience challenges while accessing or submitting the MAMP's Everyday Savings Account form. If you encounter difficulty accessing the form, ensure that you're using a compatible web browser or consider clearing your browser cache.

For electronic submissions, if issues arise during submission, try re-uploading the form or checking your internet connection. If these solutions do not work, MAMP's customer service team can provide assistance.

Additional considerations

Opening a savings account can have tax implications, especially if you earn interest on your deposits. Be sure to keep track of any interest accrued through your MAMP Everyday Savings Account, as you’ll need to report it when filing your taxes. For many, this interest is considered taxable income.

Additionally, managing your Everyday Savings Account effectively can position you for better financial health. Regularly assessing your balance and setting savings goals can help maximize the benefits of your account. Consider utilizing features such as automatic transfers to help you reach your savings milestones efficiently.

Why choose pdfFiller for your document needs?

Using pdfFiller for filling out the MAMP's Everyday Savings Account form streamlines the entire process. With an intuitive interface and cloud-based functionality, users can effortlessly manage their documents from anywhere.

Testimonials from satisfied users highlight pdfFiller's efficiency in handling forms and supporting collaborative efforts, making it an ideal solution for both individuals and teams looking for reliable document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the mamps everyday savings account electronically in Chrome?

Can I create an electronic signature for signing my mamps everyday savings account in Gmail?

How do I fill out the mamps everyday savings account form on my smartphone?

What is mamps everyday savings account?

Who is required to file mamps everyday savings account?

How to fill out mamps everyday savings account?

What is the purpose of mamps everyday savings account?

What information must be reported on mamps everyday savings account?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.