Get the free California Senate Bill 464 Sharpens State's Pay Reporting ...

Get, Create, Make and Sign california senate bill 464

Editing california senate bill 464 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california senate bill 464

How to fill out california senate bill 464

Who needs california senate bill 464?

Comprehensive Guide to California Senate Bill 464 Form

Understanding California Senate Bill 464

California Senate Bill 464 represents a significant legislative step aimed at refining pay transparency in the state. Passed as part of an ongoing effort to ensure equitable pay practices, this bill necessitates that employers disclose comprehensive pay data, thereby enhancing scrutiny on wage discrepancies across various demographic categories.

The primary objective of Senate Bill 464 is straightforward: to eliminate wage gaps and promote fair compensation practices throughout California. The bill targets not only employers but also aims to safeguard employees' rights by providing them with clearer insights into wage structures, ensuring informed discussions regarding remuneration.

The implications of SB 464 extend to all businesses, particularly those employing a substantial workforce. Employers must now adapt to increased reporting requirements, while employees stand to benefit from improved pay equity, which is a step forward in the broader movement for social and economic justice.

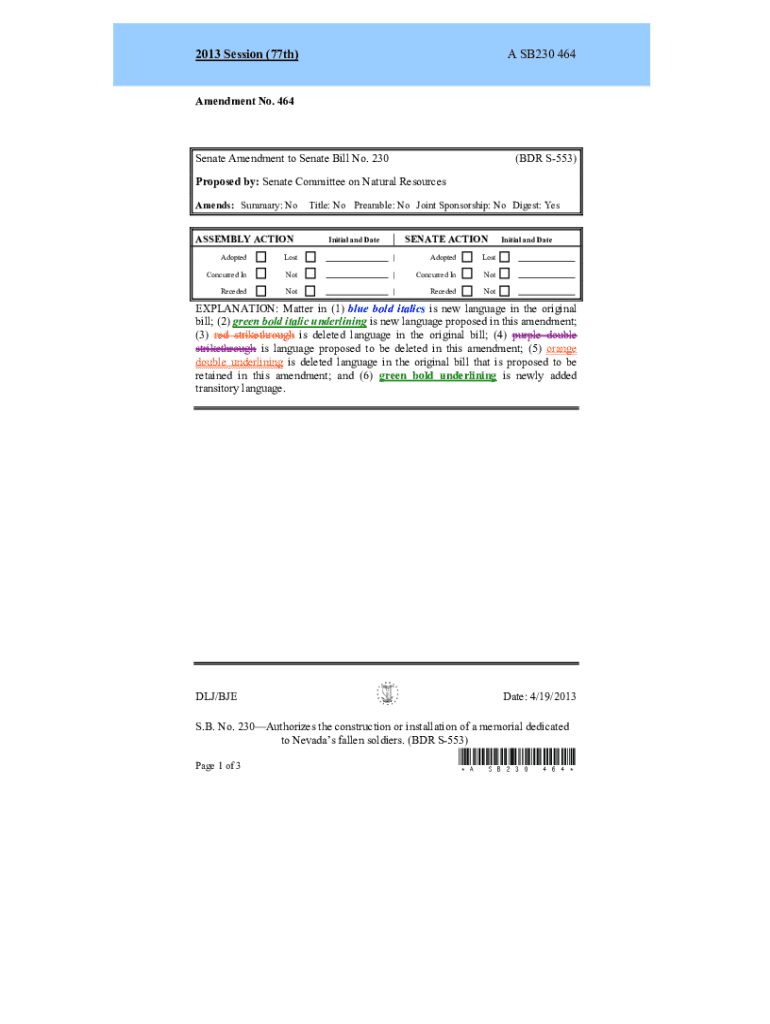

Key Changes Introduced by Senate Bill 464

Senate Bill 464 introduces significant modifications to the existing pay data reporting requirements initially established by previous labor legislation. One of the most notable changes involves the expansion of reportable categories, now requiring employers to categorize employees under specific 'standard occupational classifications.' This shift aims to enhance clarity and precision in reporting.

The implementation of Senate Bill 464 began in 2023, with critical deadlines established for employers to submit their first round of pay data reports. Employers must ensure compliance by adhering to the specified timelines to avoid penalties. For a comprehensive comparison, previous reporting requirements were less detailed, primarily focusing on overall compensation without a granular breakdown, which SB 464 corrects.

Who Needs to Comply with SB 464?

Compliance with Senate Bill 464 is mandatory for covered employers in California, specifically those with 100 or more employees. This includes public and private sector employers across various industry sectors. It's essential to understand that compliance also applies to labor contractors and those employing multiple job categories.

The bill affects employees who fall under specific job categories as outlined by the standard occupational classification. Employers must ensure they accurately report pay data to avoid backlash from regulatory bodies. Eligibility criteria for compliance typically hinge on workforce size and structure, making awareness critical for businesses of all types.

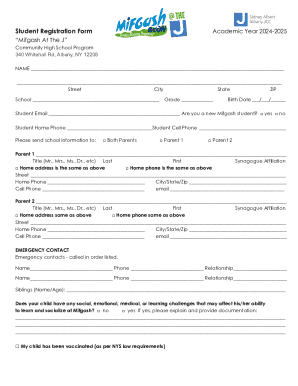

Step-by-step guide to completing the California Senate Bill 464 Form

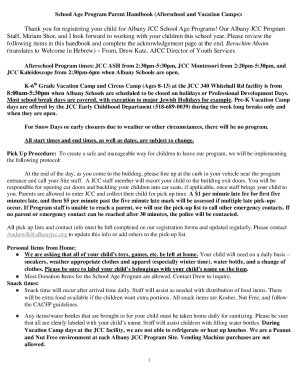

To facilitate a smooth completion of the California Senate Bill 464 Form, it is crucial to follow a structured approach. The process begins with accessing the form through platforms like pdfFiller, which provides an organized interface for document management.

Step 1: Preparing necessary information

Before filling out the form, prepare necessary data from employee records, including payroll data categorized by job title and demographic details. Employers should ensure data accuracy, focusing on a format that aligns with pay data reporting requirements.

Step 2: Filling out the form

Filling out the SB 464 form involves entering employee data into required fields, ensuring all information aligns accurately with the recorded data. Employers should pay particular attention to the categories assigned to employees to avoid penalties from misreporting.

Step 3: Reviewing and editing your submission

Once the form is filled, it is essential to review and edit the submission meticulously. Utilizing pdfFiller’s editing tools not only aids in error checking but ensures the validity of the document before submission.

Step 4: eSigning and submitting the form

Finally, the form needs to be electronically signed. pdfFiller simplifies this process by providing an easy-to-use e-signature feature. Submission can be done either through e-filing or via physical submission, depending on your organization's preference.

Leveraging pdfFiller for efficient document management

pdfFiller stands out as a robust platform that facilitates compliance with SB 464 through its comprehensive suite of features. Ease of use is paramount, allowing employers to navigate through the intricacies of the California Senate Bill 464 Form with efficiency and confidence.

The benefits of using a cloud-based platform, like pdfFiller, extend to enhanced collaboration and document tracking capabilities. Employers can streamline communication between teams, ensuring timely submissions and accurate reporting, which is critical for compliance.

Several businesses have successfully navigated the compliance landscape using pdfFiller, showcasing its effectiveness in maintaining accurate records and submitting timely reports. This not only fosters smooth internal processes but also supports compliance with state regulations.

Common challenges and solutions in SB 464 compliance

Navigating the intricacies of SB 464 compliance can present several challenges for employers. Common pitfalls include misunderstanding reporting requirements and failure to categorize employee data appropriately. These errors can lead to penalties, emphasizing the need for diligent preparation.

To overcome these challenges, employers can leverage resources available through pdfFiller for guidance on effective completion of the form. Engaging with support channels and referring to comprehensive FAQs further aids in clarifying aspects of the compliance process.

Future implications of Senate Bill 464 on employment practices

Enforcement of Senate Bill 464 is expected to impact workforce management practices significantly. As employers adapt to the new regulations, changes in hiring, promotions, and pay strategies will likely evolve to align with the increased focus on pay equity.

Beyond immediate compliance, employers now have ongoing responsibilities under SB 464 to ensure transparency and fairness in employment practices. The alignment of this legislation with broader trends in pay equity legislation indicates significant shifts in how businesses approach hiring and compensation.

Interactive tools and resources on pdfFiller

pdfFiller provides a suite of interactive tools designed to simplify the process of completing the California Senate Bill 464 Form. Users can access a library of templates and pre-filled forms, enhancing efficiency in document creation and submission.

Moreover, tutorial videos and guides offered by pdfFiller are invaluable resources for navigating the compliance landscape. Engaging with community insights and user experiences further enriches understanding, ensuring users feel supported and informed.

Keeping up with updates and amendments

Staying informed about legislative updates is crucial for compliance with California Senate Bill 464. Employers must actively track changes to ensure reporting practices remain aligned with evolving regulations.

Utilizing services like pdfFiller can provide notifications regarding updates in compliance requirements, allowing businesses to adapt their documents and processes proactively. This vigilance not only aids in immediate compliance but also fortifies organizations against future regulatory changes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit california senate bill 464 from Google Drive?

How do I make changes in california senate bill 464?

How do I complete california senate bill 464 on an Android device?

What is California Senate Bill 464?

Who is required to file California Senate Bill 464?

How to fill out California Senate Bill 464?

What is the purpose of California Senate Bill 464?

What information must be reported on California Senate Bill 464?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.