Get the free Certificate of Insurance for EHPI/GHI CBP: Base Plan

Get, Create, Make and Sign certificate of insurance for

How to edit certificate of insurance for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of insurance for

How to fill out certificate of insurance for

Who needs certificate of insurance for?

Certificate of Insurance for Form: A Comprehensive How-to Guide

Understanding the Certificate of Insurance (COI)

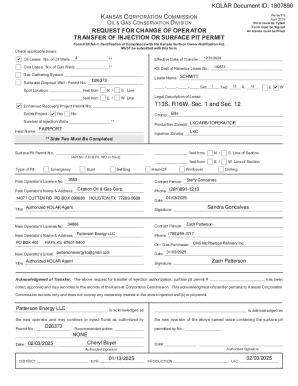

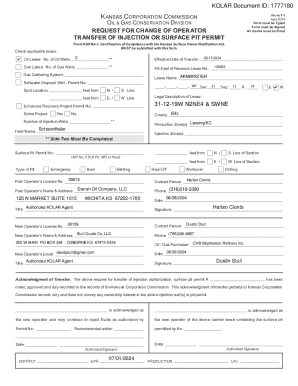

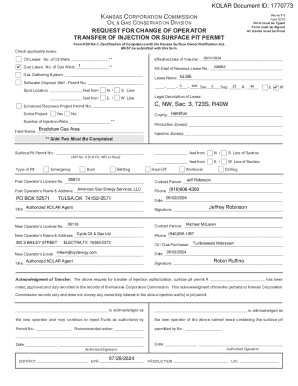

A Certificate of Insurance (COI) is a vital document used to verify that an individual or organization has the insurance coverage required for specific circumstances. This document provides proof of insurance policy details, making it a key element in various business transactions.

The role of a COI extends beyond mere verification; it further aids in risk management by assuring all parties involved that adequate insurance coverage is in place. Whether you're entering a client contract, leasing property, or collaborating with vendors, having a COI is crucial.

Common scenarios for needing a COI include subcontracting agreements, participation in events, or when dealing with landlords. Often, businesses require a COI to mitigate risk and protect against potential liabilities.

Types of certificate of insurance forms

Different situations necessitate specific types of COIs. Understanding these forms helps in addressing the unique requirements of each scenario.

Key components of a certificate of insurance

A well-crafted COI includes several key components that ensure clarity and comprehensiveness. Let’s break down these vital sections.

How to request a certificate of insurance for your needs

Requesting a COI doesn’t have to be complicated. By following a structured approach, you can ensure you receive the proper documentation for your needs.

How to fill out the certificate of insurance form

Filling out a COI form correctly is crucial to ensure compliance and coverage. Here’s a step-by-step guide to assist you.

Common mistakes when filling out a COI include leaving sections blank or inaccurately stating coverage amounts, both of which can lead to delays.

Editing and modifying your COI

Once you have your COI, there may be occasions where edits or modifications are necessary. pdfFiller's tools make this process seamless.

Signing and finalizing your certificate of insurance

Finalizing your COI includes obtaining the necessary signatures. pdfFiller's eSignature features facilitate this process.

Common issues related to certificates of insurance

Even with diligent efforts, issues can arise concerning COIs. Understanding these challenges can help mitigate their impact.

Best practices for managing your certificates of insurance

Managing your COIs is essential for compliance and organizational effectiveness. Establishing best practices can streamline this process.

Additional resources to enhance COI management

For those keen on maximizing their efficiency, leveraging additional resources can initiate better management of COIs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in certificate of insurance for without leaving Chrome?

Can I create an electronic signature for the certificate of insurance for in Chrome?

How do I complete certificate of insurance for on an iOS device?

What is certificate of insurance for?

Who is required to file certificate of insurance for?

How to fill out certificate of insurance for?

What is the purpose of certificate of insurance for?

What information must be reported on certificate of insurance for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.