Get the free Retirement Planning Made Easy: Strategies for Every Age

Get, Create, Make and Sign retirement planning made easy

How to edit retirement planning made easy online

Uncompromising security for your PDF editing and eSignature needs

How to fill out retirement planning made easy

How to fill out retirement planning made easy

Who needs retirement planning made easy?

Retirement Planning Made Easy Form - How-to Guide

Understanding retirement planning

Retirement planning is the process of determining how much money you will need to retire comfortably. It encompasses various factors such as lifestyle choices, expected expenses, and income sources after retirement. Without a solid retirement plan, you risk falling short of your financial goals, which could significantly affect your quality of life in your golden years. Key components of a successful retirement plan include understanding your current financial situation, defining your retirement goals, and choosing appropriate investment strategies to ensure that your money lasts throughout your life.

However, many individuals face common challenges in retirement planning. Some misconceptions include underestimating the amount needed for retirement or over-relying on Social Security benefits, which may not suffice. It is crucial to analyze your personal financial situation accurately and set realistic goals aligned with your desired lifestyle.

Overview of the retirement planning made easy form

The retirement planning made easy form serves as a comprehensive tool designed to streamline the retirement planning process. By ensuring that all necessary information is tracked and easily accessible, this form helps individuals and organizations effectively outline their retirement objectives. Whether you're an individual preparing for your personal retirement or part of a team facilitating retirement solutions for employees, this form can be an invaluable resource.

Step-by-step instructions for using the retirement planning form

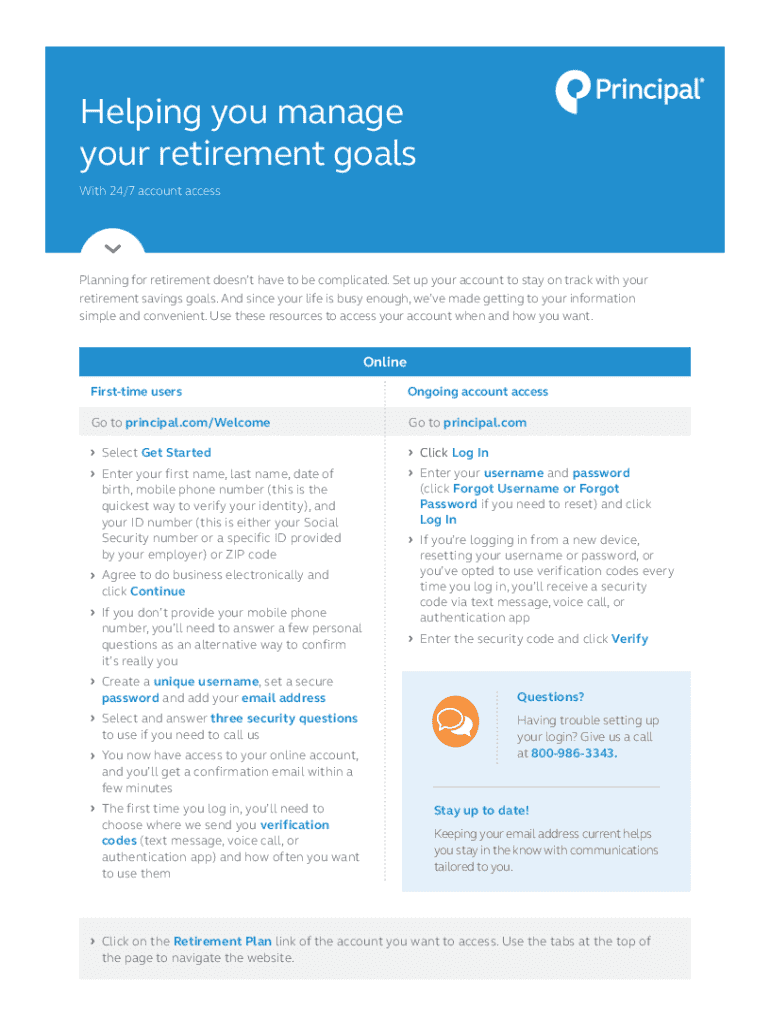

To utilize the retirement planning made easy form, start by accessing it on pdfFiller's website. You can find the form by navigating to the relevant section of pdfFiller, allowing you to download or edit it directly online. The layout of the form consists of multiple sections designed for specific inputs, ensuring you address all necessary components of your retirement plan.

Filling out the form involves several key sections, including:

Once you have filled in the necessary details, pdfFiller provides easy-to-use tools allowing for customized edits. You can add notes, alter sections for additional information, and adapt the form based on changing circumstances.

Collaborating on your retirement plan

Collaboration can enhance the effectiveness of your retirement planning. Once you’ve filled in the form, pdfFiller makes it simple to share your document with trusted financial advisors or family members. Sharing is as easy as clicking the share button on the platform, allowing others to provide their input, edit, or comment directly on the document.

After collecting feedback, take the time to analyze the suggestions made. This collaborative effort could reveal crucial insights that may lead to a more tailored and effective planning process. Addressing comments and refining your plan based on expert advice or familial input can significantly improve the overall quality of your retirement strategy.

eSigning the retirement planning form

Signing your retirement planning form is a critical step in formalizing your plan. An eSignature gives your document a sense of legitimacy, showcasing your commitment to the outlined strategies and agreements. It is vital to understand the legal implications of signing this document, which may include binding agreements with financial advisors or documentation required by employers.

To add your electronic signature through pdfFiller, follow these steps: First, navigate to the section of the form where signature is required. Click on 'eSign,' and you can then either draw your signature, choose from a stored signature, or upload an image. Once applied, ensure the signature aligns correctly, and finalize the document. This process streamlines your retirement planning document's legal integrity, helping to maintain a well-structured and recognized plan.

Managing and storing your retirement plan

An effective retirement plan is not static; it requires regular reviews and adjustments. To keep your retirement planning form updated, make it a habit to revisit your document annually or when significant life changes occur, such as a new job, marriage, or the birth of a child. Factors influencing your retirement goals, like fluctuating income or investments, should also prompt a review.

Utilizing pdfFiller’s cloud storage features enables easy access to your document from anywhere. By saving it in the cloud, you can retrieve and edit it on-the-go, helping you remain organized and prepared for discussions with advisors or family members regarding your plan. This cloud capability ensures that your retirement plan evolves along with your personal and financial circumstances.

Real-life examples of effective retirement planning

Understanding how others have successfully navigated retirement planning can offer invaluable insights. For instance, consider the story of a mid-career employee who utilized the retirement planning made easy form. By collaborating with their spouse on the form, they were able to identify gaps in their savings goals. With this clarity, they shifted their investment strategy, ultimately resulting in a successful retirement where they could travel and pursue hobbies.

Another story features a small business that provided the retirement planning form to its employees. By fostering an environment where individuals actively engaged in their financial futures, the company saw increased employee satisfaction and retention rates. This experience highlights the effectiveness of awareness and tailored strategies in attaining successful retirement outcomes.

Interactive tools and resources available on pdfFiller

pdfFiller not only offers the retirement planning made easy form but also a variety of additional resources and tools vital to enhancing your retirement planning process. These include templates for wills, healthcare directives, and other financial planning documents that can be customized to meet individual needs.

Moreover, pdfFiller provides access to financial calculators and estimators designed to assist users in making informed decisions about their retirement finances. Whether it’s estimating how much you need to save monthly or calculating potential returns on investments, these tools are invaluable for solidifying a comprehensive retirement plan.

Keeping updated: newsletters and alerts

Staying current with retirement planning is essential, given the changing laws and strategies affecting how individuals save for retirement. Subscribing to retirement planning updates through pdfFiller can provide ongoing insights into essential changes and best practices in the field.

To sign up for relevant newsletters, visit pdfFiller’s subscription page. Follow the straightforward instructions to choose topics of interest, ensuring you receive tailored updates that can significantly aid your retirement planning efforts. Regularly receiving information can foster a proactive approach to managing your future, helping you make timely adjustments based on the latest information.

Conclusion of the form utilization process

Successfully leveraging the retirement planning made easy form from pdfFiller necessitates an organized approach that integrates collaboration, legal validation, and ongoing management. By following the outlined steps, users can efficiently track their retirement strategies, ensuring they stay aligned with evolving personal financial situations.

From filling out the form to sharing it with advisors, signing it in a legally binding manner, and managing it in the cloud, each phase contributes to a comprehensive retirement planning experience. The insights gained from personal reflections and real-life examples further solidify how this form can lead to effective financial support for everyone aiming for a stable and satisfying retirement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit retirement planning made easy from Google Drive?

How can I get retirement planning made easy?

How do I edit retirement planning made easy online?

What is retirement planning made easy?

Who is required to file retirement planning made easy?

How to fill out retirement planning made easy?

What is the purpose of retirement planning made easy?

What information must be reported on retirement planning made easy?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.