Get the free CB/A: Notification form filed in connection with certain ...

Get, Create, Make and Sign cba notification form filed

How to edit cba notification form filed online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cba notification form filed

How to fill out cba notification form filed

Who needs cba notification form filed?

Comprehensive Guide to the CBA Notification Form Filed Form

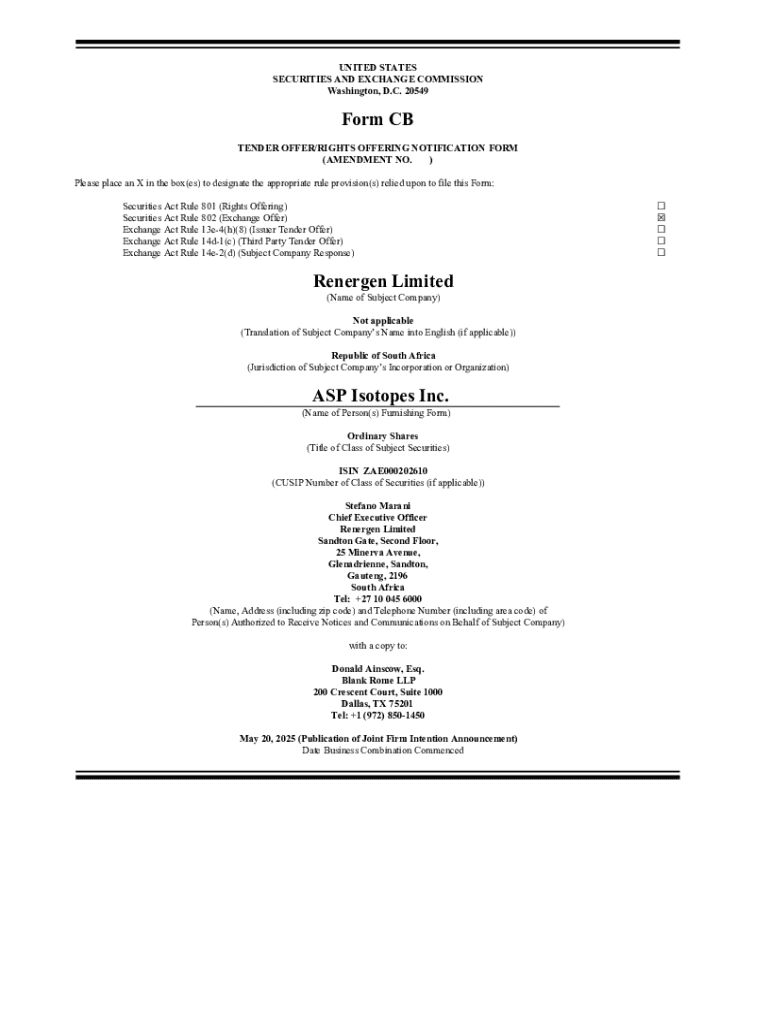

Understanding the CBA notification form

The CBA Notification Form, a crucial document in the realm of regulatory compliance, serves to notify relevant authorities about specific business activities that require oversight. Its primary purpose is to ensure that businesses operate within the legal framework established by regulatory bodies, thereby safeguarding both the business and the stakeholders involved.

Filling out the CBA notification form is significant for various reasons. Firstly, it aids in the internal governance of businesses, enabling organizations to demonstrate their commitment to compliance. Secondly, it serves as a crucial mechanism for regulators to monitor activities and ensure that companies adhere to existing regulations, helping maintain fair market practices.

Who needs to file the CBA notification form?

Certain entities, including corporations, partnerships, and sole proprietors, typically need to file the CBA notification form. The target audience primarily consists of businesses engaged in activities that fall under regulatory scrutiny, such as financial services, telecommunications, and healthcare.

Filing the form becomes necessary in various scenarios, including initiating new business practices, significant changes in operations, or when introducing new products or services that may affect the regulatory landscape. It is essential for businesses to remain proactive and file the form whenever their operations change.

Preparing to fill out the CBA notification form

Before embarking on filling the CBA notification form, it’s vital to gather all the requisite information and documentation. This includes corporate identification details, financial statements, business plans, and any other documentation that pertains to the specifics of your filing. Being organized is key to a smooth submission process.

While filing, it’s crucial to avoid common mistakes, such as providing inaccurate information or omitting required documents. Double-checking your entries and ensuring all necessary documents are included can prevent delays in processing and potential rejections.

Step-by-step guide to completing the CBA notification form

Accessing the form

The official CBA notification form can be accessed through the appropriate regulatory body's website. Typically, these forms are available in both PDF format for download and online submission formats, which provides ease of use for filers.

Completing the form fields

Each section of the CBA notification form requires specific information, including personal details, business information, and the nature of activities involved. It’s crucial to distinguish between mandatory fields, which must be filled out, and optional fields, which may provide additional context but are not required.

Reviewing your form

After completing the form, conduct a thorough review. Create a checklist to ensure that all fields are filled correctly and that all requisite documentation is attached. This final review is integral in avoiding compliance issues and streamlining the submission process.

Submitting the CBA notification form

Methods of submission

The CBA notification form can typically be submitted online through the relevant regulatory body’s website. Alternatively, physical submissions are accepted via mail or in-person at designated offices.

Confirmation of submission

Upon submission, it is essential to confirm that your form has been received, which may involve checking for an acknowledgment email or receipt from the authorities. Additionally, understanding the expected processing timelines can help manage expectations regarding any subsequent actions needed.

What happens after filing the CBA notification form

Processing timeline

Processing times for the CBA notification form can vary significantly based on several factors, including the complexity of the submission and the current workload of the regulatory body. Typically, businesses can expect a response within several weeks.

Next steps after submission

After the filing process, it is crucial to remain responsive to any requests for additional information from the authorities. Being prepared to provide further documents or clarifications helps maintain a favorable position with regulatory compliance.

Addressing concerns and issues

Common issues with CBA notification forms

Filers often face challenges such as incomplete information, lack of documentation, and misunderstandings regarding which activities necessitate filing. Awareness of these common pitfalls is key to ensuring a successful submission.

What to do if your form is rejected

In the unfortunate event that your CBA notification form is rejected, take immediate steps to identify and rectify the issues cited by the regulatory body. Gather necessary documentation to support your revised submission and consider consulting with a compliance expert to ensure all requirements are met.

Utilizing pdfFiller for the CBA notification form

Benefits of using pdfFiller for form management

pdfFiller offers a comprehensive suite of tools that streamline the process of filling out the CBA notification form. Features such as e-signatures and collaboration tools enhance workflow efficiencies, making document management easier and more efficient.

Step-by-step process for using pdfFiller

To begin using pdfFiller for your CBA notification form, first access the platform and locate the form template. The platform allows users to fill out the form directly within the web interface. Utilize advanced editing features to refine your entries, ensuring a thorough and compliant submission.

Conclusion and additional insights

FAQs about the CBA notification form

Frequently asked questions regarding the CBA notification form often include inquiries about filing deadlines, documentation requirements, and tips for successful compliance. Addressing these questions proactively can enhance the filing experience and minimize delays.

Staying updated on CBA regulations

To ensure continued compliance, it’s essential to stay informed about any changes in CBA regulations. Regularly review regulatory updates and consider engaging with professional communities or forums focused on compliance to share insights and best practices in navigating CBA requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the cba notification form filed in Gmail?

How do I edit cba notification form filed straight from my smartphone?

How do I complete cba notification form filed on an iOS device?

What is cba notification form filed?

Who is required to file cba notification form filed?

How to fill out cba notification form filed?

What is the purpose of cba notification form filed?

What information must be reported on cba notification form filed?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.