Get the free Non-Resident Application for Declaring a Home District for ...

Get, Create, Make and Sign non-resident application for declaring

Editing non-resident application for declaring online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-resident application for declaring

How to fill out non-resident application for declaring

Who needs non-resident application for declaring?

Non-resident application for declaring form: a comprehensive guide

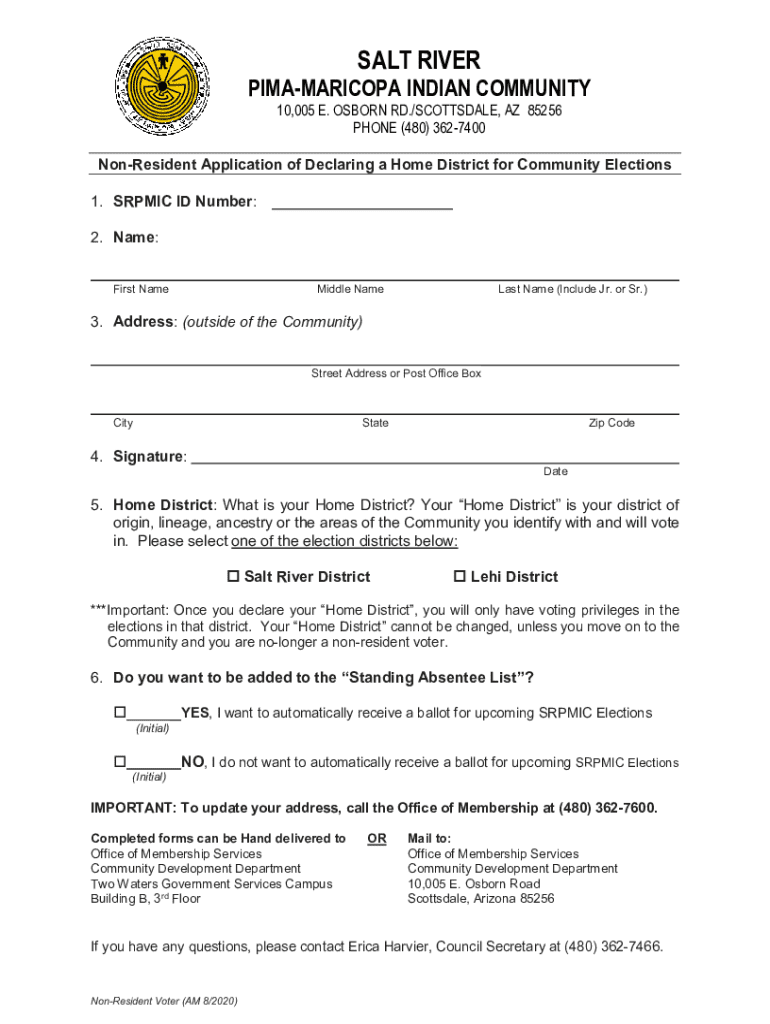

Understanding the non-resident application for declaring form

The non-resident application for declaring form serves as a crucial document for individuals and entities engaged in business or seeking tax compliance while residing outside their primary geographic tax jurisdiction. This form assists in reporting income and tax liabilities, enabling non-residents to fulfill their obligations without the complexities attached to resident filings.

Individuals and teams must recognize the importance of this form, as it not only dictates tax responsibilities but also optimizes any potential deductions and credits available for non-resident status. By correctly navigating the declaration process, taxpayers can avoid excessive taxation and enjoy the benefits of tax treaties in place between their country of residence and the income-earning jurisdiction.

Understanding the declaration process includes recognizing requisite timelines, completing the form accurately, and submitting it to the appropriate authorities. Grasping its nuances becomes essential for ensuring compliance and avoiding future tax complications.

Who needs to file the non-resident declaration?

Determining who should file the non-resident application for declaring form begins with understanding the criteria for declaring non-residency. Typically, a non-resident is someone who resides outside the jurisdiction where income is generated, working or making investments without establishing a fixed residence there. Numerous factors come into play including the duration of stay and the nature of income earned.

Common scenarios necessitating a declaration might include expatriates working temporarily in foreign countries, students studying abroad while earning income, or retirees living in one jurisdiction while receiving pensions sourced from another. Each case invokes different implications for tax obligations, as non-residents are often subject to withholding taxes on income generated within the jurisdiction.

It is important to recognize that residency status influences overall tax responsibilities significantly. Taxpayers declaring non-residency may access different deductions and credits than residents, so comprehensive awareness of tax laws governing both categories is imperative.

Preparing to fill out the non-resident declaration form

Before filling out the non-resident application for declaring form, gathering the necessary documentation and information is essential. Ensure you have valid identification, such as a passport, which attests to your non-resident status. Additionally, documentation verifying your income sources, whether through employment records or business earnings, is crucial.

Residency documentation may also be required to affirm where you reside during the tax period. Collecting this information can be daunting; thus, it is advisable to create a checklist segregating personal documents from financial records. Having organized data not only streamlines the completion of the form but also facilitates any follow-up inquiries from tax authorities.

Step-by-step instructions on completing the form

Completing the non-resident application for declaring form requires attention to detail. Start with Section 1, where you will input personal information such as your full name, current address, and identification details. This section ensures your identification matches the documentation you have gathered.

In Section 2, the income declaration is made. You’ll need to list various types of income such as wages, dividends, and interest. Each income type may require additional specifications, so being thorough is essential.

Tax treaties, if applicable, are addressed in Section 3. Here, you can explain any treaties between your country and the one where your income is originating. Documentation supporting claims under a tax treaty may be needed, so ensure you understand how these treaties influence your declaration.

Lastly, Section 4 requires additional information and signatures. Make it a point to ensure all signatories required for validating the form are present to avoid any delays.

Common pitfalls and how to avoid them

Many filers encounter pitfalls when completing the non-resident application for declaring form. One frequent mistake is the omission of necessary information — incomplete forms can lead to processing delays or rejections. Before submission, it is essential to double-check every section for accuracy.

Another common error is misunderstanding the requirements regarding income types. Clearly distinguishing between earned income and passive income can affect tax liability. If any required information is missing, a proactive approach with follow-up communication with tax authorities is advisable.

Submitting your non-resident declaration

With the form completed, knowing where and how to submit it is crucial to ensure compliance with tax requirements. Typically, the non-resident application for declaring form can be submitted to local tax offices or relevant online platforms depending on your specific jurisdiction. Being mindful of important deadlines is vital; some locations may have varying submission dates based on the taxpayer's fiscal year.

Once submitted, ensure you keep a copy for your records for future reference. After submission, it’s common to receive a confirmation of submission — whether that’s an acknowledgment receipt or an email confirmation. Keeping track of these confirmations can be beneficial in case any discrepancies arise.

Post-submission: what to expect

After you submit the non-resident application for declaring form, be prepared for a waiting period as tax authorities process your declaration. The timeline can vary based on the volume of submissions, but typically, you can expect correspondence within a few weeks. This may include requests for additional documentation or clarifications regarding the form you submitted.

In the event of such requests, respond promptly and provide any requested information. Additionally, if your declaration results in a refund or adjustment, knowing what timeline to expect will give you peace of mind during the waiting process.

Frequently asked questions (FAQs)

Non-residents often have inquiries that can clarify uncertainties surrounding the filing process. For instance, one common question is, 'What if I have multiple sources of income?' The form accommodates this by allowing extensive listings under income declaration sections, hence ensuring that all income streams are adequately captured.

Another frequent concern surrounds amendments — 'Can I amend my declaration after submission?' Typically, this is allowed, but understanding the local regulations is necessary. Lastly, non-residents often ponder how residency status affects their tax obligations, making careful consideration of applicable tax treaties vital.

Using pdfFiller for your non-resident declaration process

Navigating the non-resident application for declaring form can be made seamless with pdfFiller. This platform provides tools that allow users to edit, customize, and finalize their forms with ease. From filling out personal details to adjusting income figures, the user-friendly interface simplifies the entire declaration process.

eSigning your form through pdfFiller adds another layer of convenience. You can sign documents digitally, ensuring you maintain compliance without the hassle of physical paperwork. Furthermore, collaborating with team members or financial advisors is made simple, enabling all parties to contribute accurately towards the submission. Best of all, managing your non-resident declaration documents is accessible from anywhere, catering perfectly to your on-the-go lifestyle.

Language assistance and support options

Submitting the non-resident application for declaring form can pose challenges, particularly for non-English speakers. Resources are available to provide assistance in various languages, ensuring everyone can understand and navigate the complexities of the tax declaration process.

Consider reaching out to support services designed to clarify any doubts you may have during the process. Tax professionals or platforms such as pdfFiller can provide guidance, ensuring that all taxpayers are informed and empowered to complete their forms without difficulty. Encouragement to ask for help whenever needed is key to mitigating errors and ensuring accuracy in submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my non-resident application for declaring directly from Gmail?

How can I modify non-resident application for declaring without leaving Google Drive?

How can I fill out non-resident application for declaring on an iOS device?

What is non-resident application for declaring?

Who is required to file non-resident application for declaring?

How to fill out non-resident application for declaring?

What is the purpose of non-resident application for declaring?

What information must be reported on non-resident application for declaring?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.