Get the free affidavit of unchanged status - fill online, printable, fillable ...

Get, Create, Make and Sign affidavit of unchanged status

Editing affidavit of unchanged status online

Uncompromising security for your PDF editing and eSignature needs

How to fill out affidavit of unchanged status

How to fill out affidavit of unchanged status

Who needs affidavit of unchanged status?

Affidavit of Unchanged Status Form: A Comprehensive Guide

Understanding the affidavit of unchanged status

An affidavit of unchanged status is a sworn statement affirming that certain details—typically related to tax status—remain consistent and have not changed since a previous declaration. This form serves as a means of verification for entities that rely on the correct reporting of tax information.

Key elements included in the affidavit typically involve the individual's or business’s identification details, a clear declaration of unchanged status, and attestation through a signature. This affidavit is crucial in legal and tax contexts as it maintains the integrity of reported information and ensures compliance with regulatory frameworks.

Without this formal declaration, individuals or businesses may face challenges regarding tax complications or legal disputes, underscoring its importance in various scenarios.

Purpose and significance of the affidavit of unchanged status

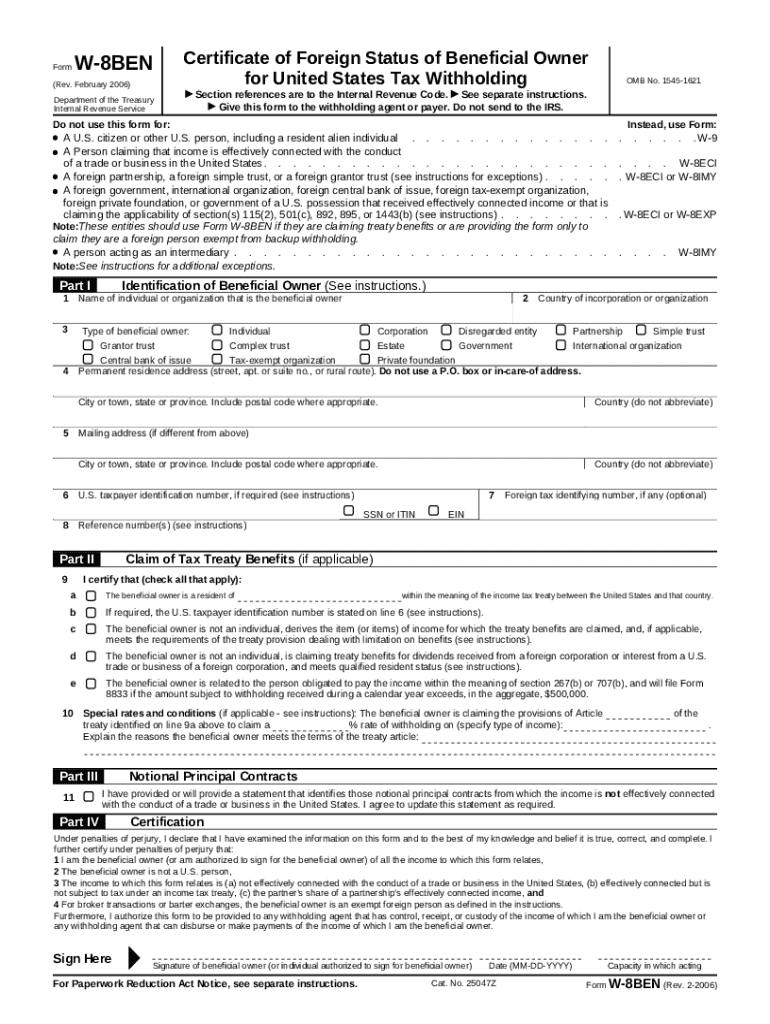

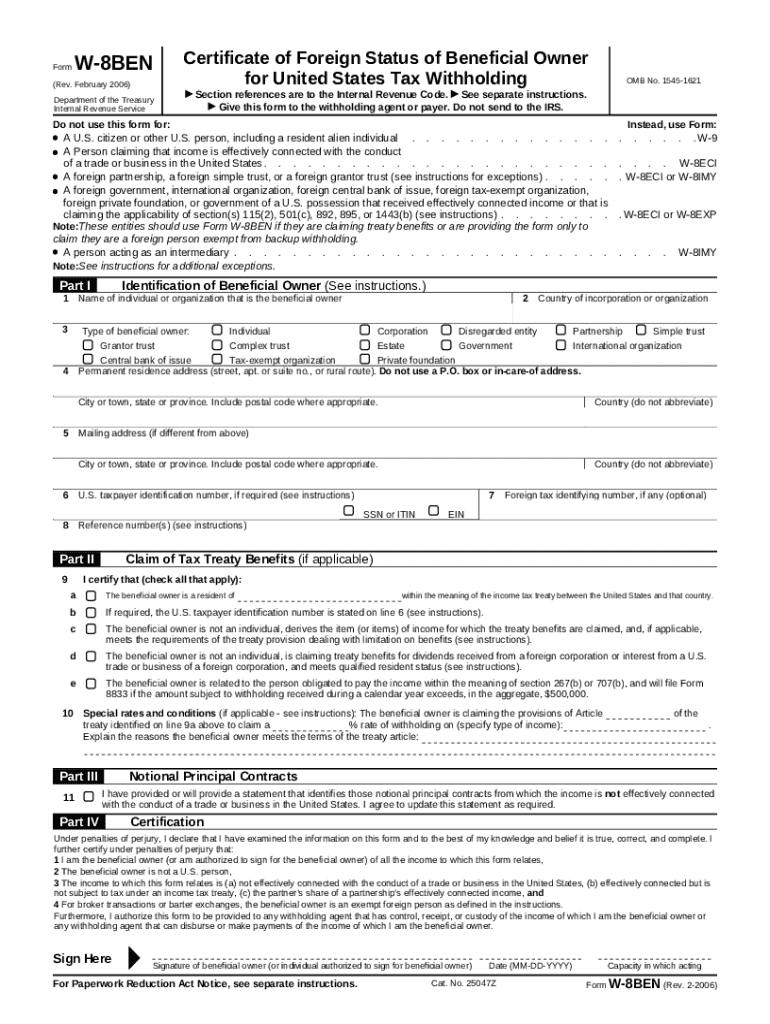

The affidavit of unchanged status is predominantly used for tax forms like W-8 and W-9, providing assurance to the IRS or other tax authorities that the information previously submitted continues to be accurate. This is particularly relevant for expatriates, freelancers, and businesses that interact with international entities.

By utilizing this affidavit, individuals protect both their personal and financial status from potential scrutiny or penalties resulting from incorrect tax filings. Common scenarios requiring an affidavit include changes in residency status, marital status, or other pertinent details that may affect one's tax obligations.

Legal framework surrounding the affidavit of unchanged status

The use of the affidavit of unchanged status is governed by specific laws and regulations that vary by jurisdiction. In the United States, these legal frameworks highlight the importance of accurate tax reporting and compliance with the Internal Revenue Service (IRS) regulations.

Failure to correctly complete or omit the affidavit can lead to significant legal implications, including fines, penalties, or further investigation by tax authorities. It’s essential for individuals and businesses to understand these legal obligations as they relate to their overall tax responsibilities.

Moreover, misleading information or lack of clarity in the affidavit can compound these legal troubles, making it imperative that the information provided aligns closely with one's tax obligations.

Components of the affidavit of unchanged status form

A typical affidavit of unchanged status form includes specific sections designed to capture essential information accurately. Key components often consist of personal details such as name, address, and tax identification number, which are necessary for tax identification.

Additionally, the affidavit includes a declaration of unchanged status that explicitly states the information that remains static. Lastly, signature requirements are mandatory to affirm the truthfulness of the declaration made, underscoring the legal weight of the document.

How to complete the affidavit of unchanged status form

Completing the affidavit of unchanged status form requires careful attention to detail to ensure that the information is both accurate and complete. Here’s a step-by-step guide to help you through the process.

Common mistakes to avoid include missing signatures, providing inaccurate details, and omitting the date from the document, as each of these issues can lead to complications with tax authorities.

Practical applications of the affidavit of unchanged status

The affidavit of unchanged status serves a wide range of practical applications, varying between individual and business contexts. For individuals, it may be primarily used for personal tax filings and assurances to banks or creditors regarding their tax status.

Conversely, businesses may utilize the affidavit for compliance in international transactions or to maintain accurate records for audits and corporate governance. The affidavit also plays a role in tax reporting, ensuring compliance with ever-evolving regulations.

Affidavit of unchanged status versus other affidavit types

When comparing the affidavit of unchanged status to other types of affidavits, such as those affirming identity or financial status, significant differences emerge in terms of purpose and usage context.

For example, an affidavit of identity is generally used to confirm an individual’s identity for legal or official purposes, whereas an affidavit of unchanged status pertains specifically to tax-related declarations. Each type is important within its own context, affecting how they are applied and interpreted legally.

Frequently asked questions about the affidavit of unchanged status

Individuals often have queries regarding the affidavit of unchanged status. For instance, what happens if one's status changes after submission? Generally, it is crucial to notify the appropriate authorities immediately to rectify the information.

Another critical aspect is how often the affidavit needs to be submitted to the IRS. This typically depends on the frequency of your transactions and any substantial changes in status. It's also important to stay updated on specific deadlines for submission in relation to tax forms to avoid any penalties.

Leveraging pdfFiller for your affidavit needs

pdfFiller offers an innovative cloud-based document management solution that streamlines the process of creating, editing, and managing your affidavit of unchanged status. By utilizing pdfFiller, users can access a wide range of features that simplify the affidavit process.

Some of the standout features include easy editing and filling out of forms, eSigning capabilities for secure and swift signatures, and collaboration tools that support teamwork for businesses navigating this documentation process.

To access templates specifically for the affidavit of unchanged status, simply visit pdfFiller’s platform, where you can find customizable options that meet your needs, making it easy to stay compliant and organized.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get affidavit of unchanged status?

How do I make changes in affidavit of unchanged status?

How do I edit affidavit of unchanged status on an Android device?

What is affidavit of unchanged status?

Who is required to file affidavit of unchanged status?

How to fill out affidavit of unchanged status?

What is the purpose of affidavit of unchanged status?

What information must be reported on affidavit of unchanged status?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.