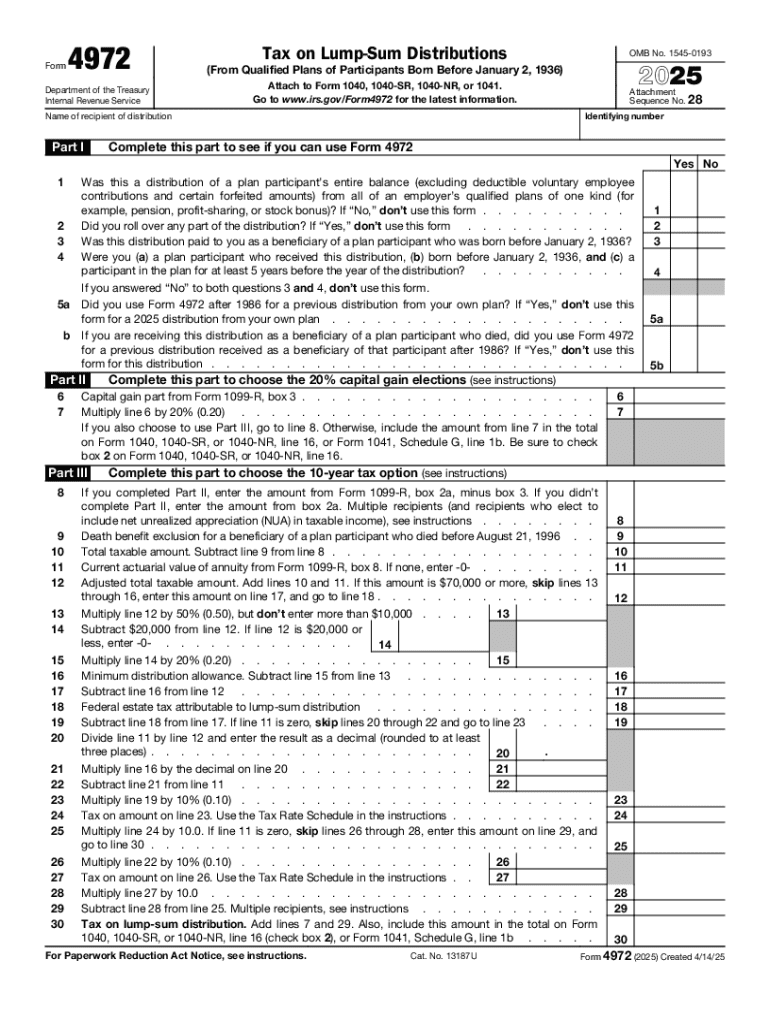

IRS 4972 2025-2026 free printable template

Instructions and Help about IRS 4972

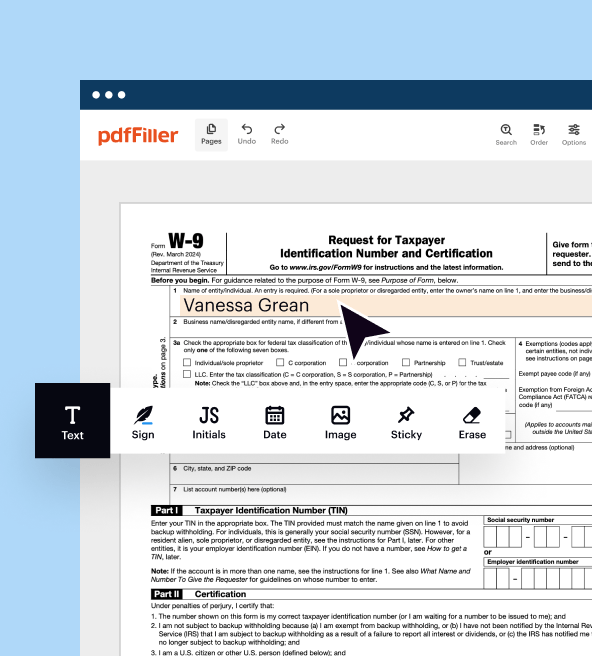

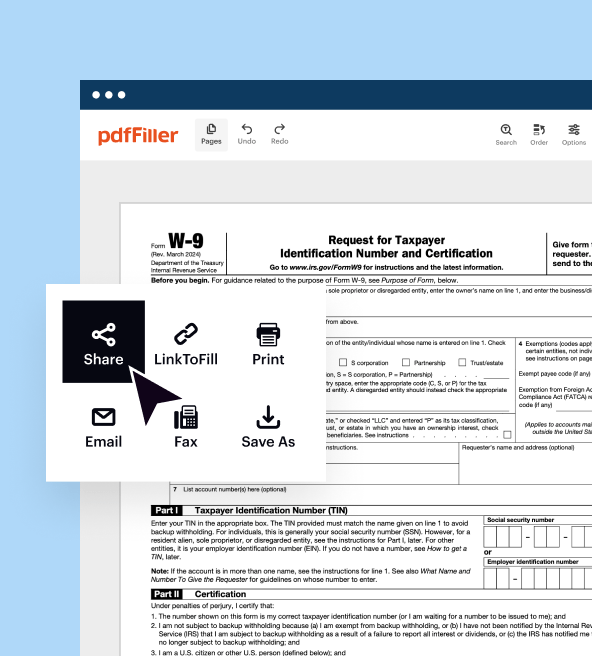

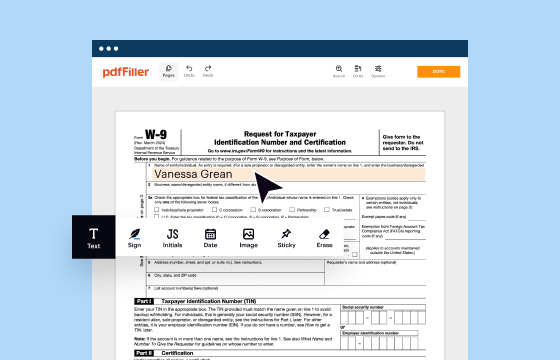

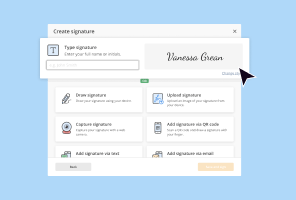

How to edit IRS 4972

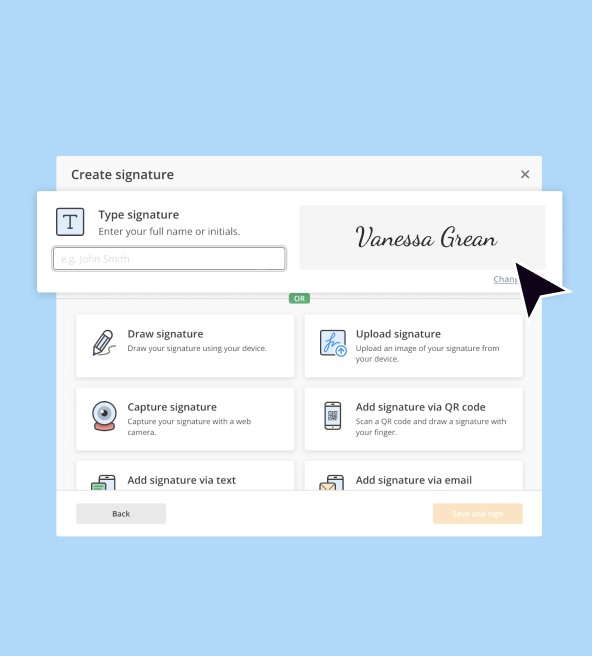

How to fill out IRS 4972

Latest updates to IRS 4972

All You Need to Know About IRS 4972

What is IRS 4972?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

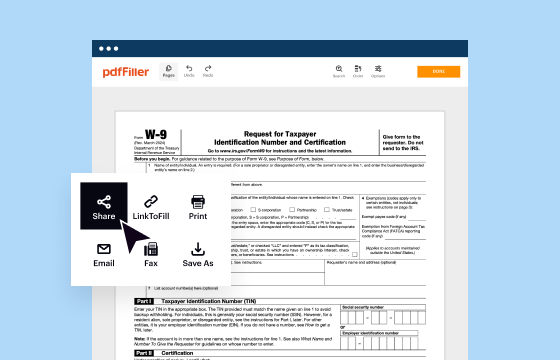

Where do I send the form?

FAQ about IRS 4972

How can I correct an error on my IRS 4972 after submission?

If you need to correct an error on your IRS 4972, you can file an amended return. This typically involves completing a new IRS 4972 form, indicating that it's a correction, and providing accurate information. Ensure you keep a copy of both the original and amended forms for your records.

What should I do if my IRS 4972 submission is rejected?

If your IRS 4972 e-filed submission gets rejected, you will receive an error code explaining the reason. Review the error message carefully to understand the issue, correct the necessary details, and resubmit the form as soon as possible to avoid delays in processing.

What privacy measures are in place for filing IRS 4972?

When filing the IRS 4972, it’s crucial to ensure that your personal information is secure. Use trusted software when e-filing, and enable e-signatures if they are accepted for your submission. Maintain confidentiality and safeguard documents to prevent unauthorized access.

Are there specific considerations for nonresidents filing IRS 4972?

Nonresidents filing IRS 4972 must be aware of different filing rules that apply to them. This can include specific tax treaties and documentation requirements that may not affect residents. It's essential to consult with a tax professional familiar with international tax laws.

See what our users say