Get the free Nonresidential Assessment Appeal Form

Get, Create, Make and Sign nonresidential assessment appeal form

How to edit nonresidential assessment appeal form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nonresidential assessment appeal form

How to fill out nonresidential assessment appeal form

Who needs nonresidential assessment appeal form?

Navigating the Nonresidential Assessment Appeal Form: A Comprehensive How-to Guide

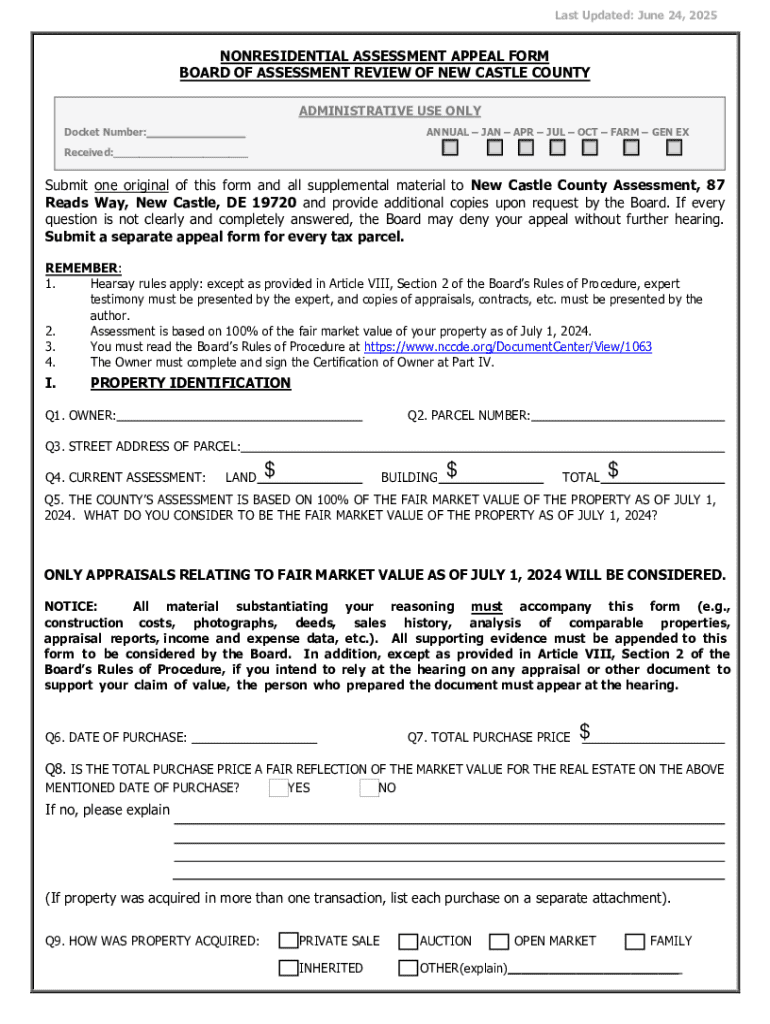

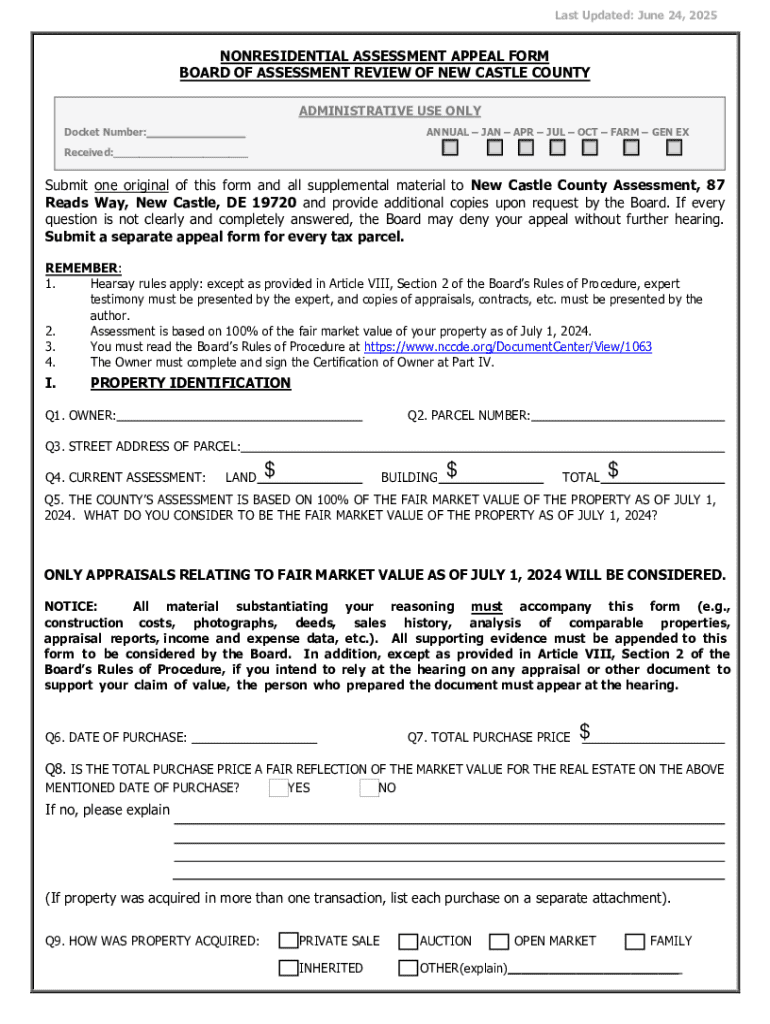

Understanding nonresidential assessment appeal forms

A nonresidential assessment appeal form is an essential document designed for property owners to contest their nonresidential property tax assessments. The appeal form serves a critical function in enabling property owners to ensure that assessments accurately reflect the value of their properties. Typically, these assessments, carried out by local tax authorities, can sometimes lead to inflated valuations that result in excessive property taxes. By utilizing the nonresidential assessment appeal form, property owners can proactively manage their tax obligations.

Understanding the importance of this form is crucial, as it can help prevent financial strain from over-assessed properties. Misvaluations can have significant impacts on a business’s bottom line, making the appeal process not just relevant but vital. The ability to file an appeal ensures that nonresidential property owners can contest questionable valuations and seek a fairer assessment.

Who can file an appeal?

Eligibility to file a nonresidential assessment appeal typically includes property owners, renters with long-term leases, or representatives acting on behalf of the property owner. Generally, all nonresidential properties, such as office buildings, retail spaces, warehouses, and industrial properties are included in this category, giving various stakeholders the opportunity to seek adjustments to their property assessments.

It's essential for potential filers to review their local jurisdiction's specific criteria. Many locations require the individual filing the appeal to hold direct interest in the property or establish a valid relationship with the property owner.

Gathering required information

Before filling out the nonresidential assessment appeal form, gathering the necessary documentation is vital. Key documents often include the property assessment notice, which details the current value assigned to the property, along with previous tax returns that can demonstrate historical tax values. Other essential items may include photographs of the property, a detailed description of its current state, and any renovation records that may impact its value.

Additionally, researching comparable properties is a critical step in strengthening your appeal. Comparable properties, or 'comps,' are similar properties in the same vicinity that have recently sold or been assessed, providing a benchmark for evaluation. Understanding market trends and pricing for these comparables can leverage your appeal significantly.

Step-by-step instructions for filling out the form

When you're ready to fill out your nonresidential assessment appeal form, start by accessing the necessary form through the pdfFiller platform. This user-friendly interface simplifies the document completion process, offering easy navigation to locate the nonresidential assessment appeal form.

Filling out the form involves a methodical approach. Each section requests specific information, including your property details, the assessed valuation, and the grounds for your appeal. It’s crucial to provide thorough explanations and cite any evidence you may have, particularly from your research on comparable properties. Common mistakes to avoid include leaving sections blank, providing incomplete information, or failing to attach supporting documents. Best practices emphasize the importance of clarity and precision, ensuring that each piece of information accurately reflects your case.

Editing and customizing your appeal document

Using pdfFiller for editing your nonresidential assessment appeal form is straightforward and efficient. The platform offers various features, including the ability to annotate, highlight, and add comments, which are particularly useful for collaboration. Detecting areas needing modification and applying changes in real-time not only streamlines the process but also ensures accuracy.

When collaborating with team members or advisors, pdfFiller makes it easy to share documents. By using the sharing options, you can invite others to review or edit the document. Additionally, tracking changes made by collaborators allows for a thorough review process, ensuring that all contributions are accounted for and documented correctly.

Submitting the appeal

After completing your nonresidential assessment appeal form, understanding submission deadlines is critical. Each jurisdiction has specific time frames within which appeals must be submitted following the assessment notice. Failing to adhere to these deadlines can result in the forfeiture of the appeal opportunity.

Choose your preferred method of submission, whether online through the local taxing authority’s website or by mailing a physical copy of your appeal. Be proactive and confirm the receipt of your appeal to ensure it's been processed. Using tracking numbers for mailed appeals can provide additional peace of mind by confirming that your documentation has reached the appropriate office.

After submission: what to expect

Once your nonresidential assessment appeal form is submitted, it's essential to understand the review process. Generally, the reviewing authority will evaluate your appeal based on the merits of the information you provided. The review process can take several weeks or longer, depending on the volume of appeals received and the complexity of each case.

There are potential outcomes following the review. If your appeal is accepted, you may receive a revised assessment that lowers your property tax liability. Conversely, if rejected, you should familiarize yourself with your next steps, which may involve further appeal processes or negotiations. Understanding these outcomes can help mitigate anxiety and prepare for future actions.

Interactive tools and support resources

Utilizing interactive tools available through pdfFiller can significantly ease the appeal process. The platform offers templates, customization options, and pristine document management features. By accessing these tools, users can efficiently manage documentation related to their appeal and ensure that all information is organized and accessible.

If challenges arise during the appeal process, pdfFiller provides ample customer support options. Users can reach out for assistance or explore a dedicated help center for troubleshooting tips and frequently asked questions (FAQs) related to the nonresidential assessment appeal process, ensuring that assistance is readily available when needed.

Related forms and documents

In addition to the nonresidential assessment appeal form, there are several related forms and documents that may be useful throughout the appeal process. These documents encompass various assessments and appeals applicable to different property types, which broadens the options available to property owners seeking to contest valuations.

Access to contextual documents can provide significant context during your appeal. Examples of these are your local tax authority's guidelines for assessments, official newsletters, and records pertaining to property tax legislation that may impact the appeal process. Familiarizing yourself with these resources can bolster your case and enhance understanding.

Document center

pdfFiller offers robust document management capabilities, allowing users to organize all essential documents efficiently. By leveraging these features, users can keep track of their appeal documentation, making it easy to find important files when needed. Utilizing cloud storage ensures that your documents are accessible anytime, anywhere.

Effective document retention practices are also important. Adhering to best practices such as naming conventions for files, organizing documents into clearly labeled folders, and using metadata can greatly enhance file retrieval and ensure that critical information is not lost.

Search for your file name

pdfFiller's interface incorporates an efficient search feature that enables users to locate existing appeals or related documents swiftly. Navigating the platform to find your files can save time, particularly when multiples documents are at play during the appeal process. Familiarizing yourself with this feature allows for easier access to past documents or any supporting materials you may have.

Implementing organizational strategies, such as maintaining a consistent naming convention for your files and structuring folders logically, enhances file accessibility. These efforts not only help in quickly retrieving documents but also in efficiently managing numerous pieces associated with your appeal.

Connecting with advisory services

In some cases, navigating the complexities of the appeal process may warrant seeking professional help. If you encounter difficulties or if the stakes of your appeal are particularly high, consulting with a tax advisor or an attorney experienced in property tax issues could be a prudent choice.

Knowing when to seek assistance is vital; situations involving complex valuations or significant sums may require expert intervention. Numerous resources exist for individuals seeking qualified advisors, ranging from local attorney directories to professional organizations specializing in tax law. Connecting with these professionals can provide essential insights and guidance tailored to your specific needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my nonresidential assessment appeal form directly from Gmail?

How can I send nonresidential assessment appeal form for eSignature?

How can I edit nonresidential assessment appeal form on a smartphone?

What is nonresidential assessment appeal form?

Who is required to file nonresidential assessment appeal form?

How to fill out nonresidential assessment appeal form?

What is the purpose of nonresidential assessment appeal form?

What information must be reported on nonresidential assessment appeal form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.