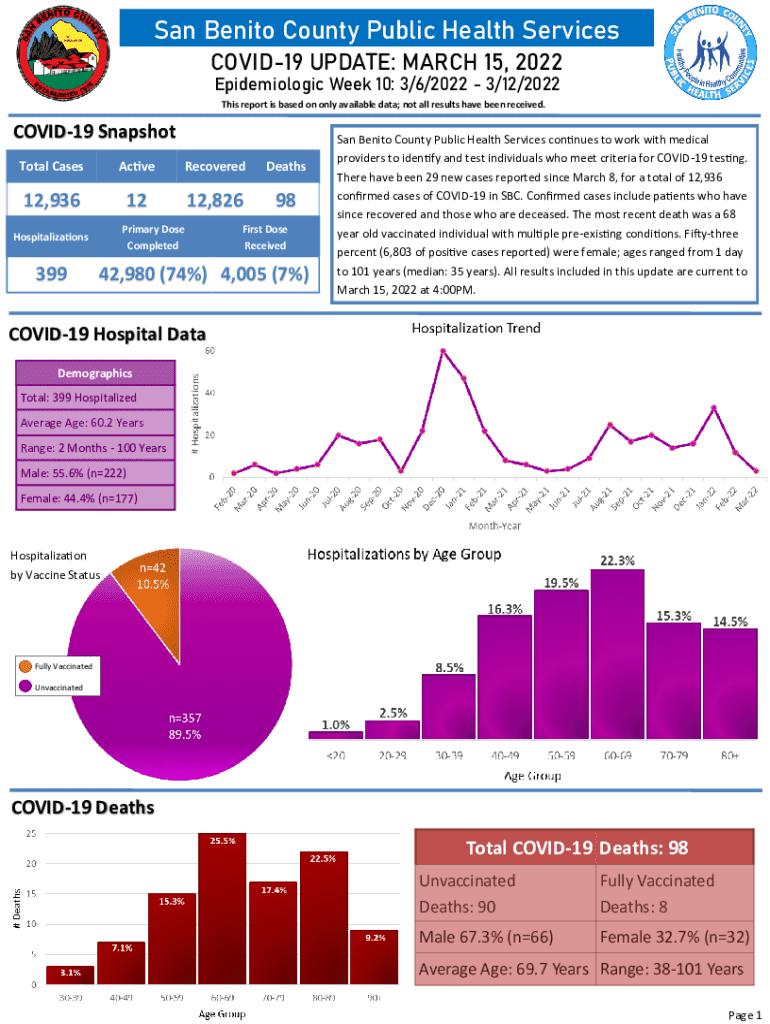

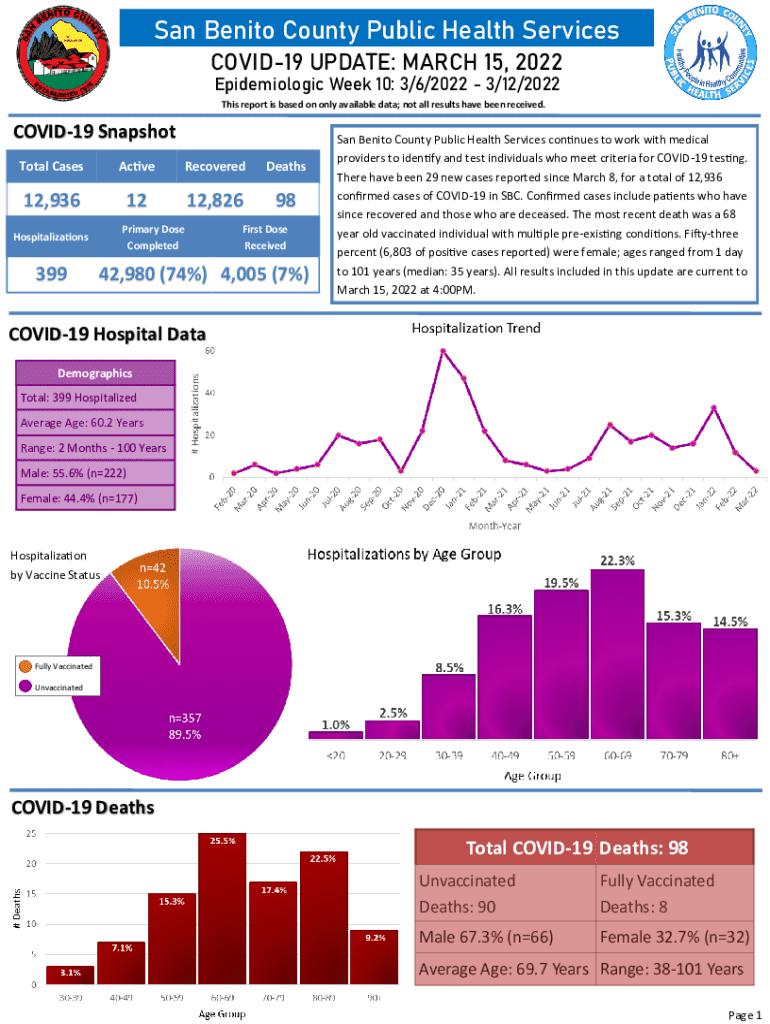

Get the free There have been 29 new cases reported since March 8, for a total of 12,936

Get, Create, Make and Sign formre have been 29

Editing formre have been 29 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out formre have been 29

How to fill out formre have been 29

Who needs formre have been 29?

Formre have been 29 form: A Comprehensive Guide

29.000 Overview of Formre and Its Applications

Form 29, commonly recognized within various industries, serves as a key document relevant to contract management and compliance. It outlines essential details about contractual engagements, reimbursement methods for contractors, and various stipulations that govern contractor relationships. Understanding the dynamics of Form 29 is imperative for both individuals and teams involved in managing contracts, particularly government contracts and construction projects, where precise documentation is pivotal.

Knowledge of Form 29 ensures that contractors adhere to pertinent taxation laws and other regulations, avoiding potential pitfalls. Its significance stretches across many sectors, making it a fundamental tool in contract negotiations, execution, and follow-ups. By familiarizing oneself with this form, stakeholders can effectively navigate the complexities of contract management and enhance their project delivery outcomes.

29.001 Key features of Form 29

Form 29 is structured to address several critical elements required in contract execution. The main sections include contractor identification, contract details, reimbursement claims, and any clauses relevant to the agreement. Key fields that need to be filled out include: contractor name, project description, payment terms, and applicable taxes.

Every section of Form 29 plays a vital role in ensuring compliance and transparency in transactions. Correctly completing these fields can help to avert misunderstandings and facilitate smoother payment processes between contractors and governmental agencies.

29.002 Understanding the legal framework

Form 29 is governed by federal requirements that guide the processes surrounding contract management and reimbursement. At the federal level, regulations dictate the mandatory fields and the order in which information must be presented. Adhering to these norms is crucial for maintaining compliance and ensuring successful contract execution.

State-specific regulations can often introduce variances that necessitate additional considerations. For instance, certain states may have their own clauses regarding contractor payments or excise taxes that must be integrated into the Form 29. Therefore, it is important for users to be aware of local laws affecting contractual agreements, as they can directly influence the content and presentation of Form 29.

Subpart 29.1 - Detailed instructions for completing Form 29

To effectively complete Form 29, a section-by-section breakdown is essential. Start with the contractor identification section, ensuring that the information matches official records to prevent processing delays.

Next, move on to the contract details. Clearly outline the scope, deadlines, and specific payment clauses. This part can significantly impact the contractor's compensation and relationship with contracting officers.

Common pitfalls include miscalculating taxes or misunderstanding reimbursement clauses. Always double-check calculations and read the legal language carefully to avoid confusion.

Subpart 29.2 - Tools for editing and signing Form 29

Utilizing pdfFiller simplifies the editing process for Form 29. First, upload your document into the platform. Once uploaded, you can make necessary edits including text adjustments, adding images, and incorporating signatures.

For eSigning, pdfFiller offers seamless integration which enhances the workflow. Users can invite other parties to sign the document electronically, ensuring legal compliance without the need for physical signatures, which is especially valuable in today's remote working environment.

Subpart 29.3 - Collaborative features for teams

pdfFiller's collaborative features allow teams to share Form 29 for group input efficiently. With real-time editing and commenting abilities, team members can provide feedback directly within the document, making it easier to manage revisions.

To ensure effective collaboration, establish best practices such as setting deadlines for feedback and designating a primary editor. This structure minimizes confusion and enhances communication, leading to more refined and accurate Form 29 submissions.

Subpart 29.4 - Managing your Form 29 document

Managing Form 29 documents involves effective storage and security measures. pdfFiller's cloud storage options ensure that documents are accessible from anywhere, making it convenient for contractors to retrieve and update their files as needed.

Moreover, security is paramount when dealing with sensitive information. Utilizing password protections and encryption features available in pdfFiller can safeguard your Form 29 and its contents from unauthorized access, preserving the integrity of the document.

29.003 Troubleshooting common issues

Common issues associated with Form 29 can range from formatting errors to misinterpretation of tax matters. One of the prevalent errors includes incomplete contractor information, which can lead to delays in approval and payment.

For resolution, ensure that all fields are filled accurately and verify the calculations for reimbursement claims. In cases of persistent issues, consider consulting with legal counsel specializing in contract law to clarify any misunderstandings or ambiguities in the form.

29.004 Frequently asked questions about Form 29

A common inquiry regarding Form 29 pertains to its general purpose. Users often seek clarity on whether compliance with this form is mandatory. The objective of Form 29 is indeed to ensure compliance with federal and state regulations, particularly concerning contractor payments.

Another frequent question revolves around the potential for revisions after submission. While amendments can be made, specific guidelines must be followed based on the original contract agreement and applicable state regulations.

29.005 Case studies and user experiences

Real-world applications of Form 29 illustrate its value across numerous industries. A particularly noteworthy case involved a government contractor who successfully utilized Form 29 to navigate taxation issues, ultimately ensuring a smooth reimbursement process. Their experience underscores the importance of thoroughly understanding the form and its implications.

Additionally, success stories from pdfFiller users demonstrate how the platform enhances document management efficiency. Users have reported improved collaboration and faster approval times by leveraging pdfFiller's editing and signing capabilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send formre have been 29 to be eSigned by others?

Can I create an eSignature for the formre have been 29 in Gmail?

How do I edit formre have been 29 straight from my smartphone?

What is formre have been 29?

Who is required to file formre have been 29?

How to fill out formre have been 29?

What is the purpose of formre have been 29?

What information must be reported on formre have been 29?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.