Get the free NonResident Alien Professional Personal Services Contract - cal msu

Get, Create, Make and Sign nonresident alien professional personal

How to edit nonresident alien professional personal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nonresident alien professional personal

How to fill out nonresident alien professional personal

Who needs nonresident alien professional personal?

Nonresident Alien Professional Personal Form: A How-to Guide

Understanding nonresident alien status

A nonresident alien is defined by the Internal Revenue Service (IRS) as an individual who is not a U.S. citizen and does not meet either the Green Card test or the Substantial Presence Test. This designation is crucial because it impacts how individuals are taxed on their income earned in the United States. Nonresident aliens are typically required to file specific tax forms, which differ significantly from those needed by U.S. citizens or residents.

Understanding nonresident alien status is important as it affects tax liability, the type of exemptions and deductions available, and compliance with U.S. tax laws. Many misconceptions exist surrounding nonresident aliens, such as the belief that they are not required to file taxes at all. In reality, nonresident aliens must report income generated from U.S. sources, and failure to do so can result in penalties.

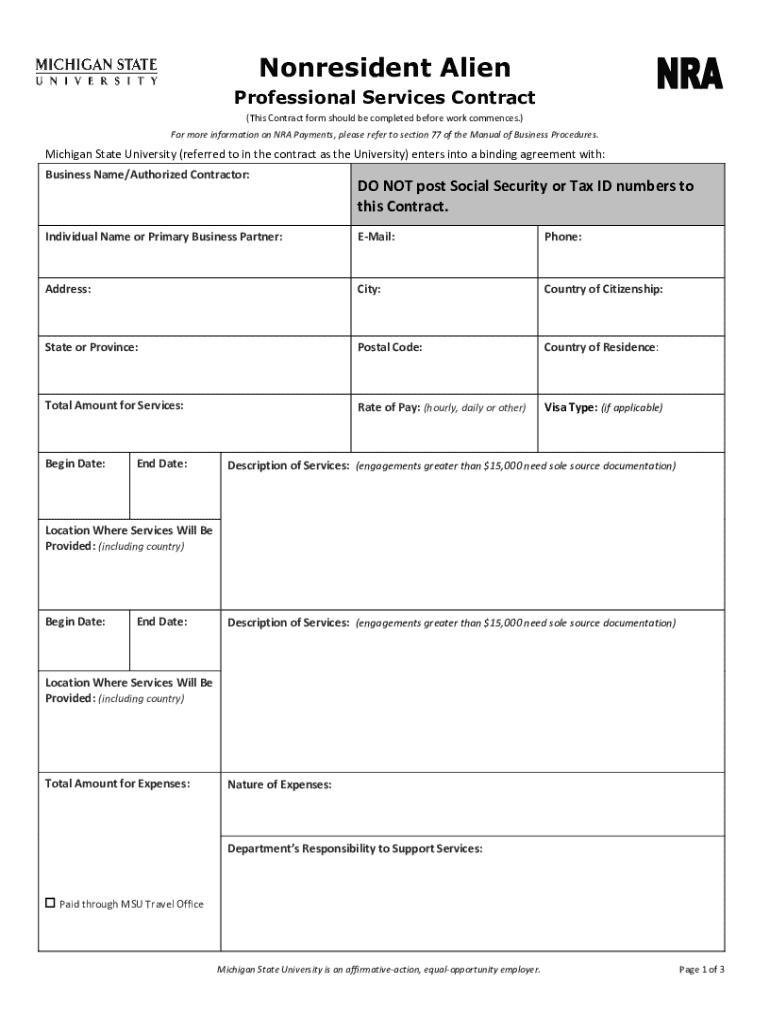

Overview of the nonresident alien professional personal form

The nonresident alien professional personal form is essential for individuals who need to declare their income for tax purposes. This form serves multiple purposes, from reporting earnings to claiming deductions where applicable. Nonresident aliens working in the U.S., including students, interns, and employees of foreign companies, need to understand the form's importance to avoid complications with the IRS.

A key responsibility of nonresident aliens is ensuring that all necessary tax forms are completed accurately and submitted on time to avoid any legal issues concerning income tax. Not everyone needs to complete the nonresident alien professional personal form; specific criteria apply based on income sources, visa type, and residency status.

Preparing to fill out the nonresident alien professional personal form

Before filling out the form, gather all necessary documentation to ensure accuracy. This includes your valid visa information, passport details, and a tax identification number (if applicable). It’s essential to confirm your residency status through the IRS’s Substantial Presence Test. Understanding if you qualify for any exceptions based on specific visa types is crucial.

Additionally, identifying applicable tax treaties is fundamental when preparing to fill out this form. Tax treaties can significantly affect how your income is taxed, including the potential for exemptions or reduced tax rates on specific types of income. Researching your eligibility for these benefits can save time and money.

Step-by-step guide to completing the form

Completing the nonresident alien professional personal form involves several key sections. Begin with personal information. Include your full name, addresses, and contact details. Next, report your income, including salary and any stipends or fellowships received, documenting the correct tax type and source of income. It's vital to be thorough and accurate to ensure compliance with IRS requirements.

Deductions and exemptions should also be highlighted, allowing you to maximize potential tax benefits. Engaging with interactive tools, such as pdfFiller's fillable PDFs and templates, can streamline this process. These tools allow for auto-population of fields, helping to save time and reduce errors.

Submitting the nonresident alien professional personal form

Once the form is completed, review it carefully for accuracy. Common errors may include incorrect Social Security numbers, misspelled names, or inaccurate income figures. Performing final checks before submission ensures a smoother process with the IRS.

You have options for submitting the form, whether electronically or via paper. Electronic submissions generally offer expedited processing, while paper submissions may take longer. It's also crucial to mark important deadlines on your calendar to remain compliant with tax submission requirements, preventing any unexpected penalties or late fees.

Editing and managing your documents with pdfFiller

If you find that changes are needed after submission, pdfFiller provides excellent tools for editing your form. You can simply access the form stored in the cloud, making changes as necessary. It’s user-friendly and doesn’t require advanced software knowledge to navigate the editing options effectively.

Beyond editing, pdfFiller allows you to store and organize your forms efficiently. Utilizing cloud features grants you easy access from anywhere, ensuring you are always prepared for tax time. Furthermore, collaborating with advisors or tax professionals is seamless with sharing options available, promoting streamlined communication and effective guidance.

Troubleshooting common issues

Frequently asked questions about nonresident alien forms can significantly aid in understanding how to navigate potential issues. Common queries might revolve around specific income types, how to claim deductions, or questions regarding IRS notices after submission. Having a solid grasp of these can instill confidence and decrease anxiety around tax season.

When in doubt, seeking professional help is often advisable. Tax laws can be intricate, especially for nonresident aliens. Taking advantage of resources for additional information, such as local tax assistance centers or online forums, can provide clarity. Engaging with experts ensures that you receive tailored advice and correct processing of your documentation.

Conclusion: The importance of properly managing your tax forms

In conclusion, navigating the nonresident alien professional personal form requires thorough preparation and attention to detail. It is crucial to grasp the implications of your status and actively manage your tax obligations to avoid penalties. With pdfFiller’s comprehensive document management features, users can streamline their filing process, making tax season less daunting.

By utilizing the tools and resources available, nonresident aliens can benefit from ease and accuracy in handling their IRS documentation, ensuring compliance and peace of mind.

Related document management resources on pdfFiller

Exploring more forms and templates for nonresident aliens can significantly enhance your document preparation process. With user testimonials and case studies highlighting successful experiences, pdfFiller offers a wealth of knowledge and resources to support all your documentation needs. Furthermore, staying updated on tax regulations affecting nonresident aliens is crucial for maintaining compliance and optimizing your financial strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my nonresident alien professional personal in Gmail?

How do I make changes in nonresident alien professional personal?

How do I complete nonresident alien professional personal on an iOS device?

What is nonresident alien professional personal?

Who is required to file nonresident alien professional personal?

How to fill out nonresident alien professional personal?

What is the purpose of nonresident alien professional personal?

What information must be reported on nonresident alien professional personal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.