Get the free Non-Employee Information Form - GURU - Penn State

Get, Create, Make and Sign non-employee information form

Editing non-employee information form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-employee information form

How to fill out non-employee information form

Who needs non-employee information form?

Non-Employee Information Form: A Comprehensive Guide

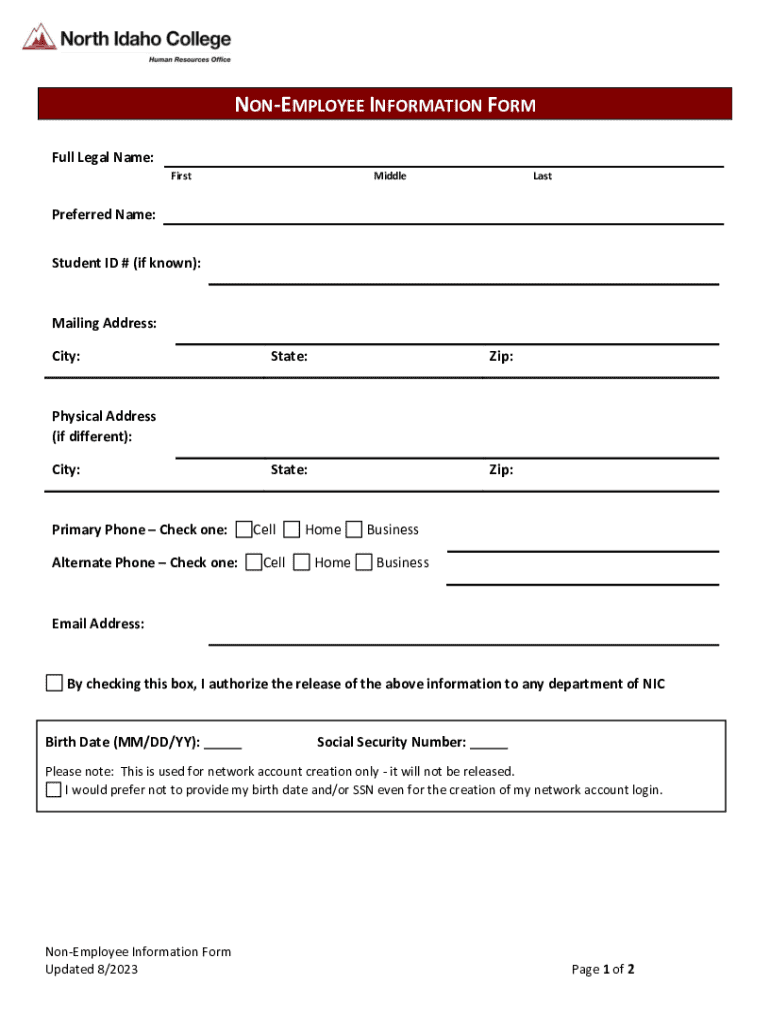

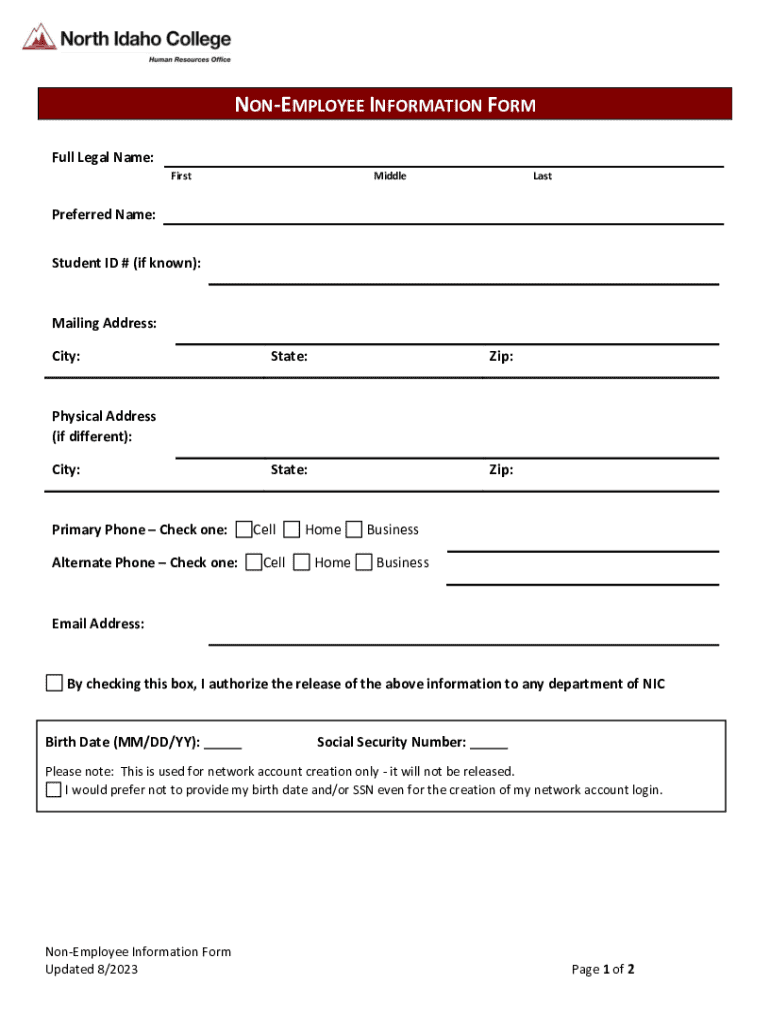

Understanding the non-employee information form

The non-employee information form is a crucial document utilized by organizations to collect necessary details from individuals who are not employed by them. This could include contractors, freelancers, and vendors who provide services but do not receive traditional employee benefits. The primary purpose of this form is to ensure accurate tax reporting and compliance with federal regulations, particularly for the Internal Revenue Service (IRS).

Filling out the non-employee information form is essential as it helps organizations track payments made to non-employees, ensuring that all tax obligations are met. Additionally, this form can facilitate smooth payments and communications between the parties involved. The target individuals for this form include freelancers, contractors, and any entity entering into a service contract with a business.

It's important to recognize that there are key differences between employee and non-employee forms. Non-employees usually complete a different set of paperwork that focuses on their independent status, making it easier for the hiring entity to classify them appropriately for tax purposes.

Key sections of the non-employee information form

When reviewing the non-employee information form, you will encounter several critical sections that require attention. Each section is designed to gather specific details that will greatly assist in the management and payment of non-employees.

Personal identification information

This section captures essential identification details. You will typically need to provide your full name, contact information (including phone numbers and email addresses), and in some cases, a Social Security Number (SSN) or Tax ID, if applicable.

Tax information

Understanding tax requirements is crucial in this section. You will be asked to provide documentation related to your tax status. This often includes IRS Form W-9, which is a request for taxpayer identification information. Submitting accurate tax information helps avoid penalties and ensures correct withholding if applicable.

Payment information

This last critical section outlines how you prefer to receive your payments. Options may include methods such as cash, electronic transfers, or physical checks. Additionally, many organizations now offer direct deposit options for faster and more secure transactions.

Preparing to complete the non-employee information form

Before diving into the completion of the non-employee information form, it's essential to gather the right documents. This preparation can help streamline the process and minimize errors.

Documents you may need

Firstly, identification documents, such as a driver’s license or passport, may be necessary to verify your identity. Secondly, tax identification documents, such as your SSN or Employer Identification Number (EIN), should be organized to reference while completing the form.

Common mistakes to avoid when filling out the form

A common pitfall is forgetting to sign the form, as an unsigned document lacks validity. Additionally, ensure that all contact information is accurate; a simple typo can lead to payment delays. Double-check your tax information for any inaccuracies, as these could result in penalties or increased scrutiny from the IRS.

Step-by-step instructions for filling out the non-employee information form

Completing the non-employee information form can seem daunting if you're unfamiliar with the process. However, breaking it down into simple steps can make it manageable.

Step 1: Gathering necessary information

Start by collecting all necessary identification and tax documents. Having these ready will help fill out the form accurately.

Step 2: Completing personal identification sections

Fill out the personal identification section meticulously. Be sure to include both your current address and any previous addresses if required.

Step 3: Filling out tax information

Here, you will enter your tax identification number, ensuring that it matches the name provided in the previous sections to avoid any discrepancies.

Step 4: Providing payment information

Indicate your preferred method of payment. Remember, options may vary, so check with the organization to ensure the method you prefer is accepted.

Step 5: Reviewing the form for accuracy

Before submitting, review the entire form for any errors or omissions. It's wise to have someone else look over it, too, as a fresh pair of eyes may spot mistakes you overlooked.

Editing and modifying the non-employee information form

After completing the non-employee information form, you may need to make edits or modifications. Changes could arise due to evolving personal information or corrections needed after review.

How to edit PDF forms using pdfFiller

With pdfFiller, editing PDF forms is a breeze. You can upload your document directly onto the platform. Once uploaded, you can use interactive tools such as text boxes, highlighting, and annotation options to make necessary changes.

Version control: Maintaining historical accuracy

Maintaining the correct version of your form is crucial, especially for tax purposes. Always save previous versions of the document with clear labels for easy access later.

Signing the non-employee information form electronically

In today's digital realm, e-signatures have become not only a convenience but a necessity. Utilizing electronic signatures streamlines the process and provides secure documentation.

Benefits of using eSignatures

eSignatures offer myriad benefits, including convenience, legality, and enhanced security. They provide a rapid way to sign documents without requiring physical presence, allowing for distributed teams to facilitate transactions seamlessly.

pdfFiller’s eSigning process

Using pdfFiller’s eSigning feature is straightforward. Simply upload your non-employee information form, add your signature using the platform's signature tools, and follow the prompts to finalize the process. This digital signature complies with federal laws, ensuring authenticity and security.

Ensuring signature authenticity and security

pdfFiller enhances security through encryption and authentication measures to verify the identity associated with each signature, minimizing the risks associated with digital signing.

Submitting the non-employee information form

Once the non-employee information form is complete and signed, it's time for submission. Choosing the right method can impact how quickly your information is processed.

Methods of submission: Online vs. offline

You may submit the form either online through the company's platform or offline via mail or fax, depending on the organization’s requirements. Often, online submissions are processed more quickly and can offer immediate tracking capabilities.

Deadlines for submission and compliance

Be mindful of deadlines for submission, especially if your work is tied to fiscal schedules or tax reporting periods. Completing your form promptly ensures compliance and seamless processing.

Managing your non-employee information form

After submission, effective management of your non-employee information form should remain a priority. Keeping track of your form status helps in understanding if further action is needed.

Keeping track of your form status

Most organizations provide a way to check the status of your form. This could be through an online portal or direct communication with the HR department. Regular follow-ups ensure you stay informed regarding payments.

How to request corrections post-submission

In the event that you notice an error after submitting the form, promptly reach out to the appropriate department to request corrections. Provide documented proof of the changes needed to facilitate expedient handling of your request.

Archive management: Storing forms securely in the cloud

To mitigate risks of loss, securely archiving your non-employee information form is beneficial. Utilizing cloud storage solutions like pdfFiller not only provides access from anywhere but ensures that your forms remain safe and retrievable.

Frequently asked questions about non-employee information forms

With non-employee information forms come numerous inquiries. Clarifying common questions can alleviate concerns and facilitate smoother operations.

What to do if you lose your form?

If you misplace your form, contact the organization that requested it. Most will have a system in place to regenerate the form quickly or may provide guidance on how to fill it out again.

Can you revoke an eSignature?

Revoking an eSignature depends on the policies of the organization and the timing of your request. Generally, if you need to make significant changes, you can discuss options with the relevant parties.

How to handle updates to your information?

If there are changes to your information, such as a name change or new address, promptly notify the organization and follow their protocols to keep your records accurate.

Additional tips for using pdfFiller in document management

pdfFiller is designed to simplify your document management processes, especially when it comes to forms like the non-employee information form.

Integrating pdfFiller with other tools for enhanced productivity

pdfFiller can integrate with various productivity tools to streamline your workflow. Sync with apps you already use to enhance efficiency and reduce redundancy in your processes.

Collaborating with teams using pdfFiller’s features

Utilizing pdfFiller for team collaboration is a great way to ensure everyone stays informed. Invite team members to view, edit, or sign documents directly on the platform. This helps increase transparency and accountability across your projects.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit non-employee information form from Google Drive?

How do I execute non-employee information form online?

Can I create an electronic signature for the non-employee information form in Chrome?

What is non-employee information form?

Who is required to file non-employee information form?

How to fill out non-employee information form?

What is the purpose of non-employee information form?

What information must be reported on non-employee information form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.