Get the free All about your dependants on Fedhealth

Get, Create, Make and Sign all about your dependants

Editing all about your dependants online

Uncompromising security for your PDF editing and eSignature needs

How to fill out all about your dependants

How to fill out all about your dependants

Who needs all about your dependants?

All about your dependants form: A comprehensive guide

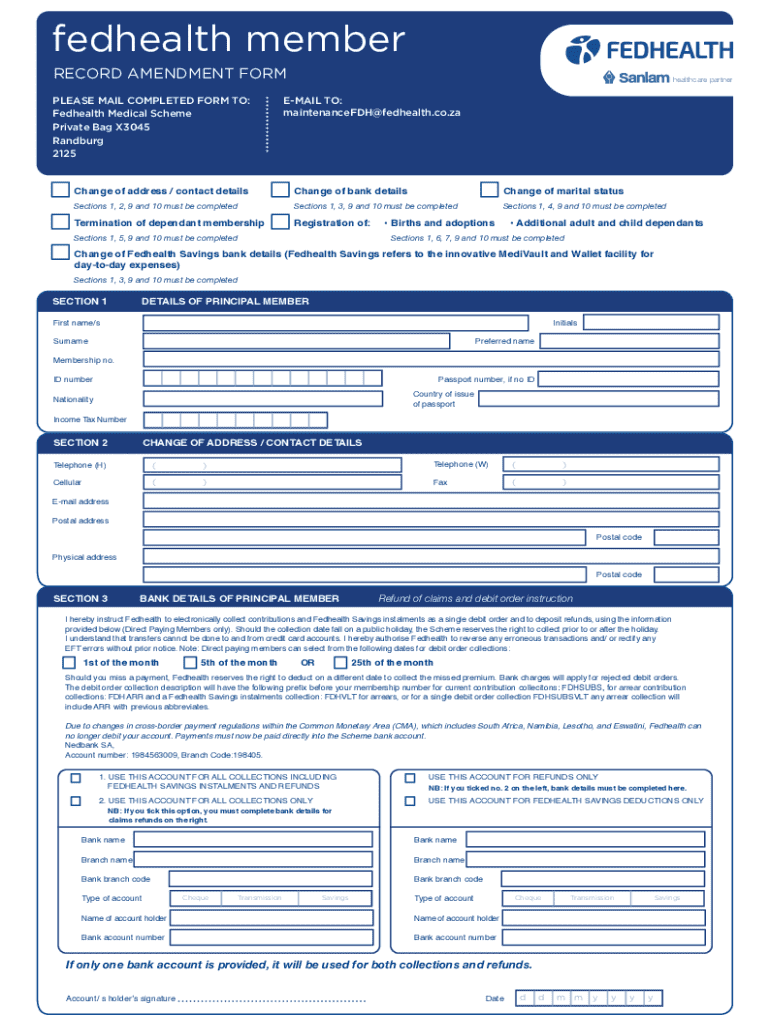

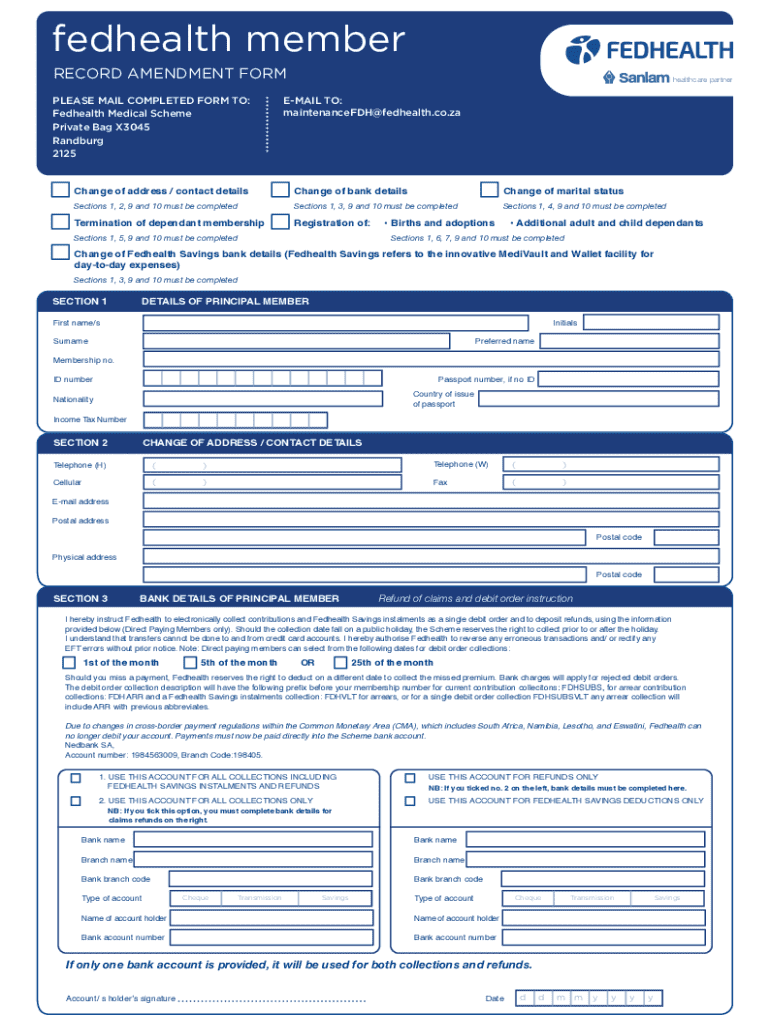

Understanding the dependants form

The dependants form is a crucial document that helps individuals report their eligible dependants for various applications, including tax filings, benefit claims, and more. This form plays an essential role in determining what benefits or deductions you may qualify for, affecting both your finances and your dependants' access to vital services.

Its importance is underscored by the fact that different government and private entities require accurate information about your dependants to process applications effectively, authorize benefits, and provide necessary services. Understanding what constitutes a dependant, the information required, and the implications of misreporting is vital for both individuals and families.

Preparing to fill out the dependants form

Before filling out the dependants form, it's crucial to gather all required documentation. This typically includes birth certificates, Social Security numbers, and any additional paperwork necessary to verify the relationship between you and your dependants. Understanding the hierarchical distinctions in family relationships, such as children, spouses, or even certain relatives, is paramount to correct form submission.

A thorough understanding of key terminology on the form can prevent common errors. For example, knowing the distinction between a dependant and a non-dependant is critical. Dependants can include children and spouses, while non-dependants may refer to other relatives or guardians not meeting legal criteria.

Step-by-step guide to completing the dependants form

Completing the dependants form may seem daunting, but breaking it down section-by-section can simplify the process. Start with filling out your personal information, including your full name, address, and contact details. Ensure that this information is current and accurate, as errors can delay processing.

Next, you'll move to the dependant information section. Here, you need to provide the names, dates of birth, and specific details about each dependant. For instance, if you have a son or daughter, make sure to list their full legal names and accurately denote their relationship to you. Special considerations apply to dependants with disabilities or special needs, which require careful documentation.

Reviewing and verifying the provided information is essential. Before submitting, double-check all entries for accuracy. This last step can prevent significant delays later due to simple mistakes.

Common mistakes to avoid when filling out the dependants form

Mistakes occur often in forms, especially regarding the definitions of relationships. For example, some individuals mistakenly refer to a stepchild as a biological child without understanding the implications involved in tax or insurance filings. It's crucial to familiarize yourself with the relevant definitions to avoid pitfalls.

Additionally, omitting vital information or incorrectly listing dependants can lead to processing delays or denials. Even a single missed Social Security number can derail your application, so ensure all required fields are accurately filled before submitting the form.

Editing and managing your dependants form

Utilizing tools like pdfFiller can significantly enhance your experience when editing the dependants form. These tools allow for seamless modification, ensuring that you can correct and update your information as needed, which is crucial for accuracy. Furthermore, features enabling electronic signatures make for a smoother submission process.

As you work through the form, regularly saving your progress is vital. This feature enables you to edit or fill in the form from any device, ensuring that your information is always accessible. This accessibility is particularly helpful if you need to consult with a partner or co-parent.

Submitting your dependants form

There are various methods for submitting your dependants form, depending on the requirements of the agency or program you're working with. Online submissions are the most efficient way to file your form; many government and insurance agencies offer direct submission options through their portals.

If you are opting for mail submissions, it's recommended to ensure delivery by using certified mail services. Whenever possible, utilize in-person options if available, as this provides immediate assistance and confirmation of submission. Be sure to inquire about expected processing times and what steps to follow if you feel there's been a delay in receiving confirmation.

Troubleshooting: issues you might encounter

Upon submission, you might receive feedback regarding your application. Recognizing common reasons for rejection, such as misreported relationship status or missing details, can help you rectify these quickly. Understanding common pitfalls allows you to proactively ensure your application aligns with guidelines.

Addressing frequently asked questions about the dependants form can also provide guidance. Familiarizing yourself with these common queries, whether through online resources or community forums, can empower you to navigate the form completion process more effectively.

Interactive tools and resources available

Before submitting your dependants form, referring to a comprehensive summary checklist can ensure that all aspects are covered. This checklist can serve as a final review tool, helping you confirm that all necessary information has been accurately completed.

Live chat support available on the pdfFiller platform can also facilitate real-time assistance for questions that arise while completing the form. Moreover, templates for varied dependants forms can save you time and ensure compliance, allowing you to tailor information quickly.

Final tips for a successful submission

To increase your chances of having your dependants form accepted without delay, adhere to best practices. Ensure that all entries are double-checked, verify relationship definitions, and keep abreast of any changes or updates to rules regarding dependants. Tax codes and social service guidelines evolve, meaning staying informed could benefit you significantly.

Establishing a reliable process for maintaining your form data will save you time in future submissions. Responsibility in managing updated information for your dependants is critical for accurate reporting.

Real-life scenarios and case studies

Learning from individuals who have successfully completed the dependants form reveals insightful strategies and common mistakes. Case studies highlight various approaches to filling out the form accurately, including better understanding complex relationships among dependants, which can differ widely across households.

Many users report issues stemming from misunderstandings about eligibility, emphasizing the importance of consulting available resources. This experience indicates that proactive communication regarding requirements is key, combining personal responsibility with community engagement for best practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send all about your dependants to be eSigned by others?

How do I edit all about your dependants in Chrome?

How can I edit all about your dependants on a smartphone?

What is all about your dependants?

Who is required to file all about your dependants?

How to fill out all about your dependants?

What is the purpose of all about your dependants?

What information must be reported on all about your dependants?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.