Get the free Guide to IRS tax forms

Get, Create, Make and Sign guide to irs tax

How to edit guide to irs tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out guide to irs tax

How to fill out guide to irs tax

Who needs guide to irs tax?

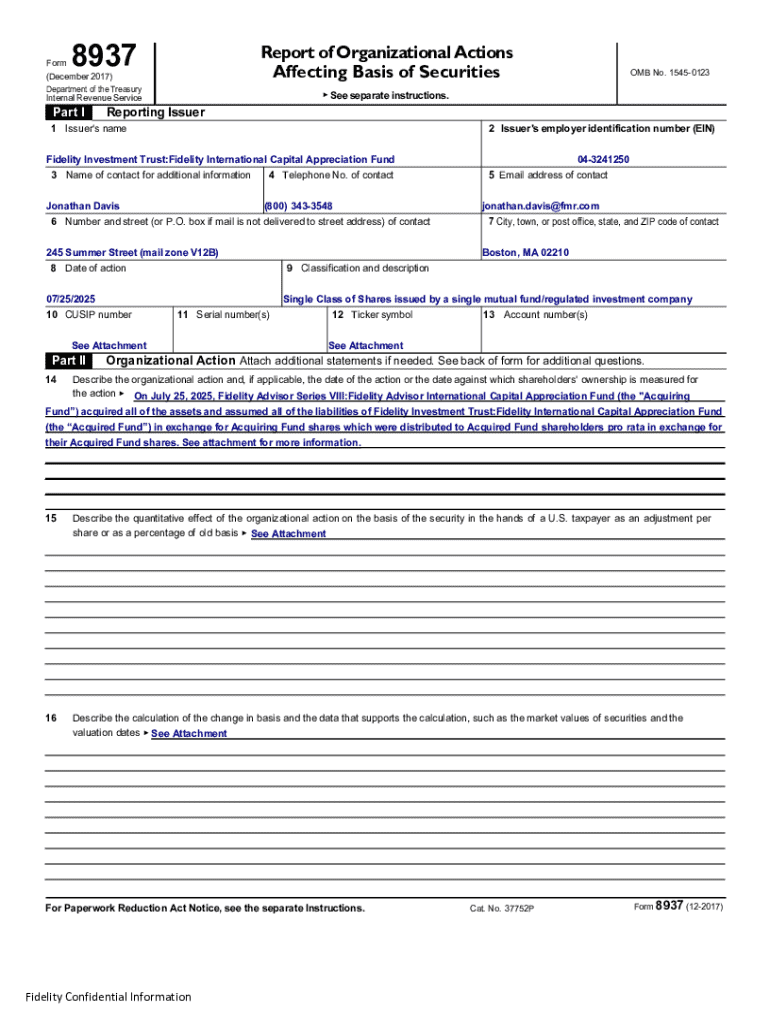

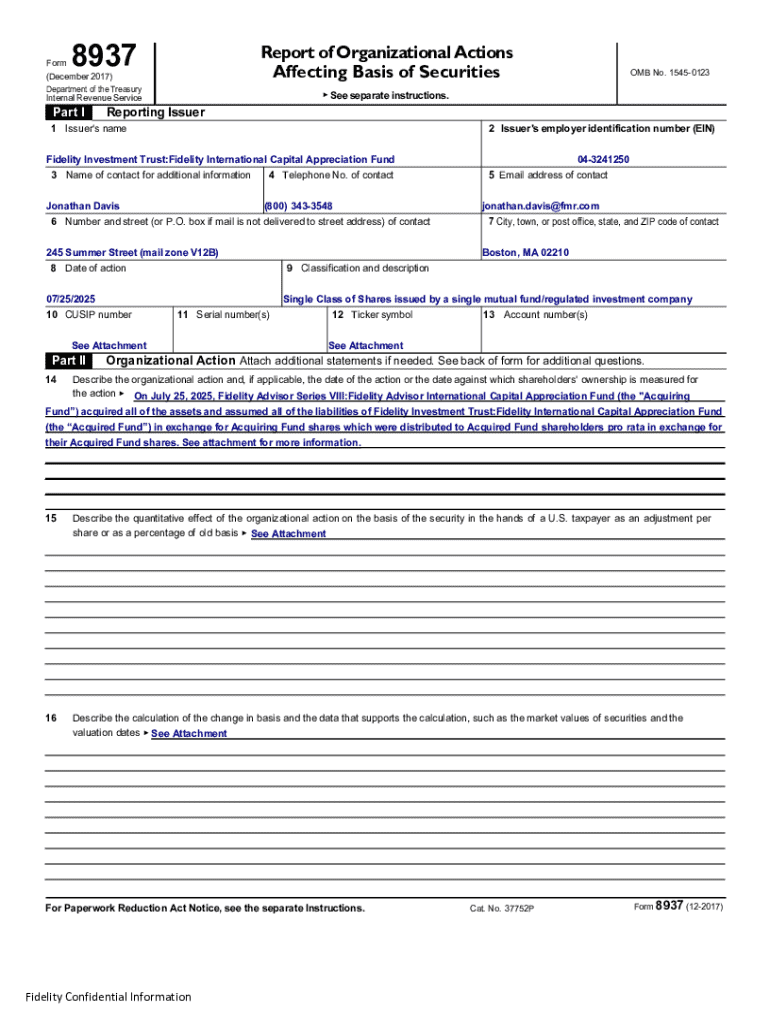

Guide to IRS Tax Form

Understanding IRS tax forms

IRS tax forms are essential documents used for reporting income, deductions, and credits to the Internal Revenue Service (IRS). These forms serve to calculate an individual's or business's tax obligations. Understanding their purpose is critical for both individuals and entities to ensure compliance and minimize any potential tax liabilities.

For individuals, these forms play a crucial role in determining tax refund eligibility or payment obligations. For businesses, they help track income and expenses and facilitate the reporting of corporate taxes. Accurate and timely completion of these forms is vital for a smooth tax filing process.

Focus on Form 1040: Individual Income Tax Return

Form 1040 is the primary document that U.S. taxpayers use to file their annual income tax returns. It encompasses all relevant income information and deductions necessary for calculating tax owed or refunds due. Completing Form 1040 accurately is critical for maintaining compliance with U.S. tax laws.

Every taxpayer must be aware of the different components of Form 1040. This form includes sections for personal information, income reporting, and deductions, which affect the overall tax calculation. Understanding these components is essential for ensuring that all income is reported and that eligible deductions and credits are claimed.

Step-by-step guide to filling out Form 1040

Filling out Form 1040 can be straightforward if you gather all necessary documentation beforehand. Start by collecting W-2s, 1099s, and any additional income records required for filing your income tax return. This preparation can prevent errors and expedite the filing process.

Once you have all necessary information, proceed to fill out Form 1040. Begin with your personal information, followed by reporting all sources of income. Following that, detail any adjustments to your income, then move on to the tax section, where you will calculate your liability. Be sure to also indicate any taxes owed or expected refunds.

Ensure to double-check your entries for accuracy before submission, as any errors could lead to delays in processing or potential audits.

An example of a completed Form 1040 can serve as a valuable reference. Look for annotated examples that explain each section, highlighting key areas that often confuse filers.

Additional schedules for Form 1040

Certain taxpayers may need to file additional schedules alongside Form 1040 to account for specific deductions and circumstances. Schedules A, B, C, D, and others play critical roles in accurately reporting varied sources of income and detailing deductions beyond the standard options.

Schedule A is necessary for itemizing deductions, while Schedule C helps self-employed individuals report their business income and expenses. Depending on your financial situation, the necessity of these schedules can vary significantly.

Common situations requiring additional documentation include self-employment income, where you'd typically need Schedule C, and property sales that may necessitate Schedule D for capital gains reporting.

Filing options for Form 1040

Filing your Form 1040 can be done electronically or via mail. E-filing is increasingly popular due to its efficiency and added benefits like instant confirmations and reduced errors. The process typically involves using a recognized tax software program that guides you through data entry and submission.

When deciding between e-filing versus paper filing, consider the speed of processing and potential for faster refunds compared to mailing in forms. Each e-filing program may have its unique steps, but overall, it is generally a more efficient way to submit your tax information.

When choosing tax software, look for solutions that offer features like guided questions, error checking, and live support for a smoother experience. Beginners may want to consider services that provide user-friendly interfaces to ease the filing process.

FAQs about Form 1040

Many taxpayers have common questions about Form 1040, especially regarding accuracy and audits. If you realize you made a mistake on your tax return, the IRS allows you to file an amended return using Form 1040-X. It’s crucial to correct errors as soon as possible to avoid complications.

If you owe money and cannot pay your tax bill immediately, the IRS provides options, such as payment plans, which can ease financial strain. Understanding your options for addressing tax liabilities can help maintain compliance even during financially challenging times.

Beyond Form 1040: Exploring other IRS tax forms

While Form 1040 is critical for individual taxpayers, various other IRS forms serve businesses and nonprofit organizations. For example, Form 1065 is used by partnerships, while Form 1120 caters to corporations. Understanding the implications of these forms can aid in effective financial management.

For nonprofits, Form 990 is essential for maintaining tax-exempt status. Each of these forms requires specific information and can impact the financial statements and tax obligations of the respective entity, making familiarity with these forms valuable.

Managing your IRS tax documents

Effective organization of your tax records is crucial for efficient tax filing and financial management. Maintain neatly organized filings of all supporting documents, including W-2s, receipts for deductions, and any correspondence with the IRS.

In today's digital age, utilizing digital document management solutions like pdfFiller can greatly simplify this process. By leveraging cloud storage, you can easily access your documents from anywhere, ensuring you have the necessary records when filing your taxes.

Preparing for future tax seasons

To stay ahead in tax season, proactive preparation throughout the year is essential. Keep track of potential deductions and credits as they arise, rather than waiting until tax season. This approach not only reduces stress but helps ensure all eligible deductions are maximized.

Establishing a routine for documenting income and expenses will simplify the preparation process when it's time to file. Use budgeting tools or financial apps to stay organized and monitor your earnings and spending year-round.

Support and resources

Tax-related queries can arise at any time, making it essential to know where to seek assistance. The IRS offers a wealth of resources, including guides and FAQs on their website, where you can find answers to a variety of tax-related questions.

In addition, community forums and professional services can provide support for more complex issues. Leveraging tools like pdfFiller not only aids in the preparation of tax documents but also enables users to eSign, edit, and manage documents efficiently from a single cloud-based platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my guide to irs tax directly from Gmail?

How do I make edits in guide to irs tax without leaving Chrome?

How can I fill out guide to irs tax on an iOS device?

What is guide to irs tax?

Who is required to file guide to irs tax?

How to fill out guide to irs tax?

What is the purpose of guide to irs tax?

What information must be reported on guide to irs tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.