Get the free Newfront Retirement Services, Inc.

Get, Create, Make and Sign newfront retirement services inc

Editing newfront retirement services inc online

Uncompromising security for your PDF editing and eSignature needs

How to fill out newfront retirement services inc

How to fill out newfront retirement services inc

Who needs newfront retirement services inc?

Comprehensive Guide to the Newfront Retirement Services Inc Form

Understanding the Newfront Retirement Services Inc form

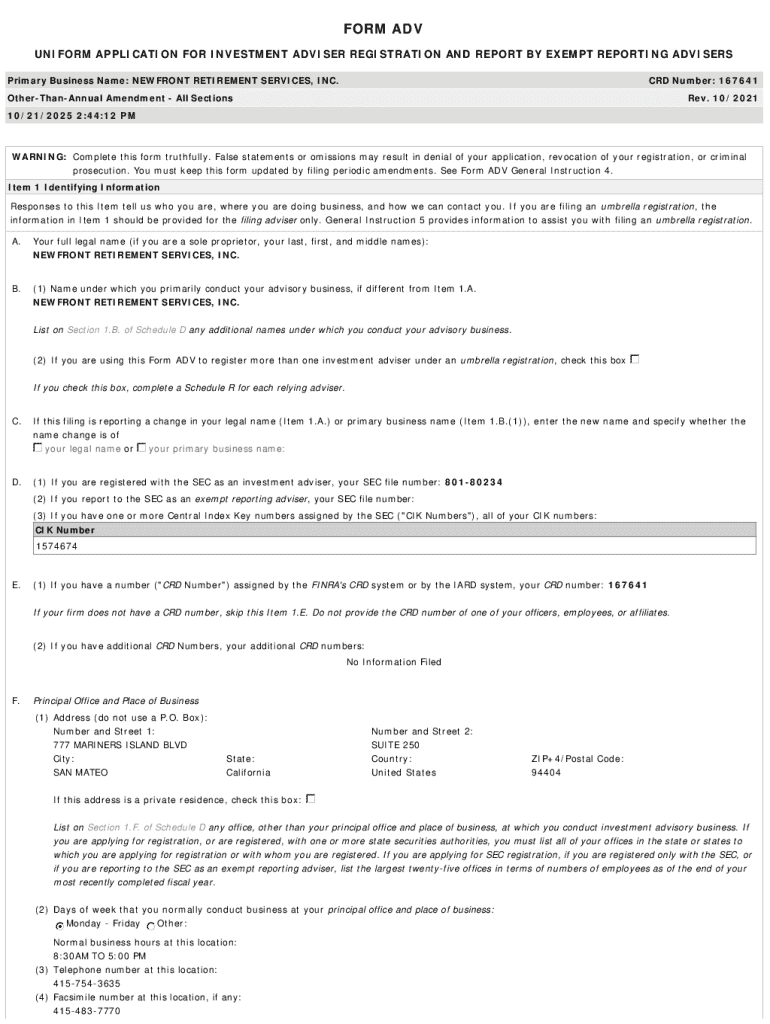

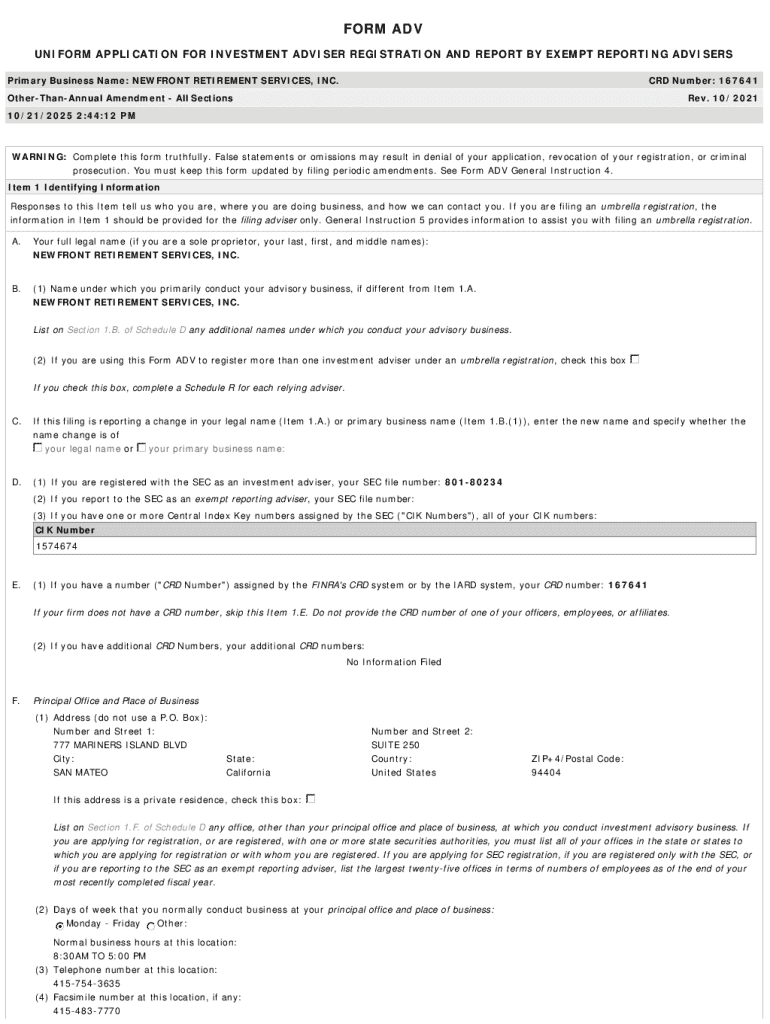

The Newfront Retirement Services Inc Form is a pivotal document crafted for individuals and teams to streamline their retirement planning process. This form encapsulates a series of essential details that inform retirement strategies and ensure compliance with various regulatory frameworks like the Employee Retirement Income Security Act (ERISA). Understanding its purpose is crucial, as it facilitates structured planning for the financial future.

Common use cases for the Newfront Retirement Services Inc Form include assessing current retirement plans, evaluating investment options, and mapping out future financial needs—empowering users to delineate their retirement objectives while adhering to fiduciary guidelines.

Key features of the form

The Newfront Retirement Services Inc Form comprises several distinct sections designed to collect comprehensive information from users. Each field serves to gather critical data on personal identity, financial standing, and retirement aspirations. Unique aspects of this form include its integration with investment fiduciary analytics which aids in decision making by offering comparative insights against ERISA regulations.

The form's design and layout also set it apart; it uses intuitive prompts to guide users through the process, minimizing errors and enhancing data accuracy. By merging critical information with user-friendly elements, the form stands as a central tool in retirement planning.

Step-by-step guide to completing the form

Filling out the Newfront Retirement Services Inc Form requires a systematic approach to ensure all required fields are addressed effectively. Before beginning the process, it's essential to gather necessary documentation, such as identification, previous financial statements, and details on current retirement accounts. These documents underpin the accuracy of the information provided.

When preparing to complete the form, users should verify their financial literacy to better understand terminologies and concepts that will appear, ensuring a more transparent and accurate filling process.

Detailed walkthrough of each section

Starting with the personal information section, it’s vital to enter your data accurately, including name, address, crucially your Social Security number, and contact information. Misentries can delay processing or lead to invalid submissions. The financial information section requires users to assess their current assets comprehensively, providing clarity on retirement investments that comply with the 2d Circuit’s guidelines on fiduciary responsibility.

Articulating retirement goals and plans is perhaps the most subjective section but equally important. Here, users should highlight specific financial needs, target retirement age, and desired lifestyle benchmarks. Formulating this section with precision greatly influences retirement advisory outcomes.

Editing and managing the Newfront Retirement Services Inc form

Utilizing tools like pdfFiller, editing the Newfront Retirement Services Inc Form becomes a hassle-free experience. Users can revise text, images, and even incorporate signatures seamlessly. The platform’s drag-and-drop functionality enhances the user experience, enabling quick rearrangements and adjustments without hassle.

Real-time collaboration features allow teams to discuss changes live, making it easier to manage group feedback and incorporate multiple perspectives effectively.

Saving and sharing your completed form

Once the Newfront Retirement Services Inc Form is filled out and reviewed, saving it securely in the cloud is vital. pdfFiller offers various options for this: users can save files in their accounts or link them directly to external storage solutions like Google Drive or Dropbox.

Sharing methods are equally versatile, allowing users to send the document via email, create sharable links, or utilize version control for collaborative purposes. Maintaining a detailed log of changes is essential for accountability in financial oversight, particularly concerning submissions regulated by the 9th Circuit.

Signing the Newfront Retirement Services Inc form

Understanding signature requirements for the Newfront Retirement Services Inc Form is crucial, as it establishes the document's validity. Electronic signatures are widely accepted and must adhere to standards outlined by the Electronic Signatures in Global and National Commerce Act (E-SIGN). Users should familiarize themselves with the legal implications surrounding e-signatures to ensure the document holds value.

Utilizing pdfFiller for eSigning is straightforward. Users can create a verifiable electronic signature to ensure that all parties' identities involved are substantiated and documented properly. The platform also integrates with leading digital signature solutions for an added layer of security, providing peace of mind concerning your retirement-centered data.

Common issues and troubleshooting

As with any form, users may occasionally encounter issues when filling out the Newfront Retirement Services Inc Form. Common problems include missing information, errors in input, or complications that arise during submission phases. Understanding potential pitfalls can save time and frustration.

Solutions may include double-checking entries before submission and using pdfFiller's built-in error checking. In scenarios where mistakes are made, users should quickly refer back to their documentation to correct inaccuracies while referencing standards set forth in regulations like 29 C.F.R. Also, connect with support services for troubleshooting tips and assistance.

Additional tips for successful retirement planning

Leveraging resources available on pdfFiller can significantly enhance your retirement planning efforts. The platform provides a variety of templates and organizational tools that aid in effective documentation. Utilizing these resources can assist in ensuring compliance and making informed decisions about your financial future.

Staying organized is equally vital; regular updates and reassessments of your financial standing will keep your retirement strategy aligned with evolving personal goals or economic conditions. Backing up your documents and maintaining a schedule for periodic reviews will help solidify your commitment to a secure retirement.

Contact information and support

For further inquiries regarding the Newfront Retirement Services Inc Form, contacting Newfront Retirement Services directly is advisable. Ensure you have relevant information prepared to facilitate quicker assistance.

Furthermore, pdfFiller's support resources are available for any questions related to the platform itself. Access their help guides, FAQs, and customer support for a complete understanding of the tools at your disposal while working with the Newfront Retirement Services Inc Form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit newfront retirement services inc in Chrome?

Can I sign the newfront retirement services inc electronically in Chrome?

How can I edit newfront retirement services inc on a smartphone?

What is newfront retirement services inc?

Who is required to file newfront retirement services inc?

How to fill out newfront retirement services inc?

What is the purpose of newfront retirement services inc?

What information must be reported on newfront retirement services inc?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.