Get the free BUSINESS CORPORATION TAX RETURN *32612491*

Get, Create, Make and Sign business corporation tax return

Editing business corporation tax return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business corporation tax return

How to fill out business corporation tax return

Who needs business corporation tax return?

Business corporation tax return form – A comprehensive how-to guide

Overview of business corporation tax return forms

The business corporation tax return form is a critical document that corporations must file with the tax authorities to report their income, expenses, and tax liabilities. It serves the purpose of outlining a corporation's financial activities over a fiscal year, allowing tax agencies to assess taxable income accurately and determine due taxes. Filing this return is a formal requirement, and failure to do so can lead to substantial penalties.

This form is essential not just for compliance, but also for corporations to avail themselves of various tax incentives and deductions, ultimately impacting their cash flow and financial health. For many entities, especially in regions like Florida, the mechanics of this filing are crucial for understanding local franchise tax obligations and ensuring adherence to state regulations.

Who must file a business corporation tax return?

Generally, all corporations conducting business must file a tax return. This includes C corporations, which are subject to corporate income tax, and S corporations that, while not taxed at the corporate level, must still file informational returns. Partnerships and sole proprietorships, being more flexible entities, have different reporting requirements but are often also required to report income and expenses.

In some instances, corporations may be exempt from filing. This could include certain non-profit entities or those that earn below a specified income threshold. In Florida, for example, corporations need to be aware of the state's specific franchise tax provisions that apply depending on the nature of business activities conducted within the state.

Understanding the tax base and rate

To accurately complete the business corporation tax return form, it is crucial to understand how to determine taxable income. Generally, corporate income is calculated as total revenue minus allowable deductions. This taxable income will then be subjected to appropriate federal and state tax rates. Each state, including Florida, has its own corporate tax rate structure, which may differ significantly from federal rates.

For example, if a corporation earns $500,000 in revenue with $300,000 in deductible expenses, its taxable income would be $200,000. If the federal corporate tax rate is 21%, the tax owed would be $42,000. Corporations must also consider the potential implications of state taxes. Florida, for instance, has its own corporate income tax rates that may apply.

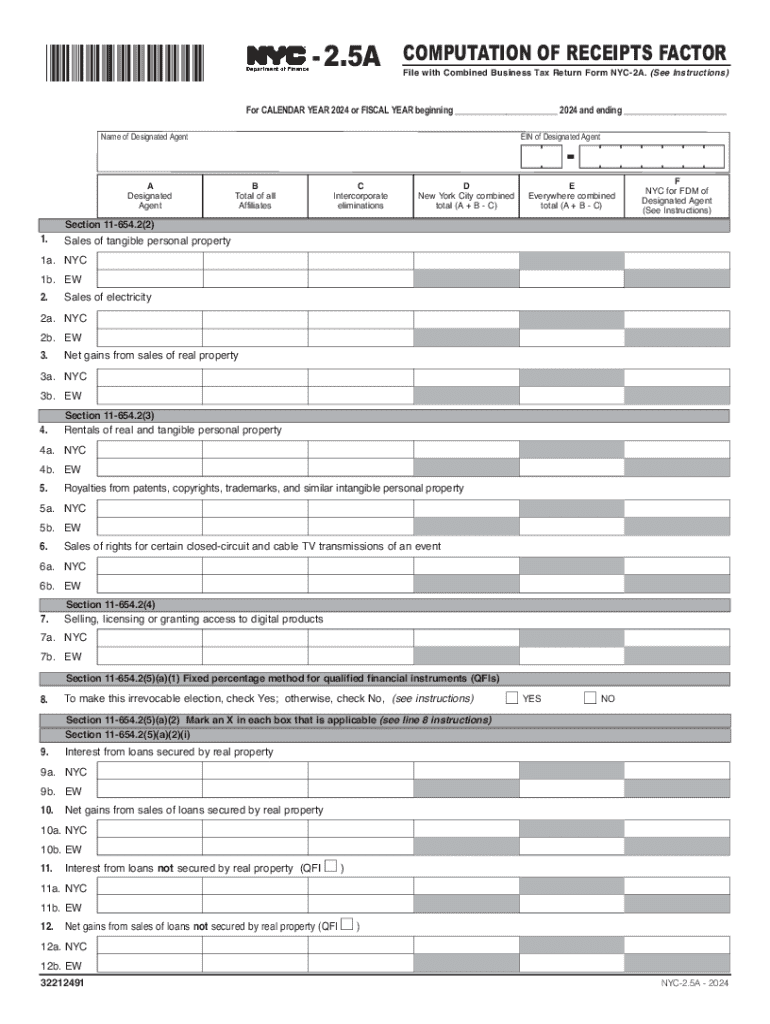

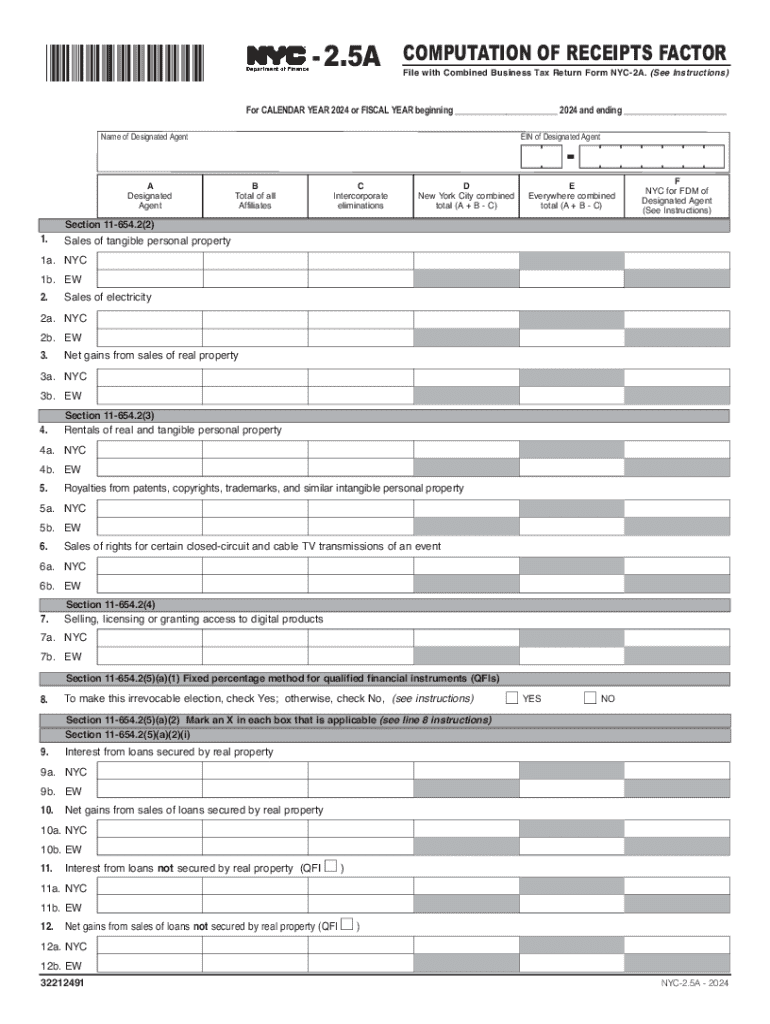

Key components of the business corporation tax return form

The business corporation tax return form comprises several key sections that require careful attention to detail. Essential fields include income sections, deductions, credits, and calculations that report the corporation's financial position. It's vital to ensure each section is accurately filled out to avoid common mistakes that might delay processing or lead to penalties. In Florida, for instance, specific provisions and privacy regulations must also be adhered to when completing this form.

Some common errors include misreporting income, neglecting to account for all eligible deductions, or failing to compare the submitted figures against prior years. Corporations should also ensure that all calculations are correct, as mistakes can lead to audits or additional liabilities.

Important dates and deadlines

Filing deadlines for the business corporation tax return form can vary. Corporations often find it necessary to file their returns on or around the 15th day of the fourth month following the end of their fiscal year. If a corporation's fiscal year ends on December 31, their return would typically be due by April 15 of the following year. It is crucial for businesses to note that extensions can be requested, providing additional time; however, any tax payments still become due on the original filing date.

Tax payments also have specific deadlines because failure to pay taxes on time can lead to interest and penalties accruing swiftly. Corporations should stay informed of both state and federal due dates, particularly with Florida's tax structure, to avoid adverse financial impacts.

Tax incentives and deductions

Corporations should be proactive in seeking out available tax credits and deductions that can significantly reduce their tax liabilities. Popular tax incentives include those for investment activities, job creation, and research and development (R&D). Deductions can also apply to business expenses such as salaries, benefits, rent, and interest expenses. Understanding these can effectively minimize dues to the state's and federal government's coffers, allowing businesses to reinvest savings to foster growth.

In Florida, businesses can benefit from additional credits that may apply to specific industries. For instance, businesses that invest in renewable energy initiatives may qualify for state-specific deductions or credits. The key is ensuring that all claimed deductions and credits are contemporaneous, accurately documented, and in line with the prevailing regulations, including those concerning Florida corporate income reporting.

Step-by-step guide to filling out the form

Filling out the business corporation tax return form can seem daunting, but breaking it down into manageable steps simplifies the process. First, gathering all necessary documentation is critical—this includes income statements, records of expenses, and previous tax filings. Once you have your documentation ready, you can begin completing the income section, ensuring that you account for all revenue generated during the reporting period.

Next, report any deductions carefully, as this is where many corporations can maximize their tax efficiency. After completing the form, review all sections meticulously for accuracy, ensuring figures correlate logically and meet regional requirements. Finally, utilize electronic submission options through platforms like pdfFiller to enhance accuracy and security while minimizing the risk of human error.

Interactive tools and resources

Taking advantage of interactive tools can enhance the experience of completing a business corporation tax return form. pdfFiller offers dynamic document creation features that enable users to easily fill out the form online, ensuring that all information is correctly entered and instantly saved. Additionally, tools for eSigning and collaboration streamline the process, allowing team members to review and finalize documents efficiently.

For corporations needing assistance, pdfFiller provides access to customer support for filing-related queries. Engaging with these resources helps businesses manage their tax documentation efficiently while ensuring compliance with local requirements, including those unique to Florida.

Common questions and answers

Navigating the complexities of business corporation tax returns often raises common questions. Many corporations wonder about the specifics of what income must be reported or which deductions they can lawfully claim. Clarifying these queries early in the process can save time and prevent issues later, including audits.

Moreover, understanding unique aspects, such as Florida's corporate tax nuances or special considerations for out-of-state revenue, can help build a comprehensive approach to tax management. Utilize resources like forums, experts in corporate tax, or even pdfFiller’s support for nuanced queries.

Managing your tax documents

Organizing and storing tax records is essential for compliance, especially for corporations. Establishing a systematic approach—whether it’s electronic or paper-based—facilitates quick retrieval during audits or reviews. pdfFiller enhances this process by providing cloud-based storage that allows businesses to manage tax documents securely and conveniently.

Ensuring compliance with regulations involves understanding local requirements for record retention. Florida corporations, for instance, must maintain tax documents for a prescribed duration to guard against potential audits. Using an organized, digital tool like pdfFiller aids in maintaining these records efficiently.

Conclusion on leveraging pdfFiller's features

Filing a business corporation tax return form is a critical responsibility that can have significant implications for any corporation. Leveraging pdfFiller’s features not only simplifies the preparation and submission process but also enhances document management and collaboration among teams. By utilizing the platform's capabilities, businesses can ensure compliance, streamline workflow, and securely handle sensitive financial documents.

Furthermore, the integration of pdfFiller into tax documentation processes offers a cohesive solution for managing corporate tax responsibilities while enabling a stress-free filing experience. The tools available through pdfFiller are invaluable for anyone seeking to navigate the complexities of business taxes effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business corporation tax return for eSignature?

How do I complete business corporation tax return online?

How do I make edits in business corporation tax return without leaving Chrome?

What is business corporation tax return?

Who is required to file business corporation tax return?

How to fill out business corporation tax return?

What is the purpose of business corporation tax return?

What information must be reported on business corporation tax return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.