A comprehensive guide to my uncle is gifting form

Understanding the gift gifting process

A gift gifting form is a crucial document that facilitates the transfer of assets or belongings from one person to another without compensation. It ensures that the donor's intent is legally recognized and that both parties adhere to financial regulations. This form is essential for documentation and clarity to avoid potential disputes in the future. Proper documentation is necessary, especially when it comes to legal matters and tax implications that arise from gifting.

Confirm the validity of the gifting process through proper documentation.

Establish the value of the gift for tax purposes.

Articulate the intent of the transfer to ensure it’s understood as a gift.

Exploring the form requirements

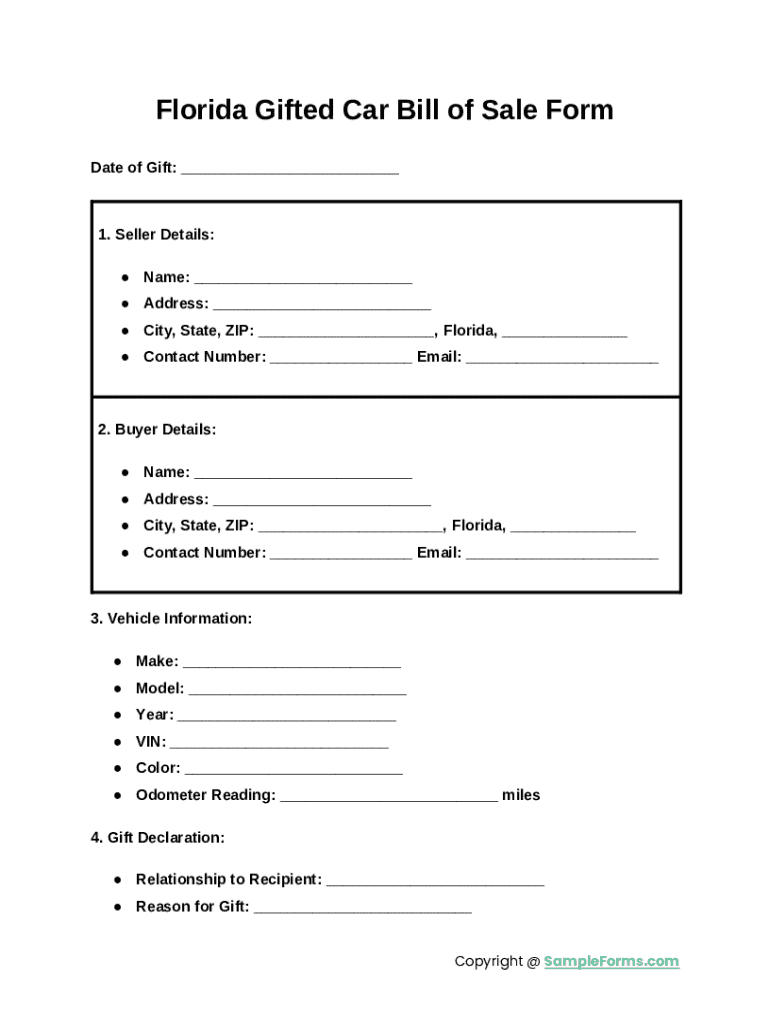

Filling out the gift gifting form requires specific information to ensure its legality and effectiveness. The main requirements include the donor's name and information, the recipient's details, and a thorough description of the gift being transferred. Collecting accurate information reduces the risk of complications in the future related to taxes or miscommunication.

Understanding the legal and tax implications associated with gifting is also crucial. The IRS sets annual gifting thresholds that vary annually, which dictate how much one can gift without incurring a gift tax. For 2023, the gift tax exemption is set at $17,000 per recipient, allowing individuals to transfer wealth without impacting their lifetime estate tax exemption. Knowing these thresholds can assure donors that their generosity won’t inadvertently result in a tax bill.

Provide the donor’s full name and contact information.

Detail the recipient’s full name and information.

Include a detailed description and valuation of the gift.

Detailed instructions for filling out the gifting form

Filling out the gift gifting form on pdfFiller is a straightforward process. Here’s a step-by-step guide to ensure accuracy and compliance:

Open the gifting form on pdfFiller.

Fill out the donor information completely, ensuring it matches official documents.

Enter the recipient's details as accurately as possible, including full legal names.

Provide a clear and concise description of the gift, including its value.

Review the form for accuracy to prevent future issues.

Save and download the filled form for future reference.

Ensuring all details are correct and valid is particularly important to support estate planning and avoid potential legal conflicts later on.

Editing and signing the gifting form

Once the gifting form has been filled, utilizing pdfFiller’s features for editing and signing is advantageous. The platform allows you to seamlessly edit text or fields if you notice any errors or require adjustments. You can also add signatures electronically, making the process of formalizing the gift easier and quicker.

If there are multiple parties involved in the gifting process, pdfFiller allows for collaboration. You can invite others to review or sign the document, ensuring everyone is on the same page regarding the gift. This collaboration can prevent misunderstandings or disputes among family members or stakeholders.

Managing and sharing your gifting documentation

Once your gift gifting form is complete, managing and storing these documents effectively is vital. Cloud-based solutions like pdfFiller provide easy access for storing all gifting forms securely. Organizing your gifts and documents in dedicated folders can facilitate easy retrieval, especially during tax seasons or financial audits.

When it comes to sharing your gifting form, pdfFiller offers secure options for sending forms to recipients or financial advisors. Secure methods for sharing ensure that sensitive information remains confidential while providing necessary documentation for tax or legal purposes.

Common mistakes to avoid while gifting

Several common mistakes can complicate the gifting process. First, overlooking IRS regulations can lead to unintended tax liabilities, affecting both the donor and recipient. It’s essential to familiarize yourself with the rules surrounding gift tax exemptions to ensure compliance.

Another mistake involves not including sufficient details in the gifting form. Vague descriptions of the gift can lead to misunderstandings and potential disputes down the line. Lastly, failing to keep accurate records can impact tax filings and estate planning. Maintaining comprehensive documentation of all gifts made is crucial to avoid complications in financial planning and taxation.

Additional considerations for gift gifting

When navigating gift gifting within families, strategic gifting among family members can yield significant advantages. Aiming to transfer wealth to children or grandchildren can help in wealth preservation and generational tax benefits. Non-cash gifts, such as gifts-in-kind or contributions toward college savings accounts (e.g., 529 plans), can also present viable options worth considering.

Moreover, understanding the broader context of gifting—like estate planning—will enhance your financial strategy. A well-planned gifting strategy can also minimize taxes and maximize benefits for loved ones, ensuring your intentions are honored and carried out.

Case studies: Successful gift gifting scenarios

Examining real-life examples of effective gift gifting strategies can provide insights into successful decision-making. For instance, families often utilize gifting to shift wealth to younger generations proactively, facilitating smoother transitions of assets and reducing potential estate tax burdens. Paying attention to lessons learned from common gifting challenges, like misunderstanding tax implications, helps in crafting a solid gifting strategy.

Many successful cases demonstrate that open communication about gifts can strengthen family relations and prevent disputes. Considering the implications of wealth transfers, strategizing gifts among family members not only fulfills emotional desires to provide but also serves as a mechanism for financial stability and tax efficiency.

Frequently asked questions (FAQs)

As you navigate the complexities of gifting, several questions may arise, such as how to ensure a gift is tax-exempt. The simplest answer lies in adhering to IRS guidelines while utilizing the annual exclusion and understanding applicable gift tax exemptions.

Another common FAQ pertains to the ability to revoke or change a gift after it has been made. Generally, once a gift is officially given and accepted, revocation is challenging unless the transaction is legally contested. Lastly, if the recipient is a minor, be aware of specific regulations regarding custodial accounts and the appropriate ways to handle gifts intended for minors.

Accessing more tools and resources on pdfFiller

For those looking to delve deeper into the gifting process, pdfFiller offers interactive features aimed at enhancing document management. Users can explore templates related to various gifting scenarios, making it simpler to create customized forms as needed. Staying informed about updates in tax law regarding gifting can also bolster your gifting strategy and ensure continued compliance.

Taking advantage of pdfFiller's resources allows you to navigate the complexities of gifting with confidence and ease, ensuring that you make the best decisions for your wealth transfers and estate planning.