Get the free Standard Form 1199A, Direct Deposit Sign-up Form, June ...

Get, Create, Make and Sign standard form 1199a direct

How to edit standard form 1199a direct online

Uncompromising security for your PDF editing and eSignature needs

How to fill out standard form 1199a direct

How to fill out standard form 1199a direct

Who needs standard form 1199a direct?

Understanding Standard Form 1199A Direct Form

1. Understanding Form 1199A

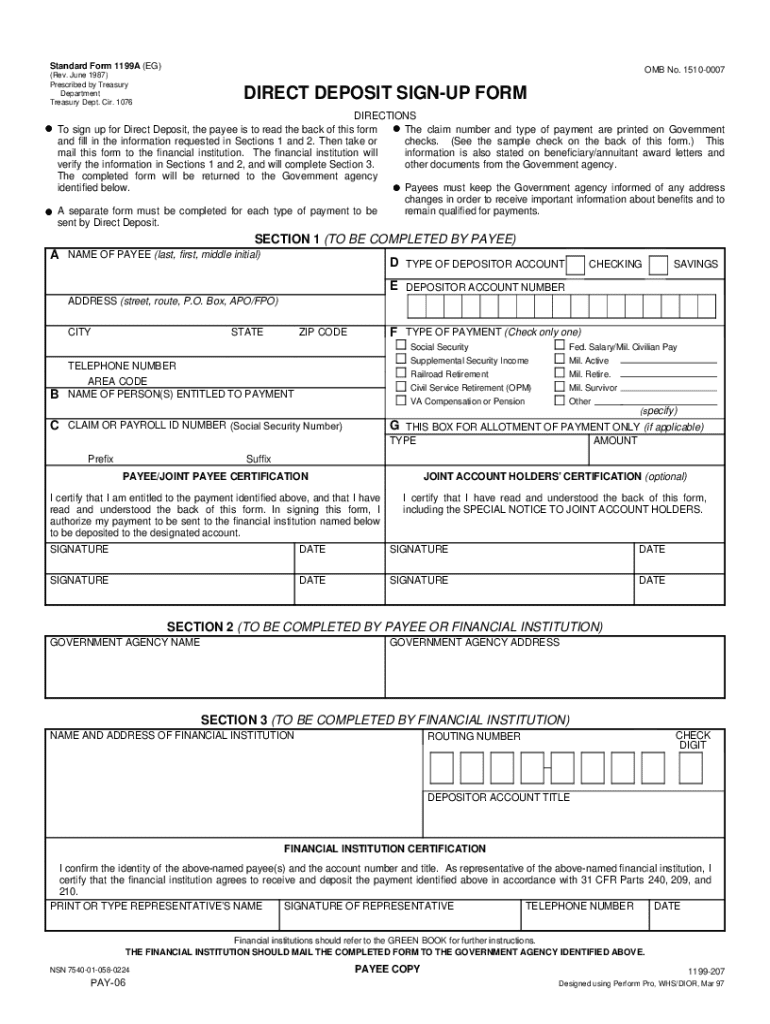

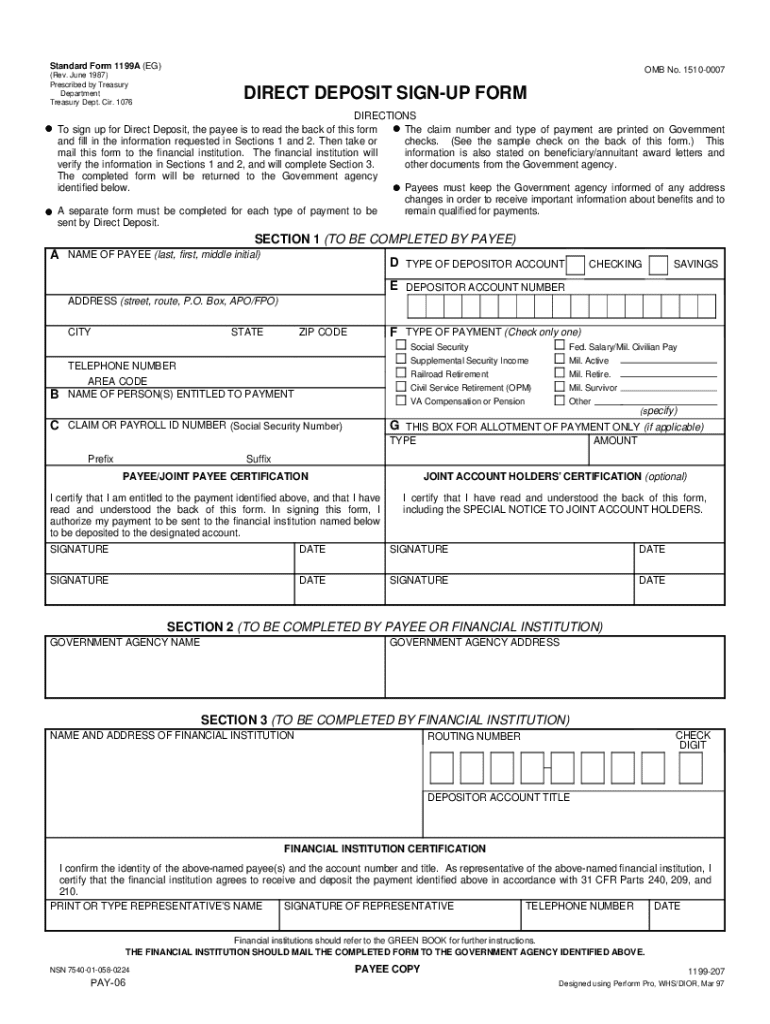

Standard Form 1199A, also known as the Direct Deposit Sign-Up Form, is an important document used by federal agencies to facilitate the direct deposit of payments such as Social Security and pension benefits. Its primary purpose is to allow individuals to authorize automatic transfers of funds to their bank accounts, ensuring timely and secure transactions.

Anyone who is receiving federal payments, including retirees, veterans, and Social Security recipients, is required to fill out Form 1199A. Ensuring that the correct banking information is provided is crucial to avoid delays in receiving funds.

1.1 Importance of accurate completion

Filling out Form 1199A accurately is vital to prevent common mistakes that could lead to payment disruptions. Errors such as incorrect account numbers or misspelled names can significantly delay the process. Consequently, users must double-check their entries to ensure that all information is correct and complete.

In financial transactions, precision matters enormously; a small error can have hefty consequences. This not only affects the recipient's access to funds but may also require cumbersome follow-ups to rectify inaccuracies.

2. Key features of the 1199A Direct Form

The structure of Form 1199A is designed to gather all necessary information to set up direct deposit efficiently. Understanding the sections can help users navigate the form with ease.

2.1 Sections of the form explained

The form comprises three key sections:

2.2 Supporting documentation needed

To complete Form 1199A, users should gather specific documents including:

Organizing these documents ahead of time can help streamline the process and ensure a hassle-free experience during form submission.

3. Step-by-step guide to filling out Form 1199A

Completing Form 1199A can seem daunting, but following a clear step-by-step approach can simplify the task significantly.

3.1 Preparation: What you need before you start

Before diving into filling out the form, it’s prudent to have certain tools and information ready, including:

3.2 Detailed instructions for each section

Now, let’s break down the completion process:

3.3 Common pitfalls during completion

Several common pitfalls can be avoided with knowledge and careful attention to detail:

To ensure accuracy, take your time, review the form multiple times before submission, and consider having someone else check it.

4. Editing and modifying Form 1199A

After your Form 1199A has been completed, you may find you need to make changes. Fortunately, tools like pdfFiller make this process straightforward.

4.1 Using pdfFiller for document management

With pdfFiller, you can easily access and edit Form 1199A electronically. The platform provides various features to enhance usability:

4.2 Saving and sharing your completed form

Once the form is edited to your satisfaction, saving and sharing it is easy. pdfFiller allows users to save completed documents in different formats, such as PDF or Word.

Additionally, sharing your document securely is straightforward, whether it’s via email or through a direct sharing link, making collaboration easy.

5. eSigning Form 1199A

The integration of eSignatures into the document management process signifies a major leap toward efficiency in handling forms like 1199A.

5.1 The importance of eSignatures

eSignatures provide several advantages, particularly regarding the legal validity of documents. These digital signatures are recognized by law, making them a secure method for signing forms.

Using eSignatures for Form 1199A streamlines the signing process. For instance, when you submit documentation to a bank or federal agency, eSignatures ensure that your documents possess the necessary validity and can be processed without delays.

5.2 Step-by-step process for eSigning

pdfFiller makes adding your eSignature simple and secure. Here’s how to do it:

6. FAQs about Standard Form 1199A

Many users have questions when navigating the complexities of Form 1199A. This section aims to address those common queries.

6.1 Common questions answered

Some frequently asked questions include eligibility requirements and troubleshooting common issues users face when completing the form:

6.2 Resources for additional help

For those seeking further assistance, there are several resources available, including government websites and user guides.

7. Managing your documents after submission

Once Form 1199A has been submitted, a few important steps remain to manage your documents adequately.

7.1 Tracking the status of your submission

Monitoring the status of your submitted Form 1199A is essential. Users can contact the appropriate agency or use their online tracking systems if available to check the progress.

7.2 Retaining copies for your records

It is wise to keep copies of all submitted forms for personal records. Best practices include using file management systems or cloud storage solutions, ensuring they are organized and easily retrievable.

8. Conclusion

Understanding and effectively managing Standard Form 1199A is crucial for anyone seeking to benefit from direct deposit of federal payments. The utilization of tools like pdfFiller can significantly ease the burden of form completion and management.

By providing features that streamline editing, eSigning, and secure sharing, pdfFiller empowers users to navigate the complexities of document management with ease and confidence.

9. Interactive tools and resources

To further assist users, pdfFiller offers several interactive tools and resources:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my standard form 1199a direct directly from Gmail?

How do I make changes in standard form 1199a direct?

How do I edit standard form 1199a direct in Chrome?

What is standard form 1199a direct?

Who is required to file standard form 1199a direct?

How to fill out standard form 1199a direct?

What is the purpose of standard form 1199a direct?

What information must be reported on standard form 1199a direct?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.