Get the free January-June 2026 Business & Professional Development Class Schedule - SCC Conti...

Get, Create, Make and Sign january-june 2026 business amp

Editing january-june 2026 business amp online

Uncompromising security for your PDF editing and eSignature needs

How to fill out january-june 2026 business amp

How to fill out january-june 2026 business amp

Who needs january-june 2026 business amp?

Your Complete Guide to the January-June 2026 Business AMP Form

Understanding the January-June 2026 Business AMP Form

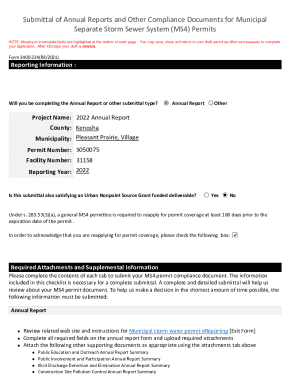

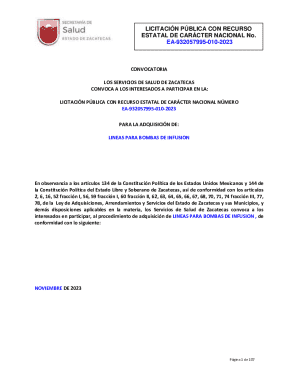

The January-June 2026 Business AMP Form serves as a crucial tool for businesses navigating their operational landscape during the first half of 2026. This form is utilized for various regulatory and compliance requirements, especially in the context of tax obligations and reporting.

The importance of the Business AMP Form cannot be overstated, as it helps businesses maintain transparency with state authorities, comply with taxation laws, and avoid penalties. In a rapidly changing business environment, accuracy in this form is paramount for strategic planning and financial health.

Identifying who needs the Business AMP Form

The target audience for the January-June 2026 Business AMP Form includes various stakeholders involved in multiple industries. Any business entity required to file taxes or comply with state and federal regulations must leverage this form.

Scenarios where the Business AMP Form is essential include businesses seeking tax refunds, those undergoing audits, or companies striving to maintain compliance with the Division of Taxation. Furthermore, professionals involved in financial planning and compliance will find this form indispensable for strategic decision-making.

Preparing to complete the Business AMP Form

To efficiently complete the January-June 2026 Business AMP Form, businesses must gather a variety of required documentation. Essential items include financial statements, bank records, tax identification numbers, and any previous tax filings. Being organized from the start can streamline the preparation process significantly.

Common challenges faced during the preparation phase include difficulty in collating financial data and ensuring accuracy across various entries. To combat these issues, businesses can create a checklist of required documents and establish a timeline for gathering this information, facilitating a smoother completion process.

Step-by-step guide to filling out the Business AMP Form

Filling out the Business AMP Form requires careful attention to detail. The form is generally divided into specific sections that guide users through the necessary compliance requirements.

To effectively navigate this form, it's beneficial to approach it section by section. Here’s a breakdown of each important component:

Additionally, using interactive tools available on pdfFiller can provide assistance, ensuring that users can fill the form with greater accuracy and efficiency.

Editing and customizing your Business AMP Form

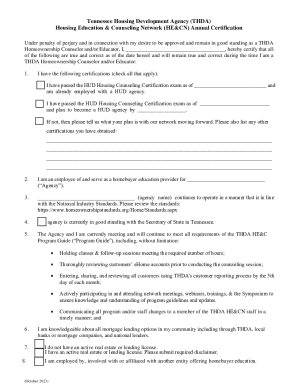

Document editing is crucial after initial completion of the Business AMP Form, as errors or changes in business circumstances may require updates. Having the ability to edit allows businesses to maintain data integrity and reflect accurate information.

Utilizing pdfFiller's editing features means you can modify your form efficiently without starting over. Including team feedback and going through a review process ensures that all changes are captured accurately and that the document meets regulatory standards.

Submitting the Business AMP Form

Understanding the submission process for the January-June 2026 Business AMP Form is key. Businesses have the option to submit online or via traditional paper methods, depending on jurisdictional requirements.

Ensuring a successful submission involves being aware of common pitfalls such as incomplete forms and missing documentation. Double-checking each section before submission and using a submission checklist can help mitigate these risks and foster compliance.

Managing and storing your Business AMP Form

Best practices for document management should be integrated into your process to ensure that the Business AMP Form is easily accessible when needed. Organizing digital files and adopting effective naming conventions can greatly enhance efficiency.

Leveraging cloud storage solutions like pdfFiller reduces the risk of losing documents and allows for easy retrieval. Utilizing cloud technology also aids in maintaining compliance with necessary regulations and facilitates collaborative efforts within teams.

Troubleshooting common issues with the Business AMP Form

As with any form submission, users may encounter various challenges. FAQs pertaining to form submission and compliance cover common queries, helping to clarify any uncertainties.

Additionally, businesses should seek resources for resolving more specific problems. Engaging with help desks or community forums can provide insights and solutions to address unique complications that arise in the submission process.

Future considerations for the Business AMP Form

As we progress through 2026, being aware of upcoming deadlines and a due date calendar is vital for businesses. Keeping track of important dates ensures timely compliance and avoids last-minute rushes that can lead to errors.

Additionally, trends in business documentation and tax compliance may unfold throughout the year. Businesses can anticipate updates regarding forms, potentially influenced by changes in tax regulations or shifts in economic landscape.

User testimonials and case studies

Real-world examples of successful Business AMP Form usage illustrate the importance of thorough preparation and submission. Case studies demonstrate how various businesses navigated the form process smoothly, leading to positive outcomes.

Learning from professionals who faced challenges but ultimately triumphed highlights valuable lessons for others. Sharing insights into their experiences fosters a community of informed users who can leverage these insights to enhance their own form completion processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get january-june 2026 business amp?

Can I create an electronic signature for signing my january-june 2026 business amp in Gmail?

How can I edit january-june 2026 business amp on a smartphone?

What is january-june 2026 business amp?

Who is required to file january-june 2026 business amp?

How to fill out january-june 2026 business amp?

What is the purpose of january-june 2026 business amp?

What information must be reported on january-june 2026 business amp?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.