Get the free California Will Forms: Will samples and guides

Get, Create, Make and Sign california will forms will

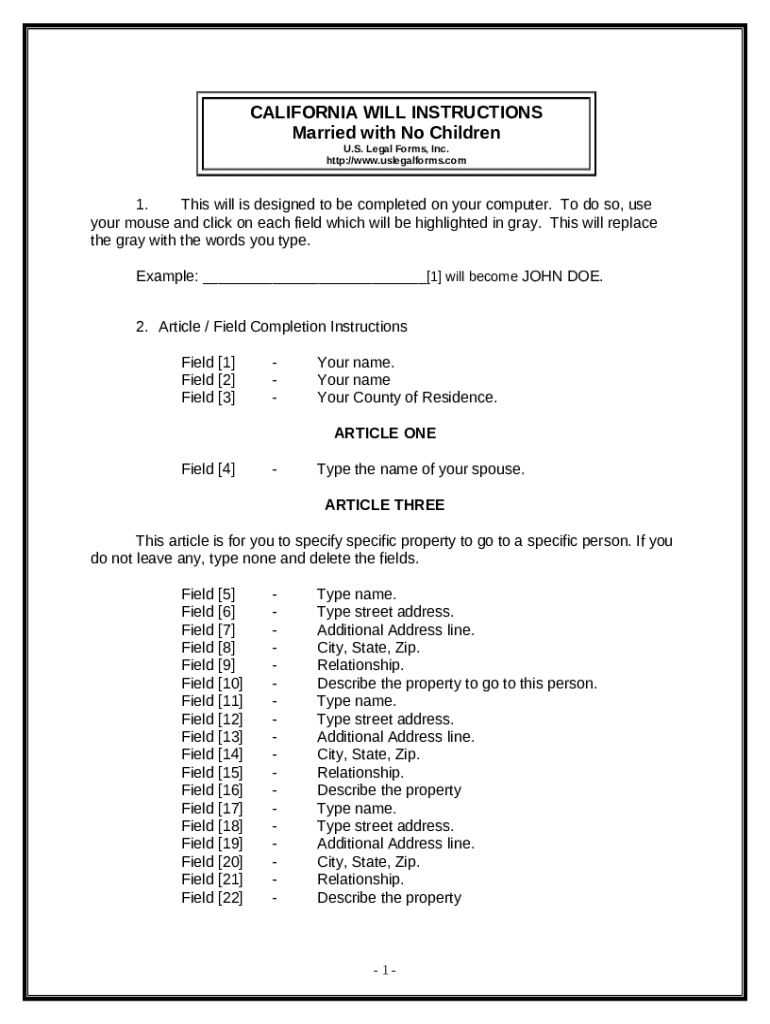

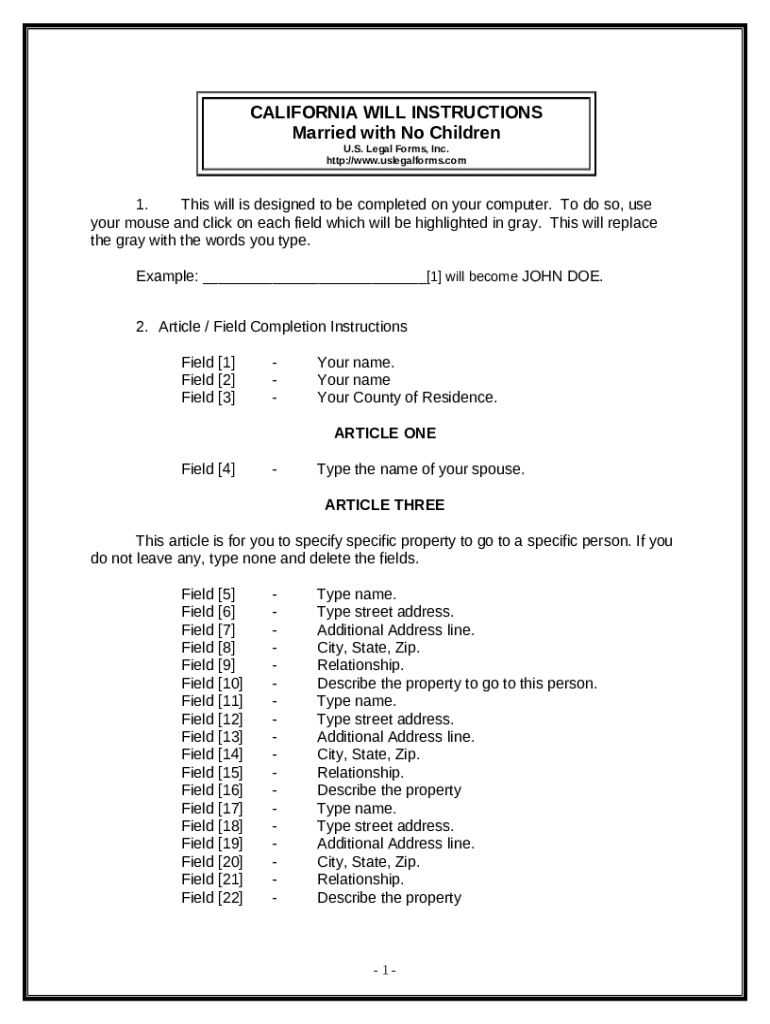

How to edit california will forms will online

Uncompromising security for your PDF editing and eSignature needs

How to fill out california will forms will

How to fill out california will forms will

Who needs california will forms will?

California Will Forms: Will Form

Understanding wills in California

A will is a legal document that outlines a person’s wishes regarding the distribution of their assets upon death. In California, wills are a cornerstone of estate planning, ensuring that your wishes are honored after you pass away. Without a will, your assets may be distributed according to state law, which might not reflect your desires.

The importance of having a will in place cannot be overstated. It not only protects your heirs and beneficiaries, minimizing potential disputes and confusion among family members, but it also ensures that your final wishes regarding your estate are followed. This planning can alleviate stress for your loved ones and provide clarity during a challenging time.

Types of wills in California

There are various types of wills recognized in California, each serving distinct purposes. The standard will, often referred to as the last will and testament, outlines how your assets should be allocated. Key components include the designation of beneficiaries, the appointment of an executor to oversee the estate, and instructions related to debt distribution.

A living will, on the other hand, is different from a traditional will. It lays out your wishes for medical treatment in cases where you're unable to communicate. This is crucial for ensuring that your healthcare preferences are met, particularly in end-of-life scenarios. Holographic wills, written by hand without the need for witnesses, are valid in California provided they meet specific requirements.

Another type is the pour-over will, which works in conjunction with a living trust, ensuring that any assets not placed in your trust during your lifetime are transferred upon your death.

Creating a will in California

Creating a will in California involves several essential steps that one must carefully navigate. First, you need to assess all of your assets, including property, investments, and personal belongings, and determine your beneficiaries. Once this groundwork is laid, appointing an executor who will manage your estate is the next vital step. Furthermore, if you have children, deciding on guardians should also be a priority.

The drafting of your will can be done either through a do-it-yourself approach or by hiring an attorney, depending on the complexity of your estate. For many, utilizing resources like pdfFiller can streamline the process significantly.

pdfFiller offers cloud-based solutions that allow you to create, edit, and manage your will forms efficiently. By using their platform, you can access a library of will templates, fill them out step by step, and keep your documents organized securely.

Legal requirements for wills in California

California has specific legal requirements you must adhere to when creating a will to ensure its validity. The state mandates that you must have at least two witnesses at the time of signing your will. These witnesses should not be beneficiaries or have any interest in your estate to avoid potential conflicts.

Signatures are crucial, as is the proper notarization in certain situations, particularly for a self-proving will. Revoking or amending your will can be accomplished easily; you can do so with a new will or by making physical changes to the original document, but it’s best to keep a record of such actions for clarity.

Common mistakes when drafting a will

One significant mistake many make is failing to regularly update their will. Life circumstances can change, and it’s crucial to keep your estate plans aligned with your current wishes. Overlooking funeral arrangements can also lead to confusion among family members, so it is wise to specify your preferences.

Additionally, not addressing debts and taxes can have severe implications for your estate. Understanding how these liabilities impact your assets and planning accordingly can help prevent unnecessary complications during the distribution of your estate.

Specific situations requiring specialized will forms

Certain situations necessitate specialized will forms tailored to individual needs. For instance, if you have minor children, your will can address guardianship in detail, ensuring your children are cared for by someone you trust in the event of your unforeseen passing.

Similarly, if you are remarrying or have stepchildren, outlining the estate distribution clearly is vital to avoid future disputes. For those with significant debts, explicitly stating how these obligations will be addressed helps provide clarity and resolve potential claims against your estate.

After your will is created

Once your will is completed, proper storage is essential. You can choose between physical and digital storage, with considerable benefits associated with keeping a digital copy in the cloud, such as ease of access and security. Informing your executor and family members about your will ensures they know where to find it and understand your wishes.

Moreover, you should routinely review your will to ensure it reflects any changes in your life, such as significant asset acquisition, familial changes, or new relationships. Establishing a recommended frequency for such reviews can help maintain the relevance of your will over the years.

What happens if you die without a will in California

If you pass away without a will in California, your estate is distributed according to intestacy laws. These laws are designed to allocate your assets in a manner deemed fair by the state, typically favoring relatives like spouses, children, and parents. However, this automatic distribution may not align with your personal preferences or family dynamics.

The impact on family and heirs can be significant. Disputes may arise regarding asset distribution, potentially leading to family rifts that could have been avoided had a will been in place. Thus, preparing a will not only reflects your intentions but also helps maintain harmony among loved ones.

Using pdfFiller for managing your will

pdfFiller offers remarkable advantages for managing your will and other essential documents. With its cloud-based document management system, users can create, edit, and store their will forms securely, all while having access from anywhere. This platform simplifies the process of document creation, making it faster and more efficient.

The ability to eSign and collaborate with executors and beneficiaries is particularly beneficial. pdfFiller facilitates document sharing, allowing for smooth communication and ensuring all parties are in agreement with your estate plans. Plus, having your will stored in the cloud means you can access it anytime, anyplace, further enhancing its manageability.

Frequently asked questions about California wills

Many people wonder, 'Can I write my own will in California?' Yes, California law permits individuals to create their own wills, though it is advisable to follow formal guidelines to ensure validity. A common query also involves the number of witnesses needed; California requires at least two witnesses who are not beneficiaries of the will. As for costs, creating a will can vary; DIY projects can be inexpensive, while hiring an attorney may incur higher fees depending on the complexity of the estate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find california will forms will?

How do I execute california will forms will online?

How do I edit california will forms will on an iOS device?

What is california will forms will?

Who is required to file california will forms will?

How to fill out california will forms will?

What is the purpose of california will forms will?

What information must be reported on california will forms will?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.