Get the free Selected pensions for Los Angeles County Employees ...

Get, Create, Make and Sign selected pensions for los

Editing selected pensions for los online

Uncompromising security for your PDF editing and eSignature needs

How to fill out selected pensions for los

How to fill out selected pensions for los

Who needs selected pensions for los?

Selected pensions for LOS form: A comprehensive guide

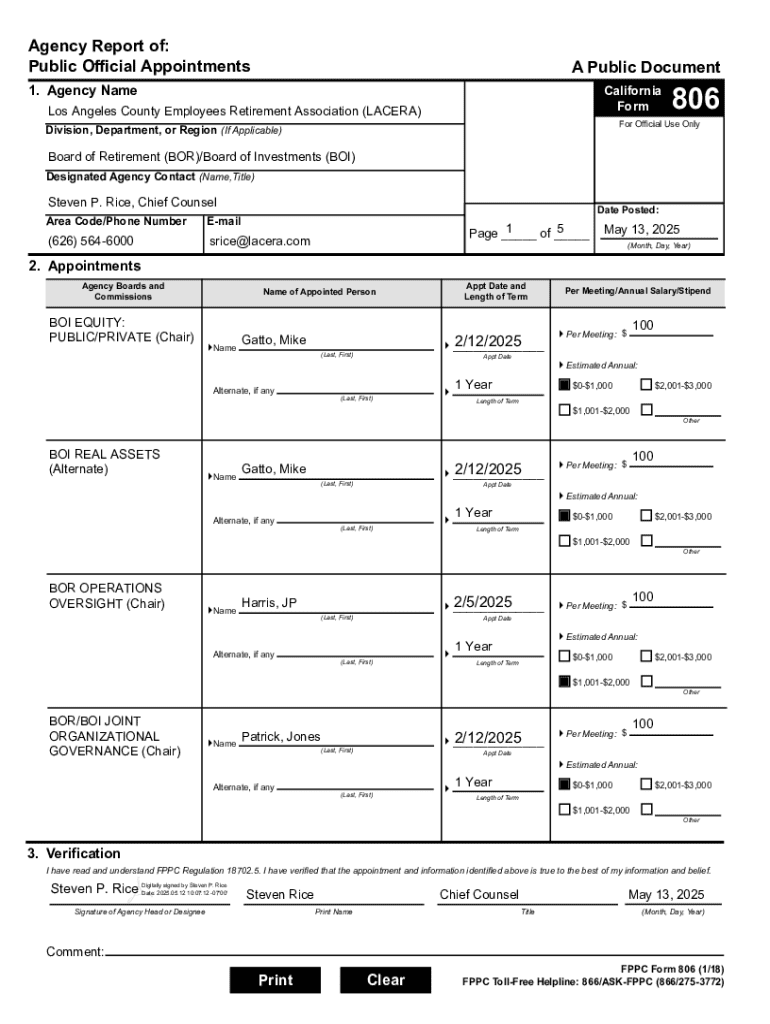

Understanding the LOS form

The LOS form, or the Letter of Option Selection, is a critical document in the process of selecting a pension plan. It serves as an official request where individuals express their preferences regarding pension benefits, integral to their retirement planning. Properly filling out the LOS form ensures that you receive the appropriate retirement payments aligned with your financial goals.

The importance of the LOS form cannot be overstated as it formalizes your choices related to pensions, ensuring that your preferred benefits are secured. Each individual's LOS form will reflect unique circumstances and choices based on their employment history, financial needs, and retirement goals. Therefore, understanding the key components of this form is essential for a smooth application process.

Types of pensions you can select

Pensions can be categorized mainly into two types: defined benefit and defined contribution plans. Defined benefit plans provide guaranteed payments based on factors such as salary history and years of service, ensuring a stable retirement income. On the other hand, defined contribution plans, such as a 401(k), depend on contributions made and investment performance, offering potentially higher returns but with more risk.

Public pensions, typically offered by government entities, often include robust benefits and job security, while private pensions may vary more significantly based on company policies. Each type carries distinct eligibility criteria based on your employment status, the length of service, and the specific rules governing each plan, which can complicate the selection process.

Key deadlines to consider

Understanding the timeline for pension selection is crucial when dealing with the LOS form. The initial selection period typically starts once you become eligible for retirement benefits, allowing you a specific timeframe to make informed choices about your pension type. Missing this initial selection period can limit your options significantly.

In addition to the initial selection, it's important to know when deadlines occur for changes after the initial selection. For example, many pension plans allow modifications only during open enrollment periods or upon significant life changes. Missing these critical deadlines can lead to stress and disrupt your financial planning, as you might be locked into a less favorable pension option.

Step-by-step instructions for completing the LOS form

Completing the LOS form requires careful preparation. Start by gathering necessary documentation, which will support the information on your form. Collect tax statements to verify your income and employment history, along with identification documents such as your driver's license or social security card. Accurate documentation is essential for a successful submission.

While filling out the LOS form, pay attention to each section. Begin with your personal details and move on to pension options, ensuring to double-check entries for accuracy. Be mindful of common mistakes, such as mislisting your employment history or omitting important identification numbers. Submit the LOS form through your preferred channel, whether by mail, online, or in person, and always seek confirmation of your submission to avoid delays.

Managing your pension selection post-submission

After submitting your LOS form, tracking your submission status is essential. Most pension plans provide a way to verify if your request is being processed. If you wish to update your pension choices later on, be sure to follow the appropriate channels to make adjustments based on your changing circumstances.

If your application is denied, understanding the appeals process is crucial. Familiarize yourself with the requirements for an appeals request. Many individuals overlook this step, which may delay or prevent their access to benefits. Properly following the appeals process can help ensure fairness and potentially reverse any unfavorable decisions.

Resources for assistance

Navigating the complexities of pension plans and the LOS form can be made easier with the right resources. Contact information for pension advisors is crucial for personalized guidance. Utilize online tools and calculators, such as pension estimators or retirement planning worksheets, to make informed decisions about your benefits.

Community support forums can provide invaluable insights and shared experiences from others who have gone through the same process. These platforms often have members offering practical advice, which can provide clarity when you're feeling overwhelmed by options and deadlines.

Frequently asked questions (FAQs)

One common concern relates to changing your mind after selecting a pension. Many plans allow for modifications, but the process and timing can differ based on your policy. It's crucial to understand your plan's specific regulations regarding revisions, as well as any potential penalties linked to changes.

Another frequent consideration is how employment history influences pension choice. A detailed examination of your employment records can reveal which options you are eligible for and offer insight into the best choices suited to your retirement goals. If you encounter issues with your LOS form, it's essential to check with your pension provider for guidance on resolving any discrepancies or misunderstandings.

Interactive tools for enhanced engagement

Utilizing interactive tools can greatly enhance your understanding and management of the LOS form process. An interactive form walkthrough can guide you through each section step-by-step, ensuring you don’t miss any vital information during your completion of the form. Additionally, tools for estimating future pension payments can give you insights into long-term benefits and help inform your choices.

Comparison tools specific to different pension types can also assist in weighing your options effectively. By directly contrasting the benefits and potential drawbacks of each plan type, you’re better prepared to make informed decisions that will affect your retirement and overall financial stability.

The role of pdfFiller in managing your LOS form

pdfFiller significantly simplifies the process of managing your LOS form through its robust suite of tools and features. With pdfFiller's PDF editing capabilities, users can easily modify their forms, ensuring all information is accurate and up-to-date. The platform also supports eSignature capabilities, allowing for a seamless signing process, which can be particularly beneficial when submitting the LOS form.

Collaboration features within pdfFiller enable teams to work together on the LOS form, share ideas, and review each other's inputs effectively. This fosters a comprehensive approach to form management, ensuring everyone involved has clarity on the selections being made. Case studies show how others have benefited from using pdfFiller, streamlining their document processes and achieving a more organized approach to pension choices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify selected pensions for los without leaving Google Drive?

How do I edit selected pensions for los in Chrome?

How do I complete selected pensions for los on an iOS device?

What is selected pensions for los?

Who is required to file selected pensions for los?

How to fill out selected pensions for los?

What is the purpose of selected pensions for los?

What information must be reported on selected pensions for los?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.