Get the free Uncashed Checks

Get, Create, Make and Sign uncashed checks

How to edit uncashed checks online

Uncompromising security for your PDF editing and eSignature needs

How to fill out uncashed checks

How to fill out uncashed checks

Who needs uncashed checks?

How-to Guide for Uncashed Checks Form

Understanding uncashed checks

Uncashed checks are payments that have been issued but not yet deposited or cashed by the recipient. This can happen for a variety of reasons, including oversight, loss of the check, or dissatisfaction with the payment. For instance, individuals may forget to cash a payroll check or choose not to deposit a small refund. Understanding why checks remain uncashed is crucial for both individuals and businesses, as failing to follow up can lead to financial losses or complications in bookkeeping.

Common reasons for uncashed checks include changing bank accounts, lack of awareness of the check's existence, or a reluctance to cash checks perceived as too small to bother with. Moreover, checks issued for certain rebates or settlements can also go uncashed for extended periods. Tracking these checks is important not just for reconciliation of personal accounts, but also for the financial health of businesses that may be operating under the assumption that their funds have already been utilized.

Who can issue uncashed checks?

Both individuals and businesses can issue checks that may go uncashed. Individuals might write personal checks for rent or gifts, while businesses often issue payroll checks, refunds, or rebates. Payroll checks, in particular, are a common source of uncashed payments since employees might neglect to deposit their checks for a variety of reasons.

The implications for the issuer are significant. If checks remain uncashed for extended periods, they may eventually be considered abandoned property, leading to the involvement of state unclaimed property programs. Awareness of the different types of checks — including payroll, tax refunds, rebates, and even checks for stocks — can help issuers manage their cash flow effectively and prevent uncashed checks from entering the unclaimed property system.

Tracking your uncashed checks

Organizing your check records is vital for tracking uncashed checks. Keeping a dedicated list or spreadsheet can help you monitor which checks have been issued and which remain outstanding. For individuals and businesses alike, maintaining an accurate record can prevent missing money and simplify the reconciliation process. It's important to regularly check the status of these checks, as timely action can prevent complications down the road.

Utilizing pdfFiller’s interactive tools can streamline this process. You can create templates for tracking checks and store them securely in one place. Look for signs such as uncashed checks beyond the typical validity period (usually 6 months to a year) to alert you of outstanding payments that need following up. Additionally, digital searches through your bank records can identify any checks that have been produced but not cashed, allowing for prompt remedial measures.

The uncashed checks form: purpose and usage

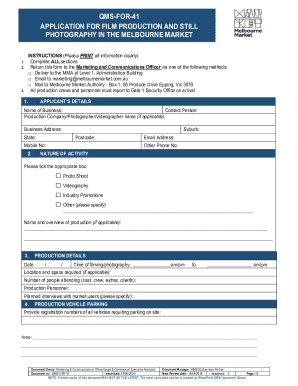

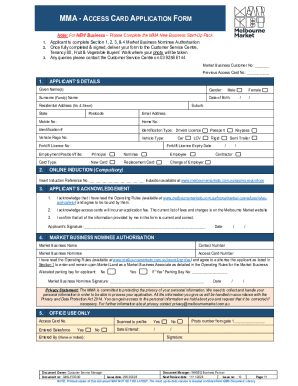

The uncashed checks form serves as a formal document that helps track and manage checks that have not been cashed. This form can be crucial for reporting purposes, particularly for businesses seeking to reconcile their accounts or individuals wanting to reclaim funds. You may encounter several scenarios where using this form is necessary, such as when notifying the bank of an uncashed payroll check or when a refund check has not been deposited within the expected time frame.

Using pdfFiller for creating and editing this form enhances its functionality. pdfFiller allows you to customize the form according to your specific needs, ensuring all pertinent information is captured. By utilizing pre-built templates and interactive features, users can easily fill out the form accurately and for multiple scenarios involving uncashed checks.

Step-by-step guide to filling out the uncashed checks form

Gathering necessary information

Before you begin filling out the uncashed checks form, gather all necessary information. This includes details like the check number, date of issue, recipient details, and issuer information, such as your name and address for individuals or business details for companies. Make sure to take note of any relevant transaction amounts and include any additional notes that might clarify the situation surrounding the uncashed check.

Accessing the uncashed checks form on pdfFiller

To access the uncashed checks form on pdfFiller, navigate directly to the platform's landing page. Use the search feature to locate the uncashed checks form template. pdfFiller boasts user-friendly features that guide you through each stage of filling out the form, including helpful prompts that ensure you don’t miss any essential fields.

Completing the form

When filling out the form, input all personal and check-related information clearly and accurately. Double-check for typos and inconsistencies, as these could lead to delays in processing your request. The clarity of the submitted information can expedite handling and reduce the risk of follow-up queries from banks or financial institutions.

Saving and exporting the completed form

After completing the form, you have various options for saving within pdfFiller. You can save the document to your online account for easy access or export the form in different formats such as PDF or Word, depending on your needs and preferences. This flexibility enables users to maintain a copy of the form for their records while ensuring compatibility with other software.

Editing and signing the uncashed checks form

How to edit the form

pdfFiller’s editing tools allow for modifications to be made easily for any errors or necessary updates in the uncashed checks form. Users can highlight and click on any field to make changes without needing to start over. This flexibility means you can quickly revise information after realizing a mistake or when specific details change.

eSigning the document

Incorporating electronic signatures into your documents has become increasingly important. With pdfFiller, eSigning a document is seamless and straightforward. Simply follow the prompts provided on the platform to sign the form digitally. It's essential to recognize that eSigned documents hold legal validity, ensuring your agreement or notice regarding uncashed checks is enforceable.

Submitting your uncashed checks form

After completing the uncashed checks form, you have multiple options for submission. You can choose to mail the form directly to your bank, email it, or submit it electronically, depending on the institution’s requirements. Timing is critical, so aim for immediate submission to ensure timely management of your uncashed checks.

It's also wise to track the status of your submission, particularly when dealing with substantial amounts of money or necessary refunds. Many banks or financial institutions will provide confirmation, ensuring you are kept abreast of the processing status and can avoid any unnecessary confusion.

FAQs about uncashed checks

Several frequently asked questions arise regarding uncashed checks that can help clarify common concerns. For example, individuals often ask what to do if a check remains uncashed for over six months. In this case, it's important to consult relevant financial institutions as policies can vary. Additionally, some questions focus on state-specific regulations and the handling of unclaimed property, reflecting the complex framework around uncashed checks.

Furthermore, accessing resources that help conduct a missing money search can be beneficial. Many state governments maintain databases that can help recover unclaimed balances. Ensuring familiarity with these policies aids both individuals and businesses in understanding their responsibility when it comes to uncashed checks.

The role of unclaimed property programs

State unclaimed property programs play a critical role in the handling of uncashed checks. These programs are established to facilitate the recovery of assets that have been abandoned, including checks that have not been cashed within a specified period. For individuals and businesses, it is crucial to conduct periodic check-ups with state databases to identify any funds that may be unclaimed.

Many states utilize property policies that require reporting of uncashed checks after a certain duration, typically three to five years. Understanding these time frames helps you take proactive measures in managing your finances and ensures that you are aware of your rights, allowing you to reclaim lost funds.

Leveraging pdfFiller for ongoing document management

pdfFiller is designed to provide comprehensive document management solutions that extend beyond just the uncashed checks form. The platform includes beneficial features for organizing, storing, and collaborating on important documents across teams or individuals. Its cloud-based nature means that users can access documents from anywhere at any time, ensuring efficiency and flexibility.

Take advantage of pdfFiller’s multitude of interactive tools to streamline document workflows and enhance productivity. With collaborative features, teams can work together seamlessly on important forms, ensuring everything required is captured and tracked efficiently.

Best practices for managing uncashed checks

To prevent uncashed checks in the future, adopt best practices for managing your payments and receipts. Establish a routine to check for outstanding payments regularly, and consider creating a financial management strategy that incorporates regular analysis of your incoming and outgoing checks.

Additionally, maintaining clear communication with recipients about payment status can help ensure they are aware of payments made to them. By organizing your records carefully and using tools like pdfFiller for document management, you can significantly lower the likelihood of checks remaining uncashed. These proactive measures contribute to overall financial wellness and integrate seamlessly into responsible personal finance or business practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the uncashed checks in Gmail?

How do I fill out the uncashed checks form on my smartphone?

Can I edit uncashed checks on an iOS device?

What is uncashed checks?

Who is required to file uncashed checks?

How to fill out uncashed checks?

What is the purpose of uncashed checks?

What information must be reported on uncashed checks?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.