Get the free Mutual will agreement sample: Fill out & sign online

Get, Create, Make and Sign mutual will agreement sample

Editing mutual will agreement sample online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mutual will agreement sample

How to fill out mutual will agreement sample

Who needs mutual will agreement sample?

Understanding and Creating a Mutual Will Agreement Sample Form

Understanding mutual wills

Mutual wills are legal documents created by two parties, often spouses or partners, detailing the distribution of their combined estate upon their deaths. They reflect a joint intent to secure each other's will and ensure that specific terms are upheld after one party has passed. This agreement is essential for couples who wish to maintain a level of control over their estate and protect their beneficiaries.

In the realm of estate planning, mutual wills serve not just as a testament to personal intentions but as a safeguard against the unpredictability of changes in circumstances. Unlike individual wills, mutual wills articulate a promise between parties to honor specific provisions, making them particularly useful for long-term legal and financial commitments.

Key features of a mutual will agreement

A mutual will agreement is characterized by several important features that distinguish it from standard wills. One key element is the joint intent and agreement between the parties involved. This establishes a legally binding document that reflects their collective wishes and ensures that those wishes are honored regardless of evolving circumstances.

Another significant feature is the provisions for survivorship, which dictate that upon the death of one party, the entire estate will typically be passed on to the surviving partner. This continuity helps maintain financial stability within families during challenging times.

Additionally, mutual wills contain restrictions on making changes after the death of one party. This means that the surviving partner cannot unilaterally alter the will without possibly facing legal challenges from the deceased party’s estate. Finally, mutual wills retain a level of flexibility by allowing parties to specify different asset distributions and beneficiaries, ensuring that unique family dynamics and wishes are accommodated.

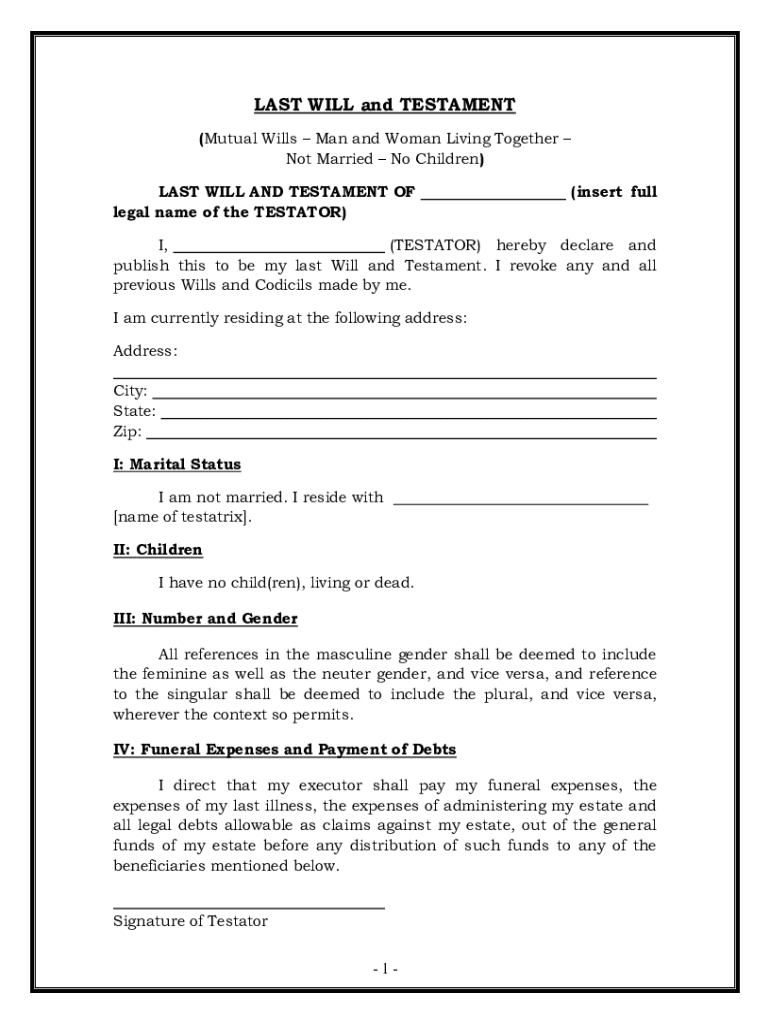

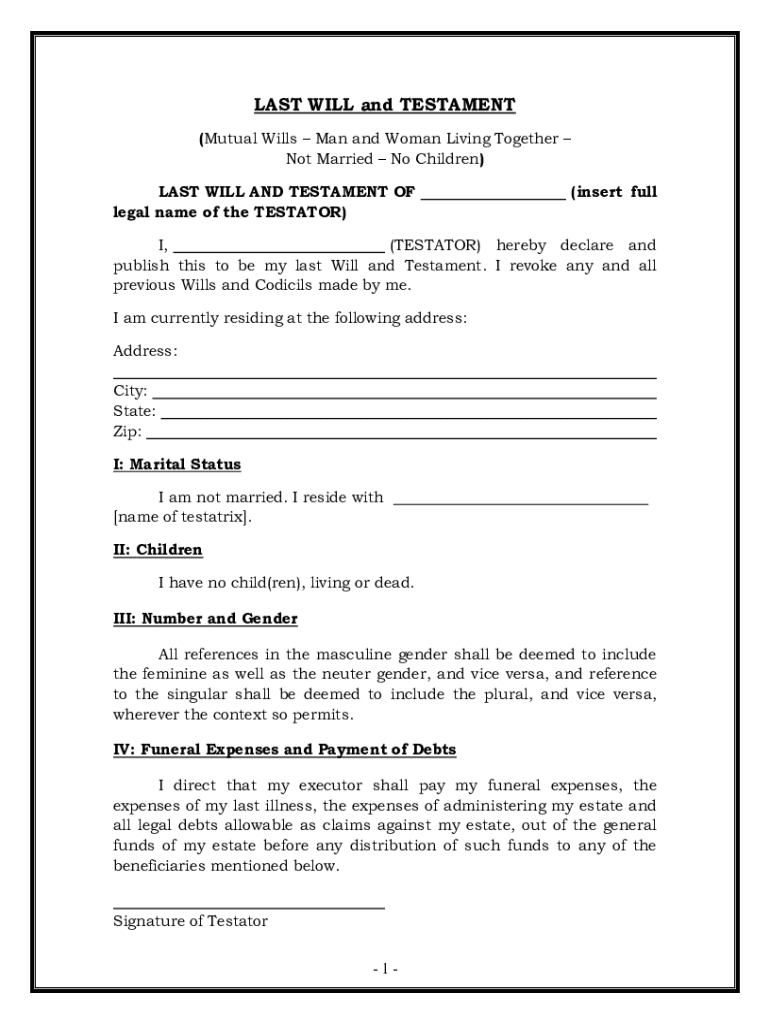

Sample mutual will agreement form

Creating a mutual will agreement requires a detailed and clear form that encapsulates all necessary components. The title and purpose of the agreement should be prominently displayed, confirming that it is indeed a mutual will. The parties involved, typically married couples or partners, should be clearly identified to avoid confusion.

The recitals section gives background information and reflects the intent behind the mutual will, outlining the shared goals of both parties. Furthermore, the distribution provisions will detail how the estate is to be divided after death, commonly including clauses such as the entire estate to the survivor and specific bequests to children or other beneficiaries. Finally, the mutual will should be signed by both parties, ideally in the presence of a notary to affirm its validity.

Steps to create a mutual will agreement

Creating a mutual will agreement is a strategic process that involves several key steps. First, assess your personal circumstances and goals regarding estate distribution. This step ensures that both parties are on the same page concerning intentions and desires for their beneficiaries.

Next, gather all necessary documentation, including assets and liabilities, to ensure a clear understanding of what will be included in the agreement. Collaborating with your partner to draft the specific terms is crucial, ensuring that both parties contribute equally and transparently to the formation of the document.

Once your agreement terms are established, use a sample form as a template to draft your mutual will. Ensuring that all essential components are included will lead to a more effective and enforceable document. It is also prudent to consult an attorney for a legal review. Their expertise will further validate your agreement and address any jurisdictional nuances that may affect its execution.

Filling out the mutual will agreement sample form

Filling out the mutual will agreement sample form requires careful attention to detail to ensure clarity and accuracy. Start by providing the header information, which typically includes the title of the document and the date it is created. Next, identify the parties involved by including their legal names and addresses, indicating their relationship.

The specific distributions and clauses also need to be articulated clearly, outlining who gets what upon death, whether it be the entirety of the estate to the surviving partner or specific bequests to children. Finally, ensure that signatures are obtained from both parties and check any requirements for witnesses, ensuring all legal necessities are met.

Editing and updating your mutual will

Regularly reviewing and updating your mutual will is crucial, as life circumstances may change, affecting your estate distribution plans. Consider when significant events occur in your life, such as the birth of a child or the passing of a loved one; these conditions often necessitate reassessing your mutual will terms.

You may also want to amend the agreement in the unfortunate event of a divorce or separation. In such cases, it's essential to follow proper procedures for updates, which usually involve drafting a new mutual will or modifying the existing document with mutual consent. Document these changes clearly to maintain the integrity of your estate plan.

Legal considerations and implications

Different jurisdictions may have varying laws regarding mutual wills, making it imperative to understand the legal landscape in your area. Some states may have specific criteria for mutual wills, while others may not recognize them at all. Engaging with a legal expert familiar with your local regulations can help navigate potential pitfalls.

Moreover, be aware that there are potential challenges to mutual wills, including disputes from other family members or beneficiaries who may feel entitled to the estate. Understanding these dynamics can help you craft clearer documentation that anticipates such challenges and can minimize future conflict. Avoid misconceptions by ensuring you have the required signatures and notarization, which are often necessary to uphold the mutual will's validity.

Tools for managing your mutual will agreement

Using cloud-based document management systems, such as pdfFiller, provides significant advantages for managing your mutual will agreement. These platforms offer users seamless editing features that allow for easy modifications or updates to your will. Accessing documents from anywhere ensures that you can stay organized and maintain control over your estate planning.

Additionally, eSigning features enhance security and compliance with legal requirements, allowing partners to sign mutual wills without physical presence. Collaborative features also enable both parties to manage changes or review the document continuously, improving communication and ensuring both partners stay informed and aligned on their estate plans.

Frequently asked questions about mutual wills

One common question is whether mutual wills need to be notarized. While notarization is not universally required, having your will notarized adds a layer of authenticity and may simplify the validation process in legal disputes. Conversely, most jurisdictions do not allow one partner to alter a mutual will unilaterally after the other has passed; any changes must respect the original agreement's intent.

Finally, mutual wills can indeed affect taxes, particularly depending on the structure of the estate and local tax laws. Consulting with a financial advisor or estate planning attorney can help clarify potential tax implications associated with mutual wills.

Success stories: Real-life applications of mutual wills

Real-life examples illustrate the impact that mutual wills can have on families. In Case Study 1, a couple created a mutual will which alleviated concerns about asset distribution after one partner's passing. By firmly establishing their intentions, their children were able to navigate the estate seamlessly, reducing potential friction and misunderstandings.

Case Study 2 showcases how clear planning through mutual wills increased family harmony. Despite the often emotionally charged nature of inheriting assets, this couple's approach led to transparent communication among all beneficiaries, providing assurance that each family member was treated equitably. These stories highlight how strategic estate planning using mutual wills decreases the chances of conflicts and fosters stability among heirs.

Interactive tools to consider

To further ease the process around mutual wills, online resources provide valuable tools. Utilize online mutual will form templates that offer user-friendly frameworks for drafting your agreement. In addition, consider interactive checklists to prepare your mutual will efficiently, ensuring all steps are covered, and nothing is overlooked.

Video tutorials on completing the mutual will agreement can also simplify the learning process, especially for those unfamiliar with legal terms or documentation. These resources ensure you are fully equipped to navigate the intricacies of estate planning with efficiency, confidence, and accuracy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get mutual will agreement sample?

How do I make edits in mutual will agreement sample without leaving Chrome?

Can I edit mutual will agreement sample on an Android device?

What is mutual will agreement sample?

Who is required to file mutual will agreement sample?

How to fill out mutual will agreement sample?

What is the purpose of mutual will agreement sample?

What information must be reported on mutual will agreement sample?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.